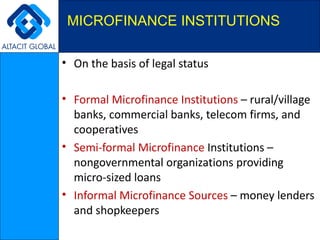

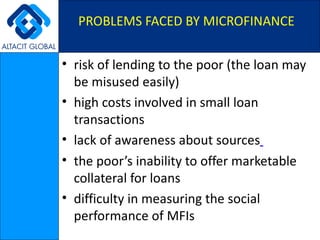

Microfinance provides small loans, savings opportunities, and insurance to low-income individuals. It began as a way to provide financial services to the poor so they can become self-sufficient. Microfinance includes products like loans, deposits, insurance, and money transfers for microenterprises, poor and low-income households. While it aims to alleviate poverty, microfinance institutions face challenges like high costs and risk of lending to poor clients who lack collateral, as well as balancing social and financial sustainability.