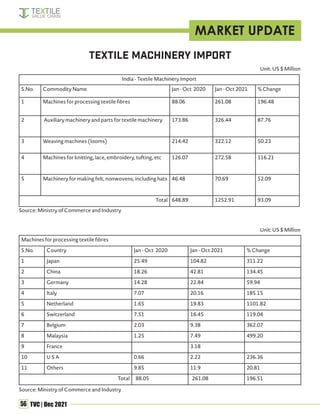

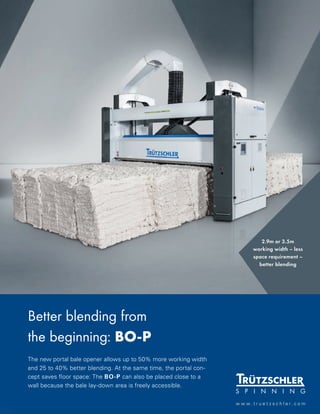

The global spinning machinery market is projected to reach $7.3 billion by 2027, growing at 5.5% annually. Major production hubs of cotton yarn are in China, India, the US, Pakistan, and others. Spinning machinery manufacturers are focusing on regions with large yarn industries like these. The market is driven by rising fashion industry GDP and demand for technical textiles. Trends include shifting toward automated machinery and preferring Spanish brands. Sustainability and recycling technologies are also gaining importance. Automation and spinning recycled fibers present growth opportunities in this expanding market.