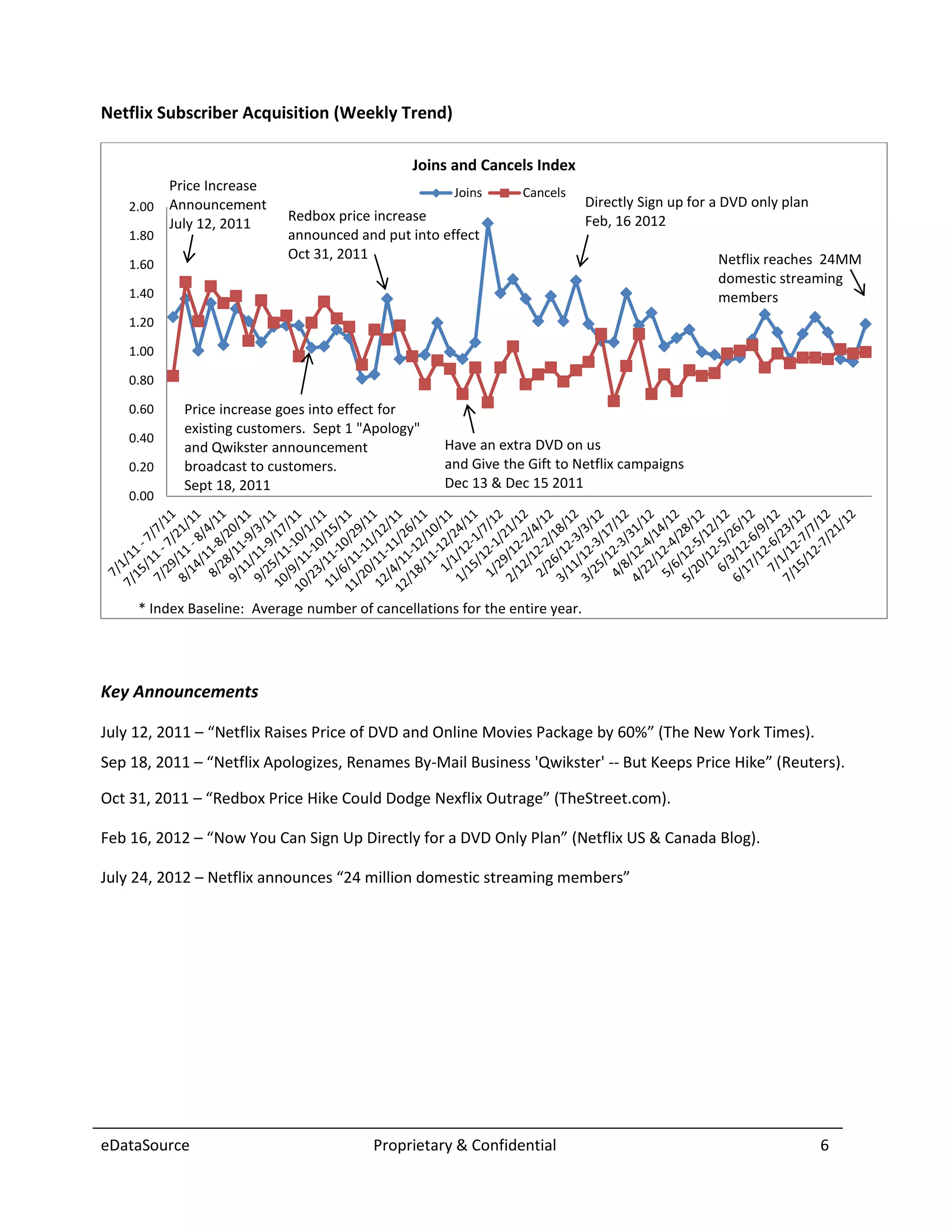

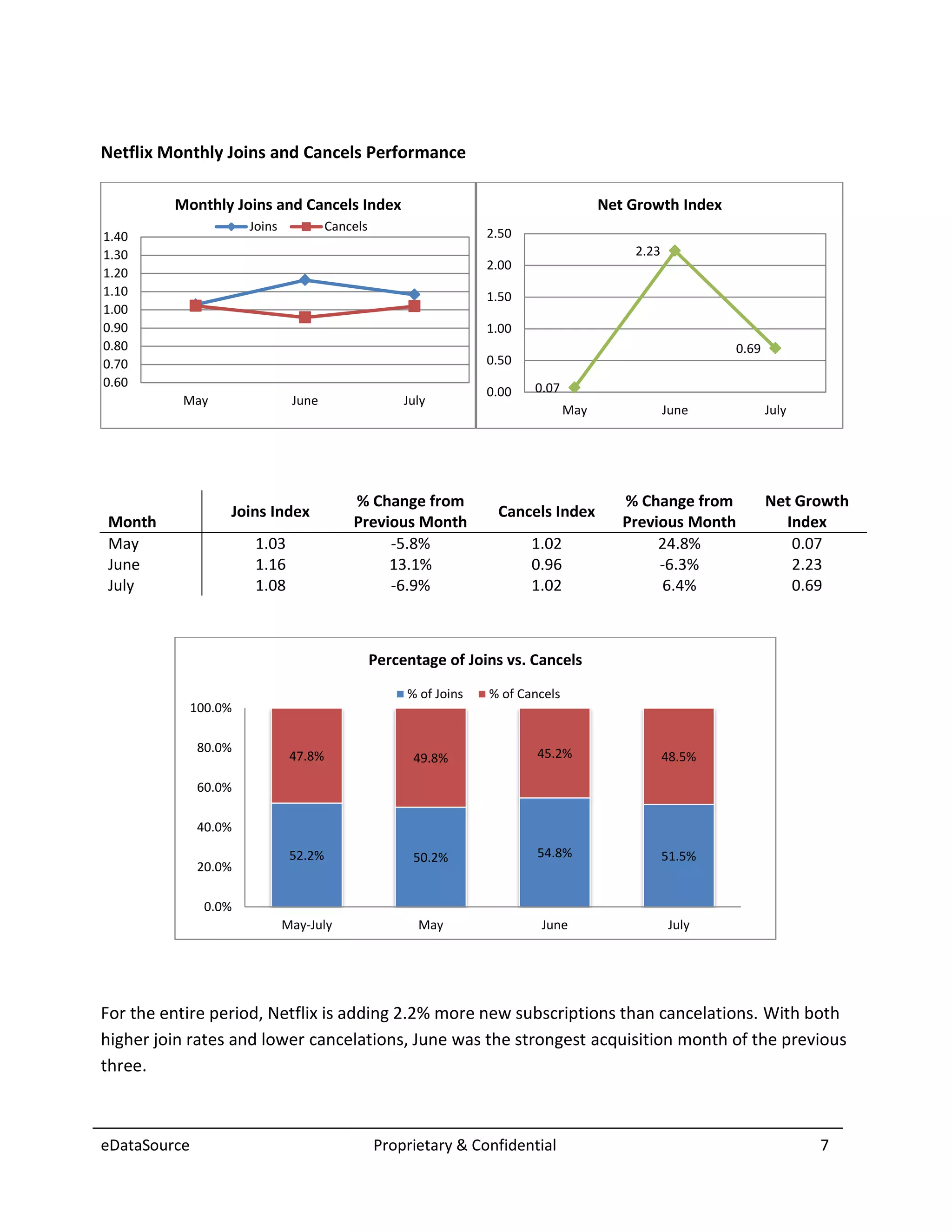

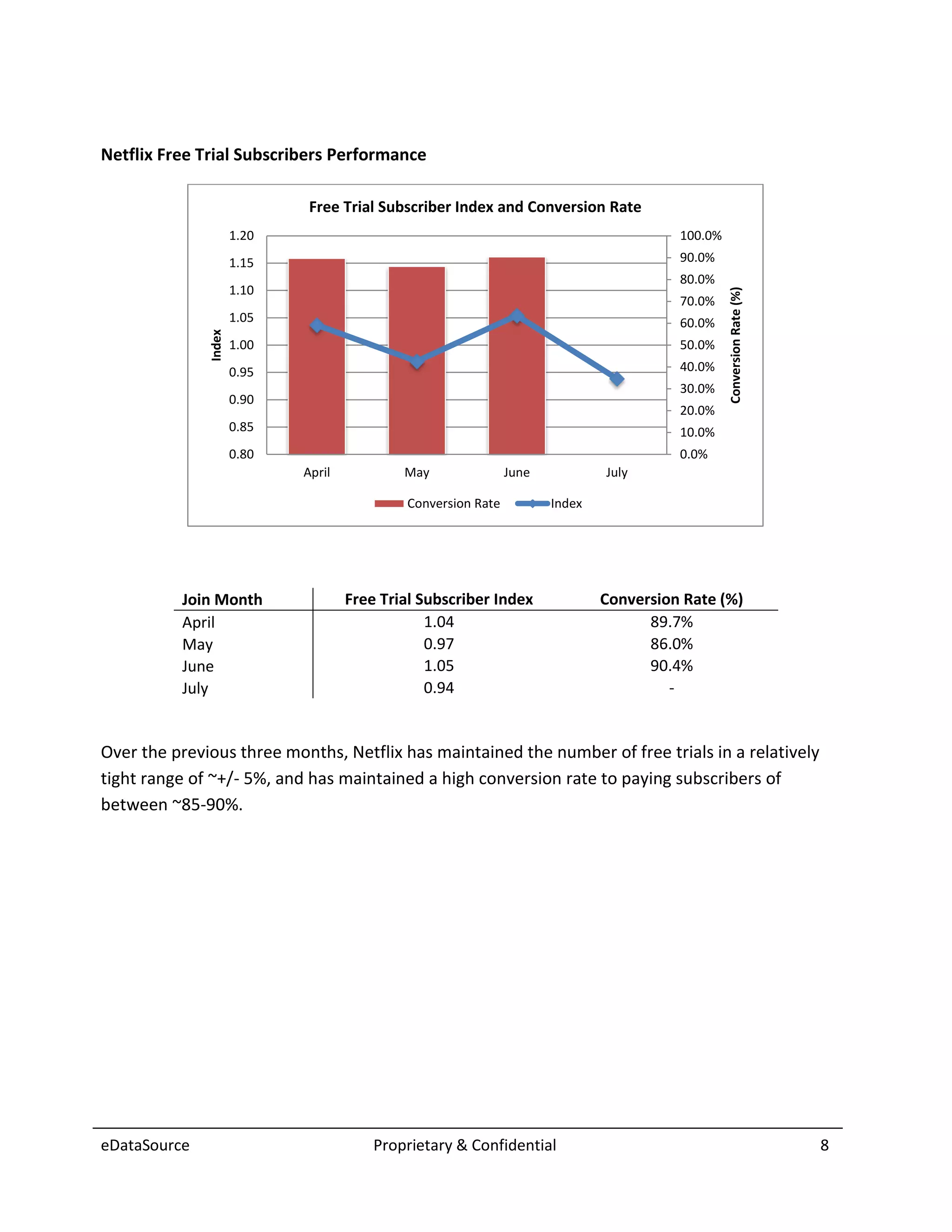

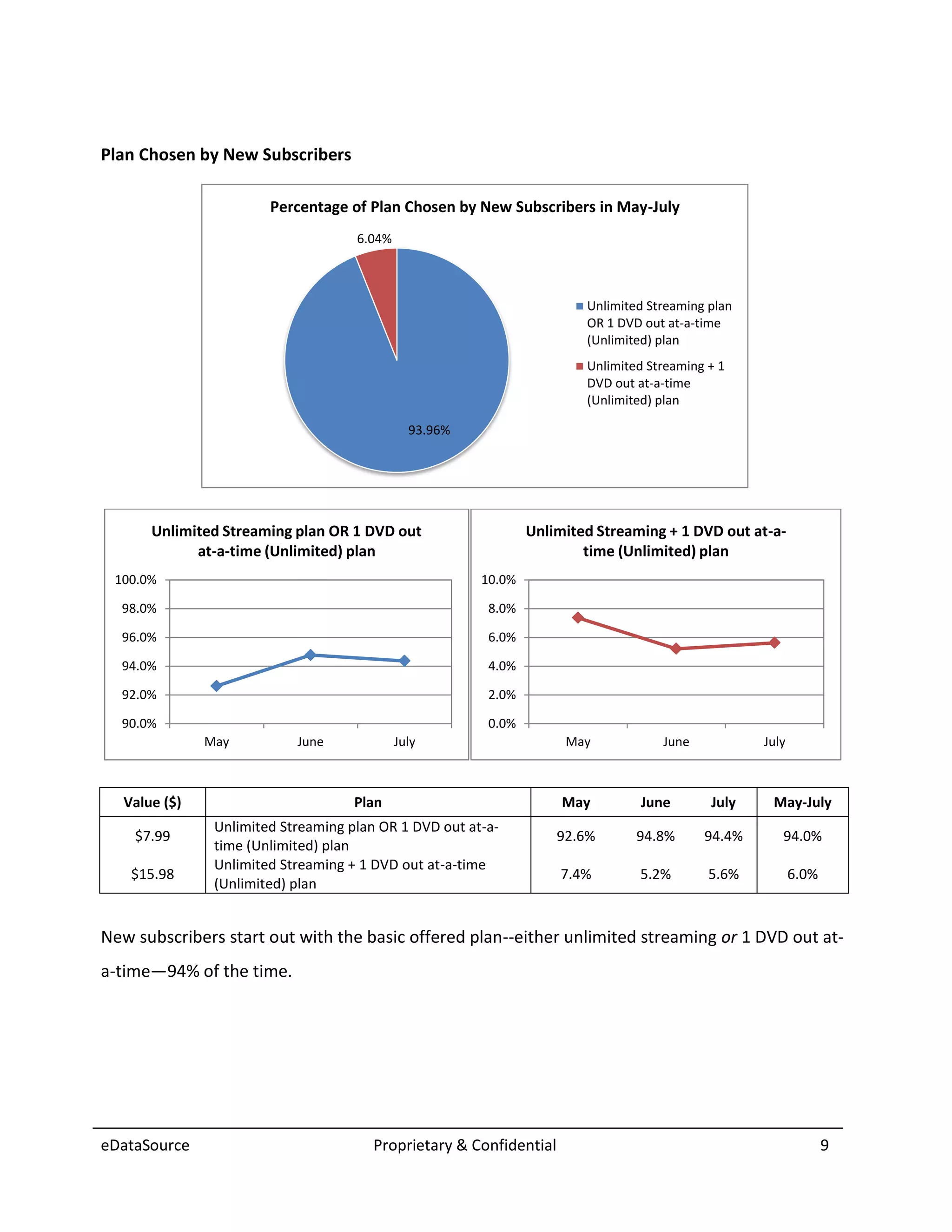

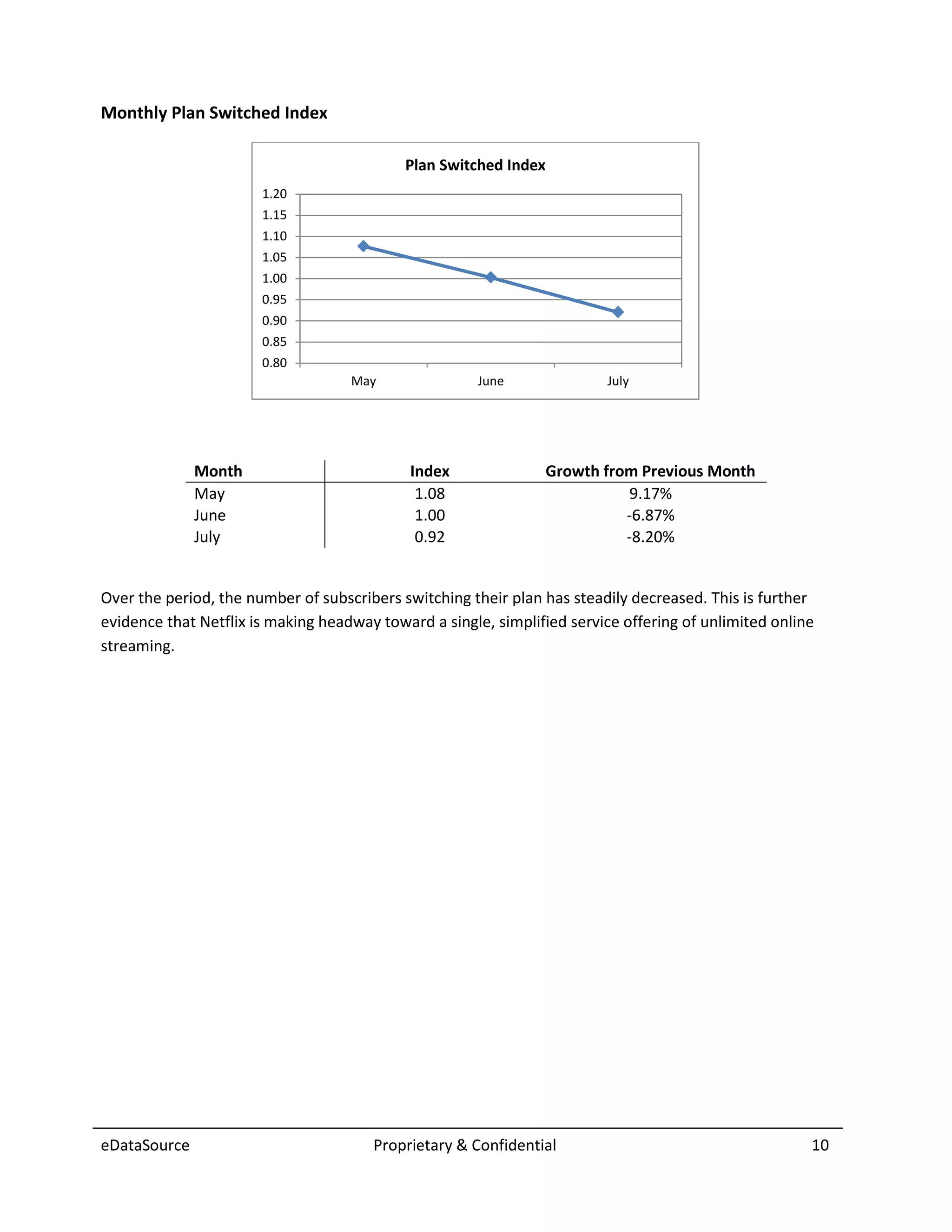

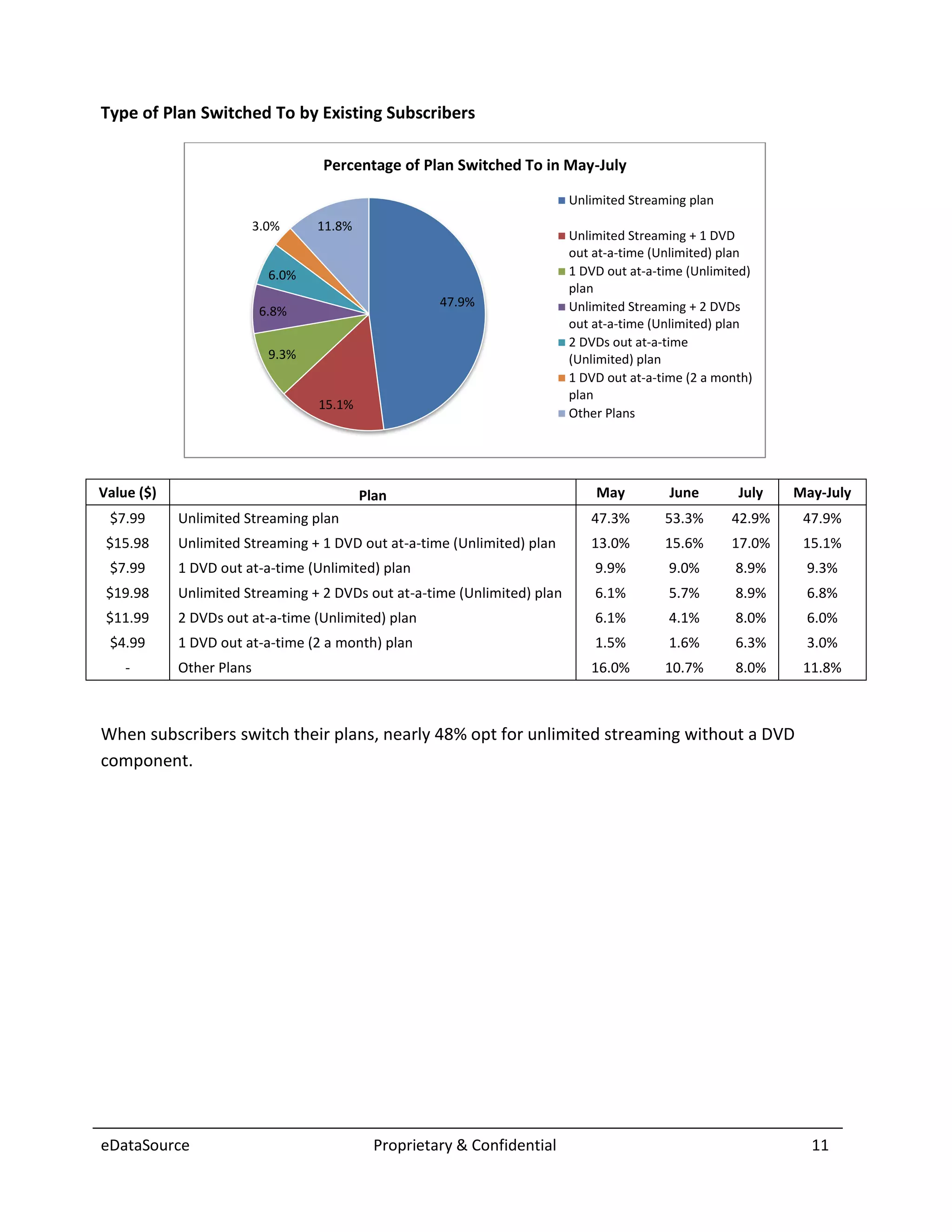

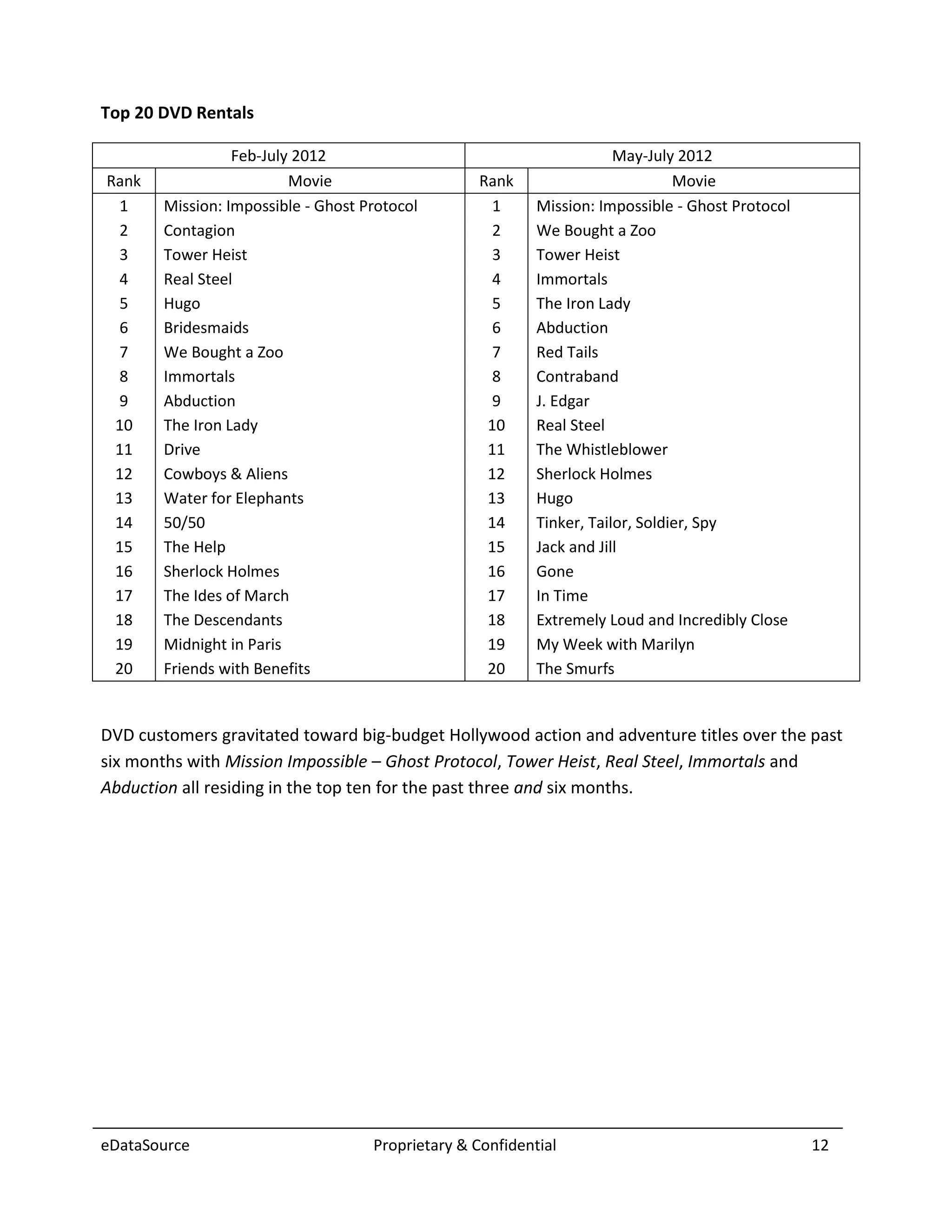

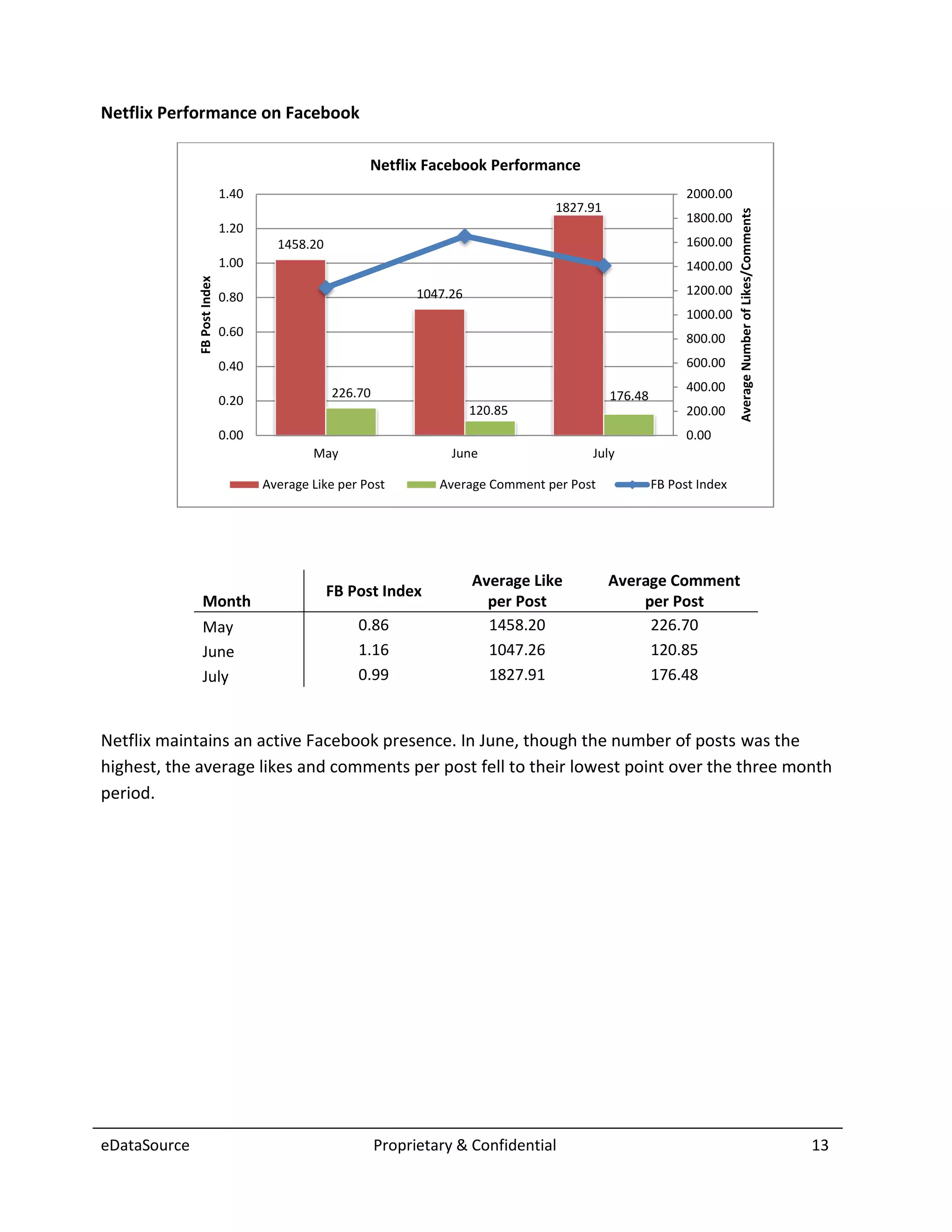

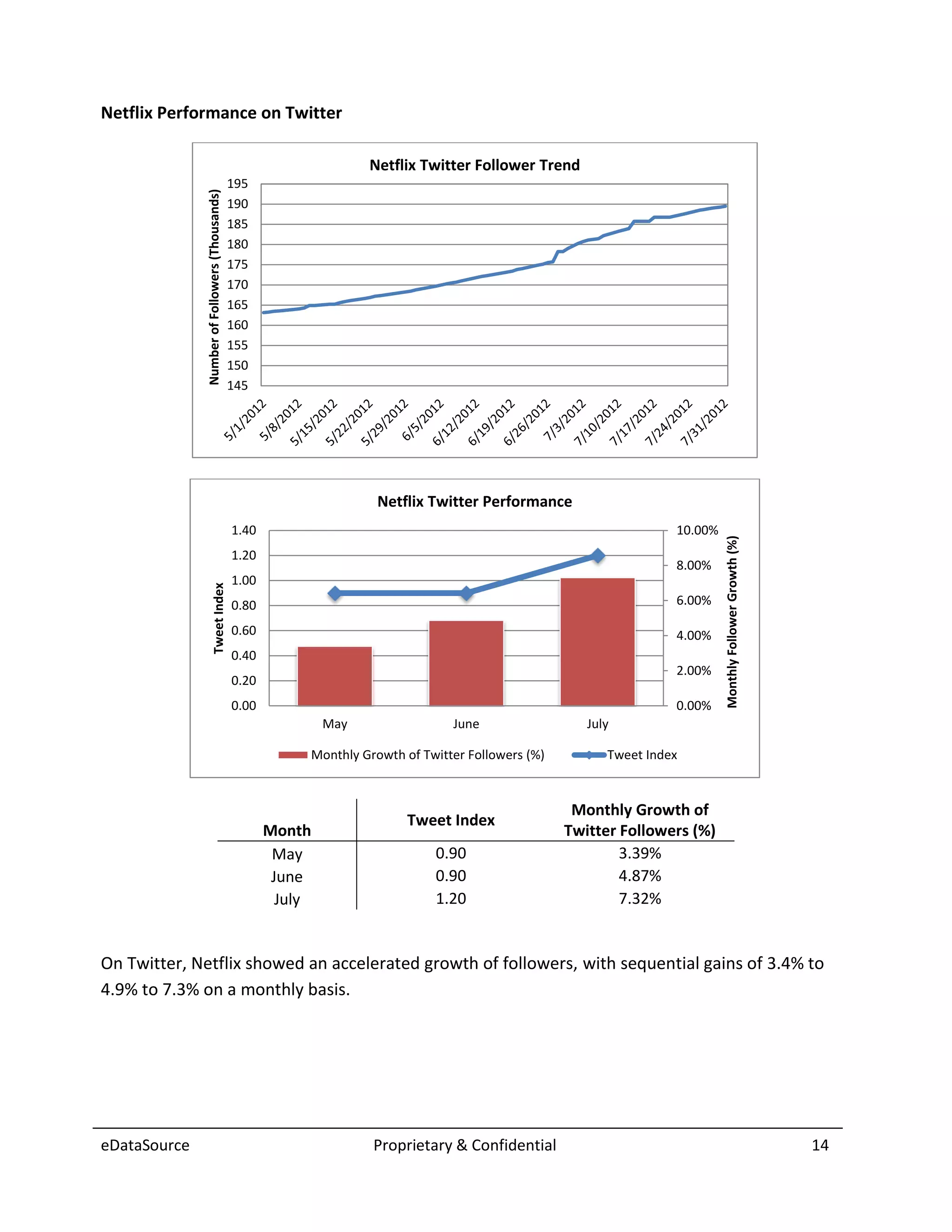

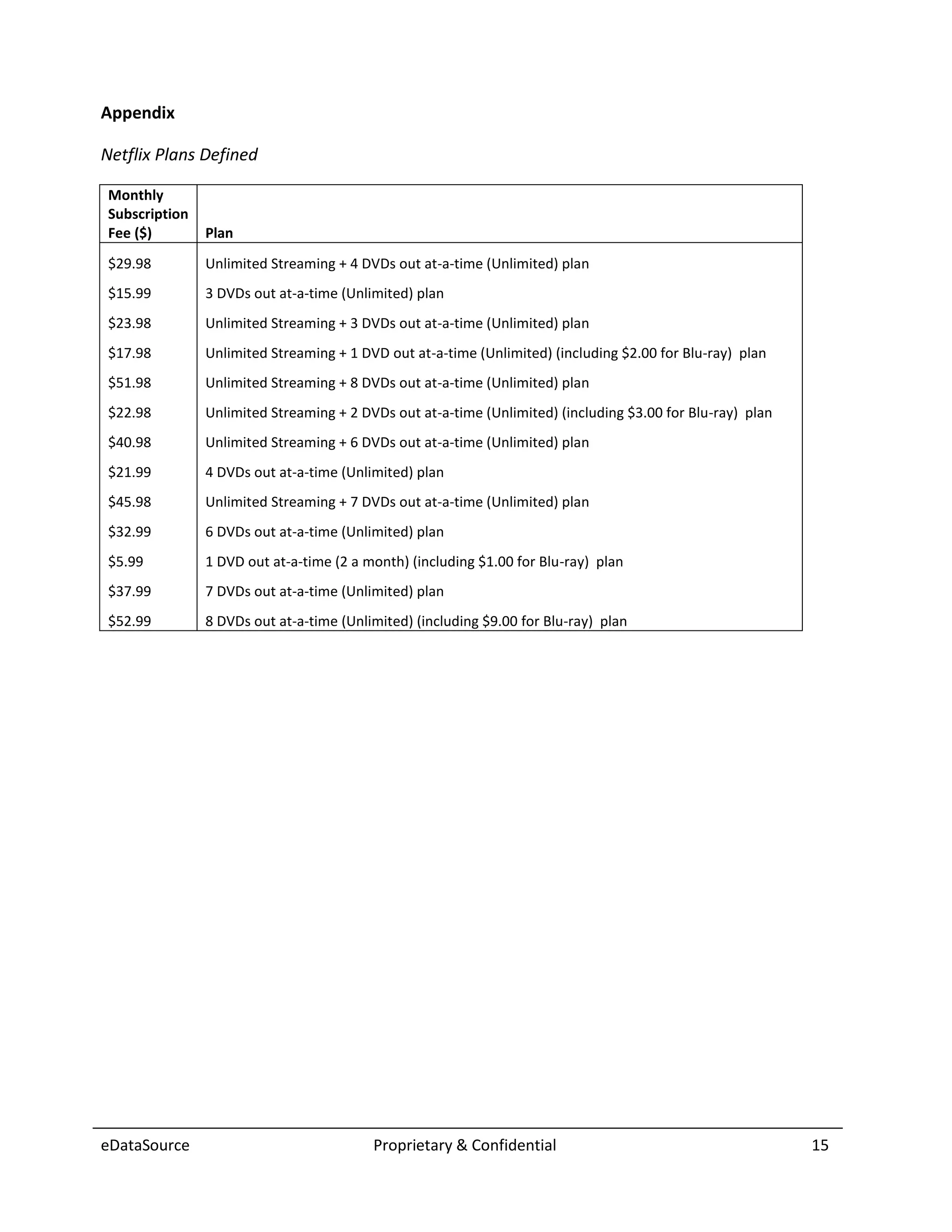

This report analyzes Netflix's business performance from May to July 2012 using data from 8,000 anonymized Netflix emails. It finds that while Netflix was once dominant in DVD rentals and growing rapidly, the company struggled after a 2011 price hike and plan changes upset customers. The report details metrics like new subscriber numbers and trends, free trial conversions, popular rentals and social media performance to understand Netflix's challenges after its missteps and as streaming becomes increasingly important.