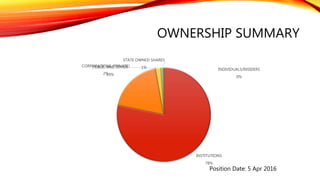

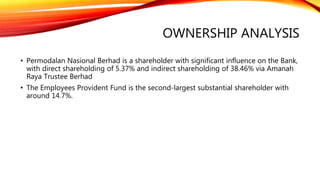

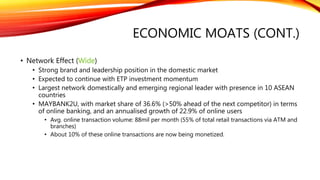

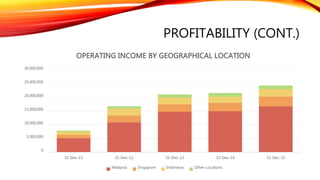

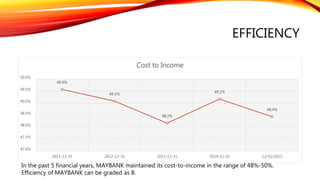

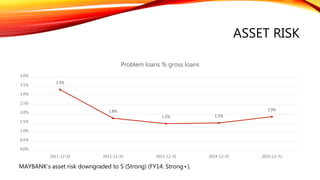

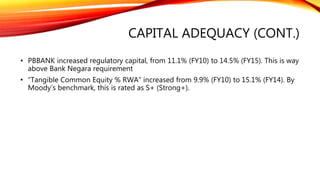

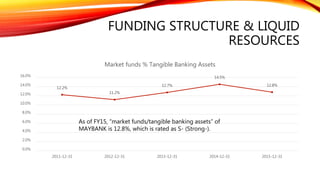

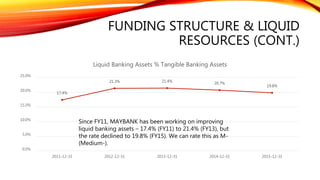

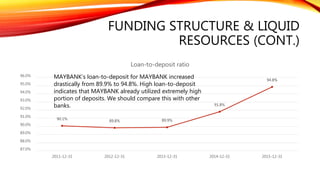

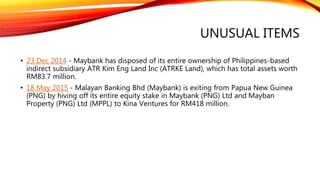

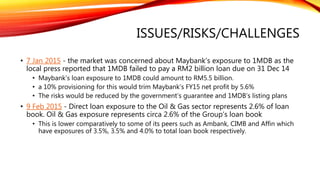

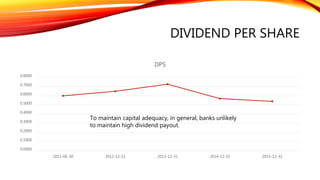

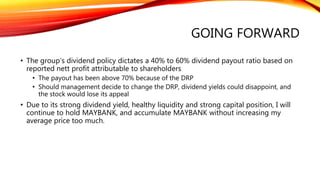

The document presents a fundamental analysis of Maybank for the financial year ending December 31, 2015. It covers various aspects including business profile, ownership structure, economic moats, profitability, financial performance, growth drivers, and associated risks. The analysis indicates that while Maybank enjoys competitive advantages, it also faces challenges such as loan exposure to high-risk sectors and persistent net interest margin compression.