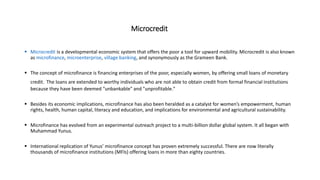

Grameen Banking provides small, collateral-free loans known as microcredit to impoverished individuals, especially women, in rural Bangladesh. The bank was founded in 1976 by Muhammad Yunus and transformed into an independent bank in 1983. It utilizes group lending and peer pressure through "joint liability groups" to achieve repayment rates over 99%. The bank has made over $4.7 billion in loans, inspiring similar models in over 40 countries. It has received several awards including the Nobel Peace Prize for its success in reducing poverty. Critics argue it can trap borrowers in debt and impose social rules, but the bank denies forcing views on clients.

![Criticism

Sudhirendar Sharma, a development analyst, claims that the Grameen Bank has "landed poor communities in a perpetual

debt-trap", and that its ultimate benefit goes to the corporations that sell capital goods and infrastructure to the

borrowers.

It has also attracted criticism from the former Prime Minister of Bangladesh, Sheikh Hasina, who commented, "There is no

difference between usurers [Yunus] and corrupt people." Hasina touches upon one criticism of Grameen Bank: the high

rate of interest that the bank demands from those seeking credit.

The Mises Institute's Jeffrey Tucker has criticized the Grameen Bank, asserting that the Grameen Bank and others based on

the Grameen model are not economically viable and depend on subsidies in order to operate, thus essentially becoming

another example of welfare.

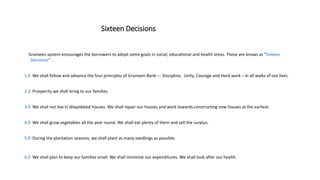

Another source of criticism is that of the Grameen's Sixteen Decisions. Critics say that the bank's Sixteen Decisions force

families and borrowers to abide by the rules and regulations set forth by the bank. In response to this, the Grameen bank

neither forces or instills its morals into those who do not choose to become a part of the Grameen Bank.](https://image.slidesharecdn.com/grameenbanking-180815044834/85/Grameen-banking-13-320.jpg)