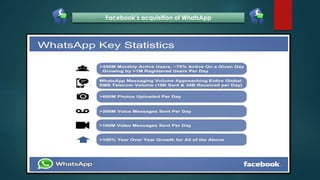

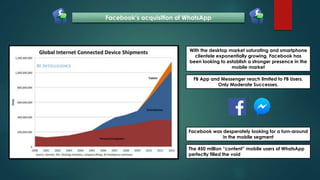

Facebook acquired WhatsApp for $19 billion in 2014. WhatsApp had 450 million active users who used the messaging app on a daily basis. The acquisition helped Facebook gain a stronger presence in the mobile market as WhatsApp users provided valuable mobile user data and traffic that complemented Facebook's existing desktop user base. While an unprecedented sum, the $42 per user acquisition cost for WhatsApp was lower than comparable social media platforms and could prove a worthwhile investment if WhatsApp monetizes its large user base.