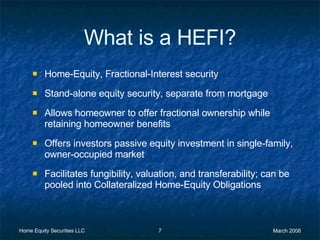

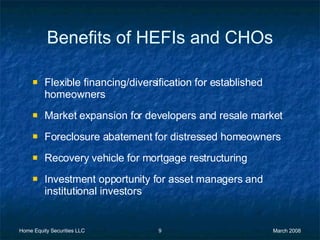

The document discusses the enormous potential of the U.S. home equity market, estimated at around $20 trillion, and the need for innovative financing solutions like home-equity, fractional-interest (HEFI) securities to complement traditional debt financing for homeowners. It outlines how HEFIs can facilitate passive equity investments, improve market access, and aid in foreclosure abatement for distressed homeowners. The document also highlights supportive methodologies and potential commercialization efforts by Home Equity Securities LLC to address the subprime mortgage crisis.