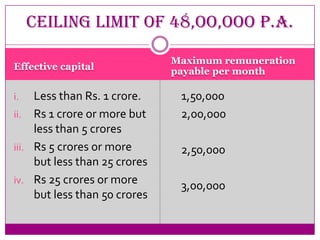

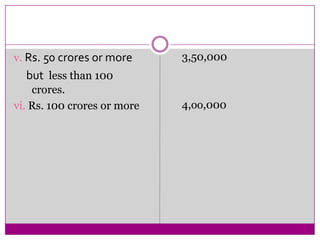

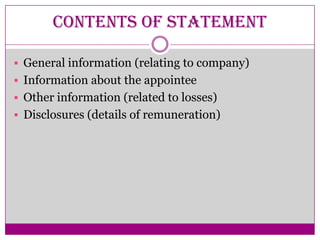

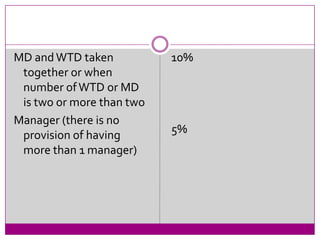

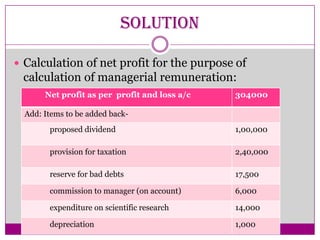

The document discusses the calculation of managerial remuneration under the Companies Act 1956. It states that total remuneration to directors, managers, and managing directors cannot exceed 11% of net profits as defined in the Act. Net profits are calculated by taking the gross profit and subtracting/adding certain items as specified. The document also provides details on calculating remuneration in cases of adequate and inadequate profits.