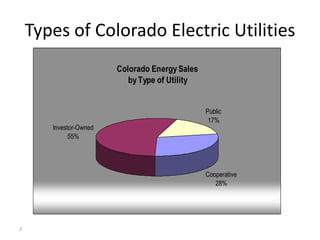

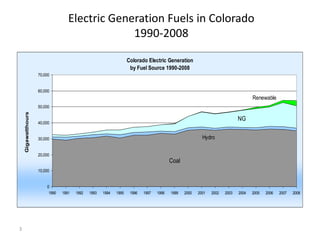

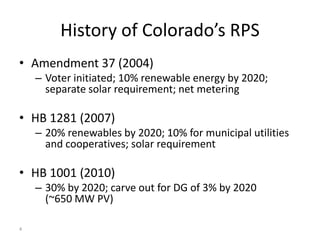

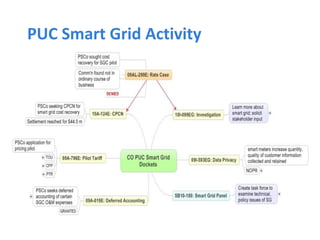

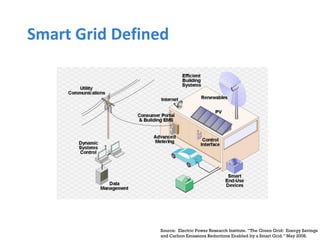

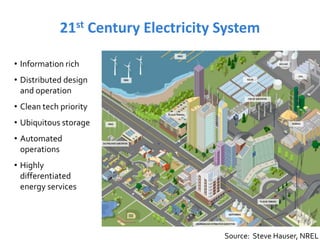

This document discusses smart grids from a regulatory perspective in Colorado. It provides background on types of electric utilities in Colorado, trends in electric generation fuels from 1990-2008 showing increased natural gas and renewables. It defines smart grids as using bi-directional communication and control over the electric grid. The document outlines challenges for regulators around technology choices, standards, and ensuring benefits for both utilities and customers. It emphasizes the need for regulatory frameworks to promote innovation while managing risks and costs for ratepayers.