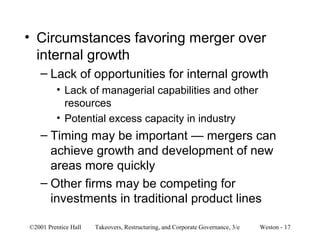

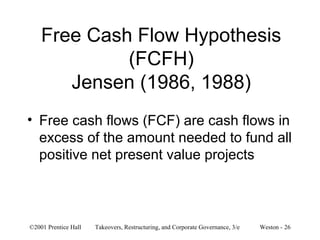

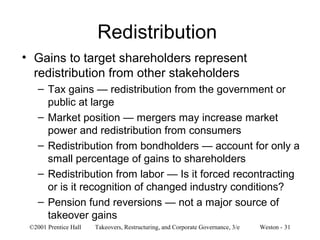

This chapter discusses theories related to mergers and tender offers. It covers various reasons why mergers may create value such as economies of scale, synergies from combining operations, and acquiring human/organizational capital. However, mergers may also be driven by agency problems and hubris. The chapter then examines models of the takeover process and frameworks for analyzing sources of value from M&As as well as potential gains/losses to target and acquiring firms.