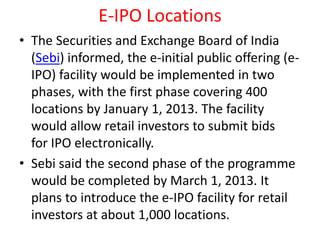

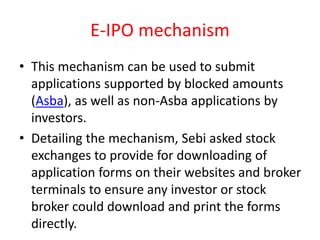

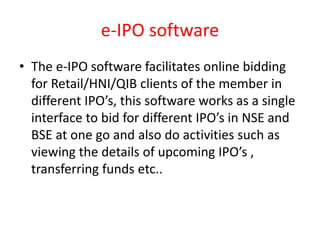

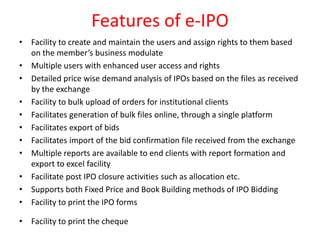

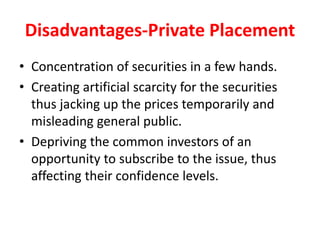

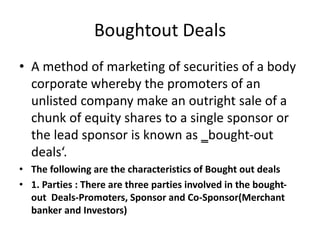

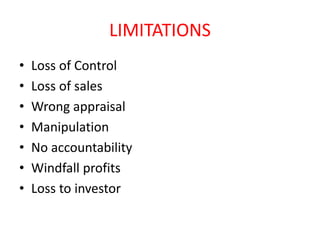

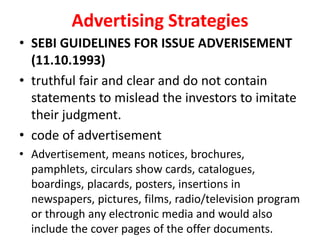

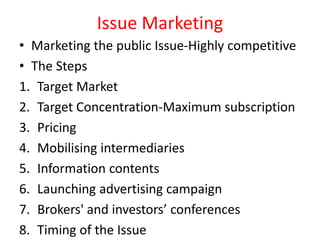

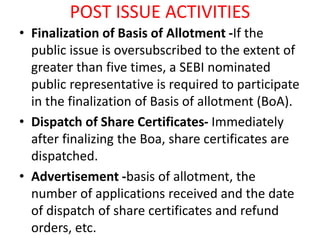

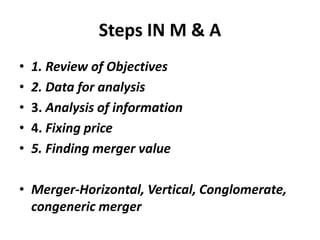

The document discusses various topics related to mergers and acquisitions (M&A), public offerings, and financial services. It defines key terms like greenshoe option, private placement, bought deals, e-IPO, and offshore issues. It also outlines the steps involved in M&A deals and describes different types of takeovers. The benefits of M&A are listed as synergies, growth, profitability, diversification, tax benefits, efficient cash use, and more.