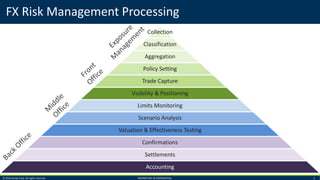

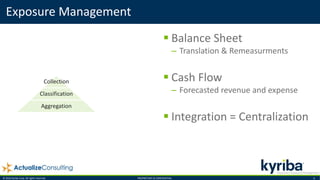

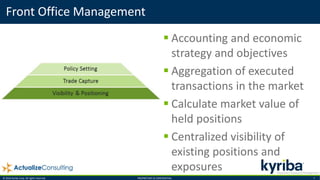

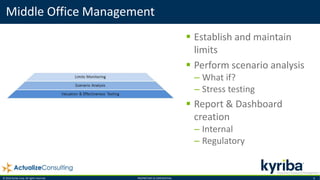

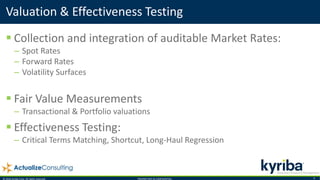

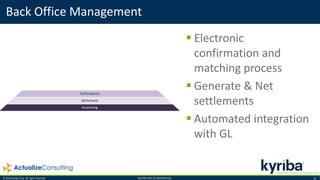

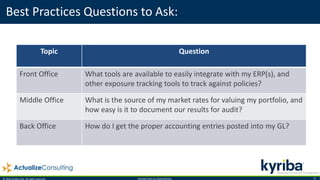

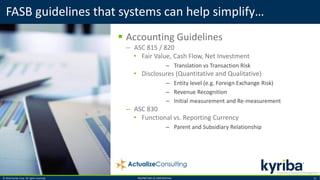

The document outlines the best practices for managing foreign exchange (FX) hedging programs, focusing on compliance, procedural elements, and automation of accounting processes. It emphasizes the importance of front, middle, and back office management in integrating FX risk management, ensuring accurate valuations, and adhering to accounting guidelines. Additionally, it highlights key questions to consider for effective implementation of an FX program within an organization.