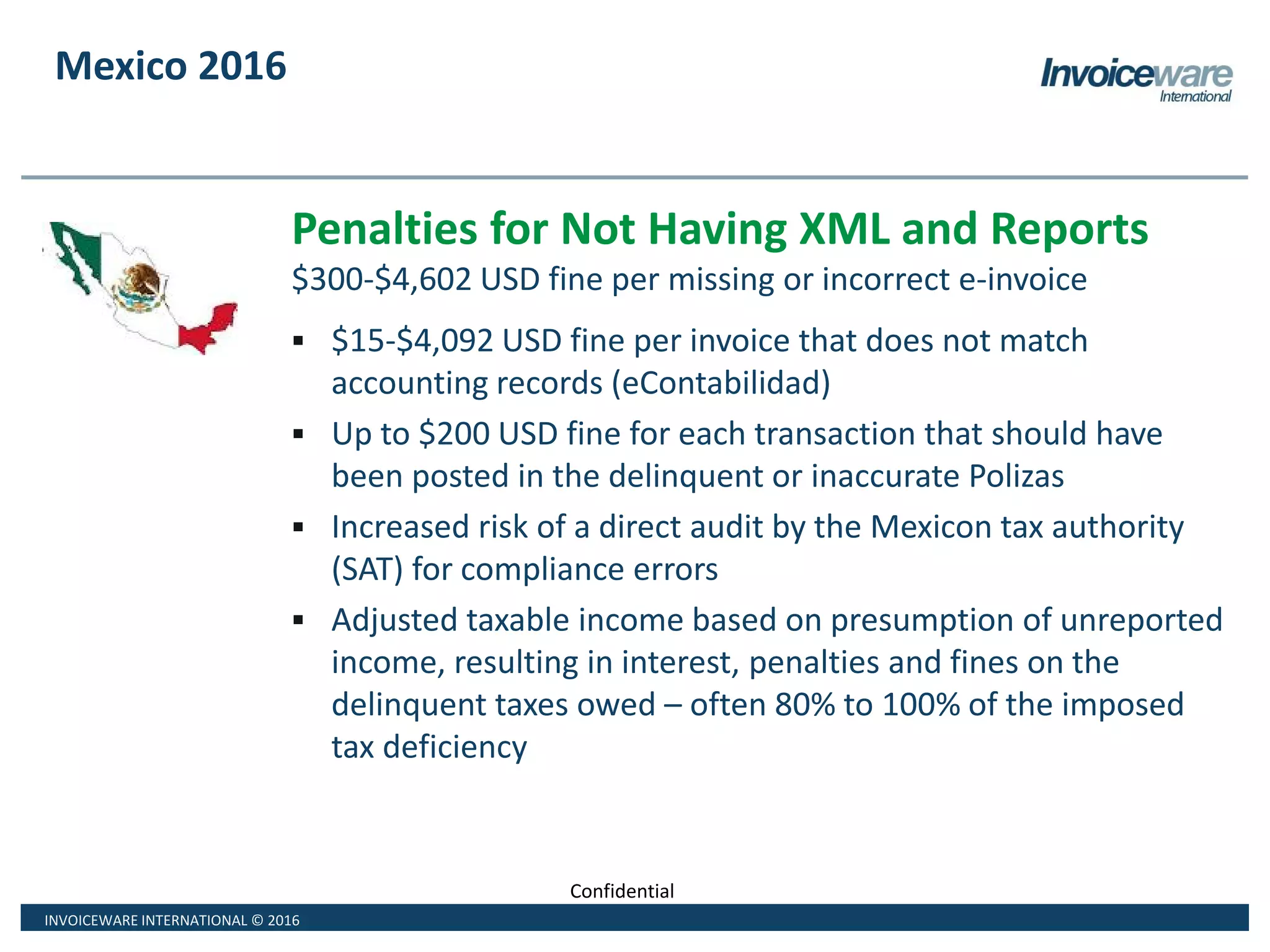

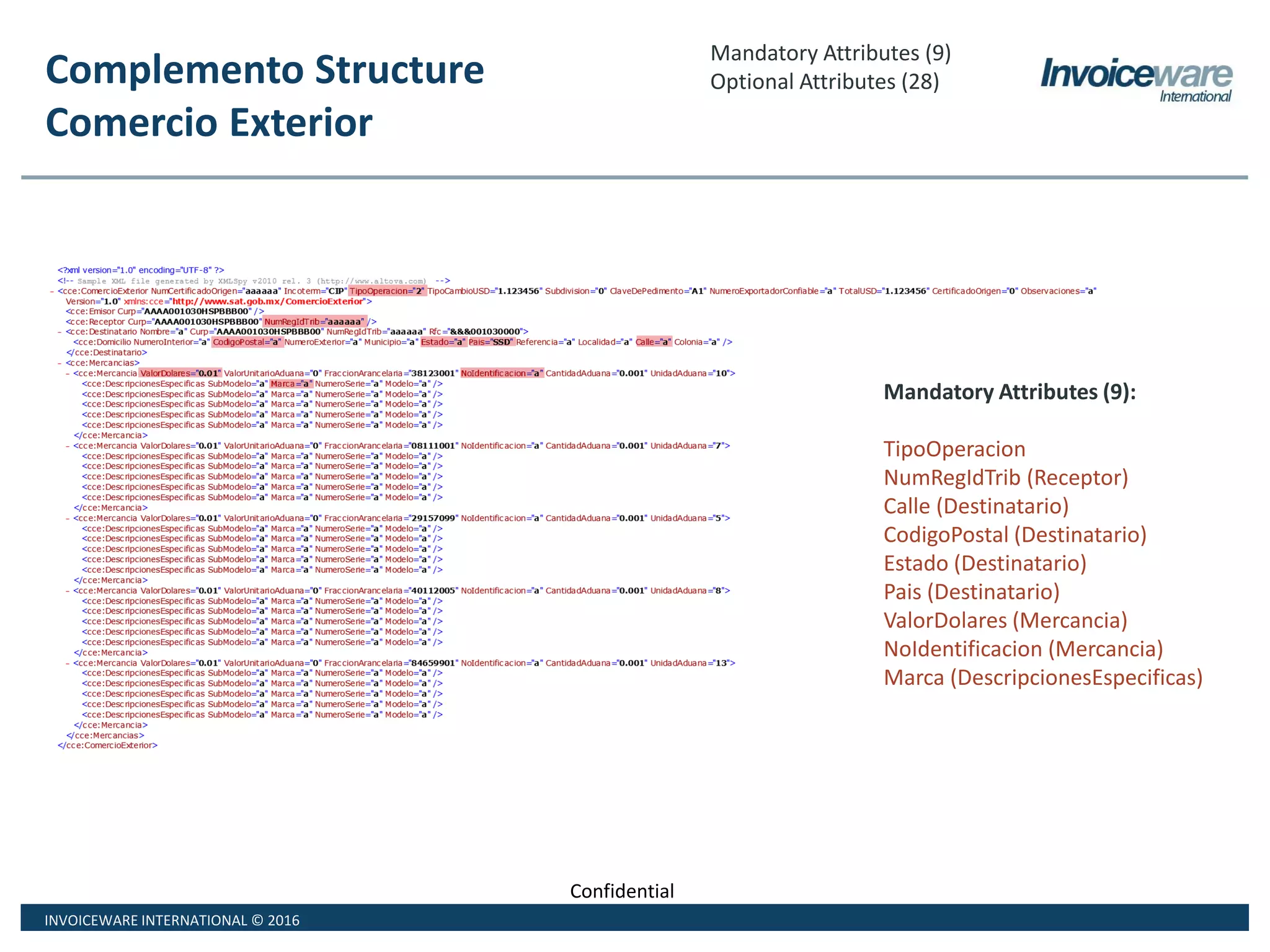

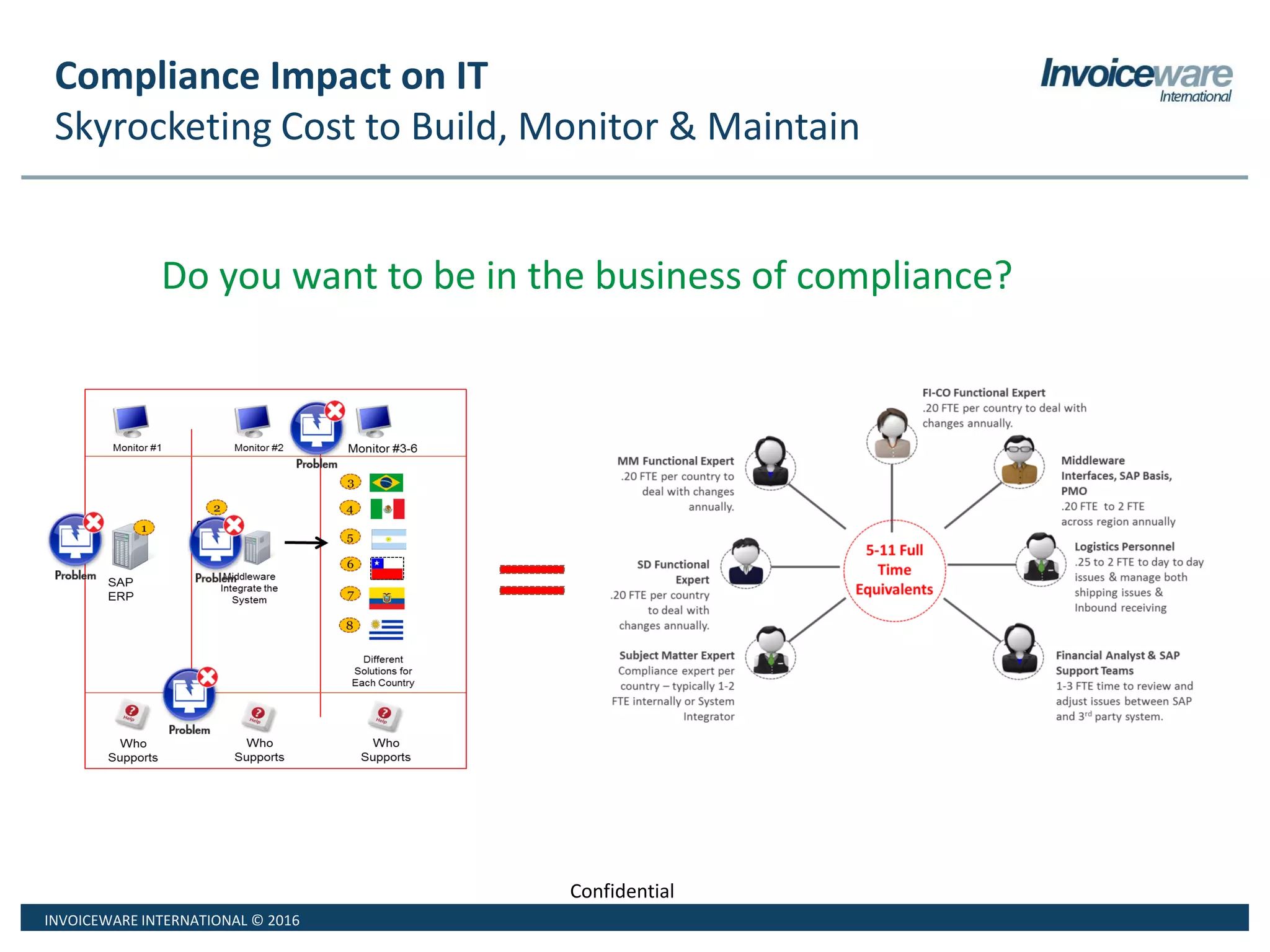

The document outlines significant changes in Mexico's business-to-government compliance landscape regarding e-invoicing and statutory reporting, including the introduction of electronic audits by the SAT and strict penalties for non-compliance. Notably, new requirements for e-invoicing, particularly concerning foreign trade transactions, will be in effect starting January 2017, emphasizing proper data validation and reporting. Additionally, the document stresses the importance of integrating compliance measures into corporate systems to reduce auditing risks and ensure accurate tax reporting.