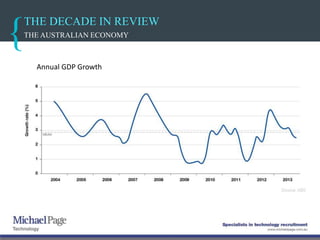

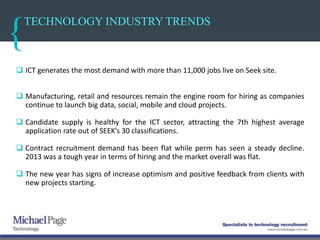

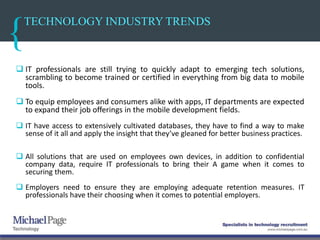

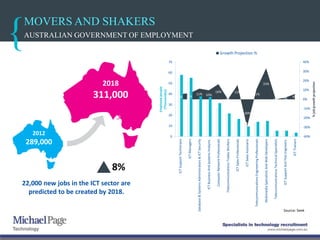

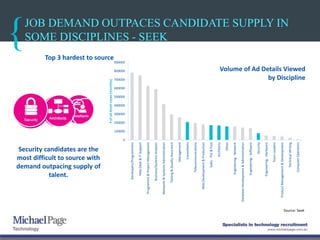

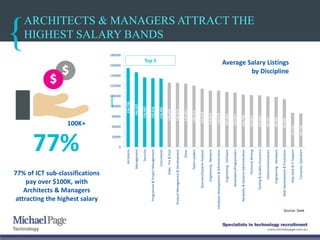

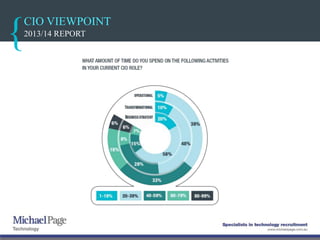

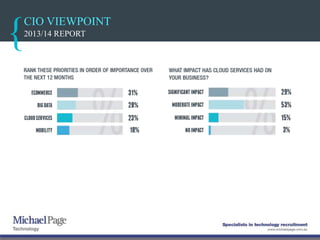

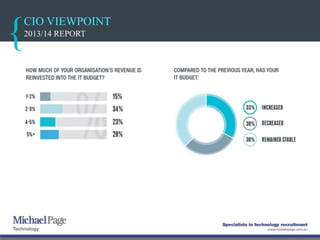

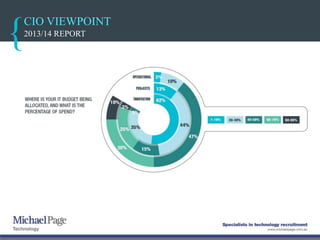

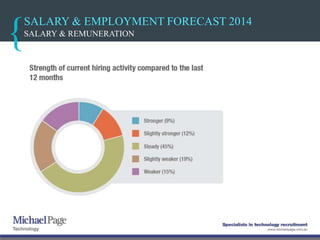

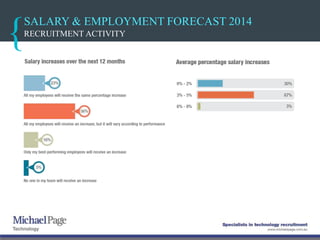

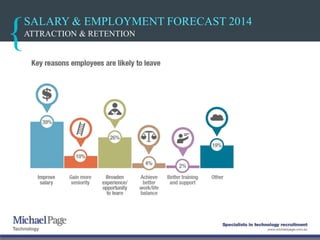

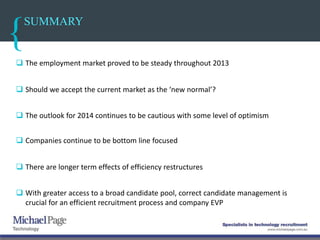

The document, presented by Emily Wilson and George Kauye, provides an overview of the employment landscape in the technology sector, highlighting trends from 2013 and projections for 2014. It notes a flat employment market influenced by global economic conditions, particularly in Australia, and presents insights into the demand for ICT jobs and emerging technology needs. The report suggests cautious optimism moving forward, emphasizing the importance of effective recruitment strategies and retention measures in a competitive job market.