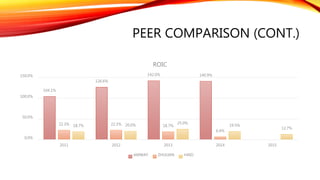

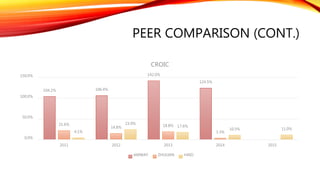

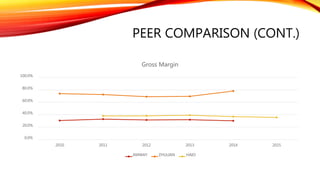

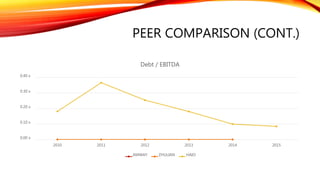

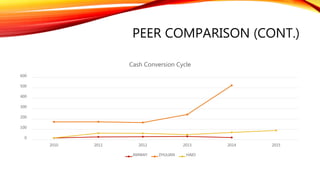

The document compares the financial performance of three direct selling companies - HAIO, Amway, and Zhulian. It analyzes metrics like return on invested capital, cash return on invested capital, gross margin, execution ability, debt-to-EBITDA ratio, and cash conversion cycle from 2010-2015. The analysis shows that Amway has consistently been the best performer, while HAIO has outperformed Zhulian in recent years, though Zhulian's cash conversion cycle is quite high due to elevated inventory levels.