- The document provides information about the board of directors, auditors, bankers, registered office, corporate office, regional offices and registrar and transfer agents of Titan Company Limited.

- It lists the names and details of the chairman, managing director, and other board members. It also provides contact information for the head of legal, auditors, bankers and offices.

- The notice is for the 30th Annual General Meeting of Titan Company Limited to be held on 1st August 2014 to transact ordinary and special business which includes adoption of accounts, appointment and re-appointment of directors and auditors, and other matters.

![59

TITAN COMPANY LIMITED

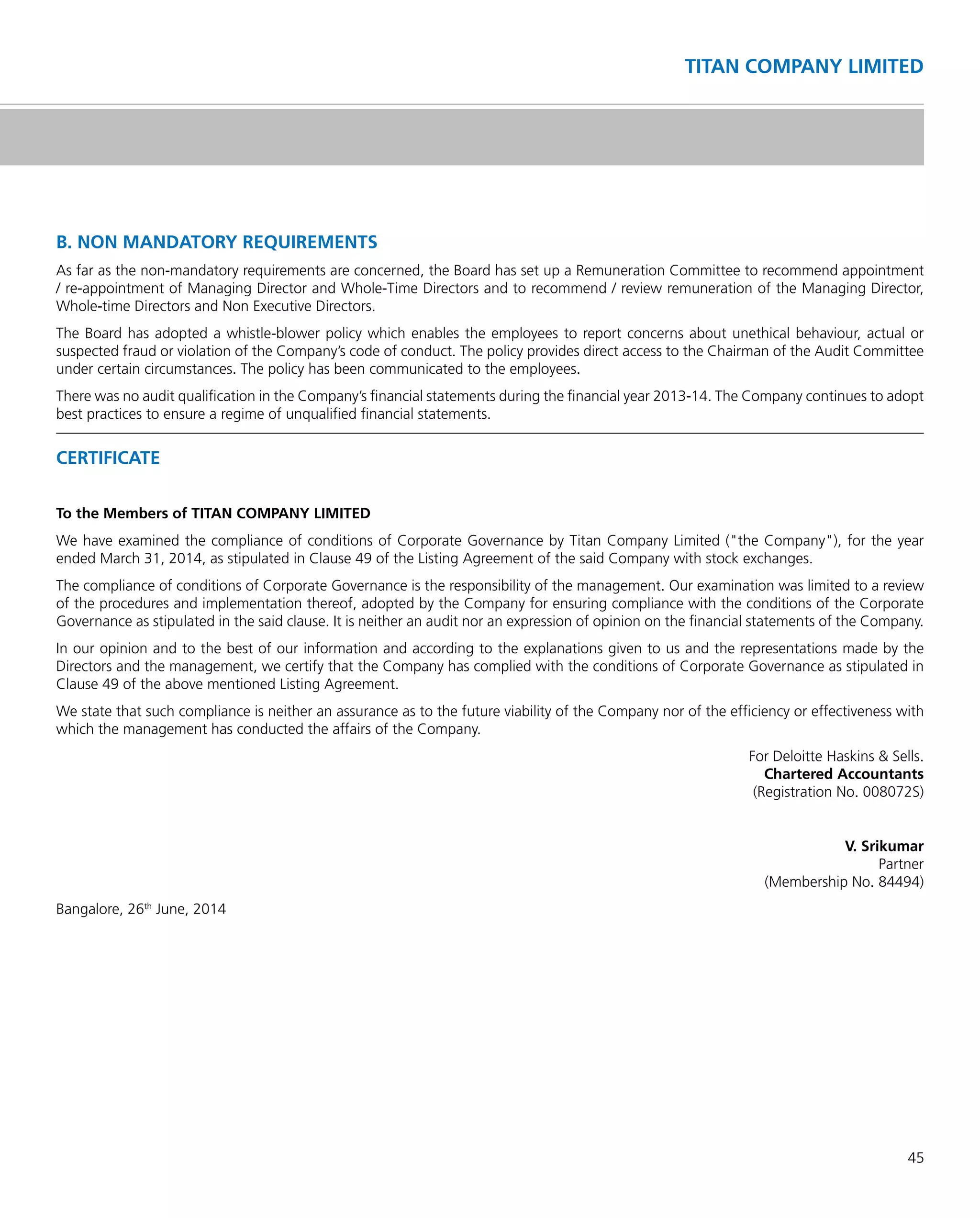

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, or exercised, or no longer qualifies for

hedge accounting. For forecasted transactions, any cumulative gain or loss on the hedging instrument recognized in hedging reserve

is retained until the forecast transaction occurs upon which it is recognized in the statement of profit and loss. If a hedged transaction

is no longer expected to occur, the net cumulative gain or loss accumulated in hedging reserve is recognized immediately to the

statement of profit and loss.

Changes in the fair value of derivative financial instruments that have not been designated as hedging instruments are recognised in

the statement of profit and loss as they arise.

ix. Investments: All long term investments are valued at cost. Provision for diminution in value is made to recognise any decline, other

than temporary, in the value of investments.

x. Inventories: Inventories [other than quantities of gold for which the price is yet to be determined with the suppliers (Unfixed Gold)]

are stated at the lower of cost and net realizable value. Cost is determined as follows:

a) Gold is valued on first-in-first-out basis.

b) Consumable stores, loose tools, raw materials and components are valued on a moving weighted average rate.

c) Work-in-progress and manufactured goods are valued on full absorption cost method based on the average cost of production.

d) Traded goods are valued on a moving weighted average rate/cost of purchases.

Cost comprises all costs of purchase including duties and taxes (other than those subsequently recoverable by the Company), freight

inwards and other expenditure directly attributable to acquisition. Work-in-progress and finished goods include appropriate proportion

of overheads and, where applicable, excise duty.

Unfixed gold is valued at the gold prices prevailing on the period closing date.

xi. Product warranty expenses: Product warranty costs are determined based on past experience and provided for in the year of sale.

xii. Employee benefits:

Short term employee benefits

All short term employee benefits such as salaries, wages, bonus, special awards and medical benefits which fall due within 12 months

of the period in which the employee renders the related services which entitles him to avail such benefits and non-accumulating

compensated absences are recognised on an undiscounted basis and charged to the statement of profit and loss.

Defined contribution plan

Company's contributions to the Superannuation Fund which is managed by a Trust and Pension Fund administered by Regional

Provident Fund Commissioner, are charged as an expense based on the amount of contribution required to be made and when

services are rendered by the employees.

Contribution to the Company's Provident Fund Trust is made at predetermined rates and is charged as an expense based on the

amount of contribution required to be made and when services are rendered by the employees.

Defined benefit plan

Contribution to the Company's Gratuity Trust, liability towards pension of retired managing director and provision towards

compensated absences are provided on the basis of an actuarial valuation using the projected unit credit method and are debited to

the statement of profit and loss on an accrual basis. Actuarial gains and losses arising during the year are recognised in the statement

of profit and loss.

xiii. Taxes on Income: Current tax is the amount of tax payable on the taxable income for the year as determined in accordance with the

provisions of the Income-tax Act, 1961.

Deferred tax is recognised on timing differences, being the difference between taxable income and accounting income that originate

in one period and are capable of reversal in one or more subsequent periods.

xiv. Segment accounting: Segments are identified based on the types of products and the internal organisation and management structure.

The Company has identified business segment as its primary reporting segment with secondary information reported geographically.

Notes forming part of the Financial Statements for the year ended 31 March 2014

NOTE 01 SIGNIFICANT ACCOUNTING POLICIES](https://image.slidesharecdn.com/titanar20141-150209033546-conversion-gate02/75/tTitan-ar-2014-56-2048.jpg)

![92

TITAN COMPANY LIMITED

30th Annual Report 2013-14

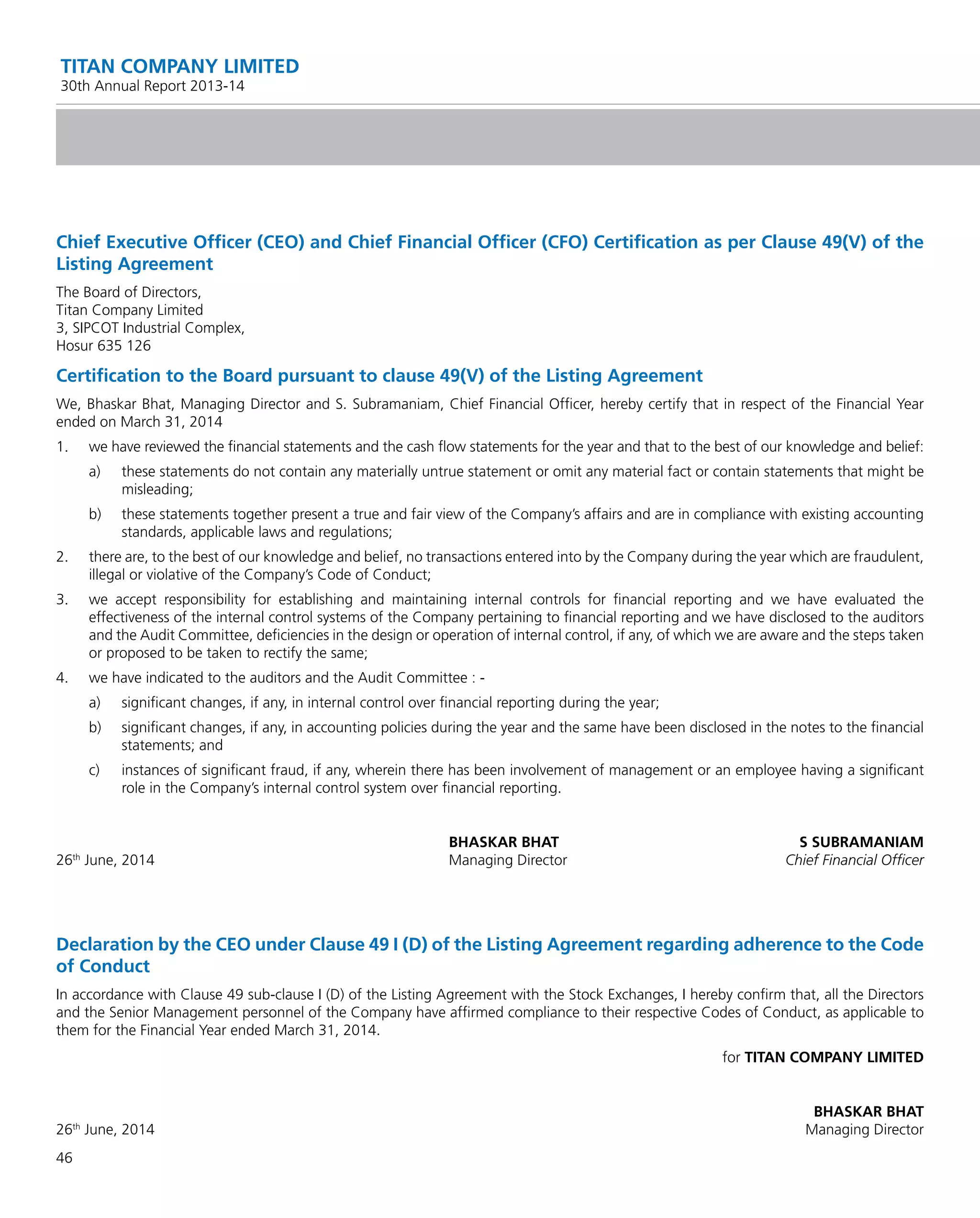

Hedging instruments are initially measured at fair value, and are remeasured at subsequent reporting dates. Changes in the fair value

of these derivatives that are designated and effective as hedges of future cash flows are recognised directly in hedging reserve and

the ineffective portion is recognised immediately in the statement of profit and loss.

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, or exercised, or no longer qualifies for

hedge accounting. For forecasted transactions, any cumulative gain or loss on the hedging instrument recognized in hedging reserve

is retained until the forecast transaction occurs upon which it is recognized in the statement of profit and loss. If a hedged transaction

is no longer expected to occur, the net cumulative gain or loss accumulated in hedging reserve is recognized immediately to the

statement of profit and loss.

Changes in the fair value of derivative financial instruments that have not been designated as hedging instruments are recognised in

the statement of profit and loss as they arise.

ix) Investments: All long term investments are valued at cost. Provision for diminution in value is made to recognise any decline, other

than temporary, in the value of investments.

x) Inventories: Inventories [other than quantities of gold for which the price is yet to be determined with the suppliers (Unfixed Gold)]

are stated at the lower of cost and net realizable value. Cost is determined as follows:

a) Gold is valued on first-in-first-out basis.

b) Consumable stores, loose tools, raw materials and components are valued on a moving weighted average rate.

c) Work-in-progress and manufactured goods are valued on full absorption cost method based on the average cost of production.

d) Traded goods are valued on a moving weighted average rate/ cost of purchases.

Cost comprises all costs of purchase including duties and taxes (other than those subsequently recoverable by the Company), freight

inwards and other expenditure directly attributable to acquisition. Work-in-progress and finished goods include appropriate proportion

of overheads and, where applicable, excise duty.

Unfixed gold is valued at the gold prices prevailing on the period closing date.

xi) Product warranty expenses: Product warranty costs are determined based on past experience and provided for in the year of sale.

xii) Employee benefits:

Short term employee benefits

All short term employee benefits such as salaries, wages, bonus, special awards, medical benefits which fall due within 12 months

of the period in which the employee renders the related services which entitles him to avail such benefits and non-accumulating

compensated absences are recognised on an undiscounted basis and charged to the statement of profit and loss.

Defined contribution plan

Company’s contributions to the Superannuation Fund which is managed by a Trust and Pension Fund administered by Regional

Provident Fund Commissioner, are charged as an expense based on the amount of contribution required to be made and when

services are rendered by the employees.

Contribution to the Company’s Provident Fund Trust is made at predetermined rates and is charged as an expense based on the

amount of contribution required to be made and when services are rendered by the employees.

Contribution to Provident Fund and Pension Fund (of a subsidiary) are made at predetermined rates to the Regional Provident Fund

Commissioner and debited to the statement of profit and loss account on an accrual basis.

Defined benefit plan:

Contribution to the Company’s Gratuity Trust, liability towards pension of retired managing director and provision towards compensated

absences are provided on the basis of an actuarial valuation using the projected unit credit method and are debited to the statement

of profit and loss on an accrual basis. Actuarial gains and losses arising during the year are recognised in the statement of profit and

loss.

Notes forming part of the Consolidated Financial Statements for the year ended 31 March 2014

NOTE 03 SIGNIFICANT ACCOUNTING POLICIES: (Contd.)](https://image.slidesharecdn.com/titanar20141-150209033546-conversion-gate02/75/tTitan-ar-2014-89-2048.jpg)