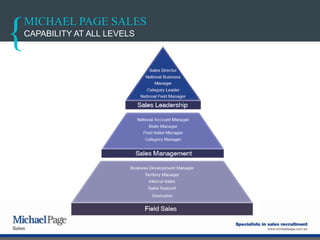

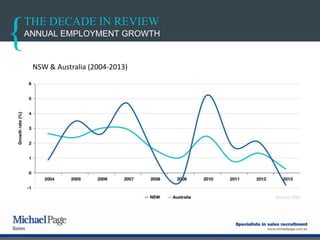

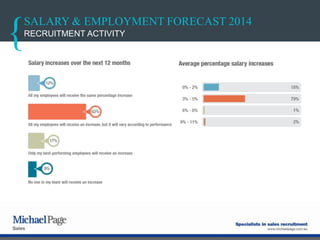

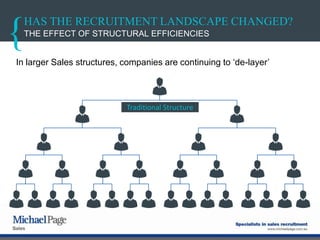

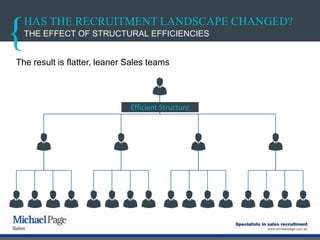

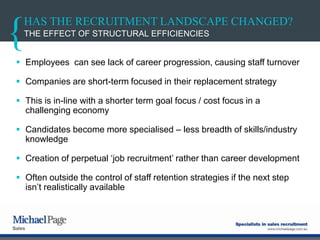

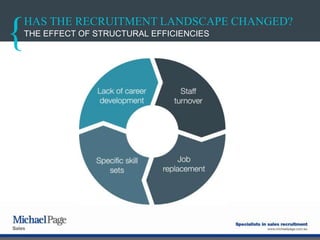

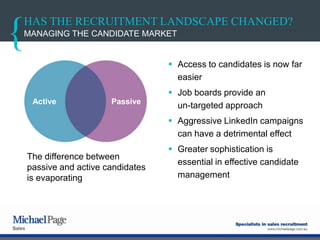

The document summarizes the Australian employment market in 2013 and outlook for 2014 based on a presentation by Richard Dunlop and Christy Moses. It discusses that the 2013 market was relatively flat with cautious employer confidence. While forecasts don't predict major growth, companies remain focused on costs and efficiency. Restructuring has led to flatter organizational structures and challenges with career progression, affecting the recruitment landscape. Effective candidate management is important for efficient recruitment in the current environment.