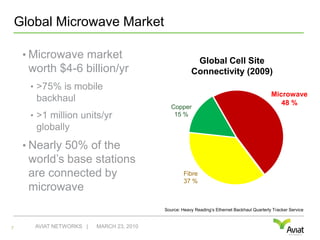

Aviat Networks highlights the importance of microwave solutions for LTE wireless networks, especially in addressing the backhaul bottleneck due to growing mobile internet demands. As operators transition from copper and fiber to more efficient microwave technologies, they can achieve greater connectivity and cost efficiency, particularly in areas where fiber installation is economically infeasible. The document emphasizes that there is no 'one size fits all' solution for backhaul, and microwave can complement fiber in providing effective network migration for next-generation 4G/LTE services.