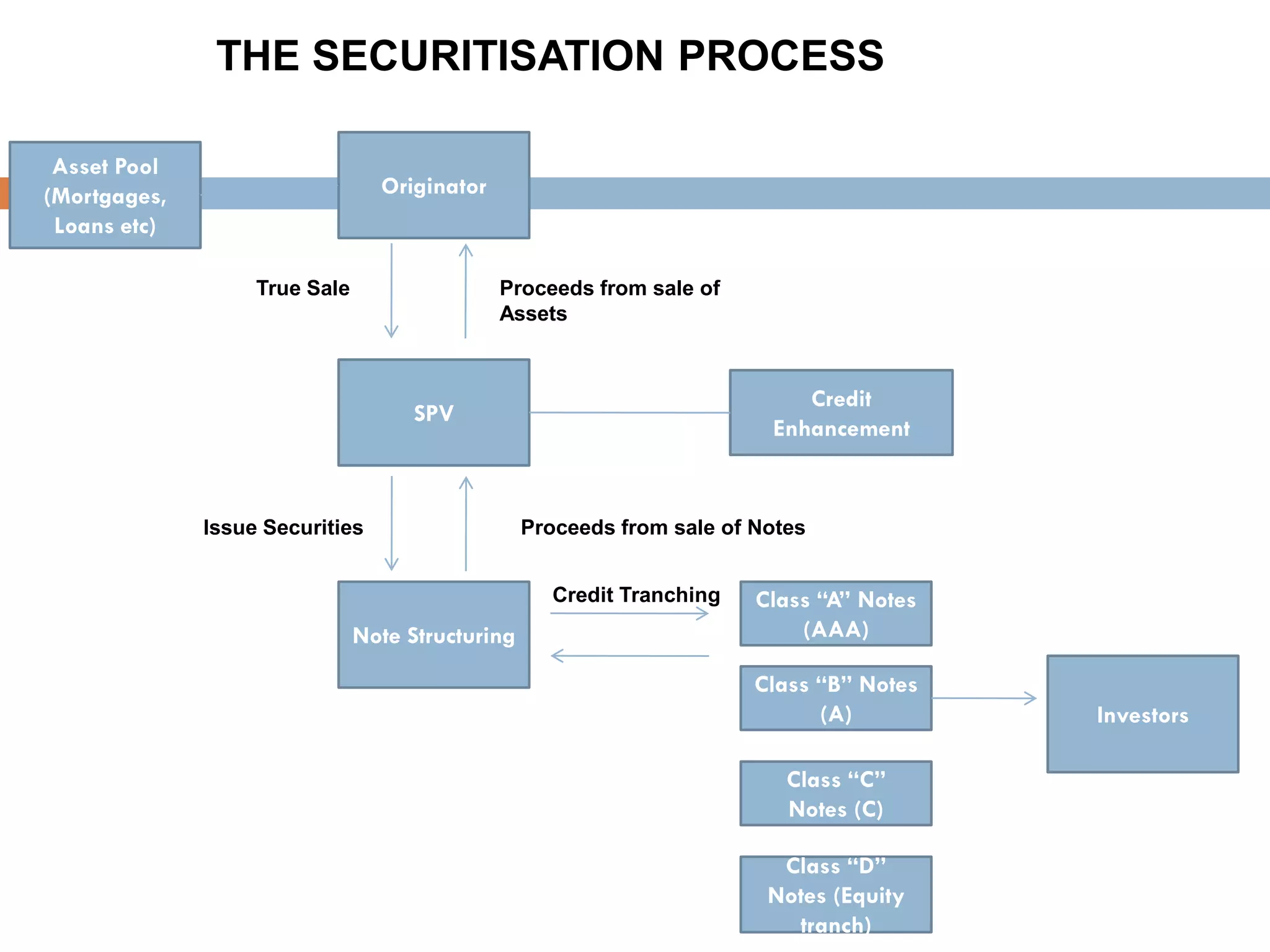

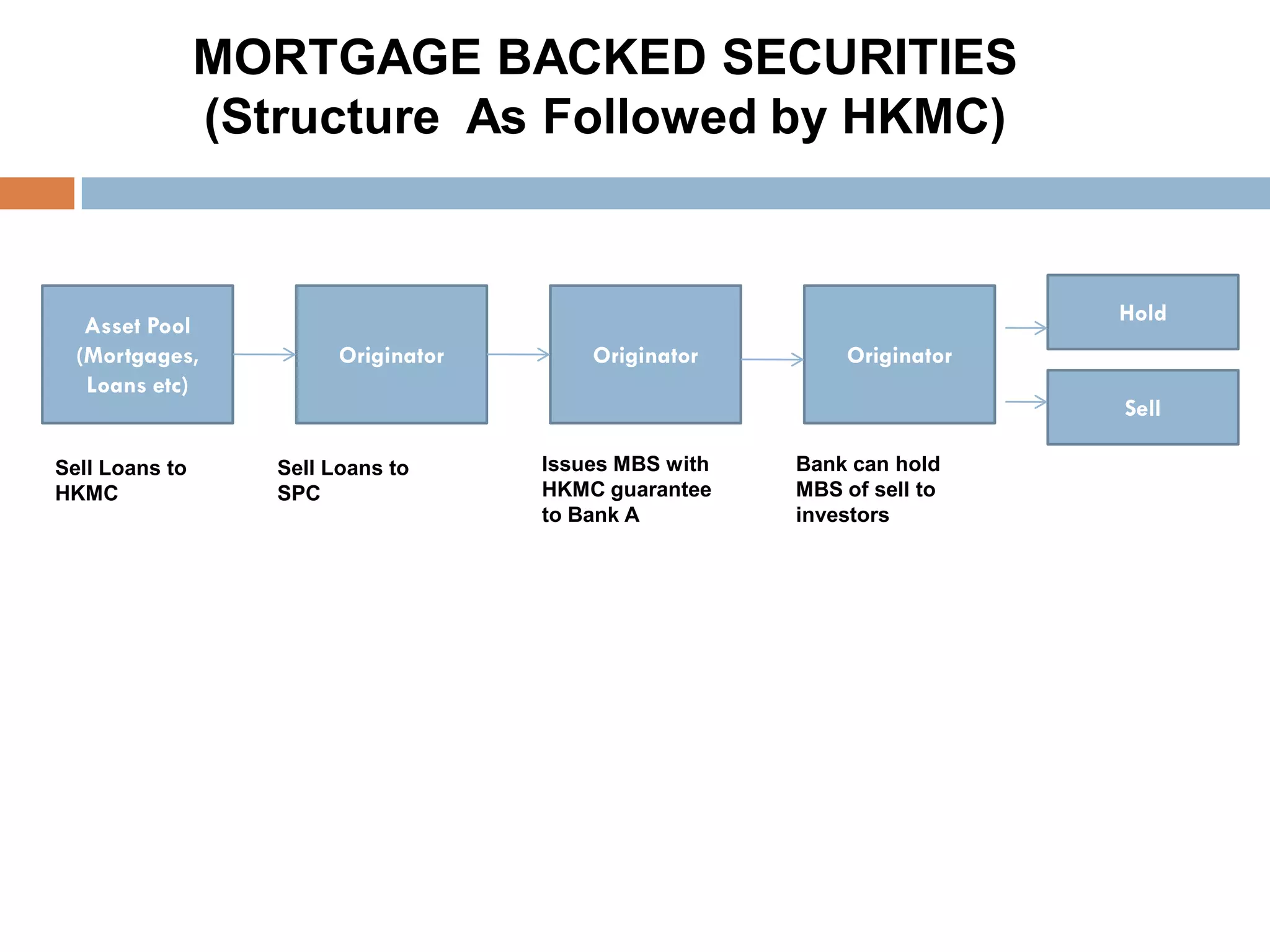

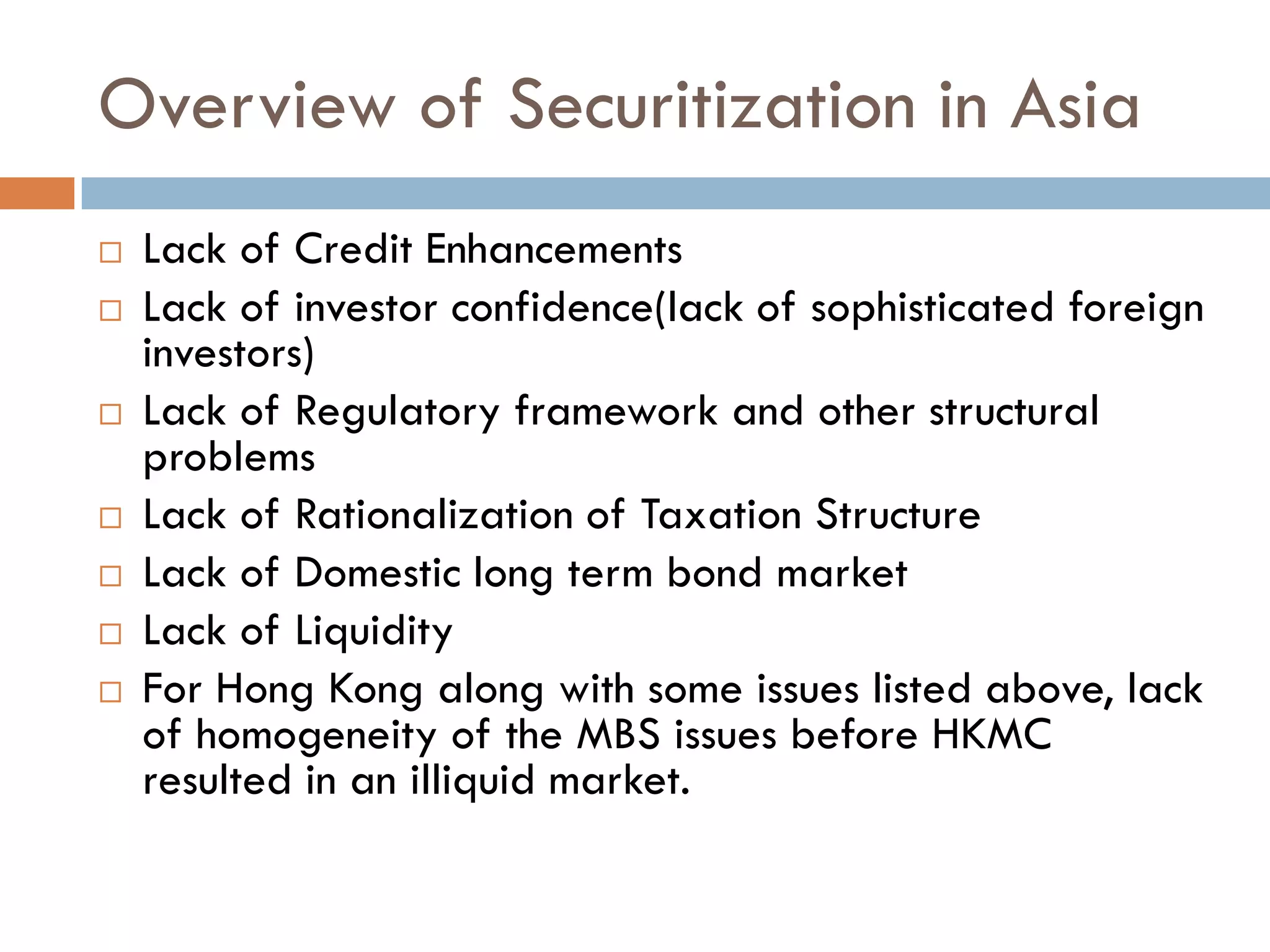

The document discusses mortgage securitization in Hong Kong and Asia. It defines securitization and describes the process, including the roles of originators, special purpose vehicles, and credit enhancements. The presentation notes benefits of securitization for parties like HKMC, banks, and investors. Conditions for thriving securitization markets are listed, such as sufficient mortgage volumes, strong regulatory frameworks, and market infrastructure. Risk allocation between originators and HKMC is examined. Overall, the document recommends that banks enter the growing MBS market in Hong Kong by working with HKMC due to benefits like risk transfer, capital relief, and funding diversification.