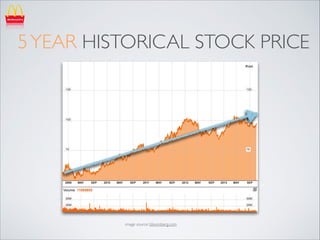

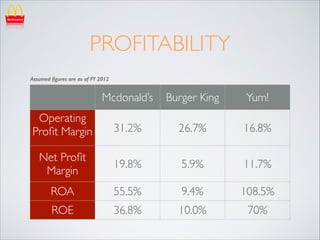

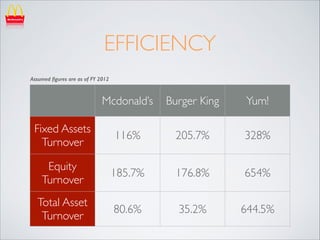

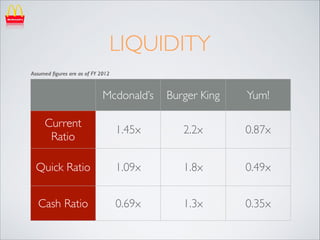

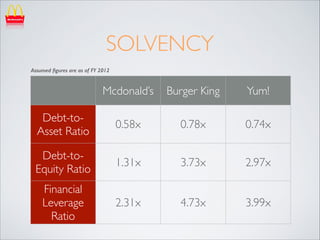

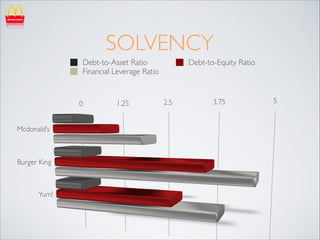

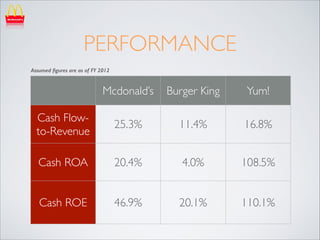

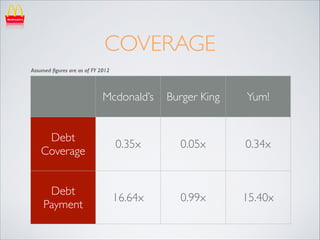

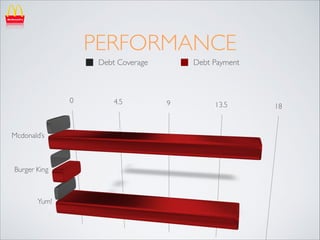

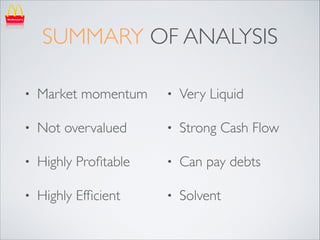

This document analyzes an investment in a leading global foodservice retailer. It provides company information, reviews market data, and analyzes the company's finances. The financial analysis shows the company has experienced steady revenue, income, and dividend growth in recent years. It is also highly profitable, efficient, liquid, and able to cover its debts based on various financial metrics compared to competitors. Based on this analysis, the document recommends a strong buy position in the company.