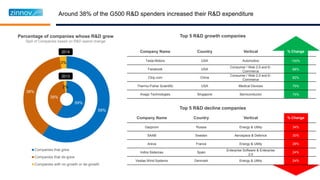

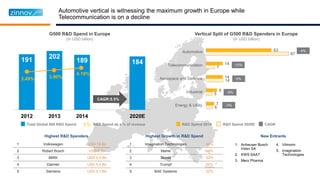

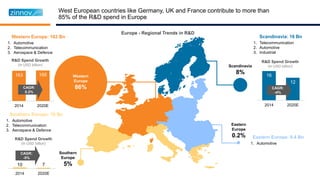

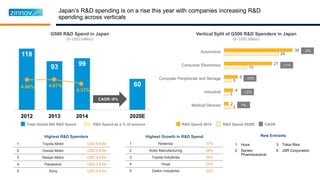

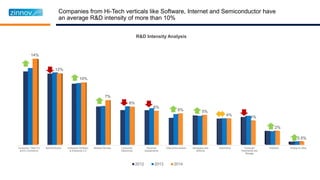

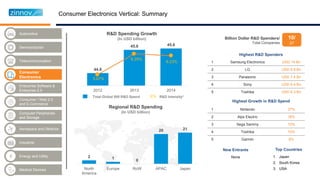

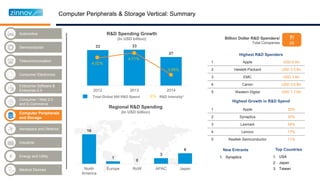

The document provides an overview of global R&D trends among the top 500 R&D spending companies from 2012-2014. Key findings include:

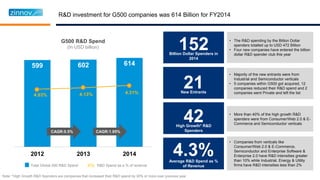

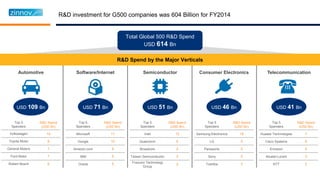

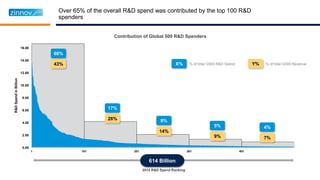

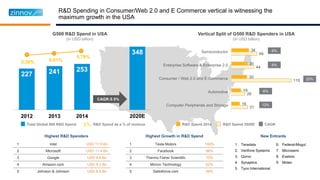

- Total R&D spending by these companies was $614 billion in 2014, with North America and Europe contributing over 70%.

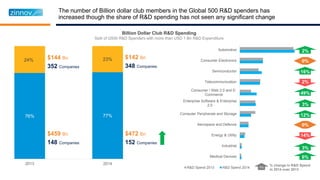

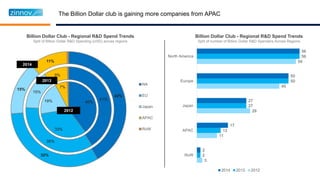

- The number of companies spending over $1 billion on R&D increased to 152 in 2014, with many new entrants from industrial and semiconductor sectors.

- Fast growing sectors for R&D included consumer/web 2.0, semiconductor, and enterprise software, while energy/utilities saw slower growth.