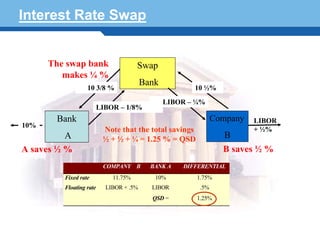

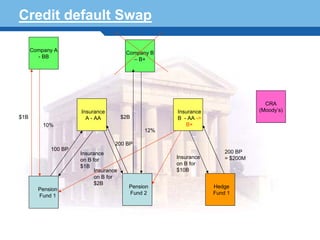

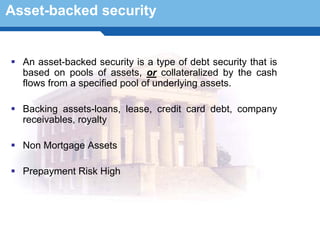

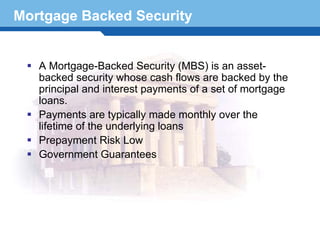

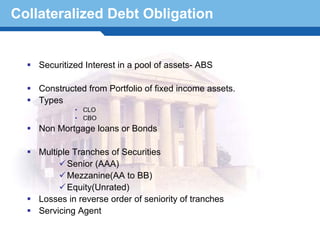

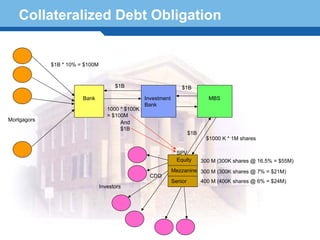

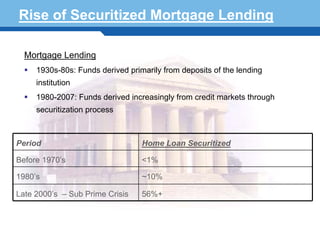

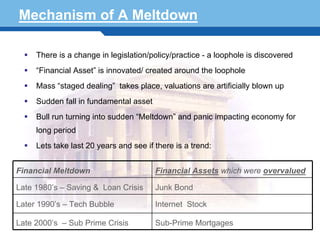

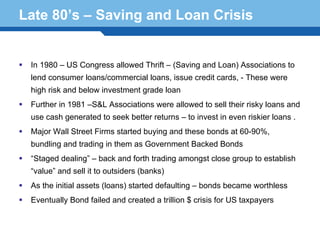

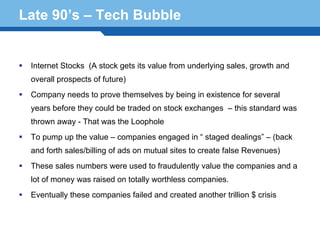

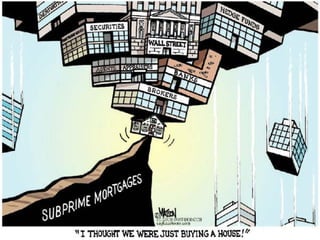

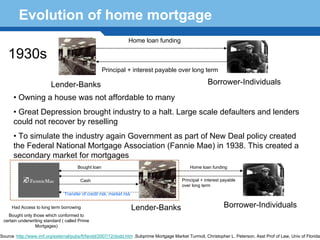

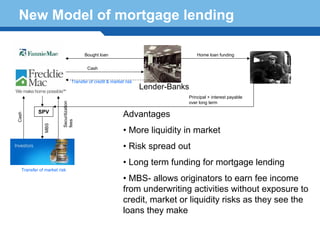

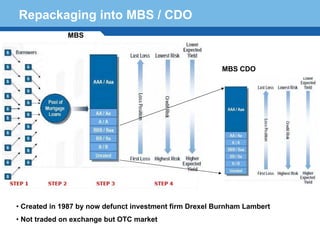

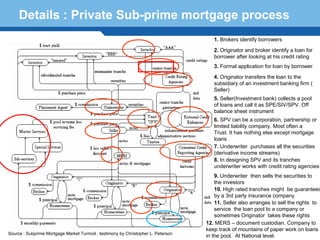

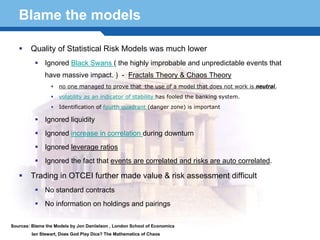

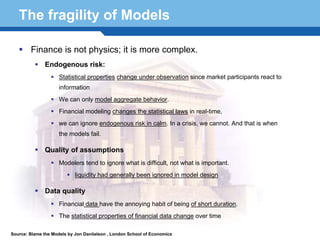

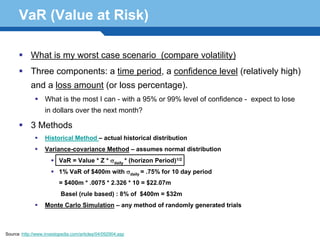

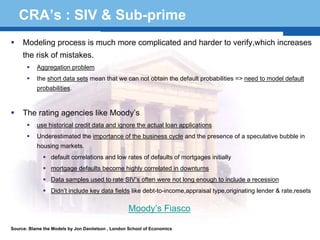

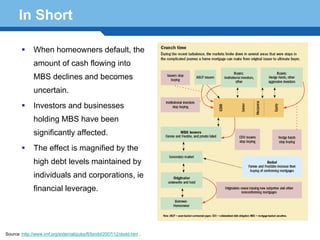

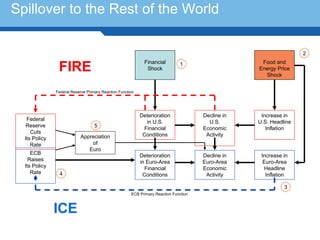

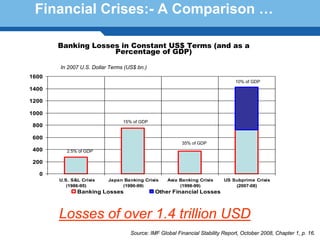

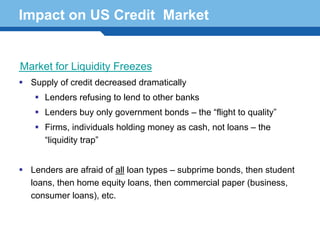

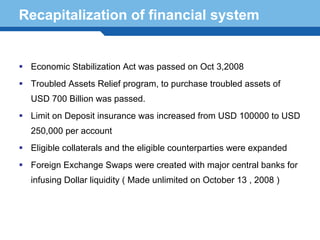

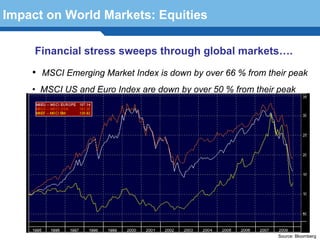

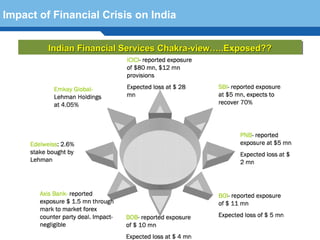

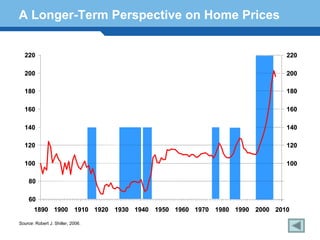

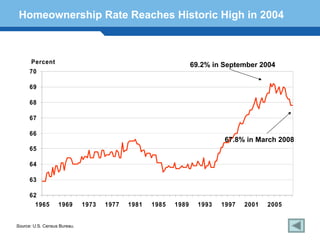

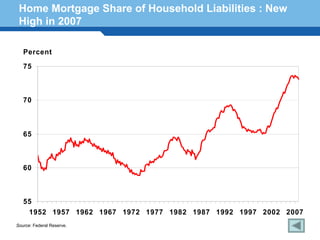

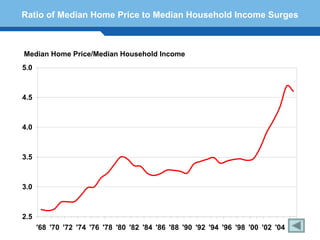

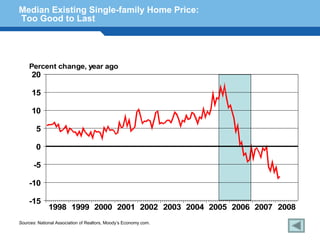

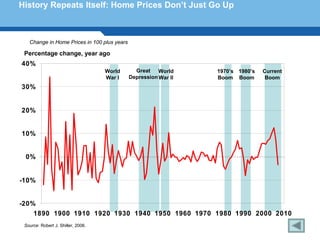

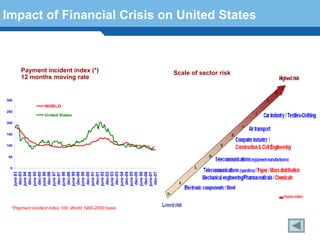

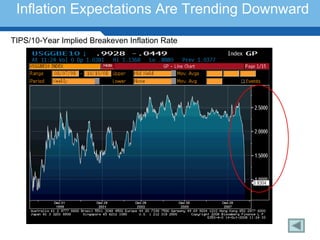

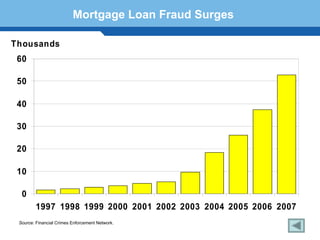

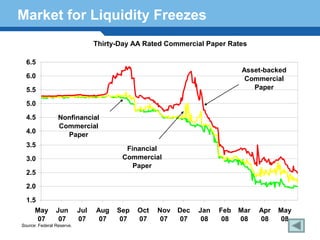

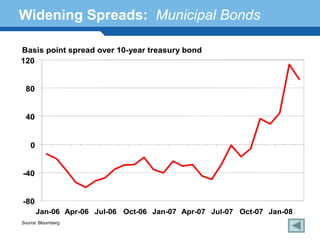

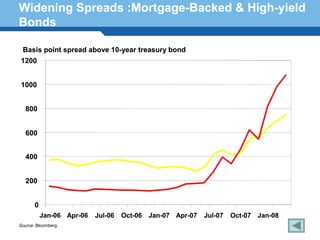

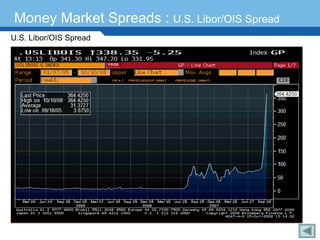

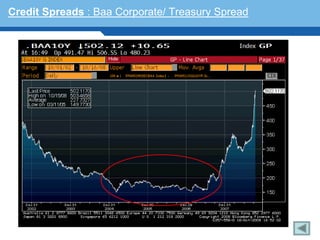

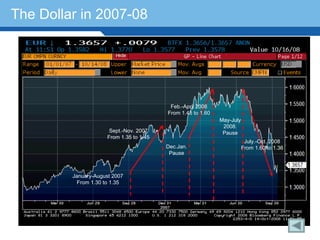

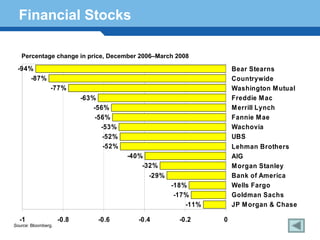

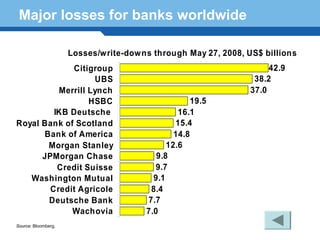

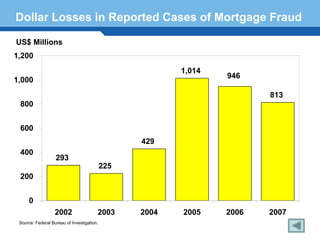

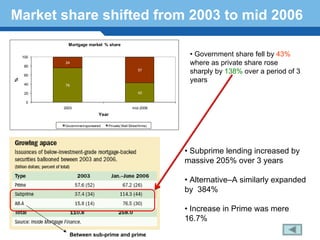

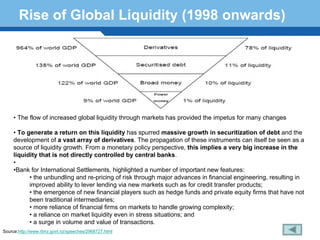

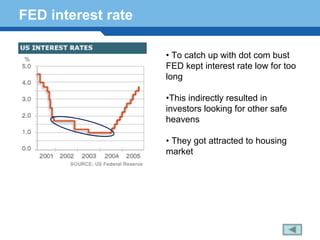

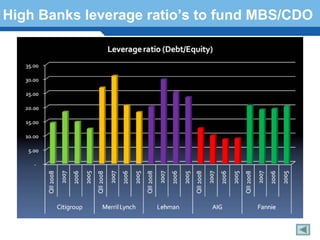

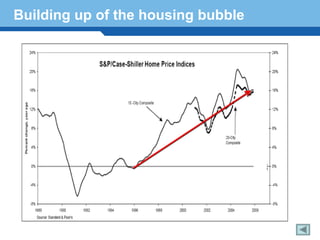

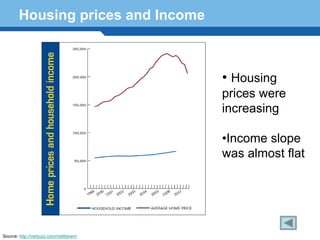

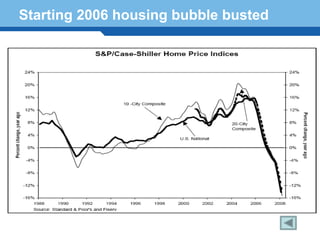

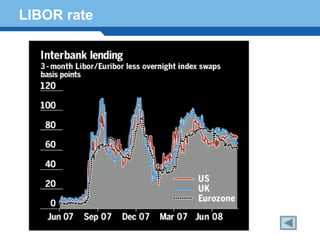

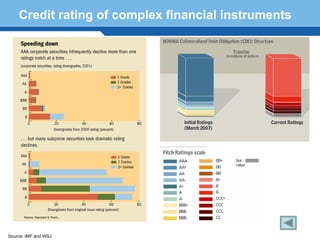

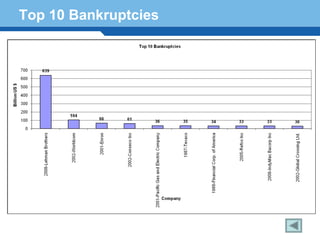

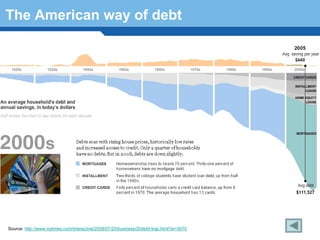

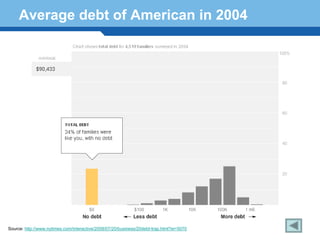

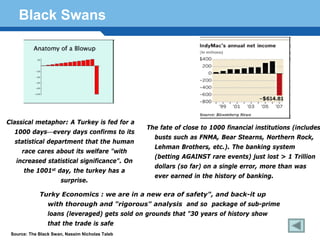

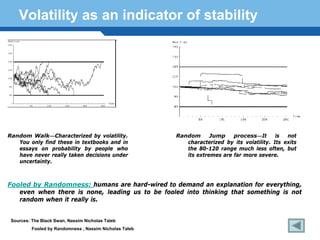

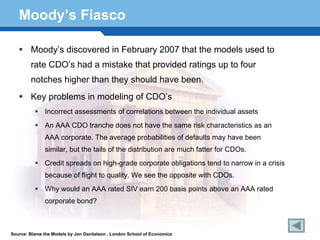

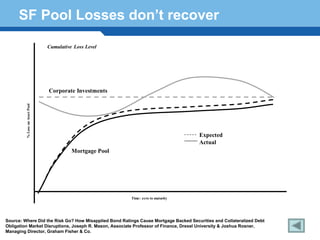

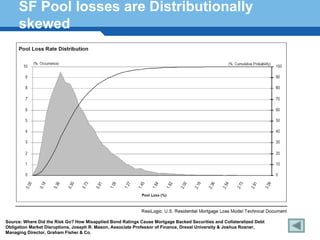

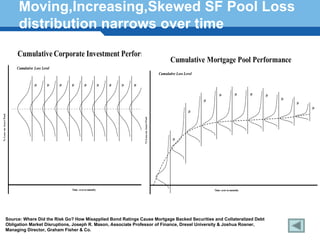

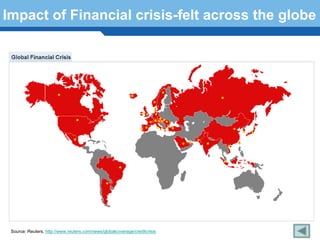

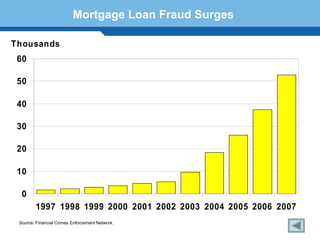

The document discusses the financial meltdown of 2008 and its causes. It provides context on the rise of securitized mortgage lending from the 1930s-2007. A key development was the increasing use of mortgage-backed securities from the 1980s onward. It then outlines the timeline of major events from 2008, including the collapse of investment banks like Lehman Brothers and bailouts of companies like AIG. The complex financial instruments like CDOs and their role in inflating the housing bubble that eventually burst are also examined.