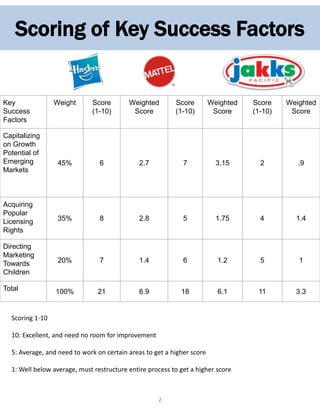

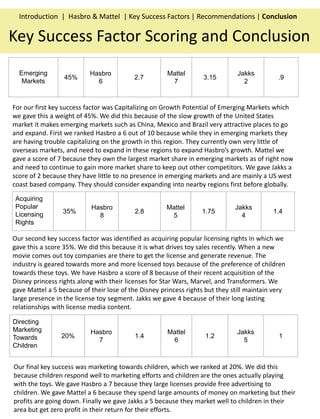

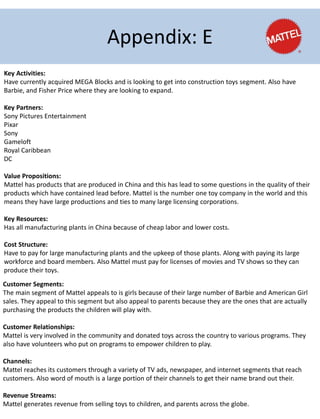

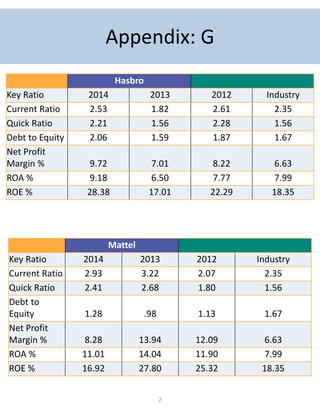

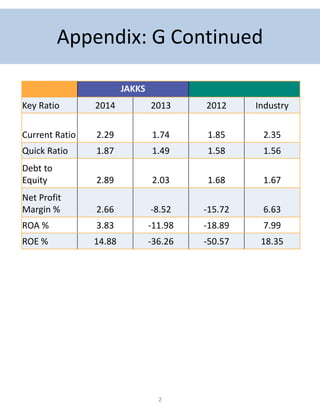

This report analyzes the toy industry and key competitors Hasbro and Mattel. It identifies three key success factors for toy companies: capitalizing on emerging markets, acquiring popular licensing rights, and strategizing marketing towards children. Hasbro is better positioned than Mattel according to these factors. Hasbro has a higher score for capitalizing on emerging markets growth, while Mattel has struggled with losing licensing rights to Disney properties and needs to expand internationally to succeed future. The toy industry is diverse but companies must utilize strategies like emerging market expansion and licensing to remain competitive.