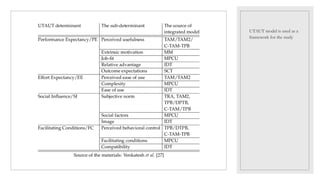

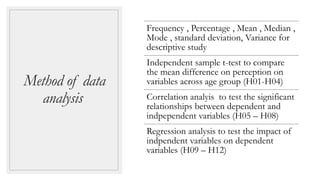

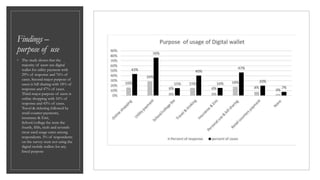

The study investigates factors influencing the usage of digital mobile wallets in Nepal, focusing on performance expectancy, effort expectancy, social influence, and facilitating conditions across different age groups. It finds that while the perceptions of these factors are similar across age groups, performance expectancy and social influence have a significant positive impact on users' behavioral intention to adopt digital wallets. The results challenge previous studies and offer practical implications for service providers seeking to enhance user engagement.