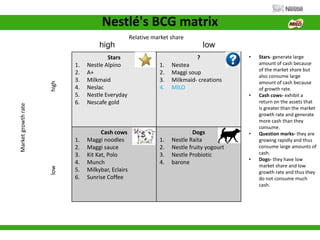

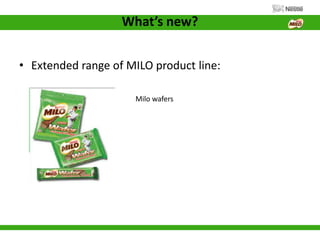

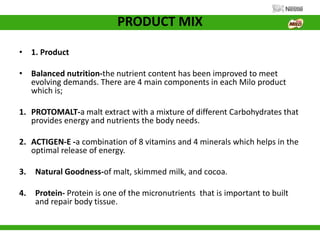

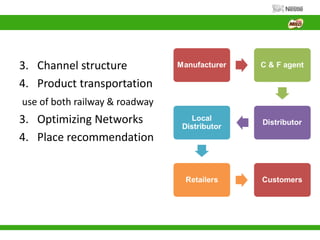

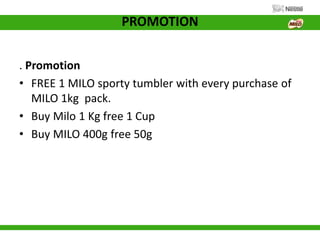

The project report discusses the revival strategy for Nestle Milo, addressing industry trends and the product's past failures due to taste and marketing issues. The plan includes introducing new flavors, improved nutritional content, and eco-friendly packaging to attract the younger demographic and compete against established brands. The marketing strategy, emphasizing product positioning and promotional offers, aims to restore Nestle's market position and appeal to both nostalgic consumers and new buyers.