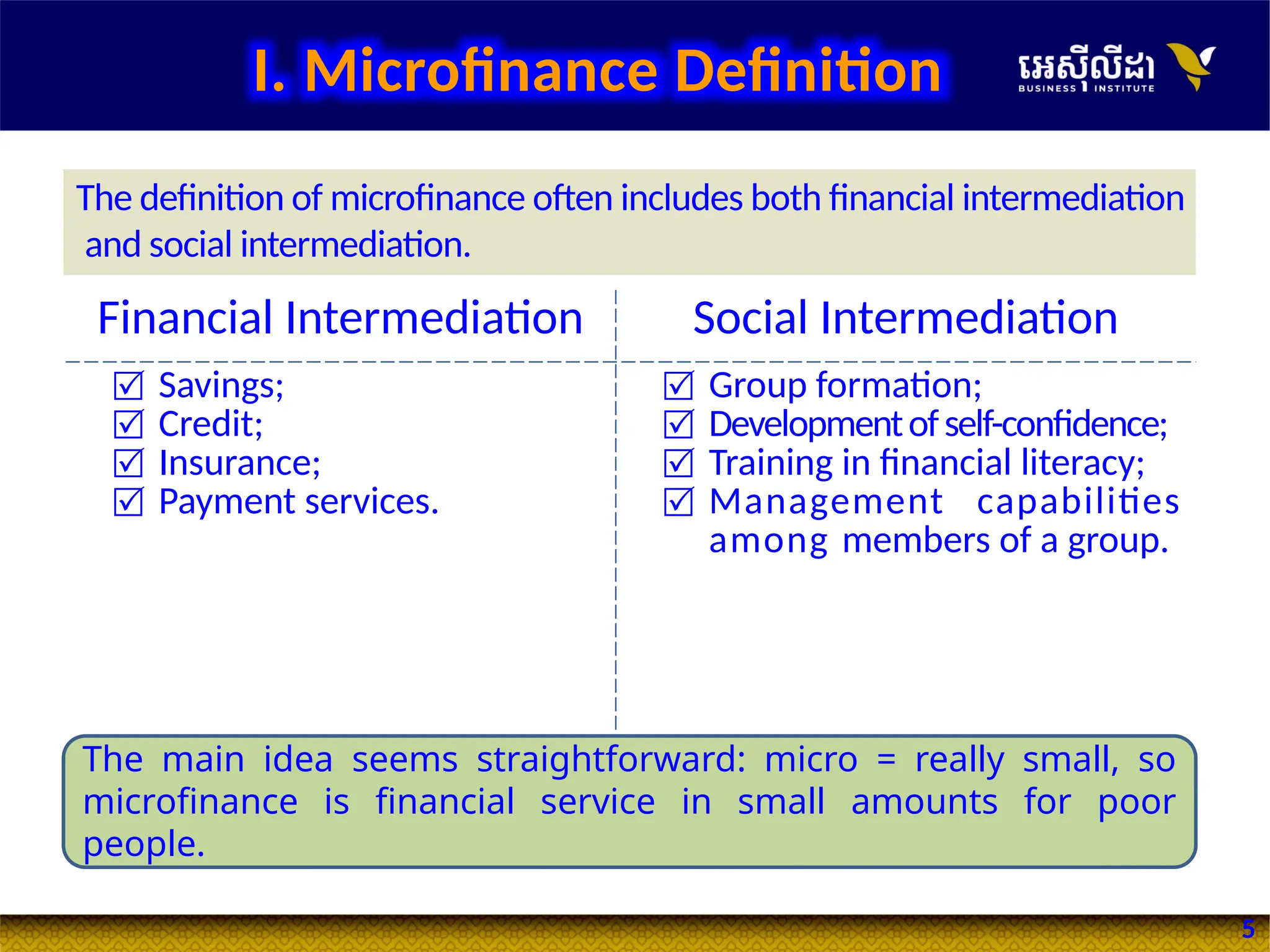

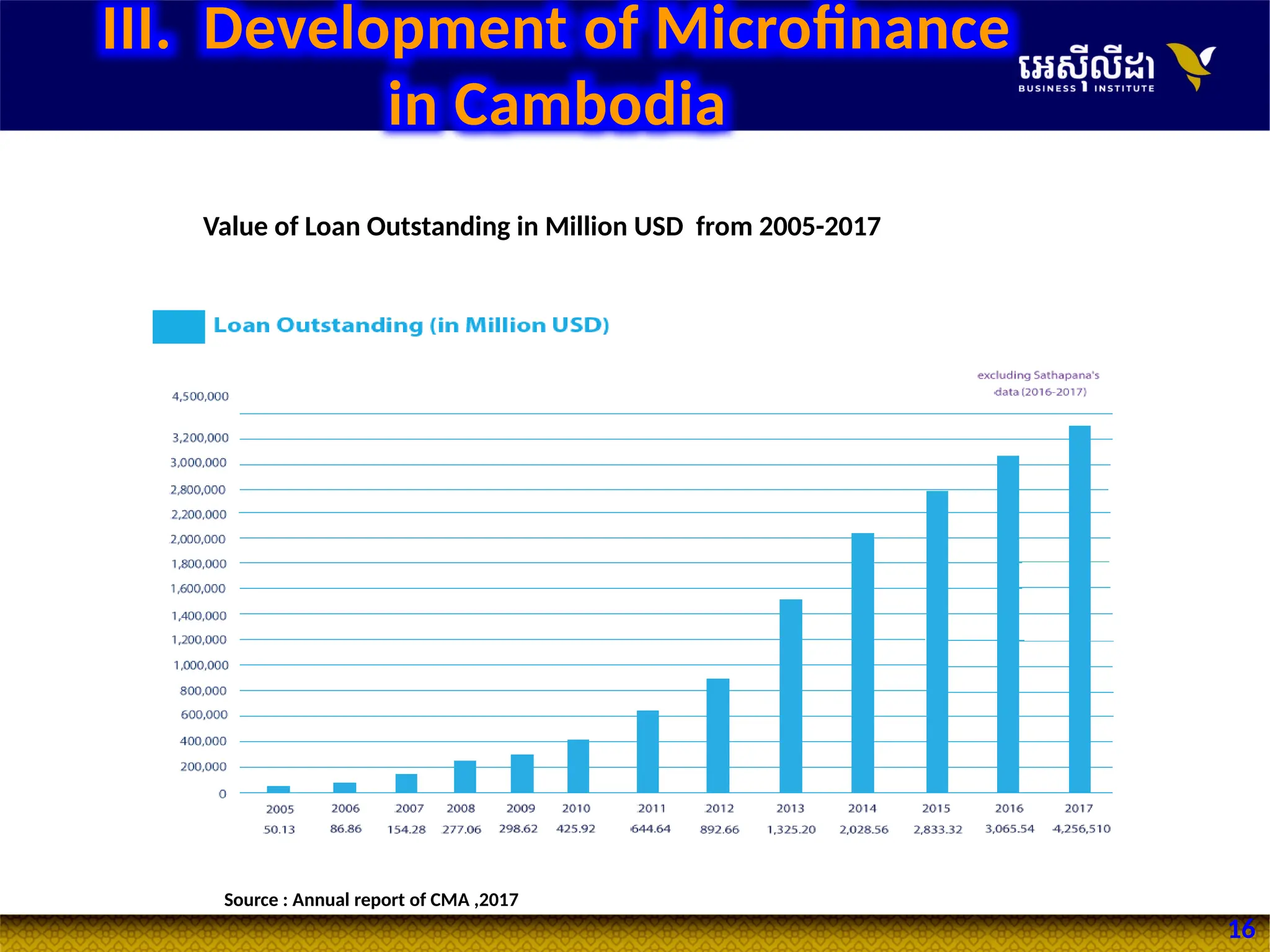

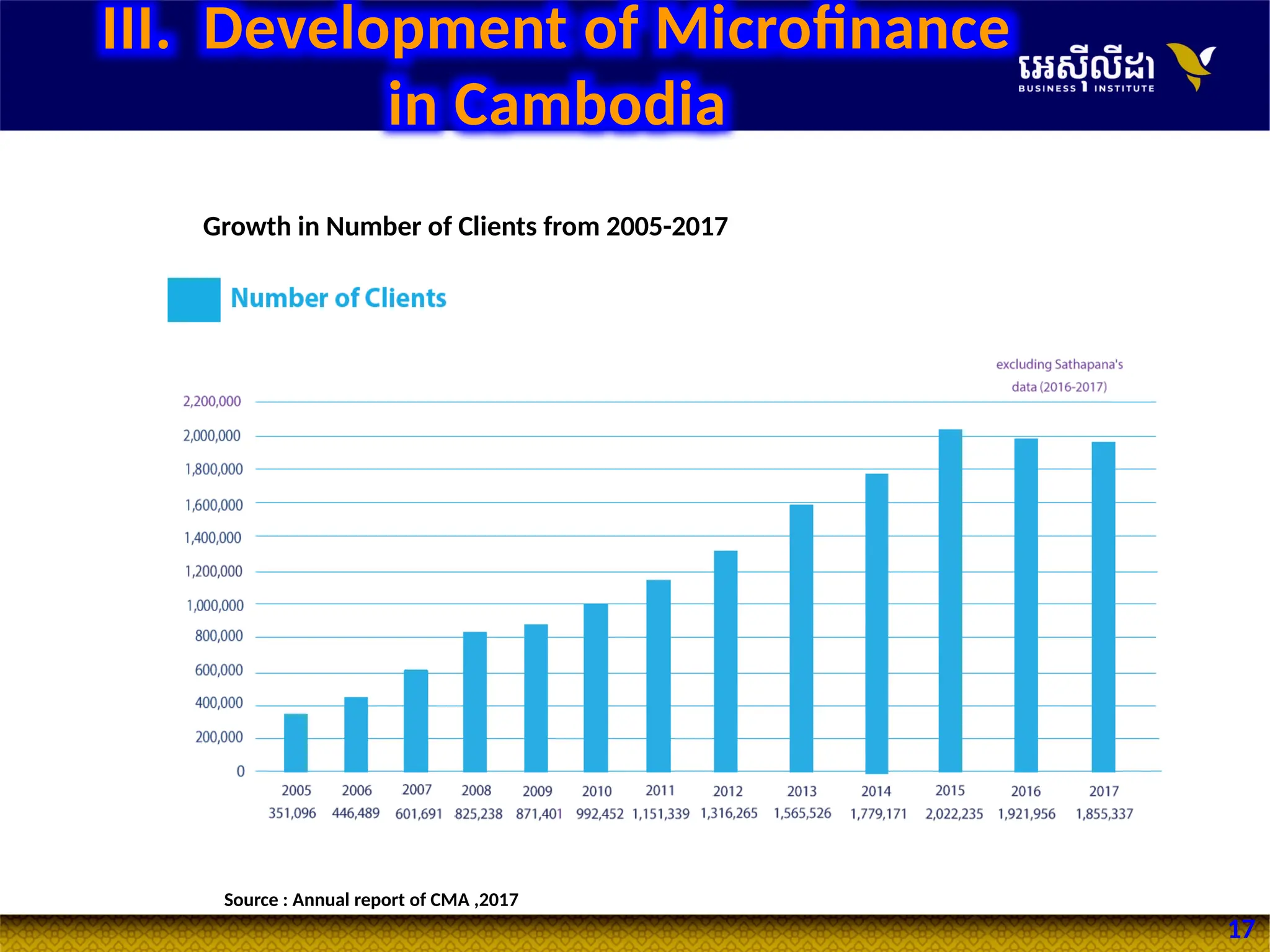

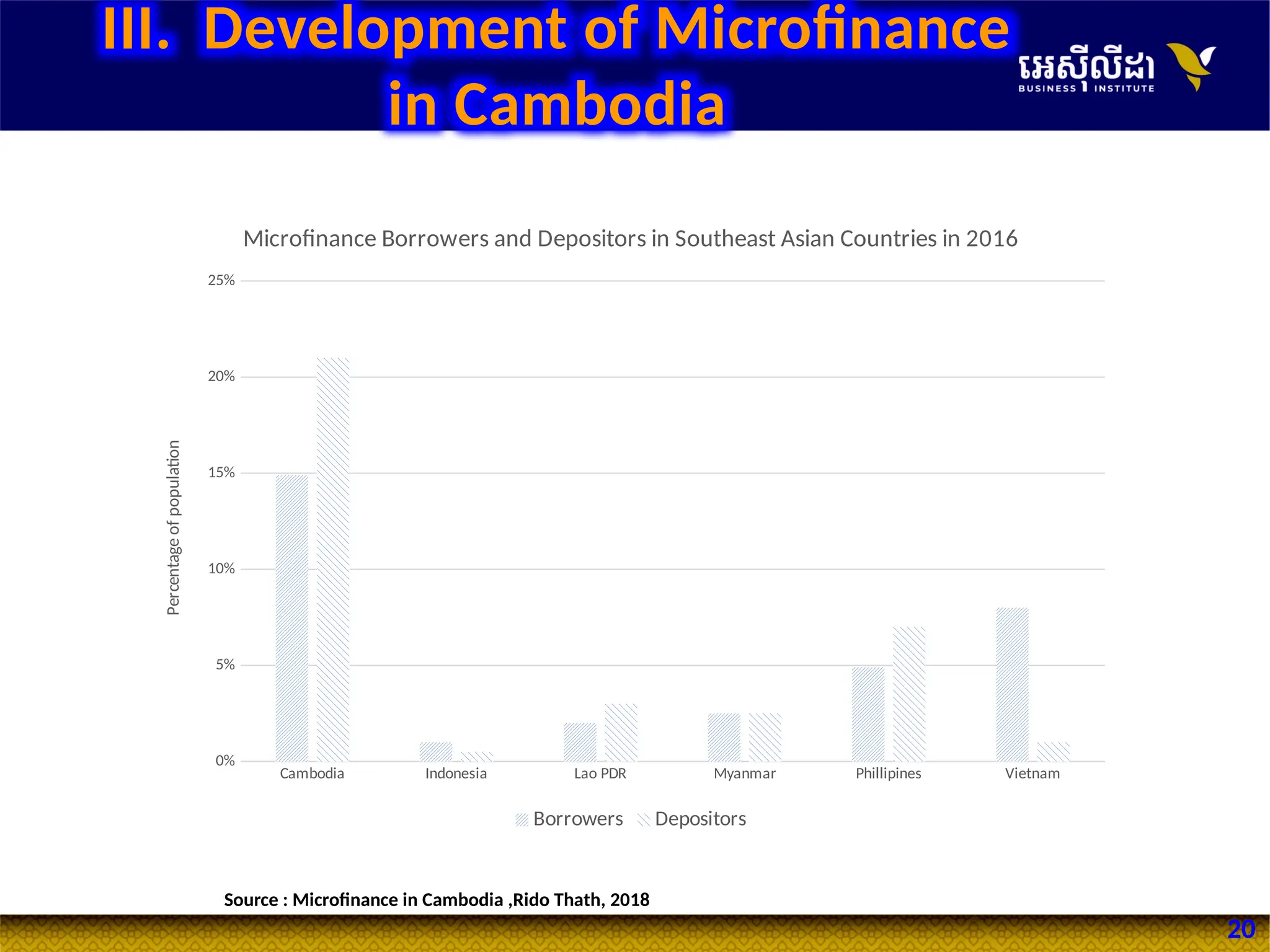

The document provides an overview of microfinance, defining it as a service aimed at providing financial support to low-income individuals, especially in Cambodia, where it has developed since the early 1990s. It discusses the challenges faced by the microfinance industry, including over-indebtedness and financial literacy, while highlighting the positive impacts on poverty reduction, job creation, and family welfare. Additionally, it outlines the historical evolution of microfinance in Cambodia, from initial donor-led initiatives to a more sustainable market-driven approach.