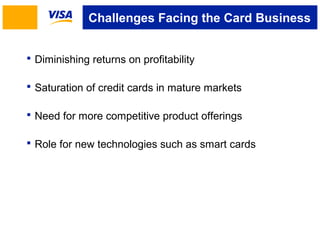

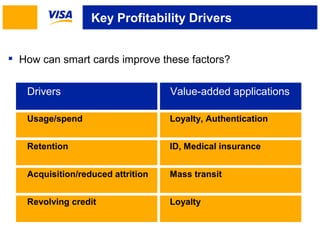

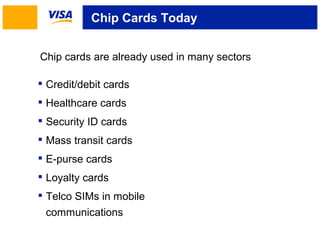

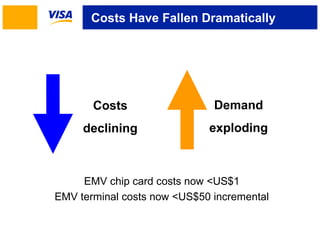

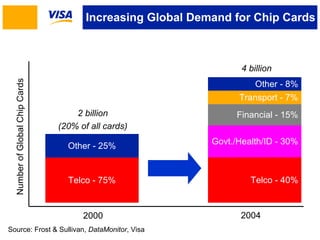

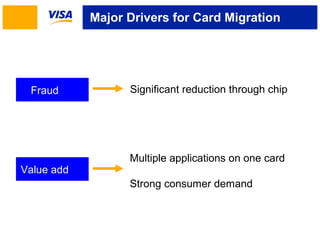

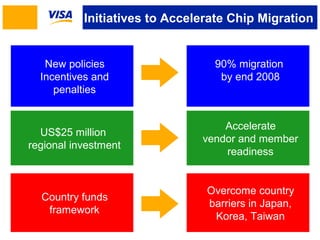

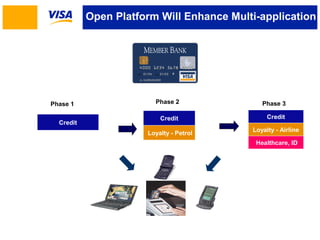

Visa is promoting the use of smart card technology to maximize cardholder value for issuers. Smart cards can improve key profitability drivers for card issuers like usage, retention, and acquisition by enabling value-added applications for loyalty programs, authentication, ID verification, medical insurance, and mass transit payments. Visa's vision is for all payment cards to contain chips and carry multiple applications over the next 10 years. Costs of chip cards and terminals have fallen dramatically, and global demand for chip cards is exploding as they are increasingly used for payments, ID, transit, and loyalty programs.