Survey results: Consumer discretionary spending in China

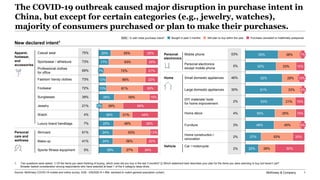

- 1. McKinsey & Company 1 The COVID-19 outbreak caused major disruption in purchase intent in China, but except for certain categories (e.g., jewelry, watches), majority of consumers purchased or plan to make their purchases. New declared intent1 Apparel, footwear, and accessories Personal care and wellness Home Vehicle Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 894, sampled to match general population (urban) 1. Two questions were asked: 1) Of the items you were thinking of buying, which ones did you buy in the last 3 months? 2) Which statement best describes your plan for the items you were planning to buy but haven’t yet? Broader basket consideration among respondents who have selected at least 1 of the 4 category deep-dives. Personal electronics 20% 17% 13% 13% 26% 36% 25% 24% 24% 39% 55% 63% 72% 66% 61% 59% 39% 21% 46% 63% 56% 27% 25% 20% 21% 22% 26% 15% 59% 44% 28% 13% 20% 34% 7% 2% 55% 52% 62% 61% 63% 50% 48% 27% 22% 38% 33% 28% 33% 21% 35% 45% 53% 28% 15% 16% 15% 20% 50% 6% 7% 10% 6% Casual wear Sportswear / athleisure Professional clothes for office Sports/ fitness equipment Skincare Fashion/ trendy clothes Footwear Sunglasses Jewelry Watch Luxury brand handbags Make-up Mobile phone Home décor Large domestic appliances Personal electronics except mobile phone Small domestic appliances Furniture DIY materials/ tools for home improvement Home construction / renovation Car / motorcycle 75% 73% 69% 5% 61% 73% 72% 39% 21% 4% 7% 41% 53% 5% 46% 30% 2% 4% 3% 2% 2% Bought in past 3 months Still plan to buy within the year Purchase cancelled or indefinitely postponedXX% - % with initial purchase intent2

- 2. McKinsey & Company 2 This document reflects survey results in the China market for two categories – mobile phones and large domestic appliances. McKinsey & Company 22 Mobile Phones Large Domestic Appliances . Separate surveys were launched to capture extensive insights for each category

- 3. McKinsey & Company 3 Just 7 percent of those with the intent to purchase a mobile phone before the COVID-19 outbreak plan to forego their purchase. 100 5 48 12 7 3 24Still plan to buy this year2 All respondents 38 Bought in past 3 months1 Will forego purchase2 55 2 Spent/intend to spend less than planned Spent/intend to spend more than planned Spent/intend to spend same as planned However, initial signs point to potentially increased price/ promo sensitivity as planners look to trade down 1. Q: Of the items you were thinking of buying, which ones did you buy in the last 3 months? 2. Q: Which statement best describes your plan of the items you were planning to buy but haven’t yet? (Will buy in next 3 months/ Will buy in next 6-8 months/ Postponed indefinitely/ Will not buy it anymore even though I still want it/ Will not buy, I’m not sure I want this anymore) 3. Q: Which statement best describes your purchase/ planned purchase? (Bought the same item/ brand as planned/ Spent less or bought a cheaper item/ brand instead/ Spent more than planned or bought a more expensive item/ brand instead) Current declared purchase behavior/intent for mobile phones1 % of respondents with pre-COVID-19 purchase intent 93% of respondents with pre-COVID-19 purchase intent have either bought a phone, or still plan to do so within the year 91% of respondents who purchased a phone (i.e., “buyers”) spent the same as their original plan 31% of respondents planning to buy a phone later this year (i.e., “planners”) are looking to trade down or spend less Category highlights Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 894, sampled to match general population (urban)

- 4. McKinsey & Company 4 Uncertainty over the COVID-19 outbreak’s impact on income is the most cited reason for trading down or not completing a purchase. 1. Q: Which statement best describes the reason for spending less on your future mobile phone? Q: Which statement best describes the reason for spending less on your mobile phone? Q: You mentioned you have dropped the plan of purchasing the mobile phone, Which statement best describes the reason for it? 51% 36% 4% 4% 2% 2% I have less time to browse because of this crisis I want to save money because I am worried about impact of COVID-19 on my income I feel guilty to spend on mobile phone given the serious impact of COVID-19 on society I have to spend money on other things I found a really good promotion even though I wasn’t actively looking I could not find anything I liked, either online or in physical stores Consumer sentiment for spending less / not purchasing mobile phones,1 % of respondents Social guilt could also play a factor in demand Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 222 for mobile phone deep-dive, sampled to match general population (urban)

- 5. McKinsey & Company 5 Responses suggest an inclination among those who have traded down or plan to trade down to stay with their preferred brand— albeit with a discount or promotion. 1. Q: You answered previously that you still bought a cellphone, but spent less than planned. Which statement best describes your purchase? (Represents 9% of those who have purchased a mobile phone in the past 3 months) 2. Q: You answered previously that you still intend to buy a cellphone, but will spend less. Which statement best describes your future purchase? (Represents 31% of those who have plan to purchase a mobile phone later this year) 25% 21% 50% 57% 25% 21% Cheaper brand Respondents who have purchased mobile phone in past 3 months1 Respondents who intend to purchase within the year2 Same brand, cheaper model Same brand, same model with a discount or promo ~57% of respondents intend to stick to the same brand and same model as they had planned, and are looking for a discount or promotion to make the purchase Intention for consumers who have traded down or plan to trade down their purchase,1,2 % of respondents Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 222 for mobile phone deep-dive, sampled to match general population (urban)

- 6. McKinsey & Company 6 While most past purchases were in physical stores, responses appear to indicate a shift to online marketplaces for future phone purchases. Potentially at the expense of single-brand and multi-brand stores Channel used or intended for purchase,1 % of respondents 1. Q: Where did you buy your prior phone? Q: For the phone you bought, which kind of store did you buy it from? Q: For your planned phone purchase, which kind of store will you buy it from? Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 222 for mobile phone deep-dive, sampled to match general population (urban) Exclusive brand outlet or pop-up Online marketplace with multiple brands Mobile operator physical store Brand official website Multi-brand electronics stores Mobile operator website Online site of multi-brand stores Brand official APP Brand official social media channel Online website Physical store Prior channel used 4% 6% 7% 8% 6% 6%8% 4% 6% 10% 5% 10% 13% 6% 11% 11% 13% 18% 17% 36% 32% 34% 18% 1% 3% Buyers Planners

- 7. McKinsey & Company 7 The survey responses suggest that the shift to online channels in the mobile-phone category may remain following the COVID-19 crisis. Expected change in consumer channel preference,1 % of respondents who use the channel 1. Q: How do you think your shopping preference for cellphones will change in the following channels after COVID-19 compared to before? ~18% of respondents expect to use physical store channels less than before Online websitePhysical store 44% 40% 35% 33% 27% 24% 22% 12% 9% 53% 54% 60% 55% 61% 71% 61% 70% 71% 56% 10% 10% 16% 17% 18% 20% 1% 3% 2% 2% 1% 2% 23% 3% 5% Online marketplace with multiple brands 0% Brand official app 3%Brand official social media channel Mobile operator website Online website of Multi-brand stores 5%Brand official website Exclusive brand stores Mobile operator physical store Multi-brand electronics stores 1%Secondhand exchange sites Will use this channel more Will discontinue using this channelNo change in using this channel Will use this channel less Net increase in channel preference2 +40% +34% +29% +21% +15% +18% +6% -6% -11% -42% Online channels may gain ~34% additional purchase traffic switching from physical stores Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 222 for mobile phone deep-dive, sampled to match general population (urban) Leading channel pre- COVID-19

- 8. McKinsey & Company 8 The most commonly cited barrier for buying online among those who prefer in-store shopping is the lack of touch and feel experience. 1.Q: What are the Top 3 factors preventing you from buying your future cellphone ONLINE? 2.Q: What are the Top 3 reasons driving you to buy your future cellphone in ONLINE channels? 62% 34% 28% 28% 21% 17% 14% 14% 10% 10% Limited technical support Difficult to use website / mobile app Long delivery times I like seeing and testing before buying Concern about safety of delivery Uncertainty about delivery times and process Sustainability issues (e.g., packaging waste) Concern about data safety in website / mobile app Limited real-time advice / answers to questions Unclear return policy 32% 27% 27% 20% 18% 17% 15% 13% 13% 13% Better price Convenient return process Wide assortment of products Convenience Promotion/ Discount Reliable customer service Multiple payment options Fast delivery Live support on the site to answer my questions Ability to combine multiple orders into one shipment Barriers to buying online for respondents who prefer physical stores,1 % of respondents Reasons for buying online for respondents who prefer online,2 % of respondents Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 222 for mobile phone deep-dive, sampled to match gen pop (urban)

- 9. McKinsey & Company 9 This document reflects survey results in the China market for two categories – mobile phones and large domestic appliances. McKinsey & Company 99 Large Domestic Appliances Separate surveys were launched to capture extensive insights for each category . Mobile Phones .

- 10. McKinsey & Company 10 The results suggest less disruption in large appliances, but some respondents expect to trade down for future purchases this year. Current declared purchase behavior/intent for large domestic appliances,1,2,3 % of respondents with pre-COVID-19 purchase intent 1.Q: Of the items you were thinking of buying, which ones did you buy in the last 3 months? 2.Q: Which statement best describes your plan of the items you were planning to buy but haven’t yet? (Will buy in next 3 months/ Will buy in next 6-8 months/ Postponed indefinitely/ Will not buy it anymore even though I still want it/ Will not buy, I’m not sure I want this anymore) 3.Q: Which statement best describes your purchase/ planned purchase? (Bought the same item/ brand as planned/ Spent less or bought a cheaper item/ brand instead/ Spent more than planned or bought a more expensive item/ brand instead) Category highlights ~94% of respondents either purchased in the last 3 months or plan to purchase later this year ~17% of respondents who purchased a large appliance spent less than originally planned ~39% of respondents planning to buy large domestic appliances later this year are looking to spend less than originally planned Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 225 for large domestic appliances deep-dive, sampled to match general population (urban) 100 11 45 13 6 6 17 3 Will forego purchase2 Still plan to buy this year2 All respondents Bought in past 3 months1 61 33 Spent/intend to spend same as planned Spent/intend to spend less than planned Spent/intend to spend more than planned However, just 6% state intention to completely forego purchase

- 11. McKinsey & Company 11 Along with income uncertainty, social guilt also appears to play a role in respondents’ decisions to spend less or forego a purchase. Reason for planning to spend less or foregoing future large-appliance purchases,1,2 % of respondents 34% 23% 18% 9% 7% 7% 2% I had to spend money on other things instead I felt guilty to spend a lot given the serious impact of COVID-19 on society I wanted to save money because I’m worried about the impact of COVID-19 on my income My plans have changed (e.g. moving, renovation, etc.) I don’t want to leave my house, and I don’t want to buy online I have less time to browse because of the crisis I have other things on my mind, and this is not a priority 1. Q: Which statement best describes the reason for spending less on your FUTURE large domestic appliances? 2. Q: You mentioned you have dropped the plan of purchasing large domestic appliances, Which statement best describes the reason for it? Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 225 for large domestic appliances deep-dive, sampled to match general population (urban)

- 12. McKinsey & Company 12 1. Q: You answered previously that you still bought large domestic appliances, but spent less than planned. Which statement best describes your purchase? (Represents 17% of those who bought a large domestic appliance in the past 3 months) 2. Q: You answered previously that you still intend to buy large domestic appliances, but will spend less than planned. Which statement best describes your future purchase? (Represents 39% of those who plan to buy a large domestic appliance within the year) 50% of respondents intend to stick to the same brand as they had planned, out of which ~72% are looking for a cheaper model within the same brand Those who plan to spend less suggest they are likely to purchase the same brand, but a cheaper model. Nearly a third of respondents are likely to switch to a cheaper brand in this category 41% 21% 15% 29% 11% 36% 33% 14% Same brand, cheaper model Respondents who have purchased large appliances in past 3 months1 Respondents who intended to purchase in next 3-6 months2 Same model with a discount of promotion Not buy some of the appliances I originally planned Cheaper brand Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 225 for large domestic appliances deep-dive, sampled to match general population (urban) Intention for consumers who have traded down or plan to trade down their purchase,1,2 % of respondents

- 13. McKinsey & Company 13 In the short term, the findings suggest that online marketplaces could hold as the leading purchase channel for large appliances. Although physical appliance stores still play an important role for respondents, dept stores could continue to be challenged Channel used or intended for purchase,1 % of respondents 1. Q: Where do you typically purchase these kinds of appliances? Select all that apply Q: Where did you buy your appliances from? Q: Where will you most likely buy your large domestic appliances? Physical appliance store with multiple brands Online marketplace with many brands Physical department store Online website of appliance store Brand official app Online website of department store Brand official website Single brand store Online website Physical store Prior channels used 5% 5% 6% 7% 6% 7%6% 6% 5% 8% 5% 25% 8% 8% 34% 25% 23% 35% 20% 10% 31% 30% 4% 44% 2% 4% 4% Buyers Planners Brand official social media channel Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 225 for large domestic appliances deep-dive, sampled to match general population (urban)

- 14. McKinsey & Company 14 In the longer term, consumer preferences appear to shift even more online, toward marketplaces and appliance store sites. Net increase in channel preference2 33% 29% 27% 26% 26% 23% 23% 22% 21% 59% 39% 63% 36% 31% 60% 42% 64% 40% 26% 26% 32% 27% 33% 12% 12% 8% Physical multi-brand appliance stores Online website of multi-brand appliance stores 2% Brand official app 7% Physical department stores 6%Online marketplace with multiple brands 6% 6% Brand official social media Online website of department store 3% 3% 14% Brand official website 6% 9% Single-brand store Will use this channel lessWill use this channel more No change in using this channel Will discontinue using this channel Channel penetration among respondents pre-COVID-193 1. Q: How do you think your shopping preference for large domestic appliances will change in the following channels after COVID-19 compared to before? 2. Net intent is calculated by subtracting % of using less and discontinue use from using more 3. Q: Where would you typically purchase large appliances? Online websitePhysical store +24% 44% -3% 8% +17% 35% -13% 6% -18% 5% +6% 34% -12% 6% +8% 25% -18% 4% Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 225 for large domestic appliances deep-dive, sampled to match general population (urban) Leading channels pre-COVID-19 Expected change in consumer channel preference1 % of respondents who use the channel

- 15. McKinsey & Company 15 Special features and look/ style appear to have increased in importance, while customer service has decreased The most commonly cited key buying factors are good value for money and trusted brands. Importance of key buying factors for those who are planning to buy within the year,1 % of respondents 22% 21% 19% 19% 19% 18% 18% 16% 16% 15% 15% 8% 3% Lifetime / Sturdiness / ability to last Special features Reco from friends / family Good value for money Look / style Trusted brand Electricity efficiency Affordable price Ongoing promotions International brand name Customer service Guarantee / warrantee program Same brand as my current appliances +1% -1% +7% +4% -1% +5% +3% +1% -3% +10% Difference from pre-COVID-192 1. What are the top factors that you will prioritize in the appliances that you plan to buy? 2. What were the most important factor(s) that made you consider these brands before the outbreak? Difference is calculated by subtracting percentage of respondents selecting the factor for Jan purchase from percentage of respondents selecting the factor for future purchase Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 225 for large domestic appliances deep-dive, sampled to match general population (urban) 0% -11% -5%

- 16. McKinsey & Company 16 With future purchases potentially moving online, the results suggest convenient return processes and easy-to-use interfaces will be important. ‘Touch and feel’ experience is the most commonly reported barrier to online shopping 1. Q: What are the Top 3 reasons driving you to buy your future large appliances in ONLINE channels? 2. Q: What are the Top 3 factors preventing you from buying your future large appliances ONLINE? 41% 37% 33% 30% 22% 15% 15% 15% 11% 11% Lack of prolonged payment options I like seeing and testing them first before buying Inconvenient return process Uncertainty about delivery times and process Concern about safety of delivery Unclear return policy Shipping costs Limited technical support Limited product information Non user friendly website/ mobile app 22% 22% 20% 20% 17% 17% 17% 17% 13% 13% Convenient return process Easy to use shopping interface Convenience Better price Promotion/ discount Instructional content Fast delivery Personalized recommendation Live support on the site Recommendations from friends and family Barriers to buying online for respondents who prefer physical stores,2 % of respondents Reasons for buying online for respondents who prefer online,1 % of respondents Source: McKinsey COVID-19 mobile and online survey, 4/28 - 5/9/2020 N = 225 for large domestic appliances deep-dive, sampled to match gen pop (urban)

- 17. McKinsey & Company 17 Disclaimer McKinsey does not provide legal, medical, or other regulated advice or guarantee results. These materials reflect general insight and best practice based on information currently available and do not contain all of the information needed to determine a future course of action. Such information has not been generated or independently verified by McKinsey and is inherently uncertain and subject to change. McKinsey has no obligation to update these materials and makes no representation or warranty and expressly disclaims any liability with respect thereto.