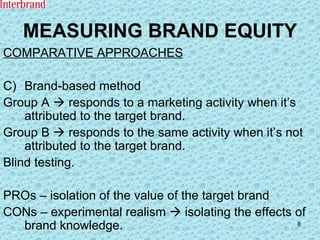

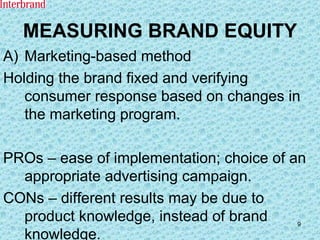

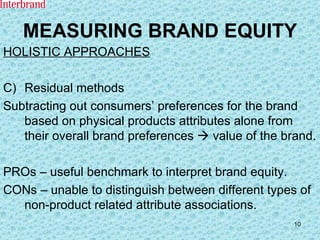

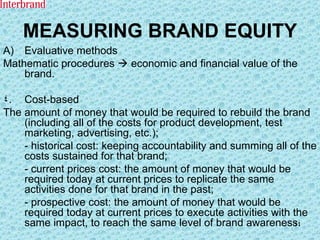

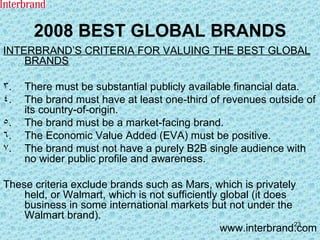

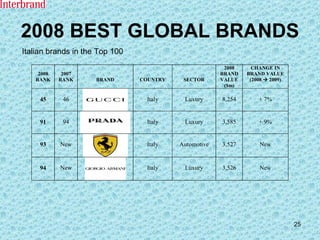

The document outlines Interbrand’s methods for measuring brand equity, emphasizing that brand equity reflects the economic and financial value of a brand based on its market performance and consumer perceptions. It discusses various approaches, including comparative and holistic methods, and details the Interbrand brand strength score, which incorporates seven key factors to assess the brand's ability to generate future earnings. Ultimately, the document highlights the importance of brand equity measurement for strategic business purposes, such as mergers and acquisitions.