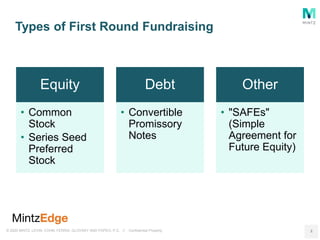

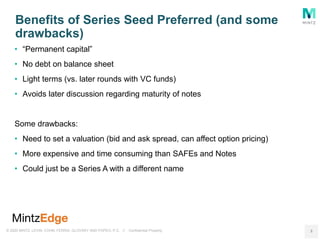

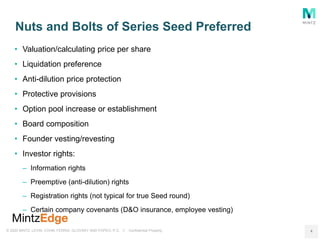

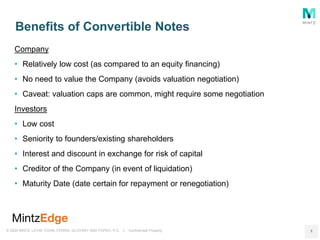

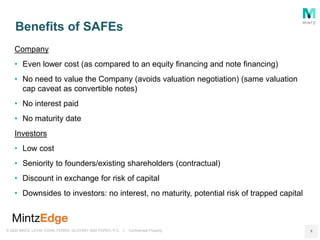

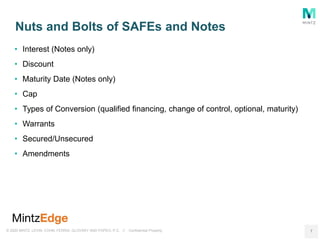

This document discusses different types of financing for early-stage startups, including equity, debt, and other options like SAFEs. It outlines the benefits and drawbacks of common seed financing structures like preferred stock, convertible notes, and SAFEs. Key details like valuation, liquidation preferences, and investor rights for each option are also summarized. The presentation aims to help startups understand their financing-readiness for an initial fundraising round.