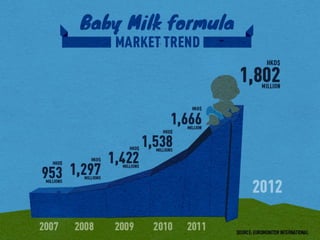

The document analyzes the baby formula market in China and Hong Kong and discusses various companies' digital marketing approaches. It finds that:

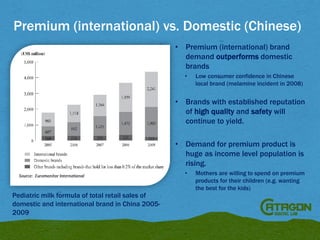

- Premium international brands like Wyeth Gold and Mead Johnson lead the market through established reputations, while local confidence in Chinese brands was damaged by a past safety incident.

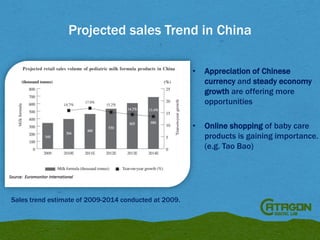

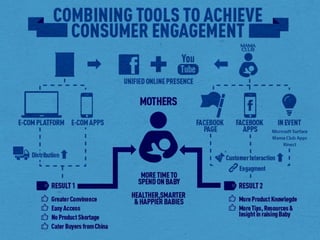

- E-commerce is a major driver of growth in China, with over half of online shoppers using mobile apps. Companies like Wyeth Gold and Friso have developed mobile apps and online platforms.

- Wyeth Gold engages customers through its website, Mama Club, Facebook app, YouTube channel and mobile app. Mead Johnson also has a strong digital presence with its website and Mama Club.