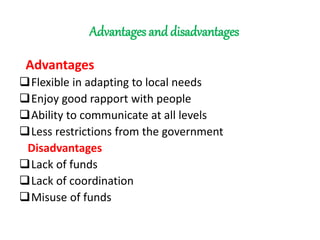

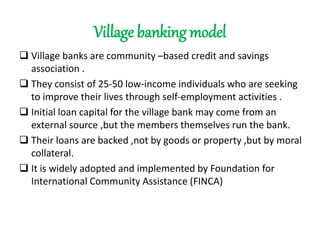

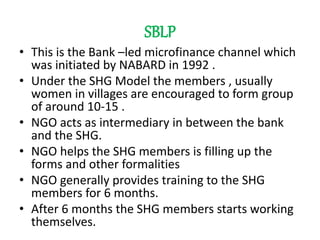

The document discusses various models of microfinance including joint liability groups, credit unions, cooperatives, community banking, bank guarantees, non-governmental organizations, and village banking. It also describes two common channels for microfinance - self help group bank linkage programs and microfinance institutions. Under each model or channel, it provides brief details about features, formation process, advantages and disadvantages.