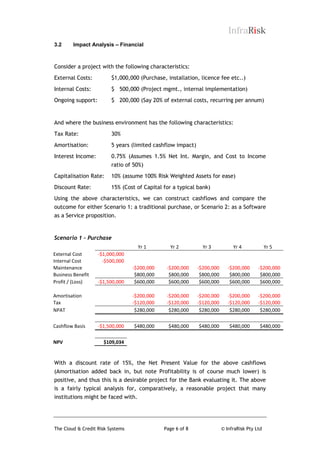

The white paper by Infrarisk examines the benefits of cloud computing, particularly Software as a Service (SaaS), for financial institutions, highlighting its ability to mitigate implementation risk, reduce infrastructure management concerns, and enhance capital efficiency. A comparative analysis reveals that a SaaS approach can significantly increase net present value (NPV) for banks, as evidenced by a hypothetical project illustrating an NPV of $1,554k versus $109k for a traditional purchase model. Overall, the document advocates for embracing cloud solutions to enhance agility and financial performance in the banking sector.