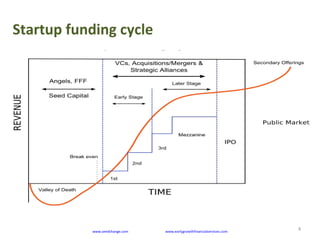

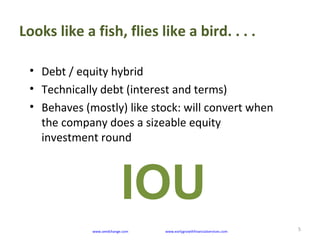

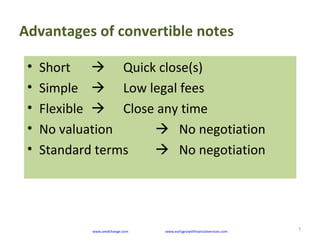

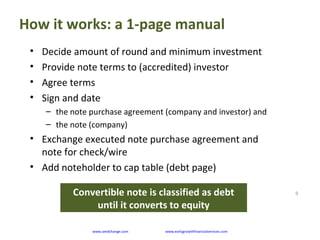

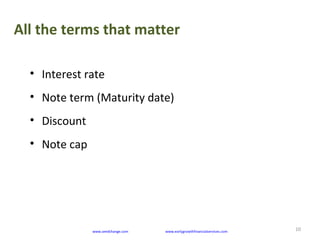

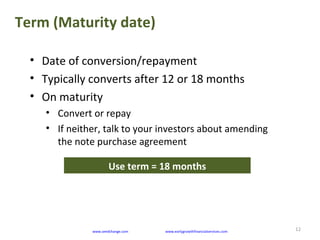

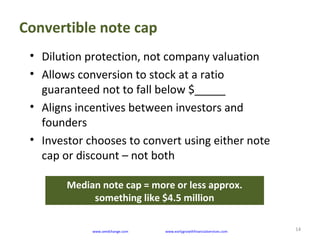

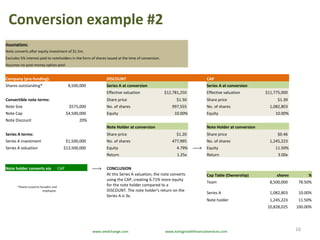

This document discusses convertible notes, which are a hybrid of debt and equity used for early-stage startup funding. Convertible notes allow startups to receive funding in exchange for a note that can later convert to equity shares. The document outlines key terms of convertible notes like interest rates, maturity dates, discounts, and note caps. It provides examples of how notes would convert under different valuation scenarios. While convertible notes provide flexibility, the document notes that investors ultimately want equity and alternatives like SAFEs were created that act more like stock.