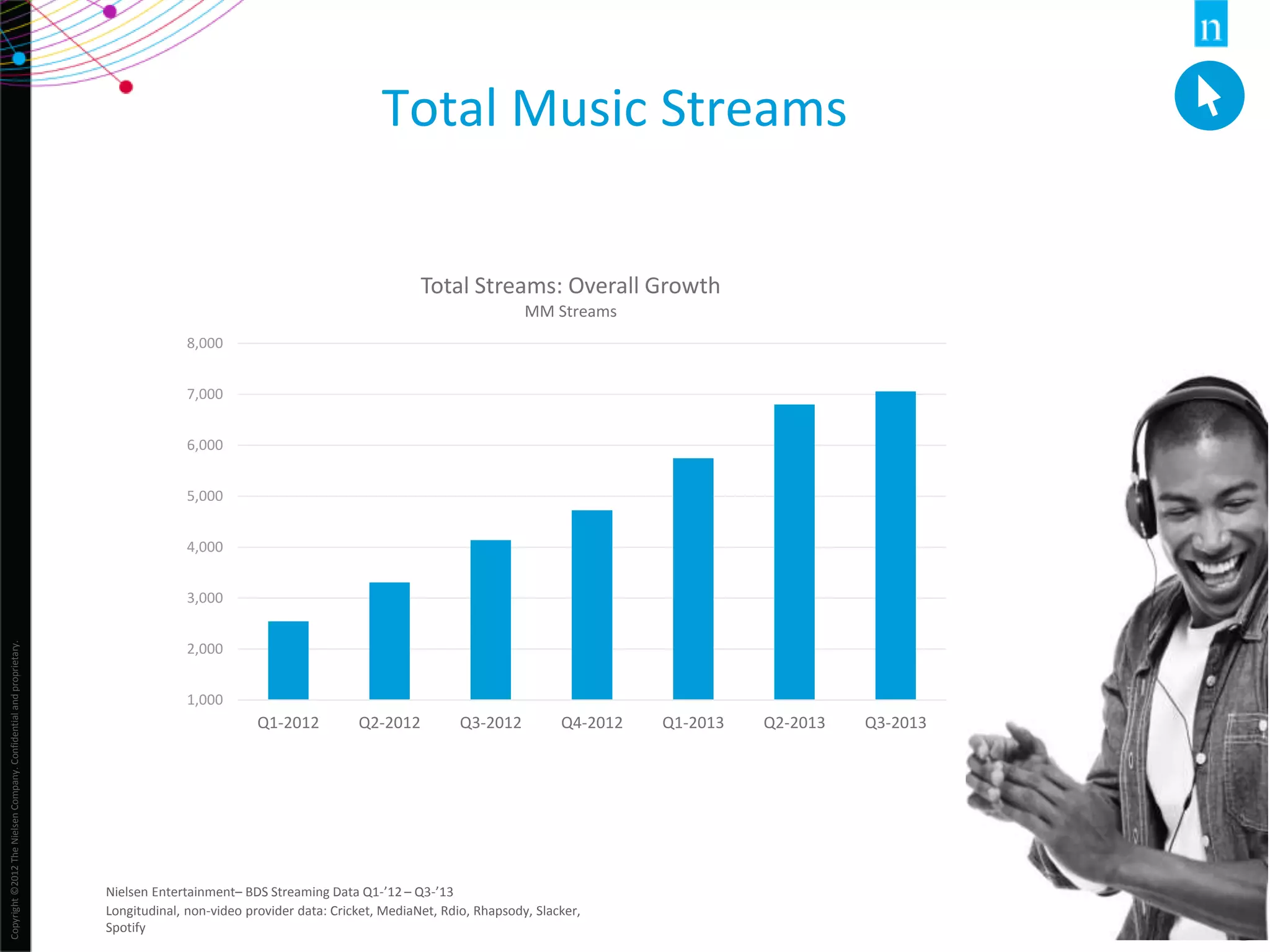

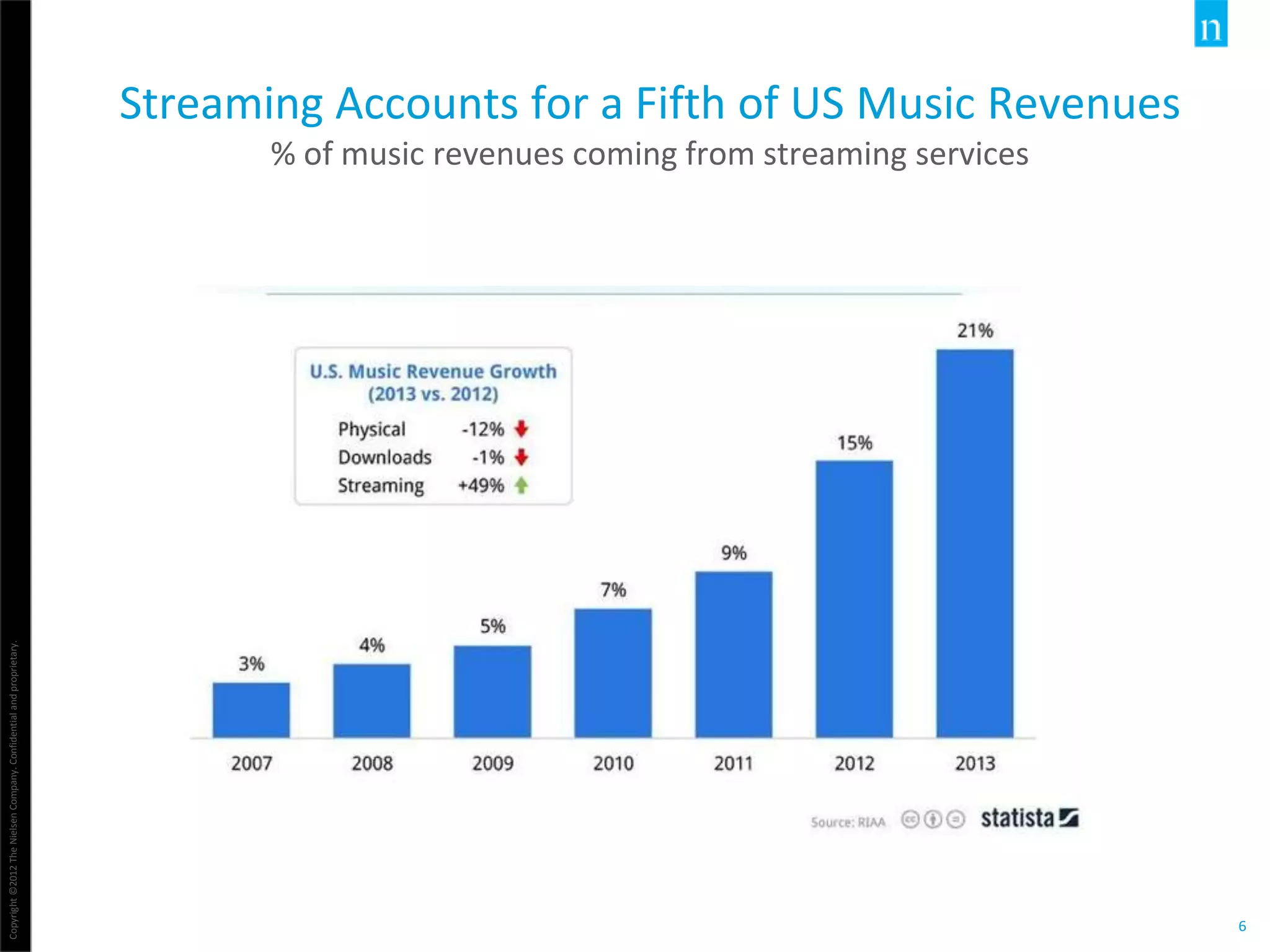

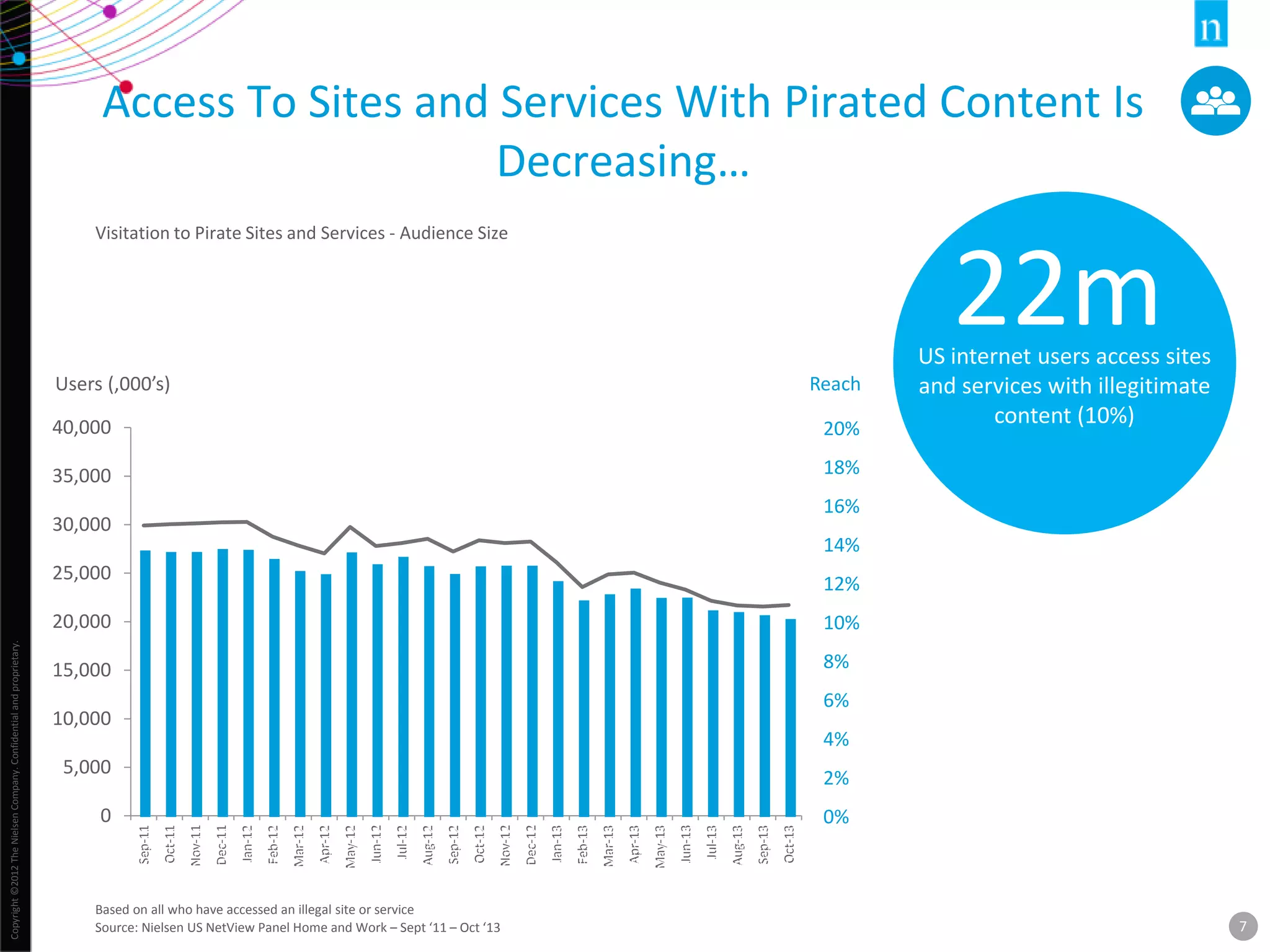

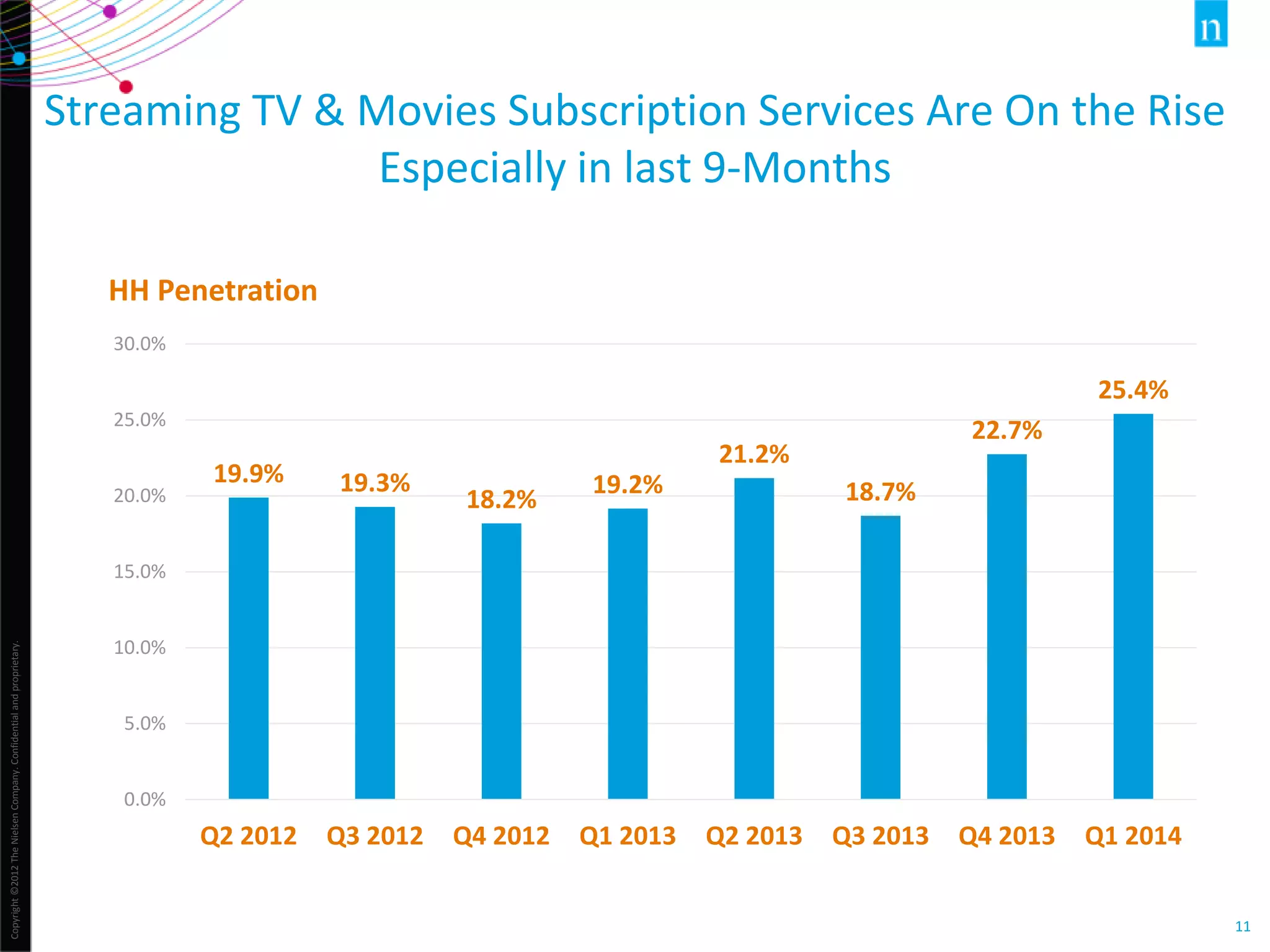

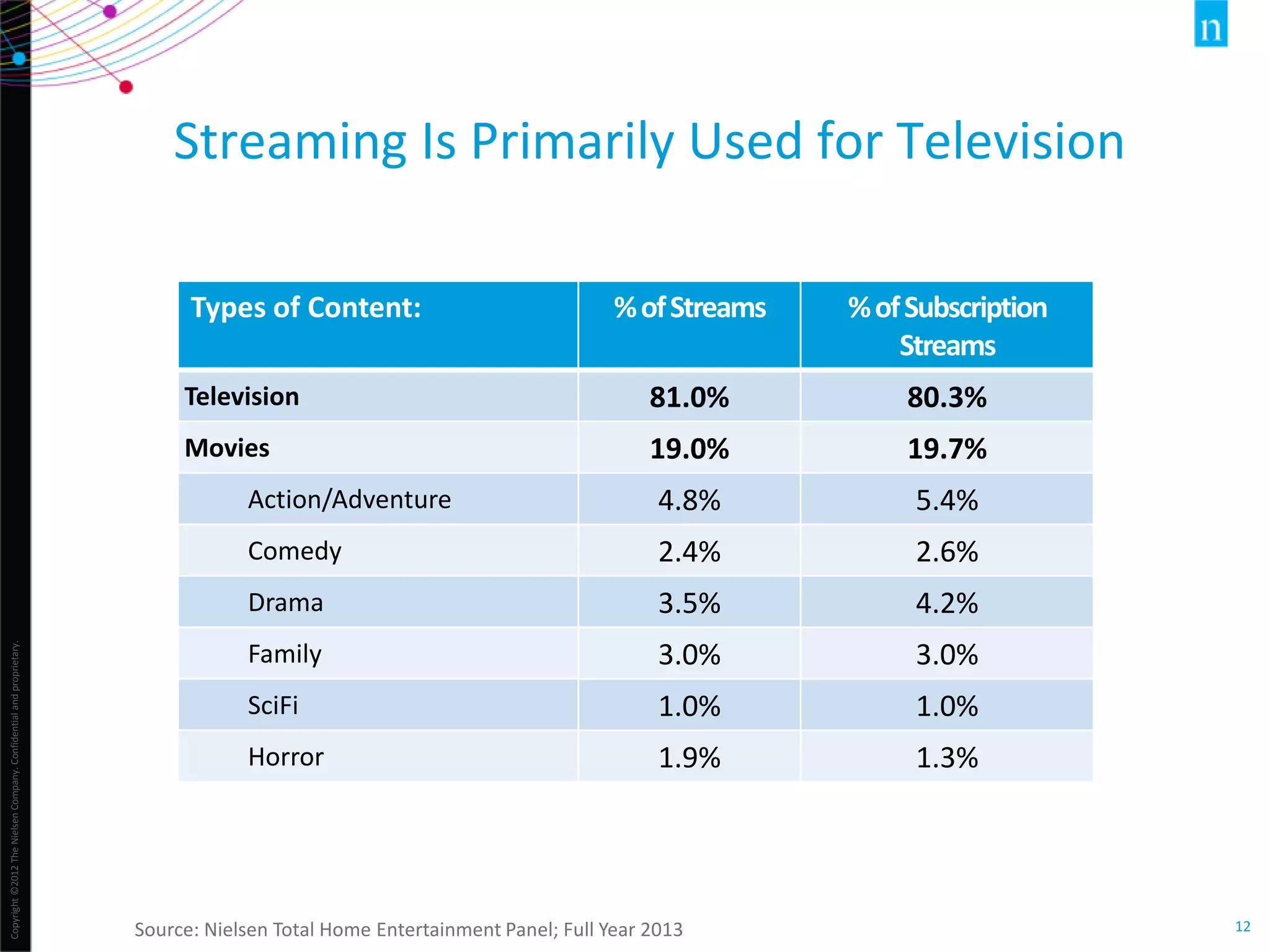

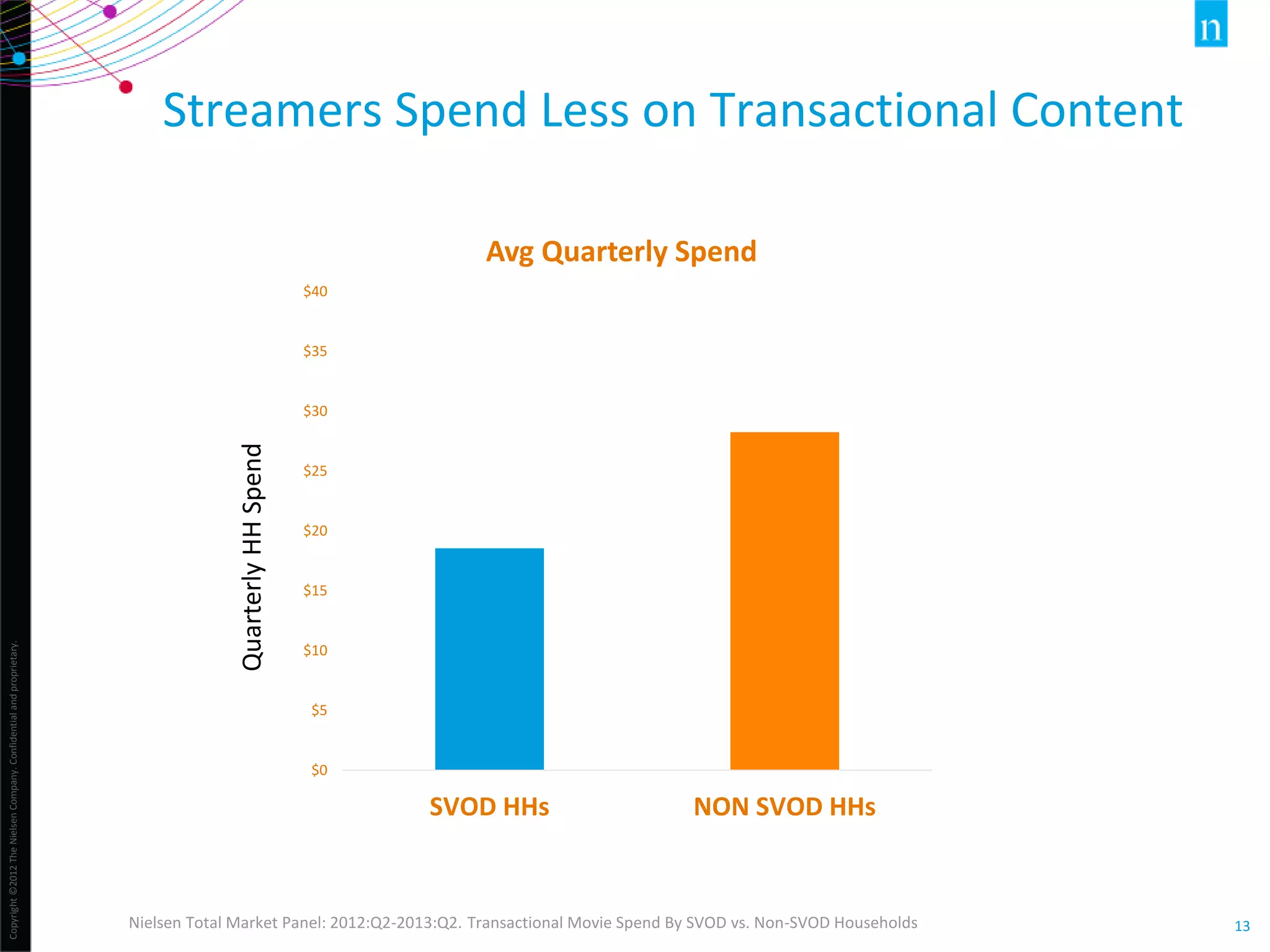

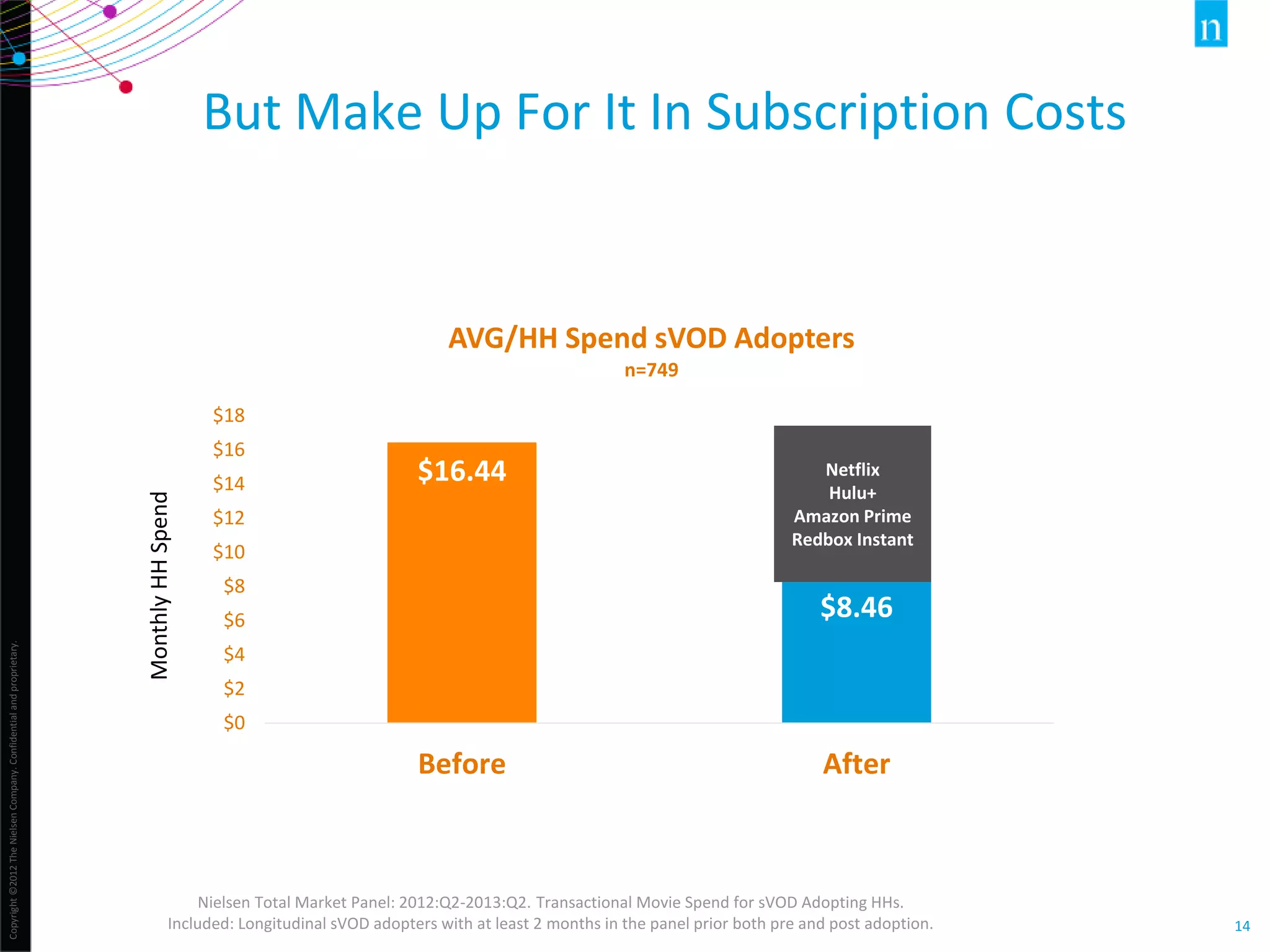

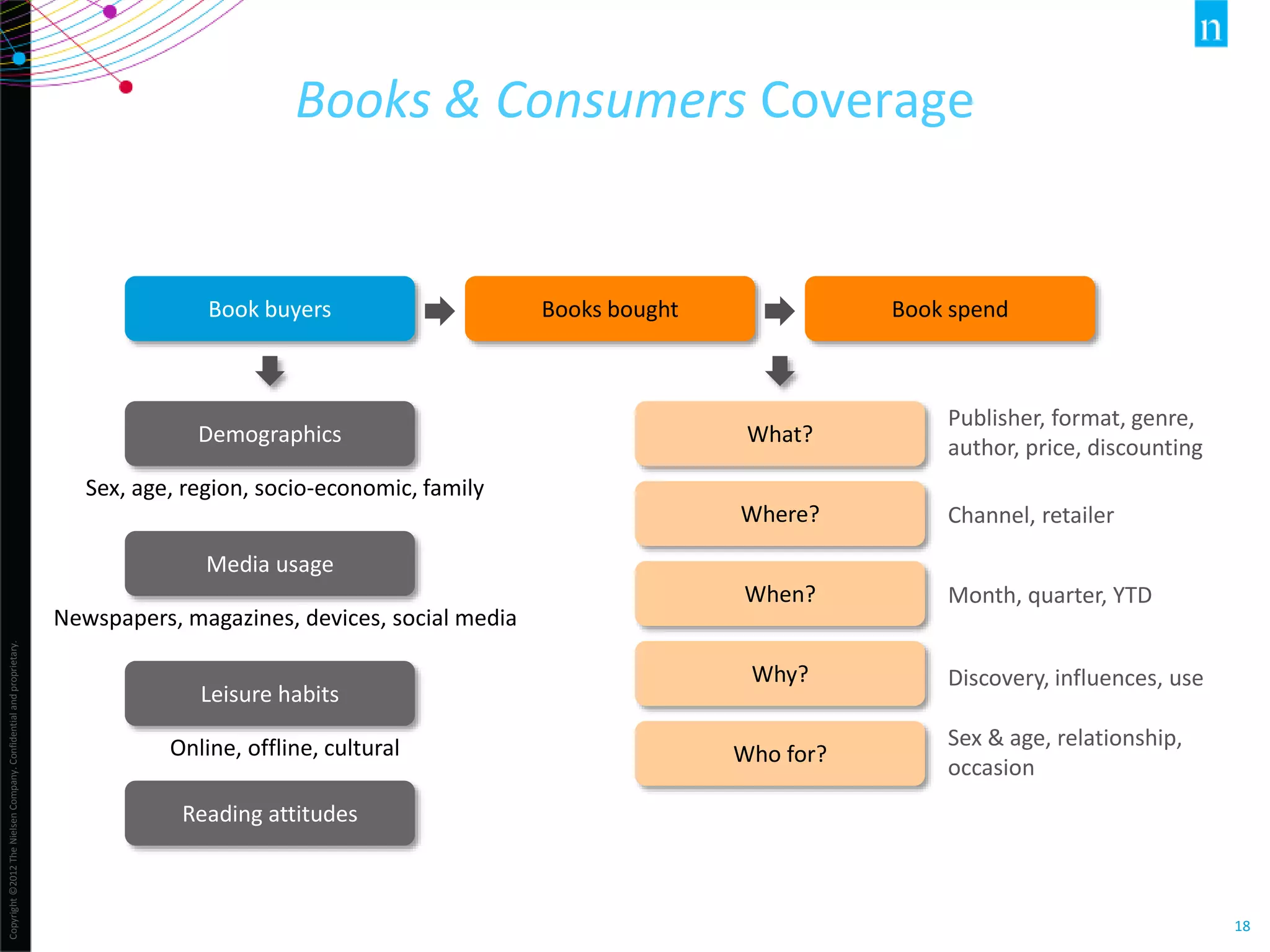

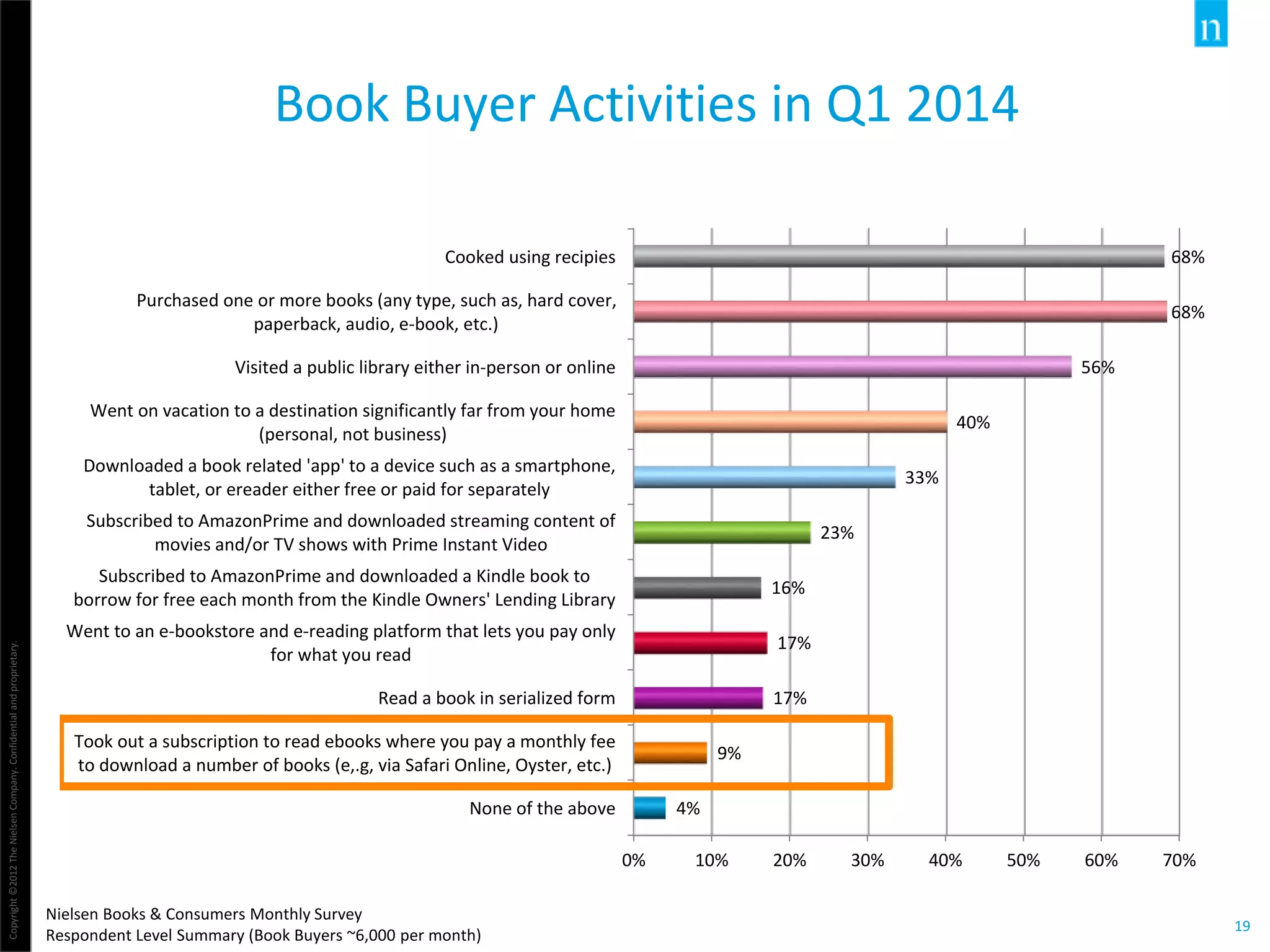

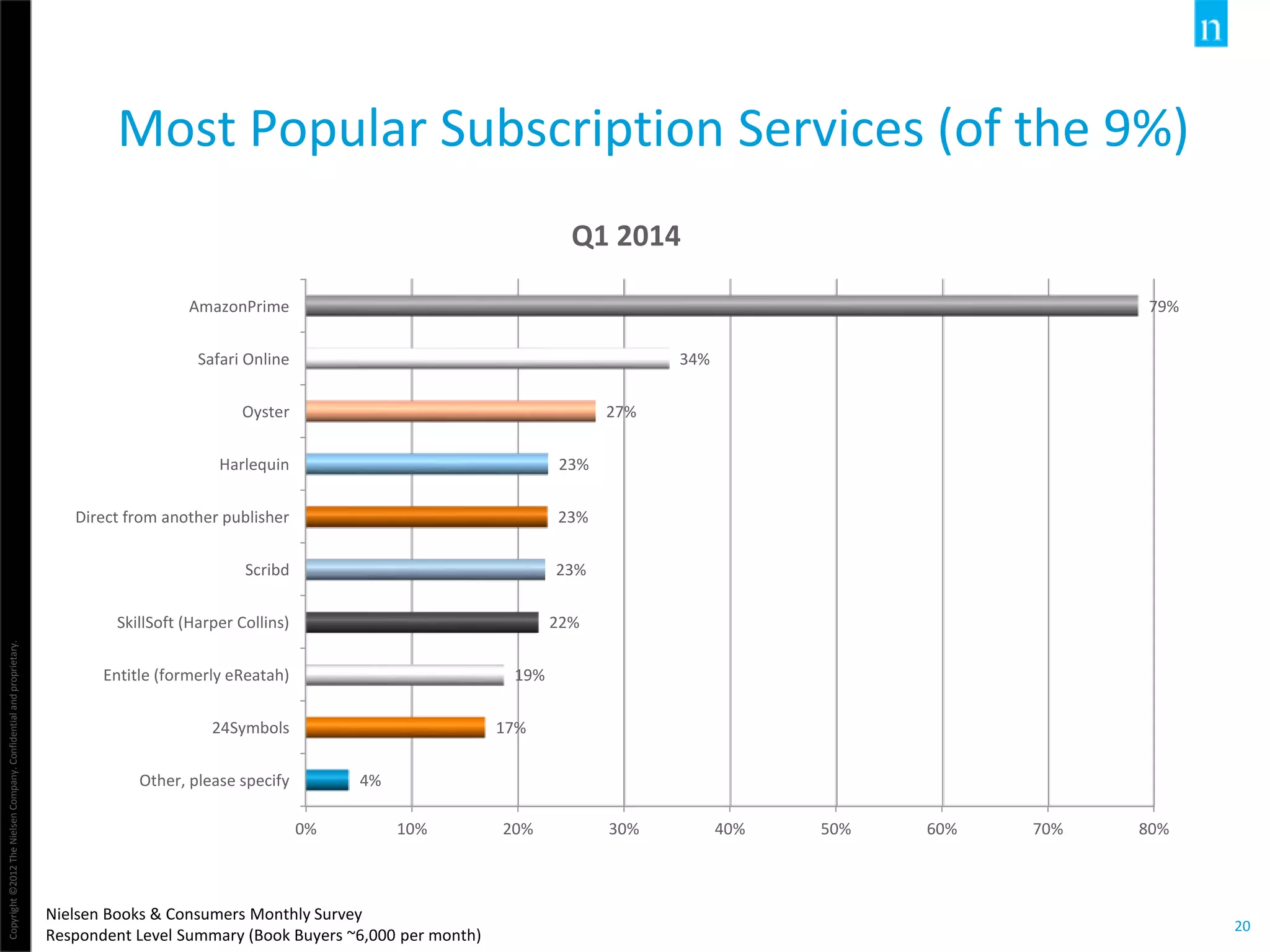

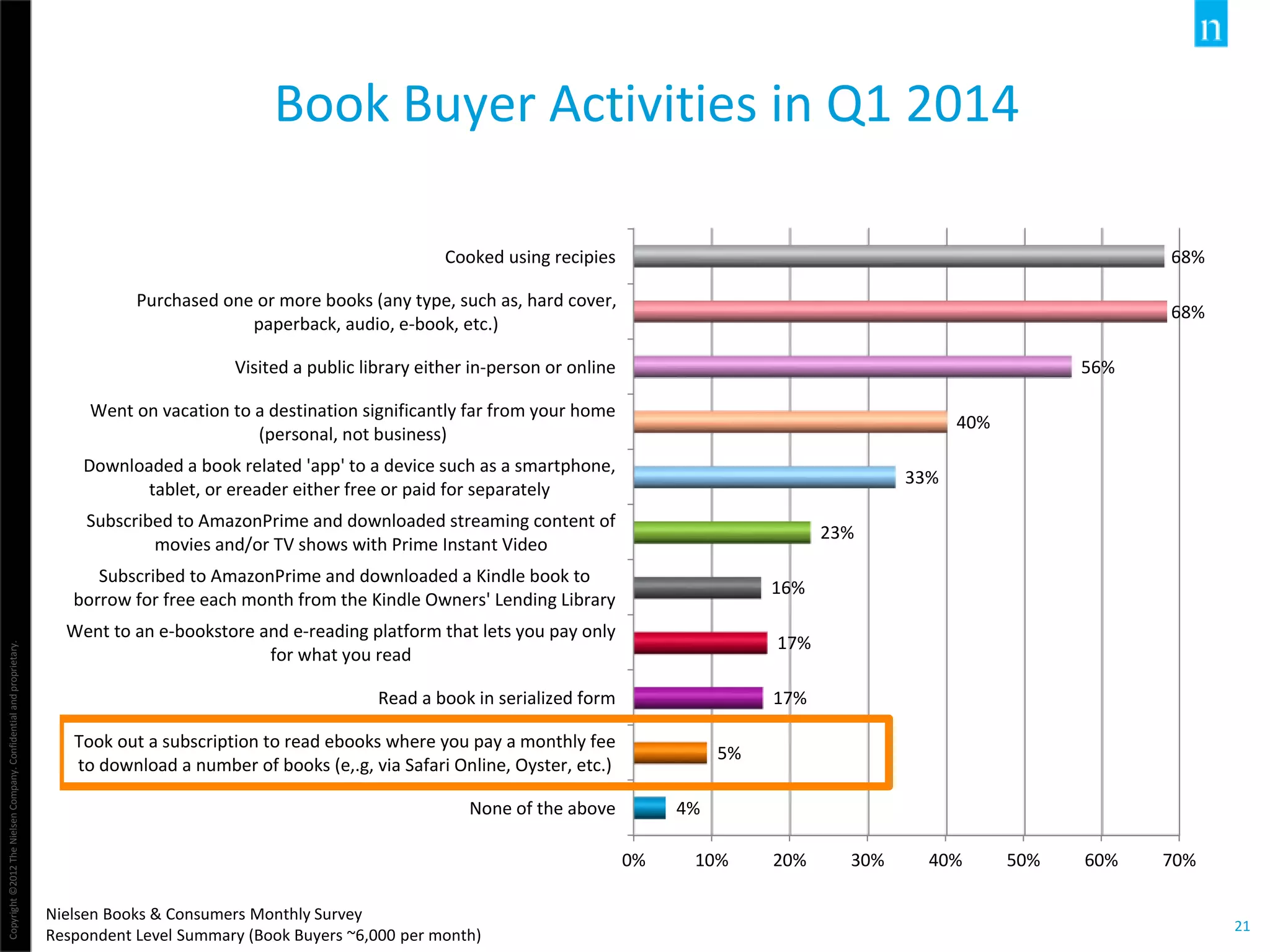

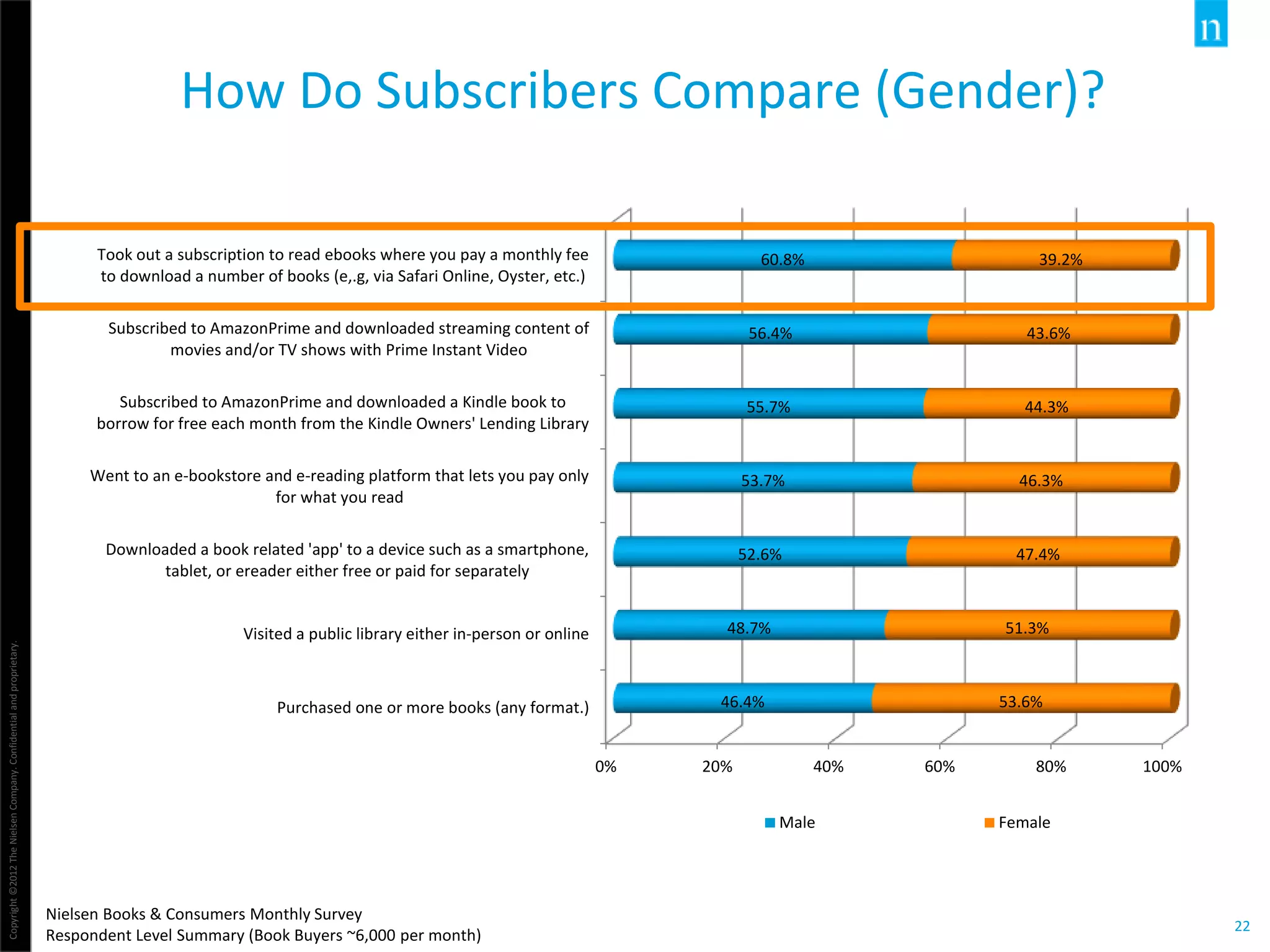

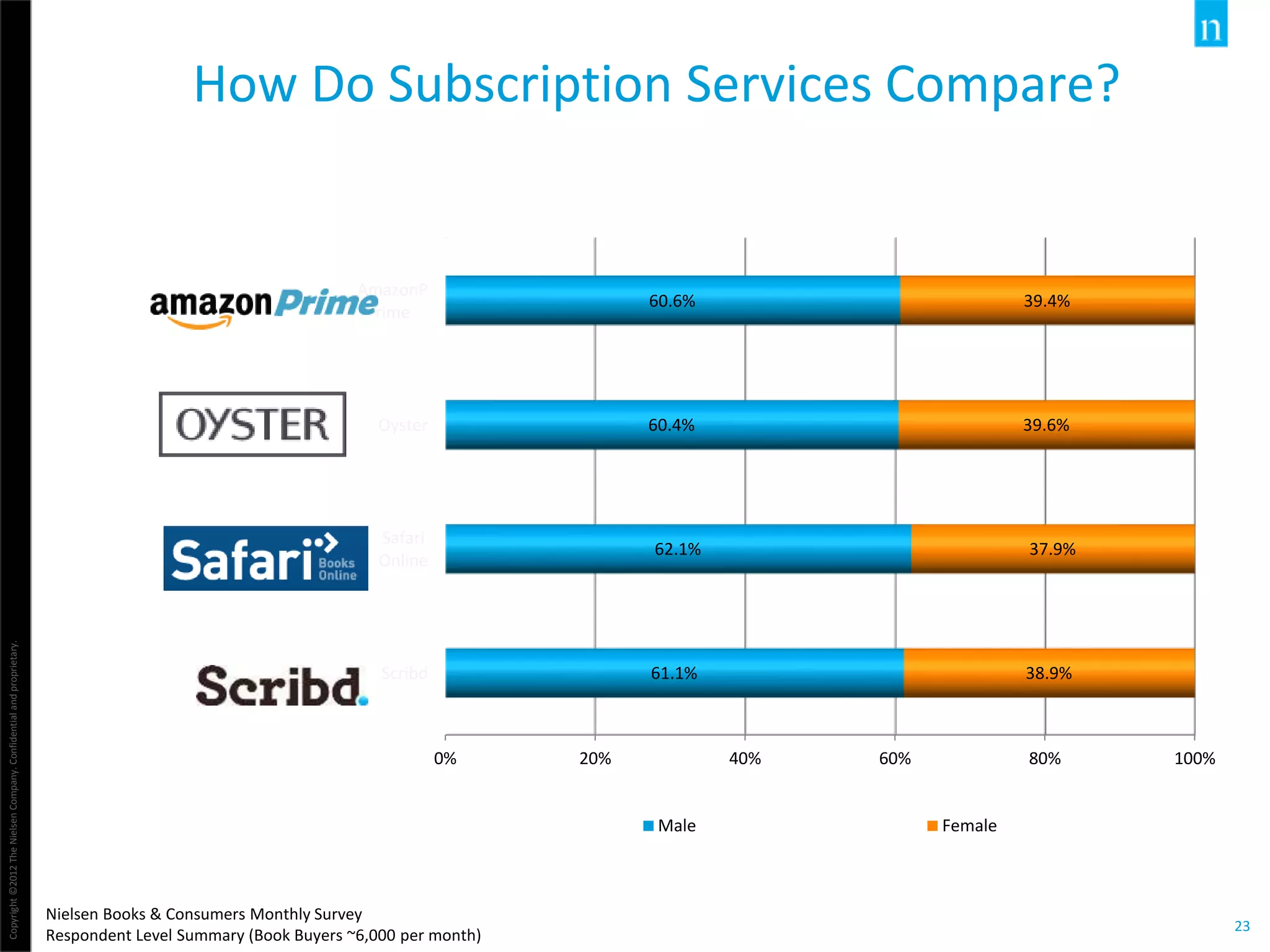

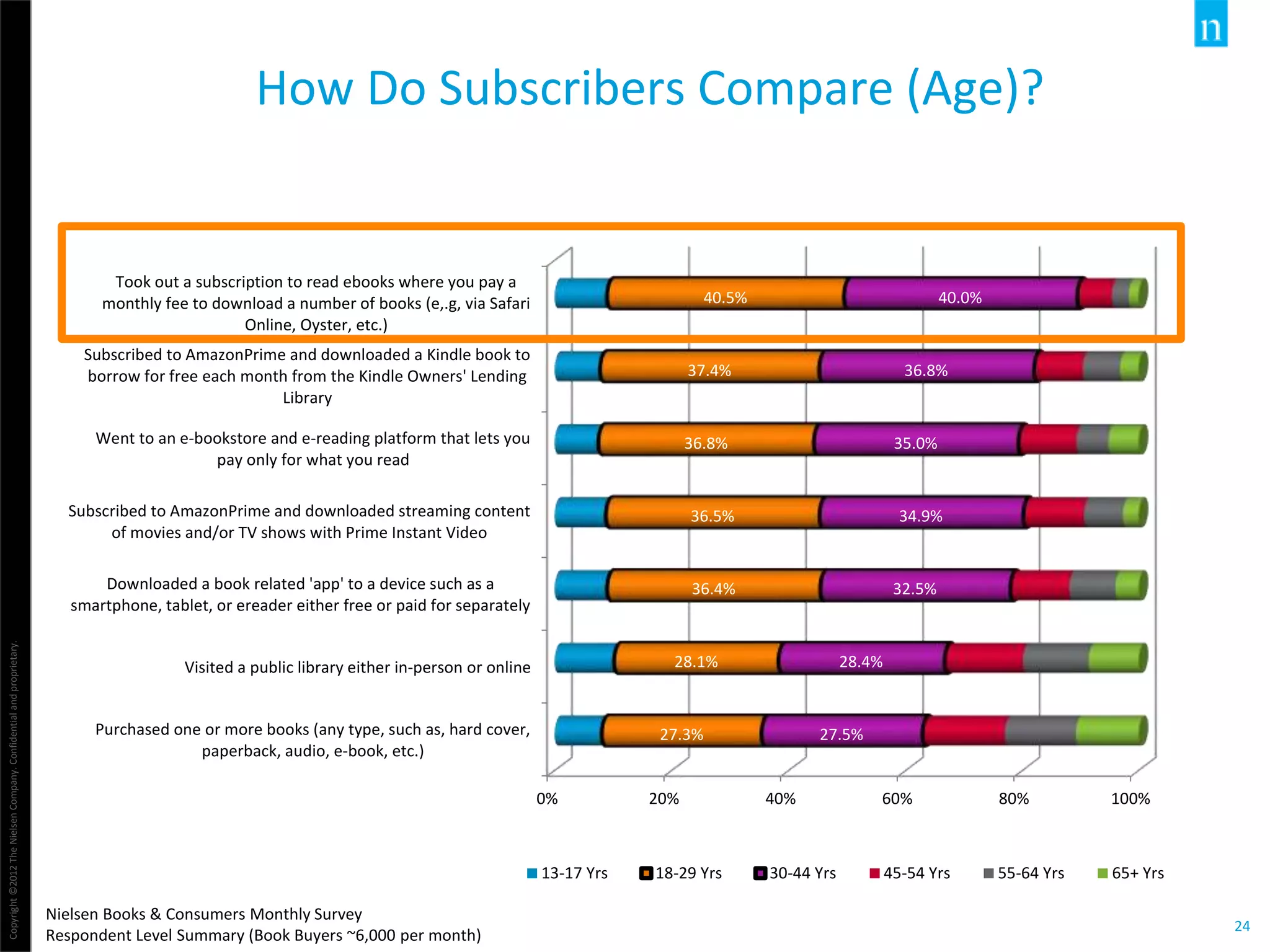

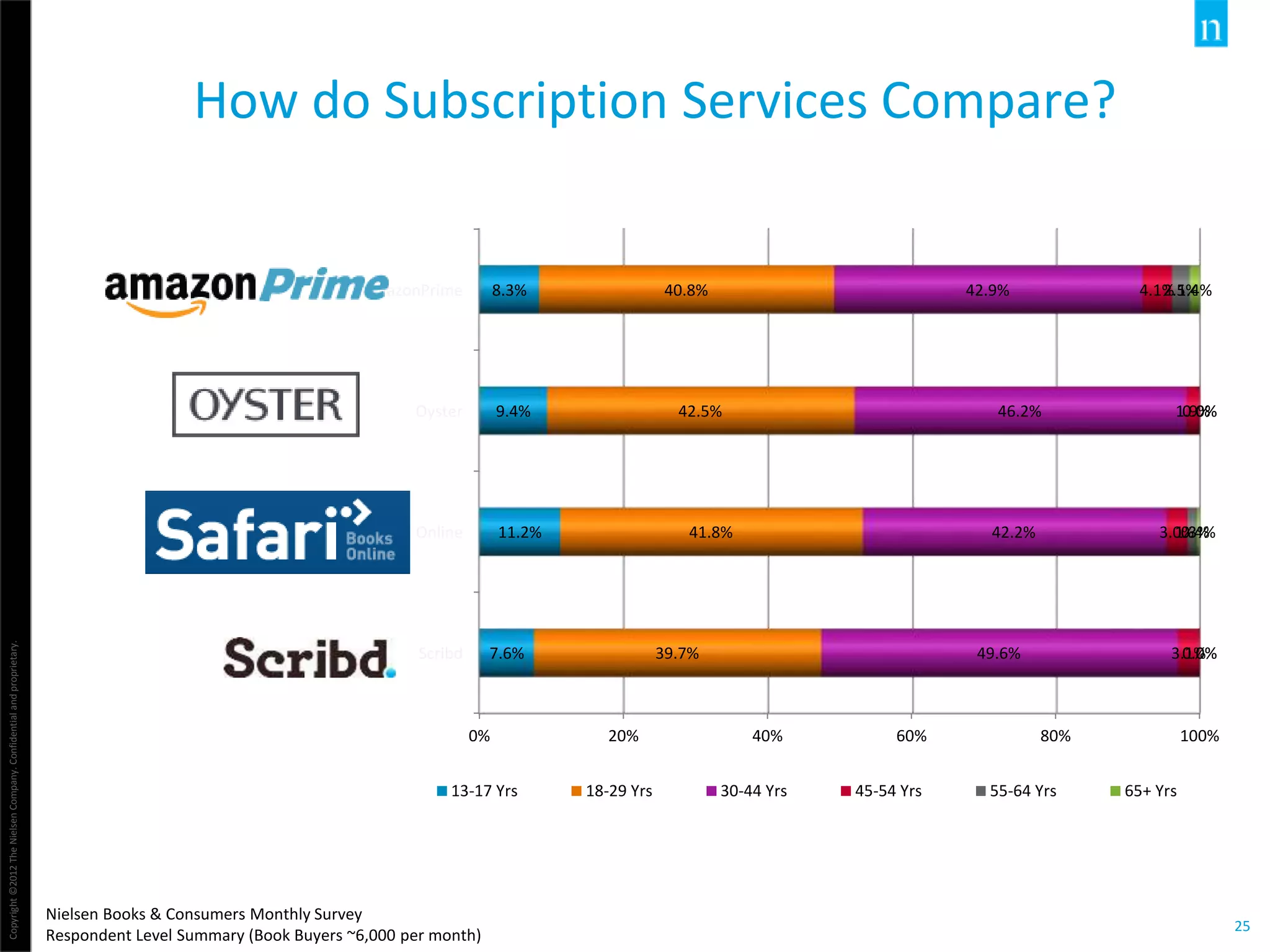

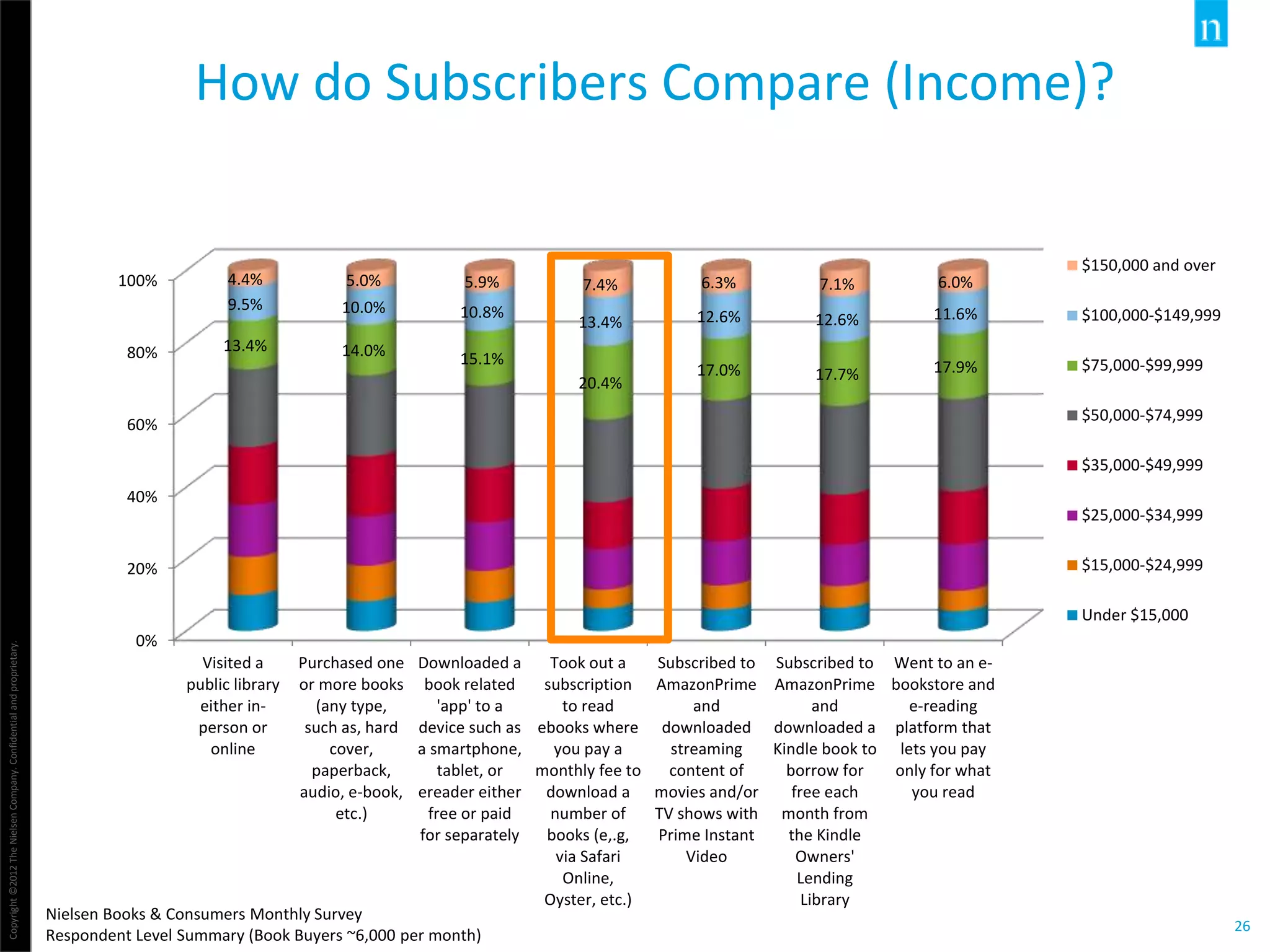

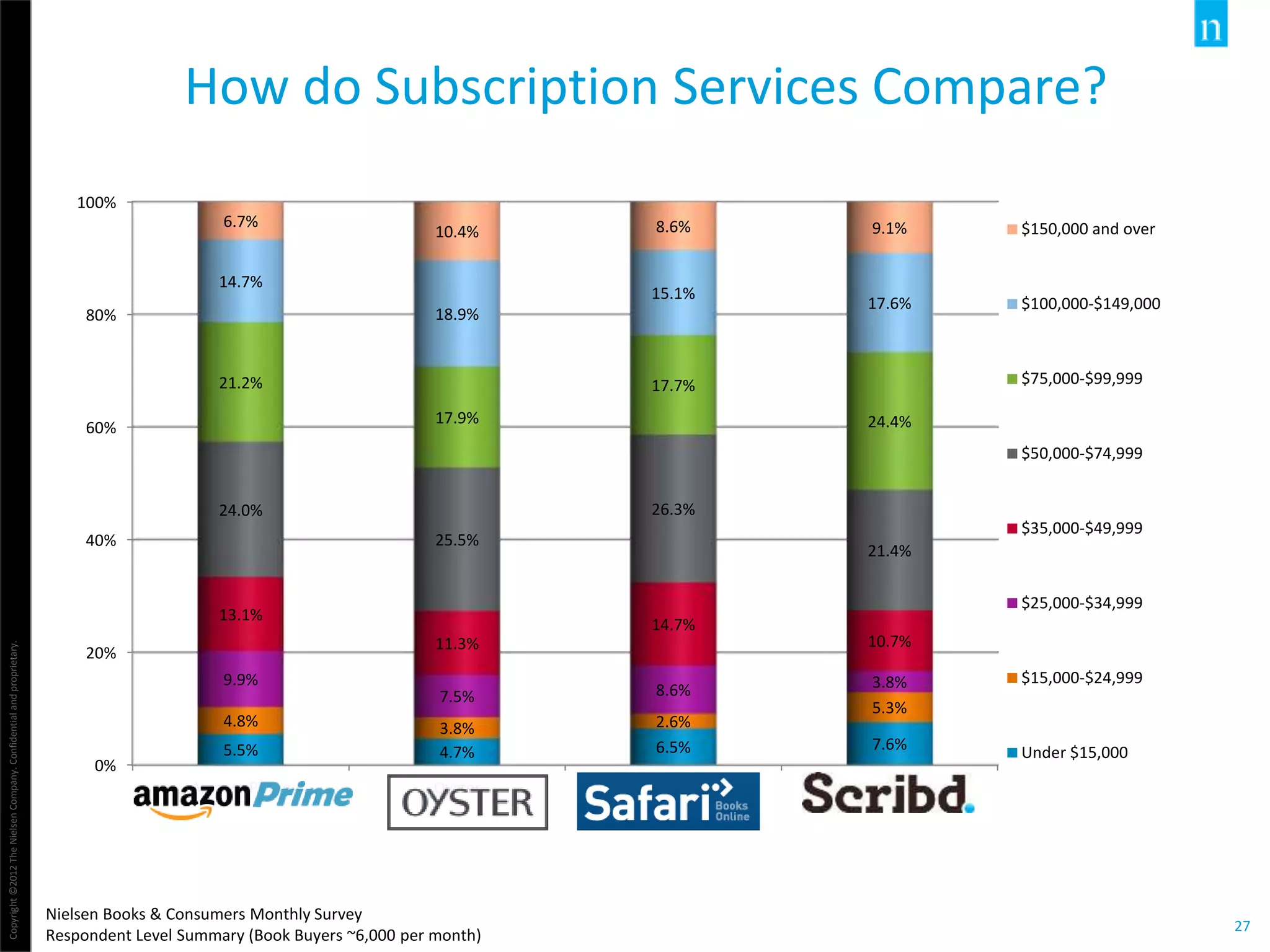

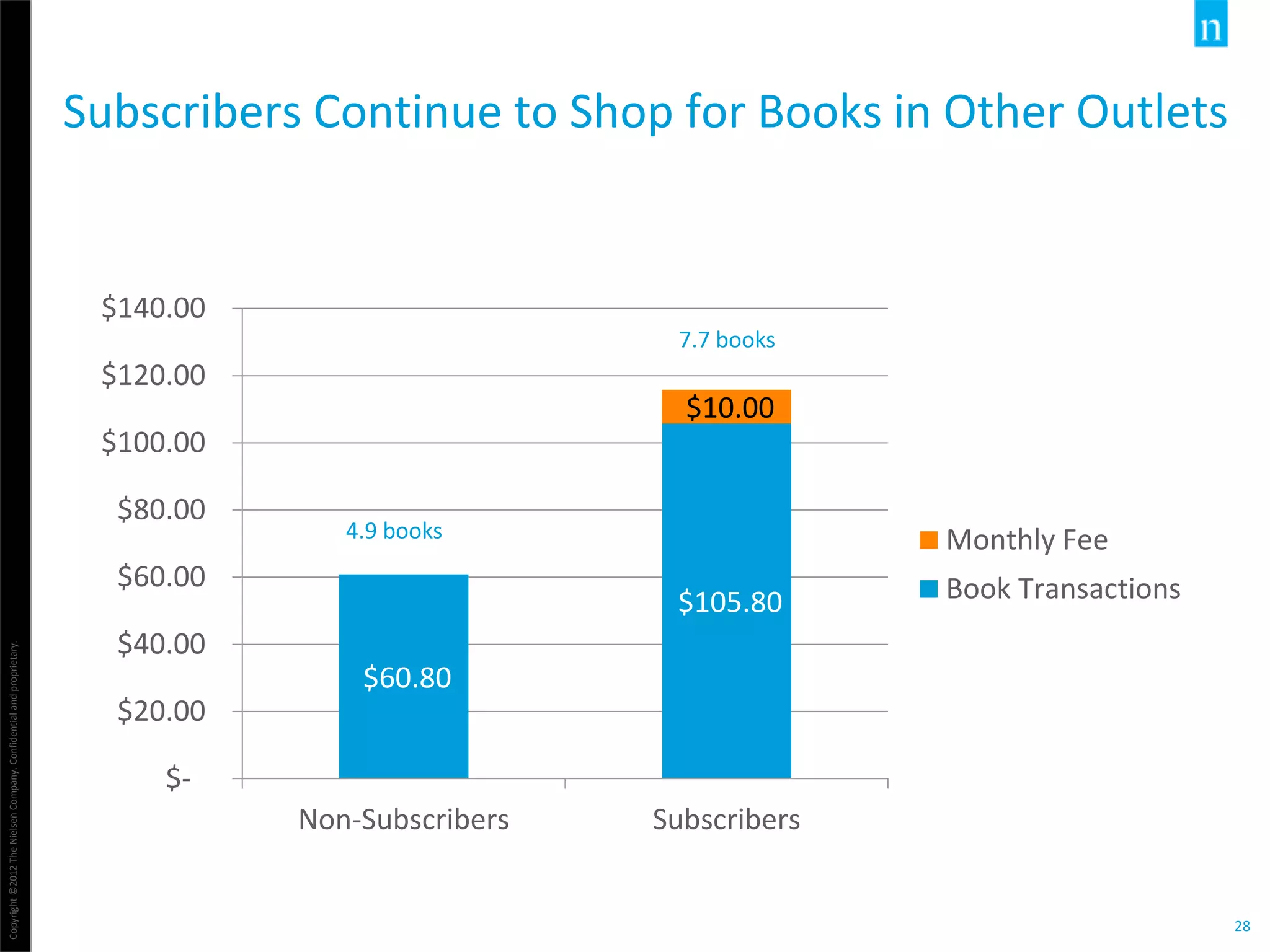

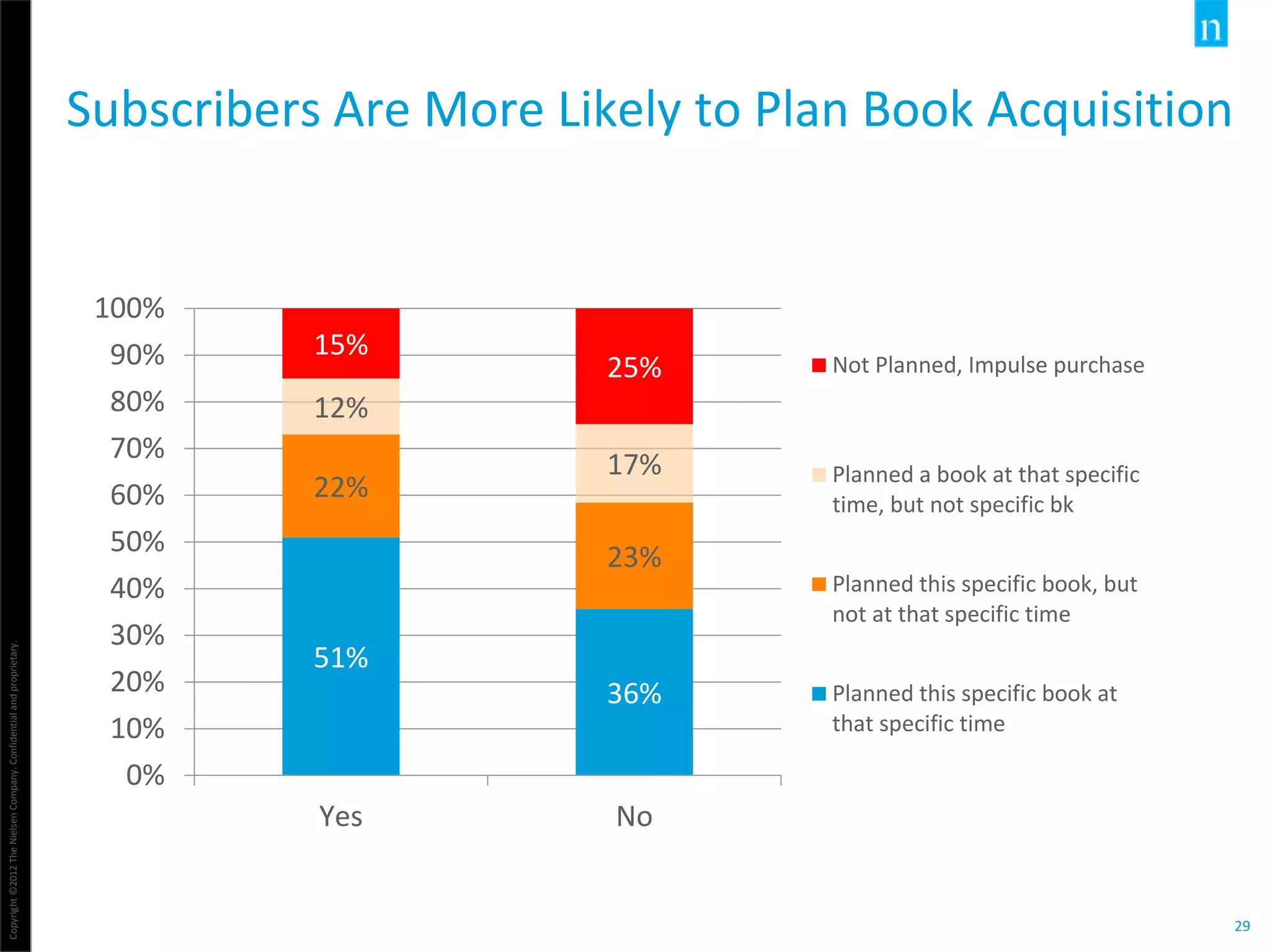

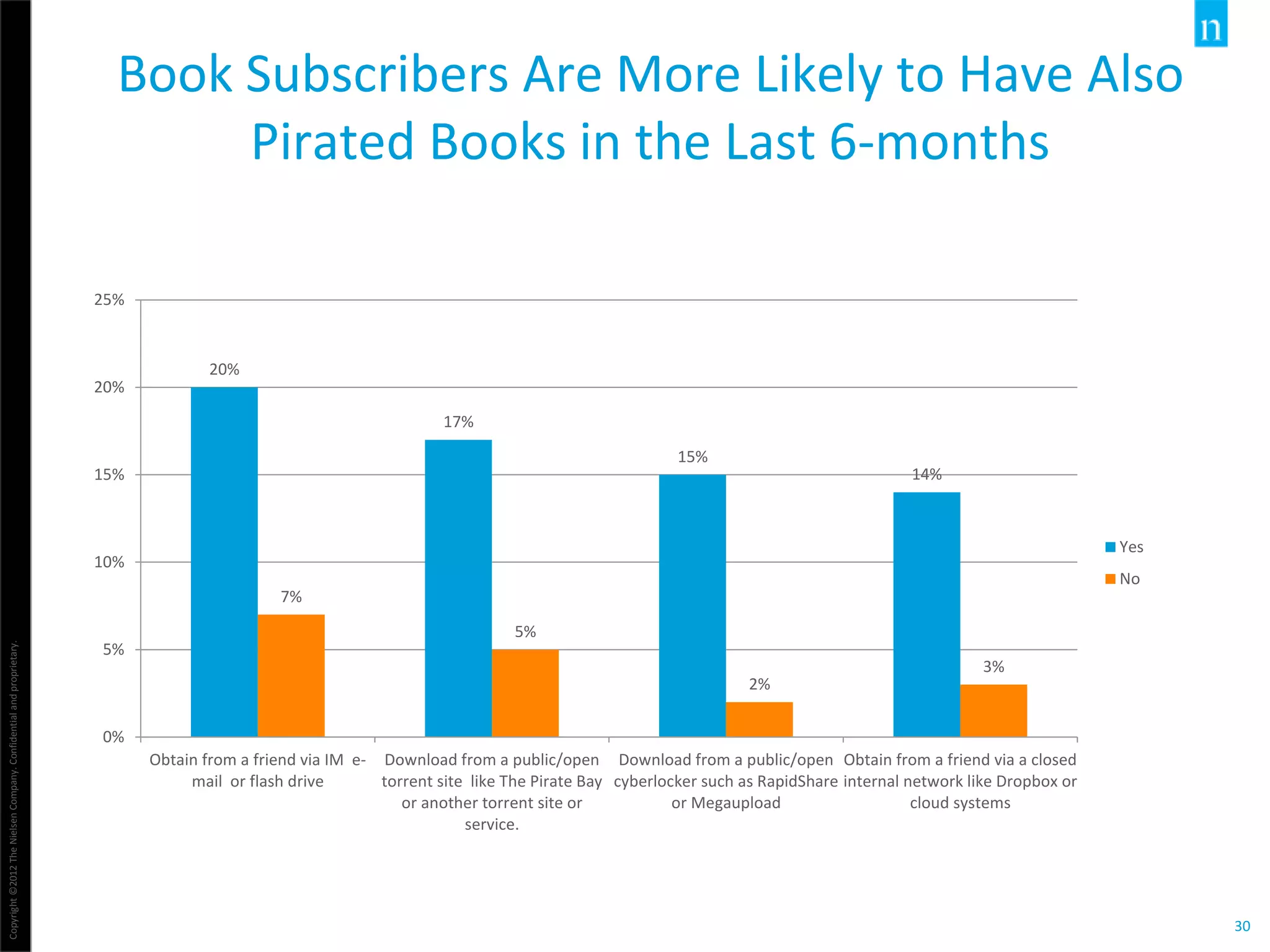

The document discusses the trends and data surrounding subscription services for music, TV, movies, and books as of Q1 2014, detailing user demographics and behaviors. It highlights the growth in streaming services, specifically noting that younger, tech-savvy individuals are predominant among music streamers and that subscription models are impacting consumer spending habits. Additionally, it emphasizes the incremental growth in book subscription services, with early adopters exhibiting specific demographic traits.