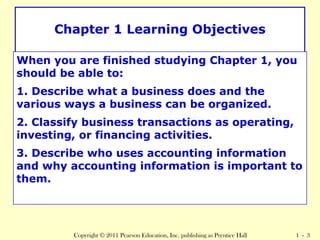

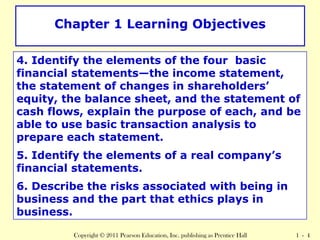

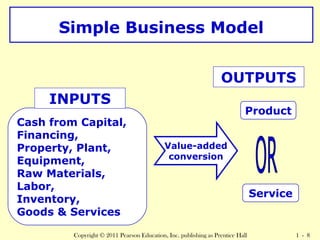

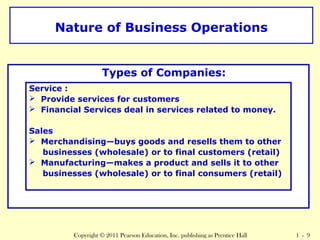

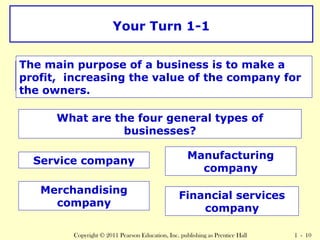

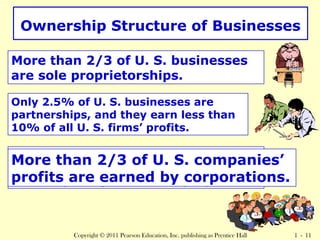

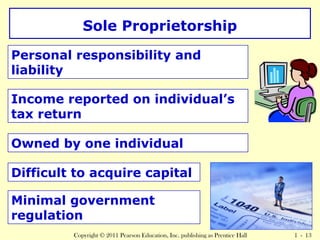

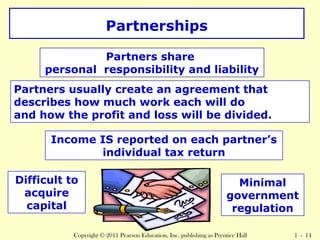

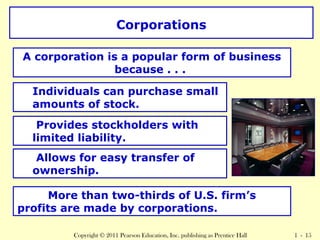

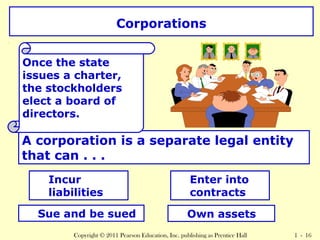

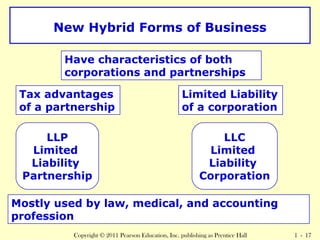

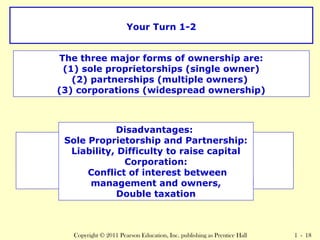

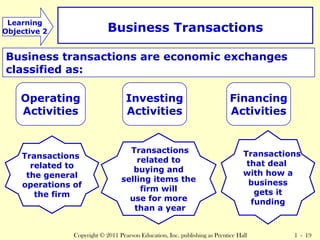

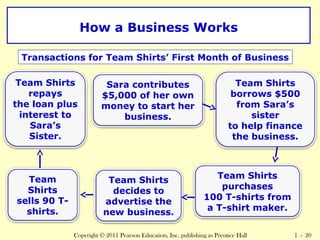

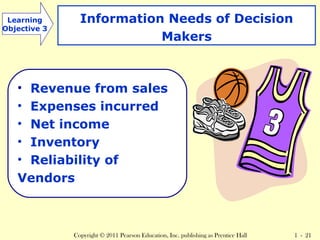

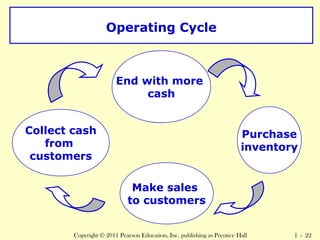

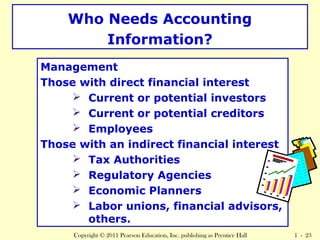

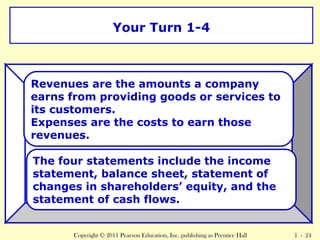

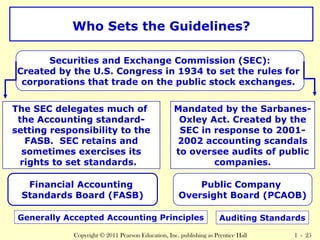

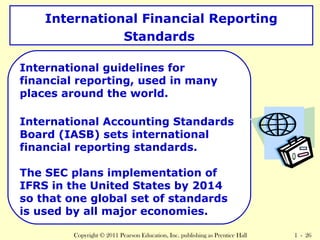

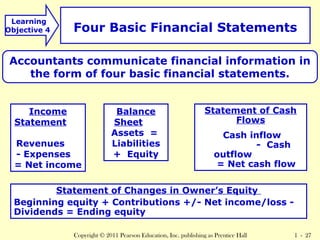

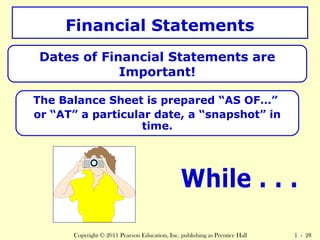

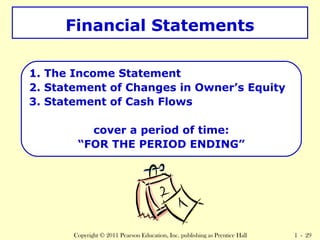

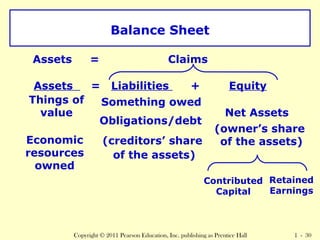

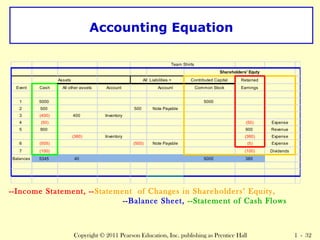

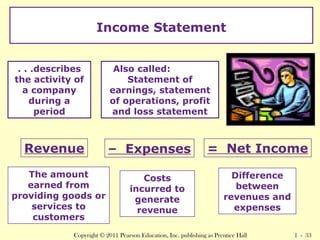

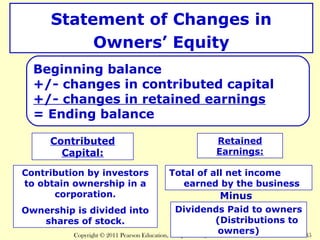

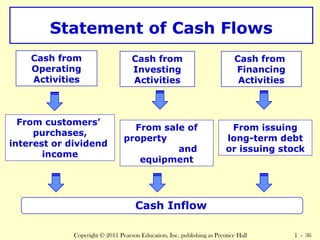

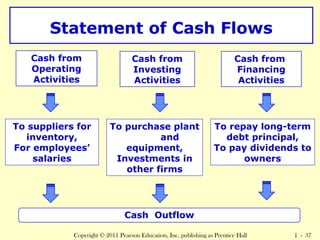

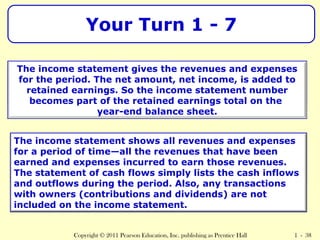

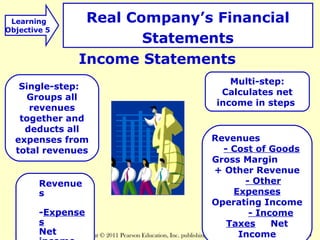

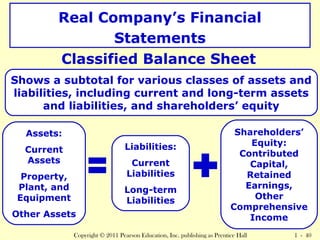

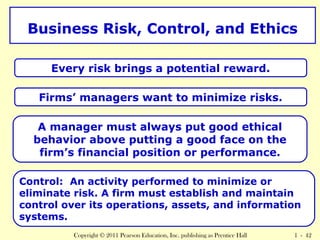

The document provides an overview of key concepts in financial accounting and business. It discusses the purpose of businesses, different types of business organizations and ownership structures. It also covers the four basic financial statements - income statement, balance sheet, statement of shareholders' equity and statement of cash flows - and how they are used to analyze business transactions and report financial performance and position. The learning objectives aim to describe business fundamentals and accounting principles for external reporting.