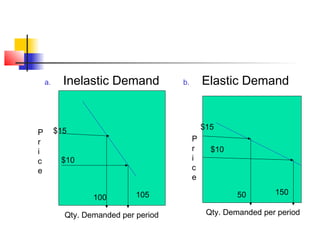

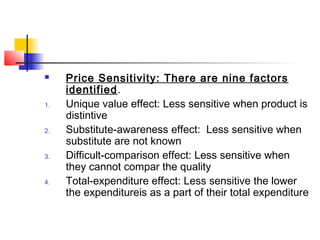

This document discusses pricing objectives and strategies that companies can pursue, including survival, maximum current profit, maximum market share, and market skimming. It also covers determining demand curves and the factors that influence price sensitivity. Finally, it outlines the key considerations in selecting and managing marketing channels, such as identifying intermediaries, evaluating channel members, and the different types of power that can help manage channels.