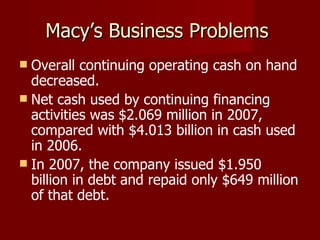

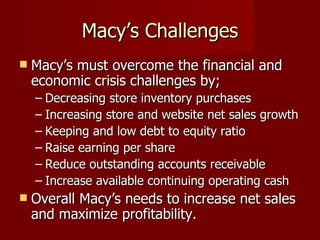

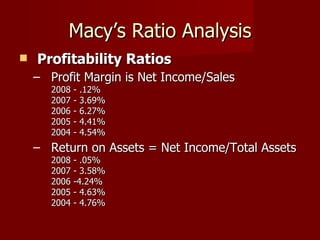

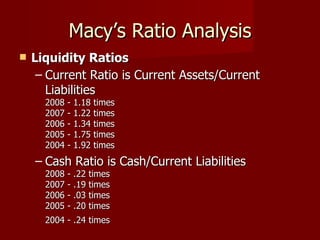

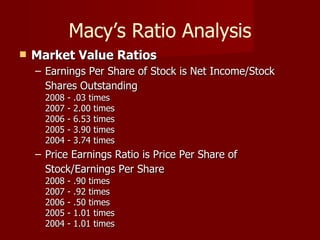

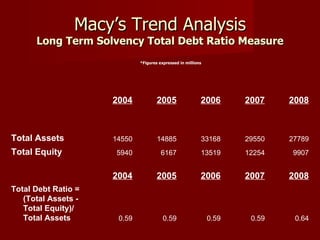

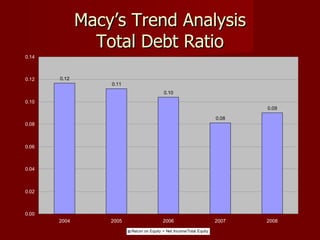

Macy's is a large retailer founded in 1858 with over 800 stores across the US and a thriving online business. It has seen fluctuating financial performance in recent years. While sales grew steadily from 2004-2007, Macy's suffered in 2007-2008 as the economy weakened. It faces challenges to increase sales and profits in the current economic environment through strategies like reducing inventory and raising sales. Analysis of its financial ratios over time show trends in profitability, liquidity, asset use, and debt levels that provide insights into its historical and future performance.