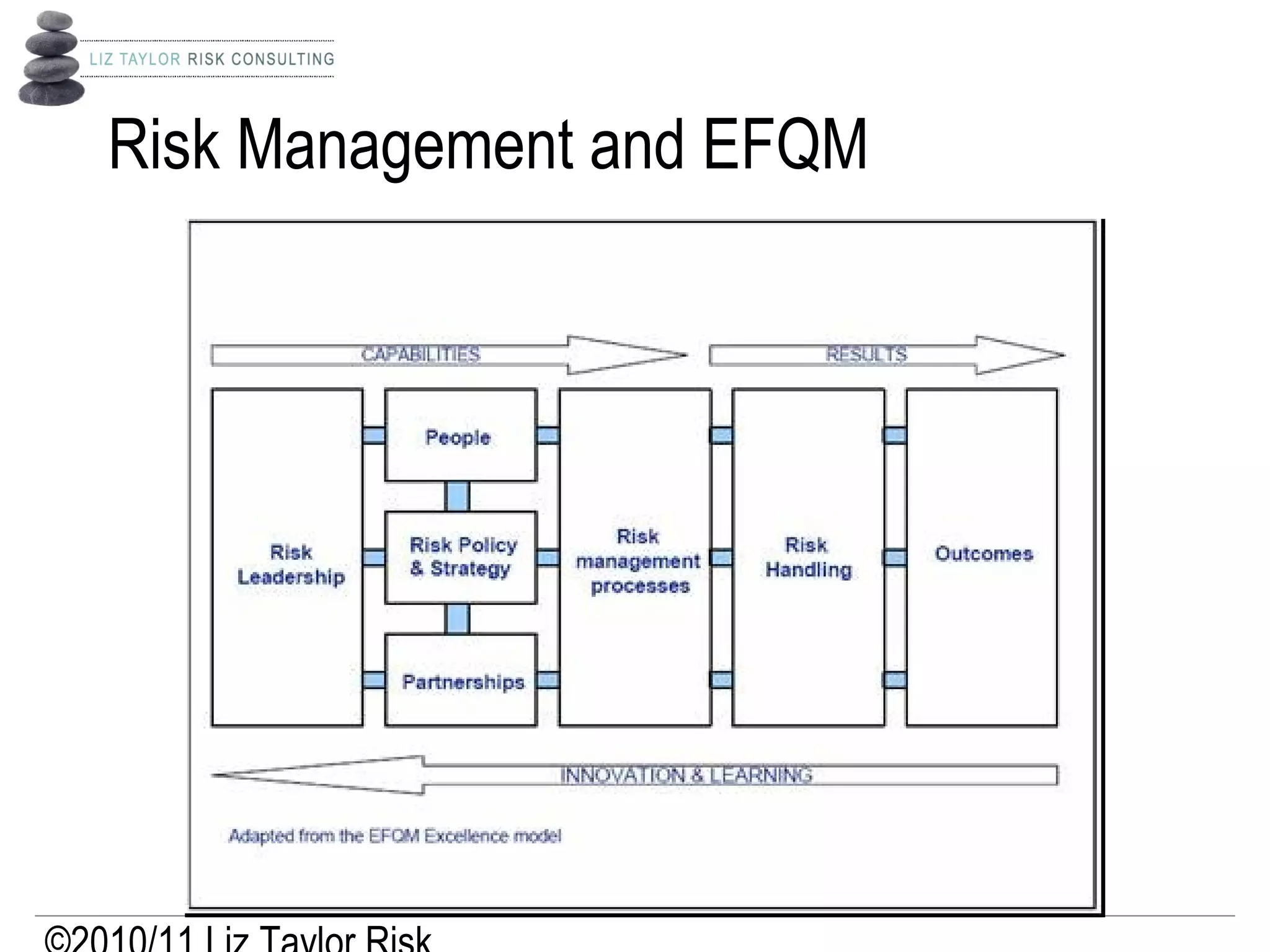

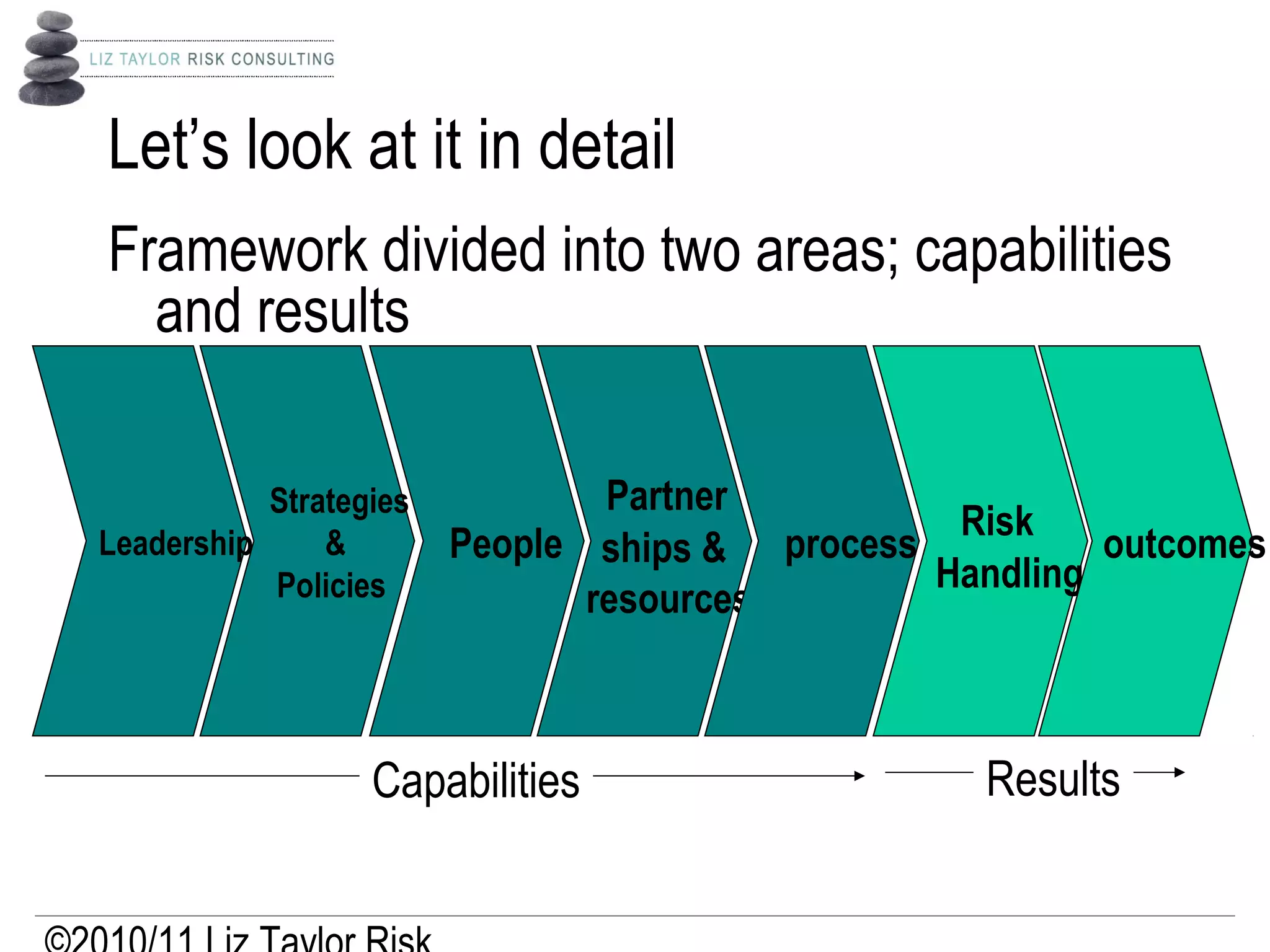

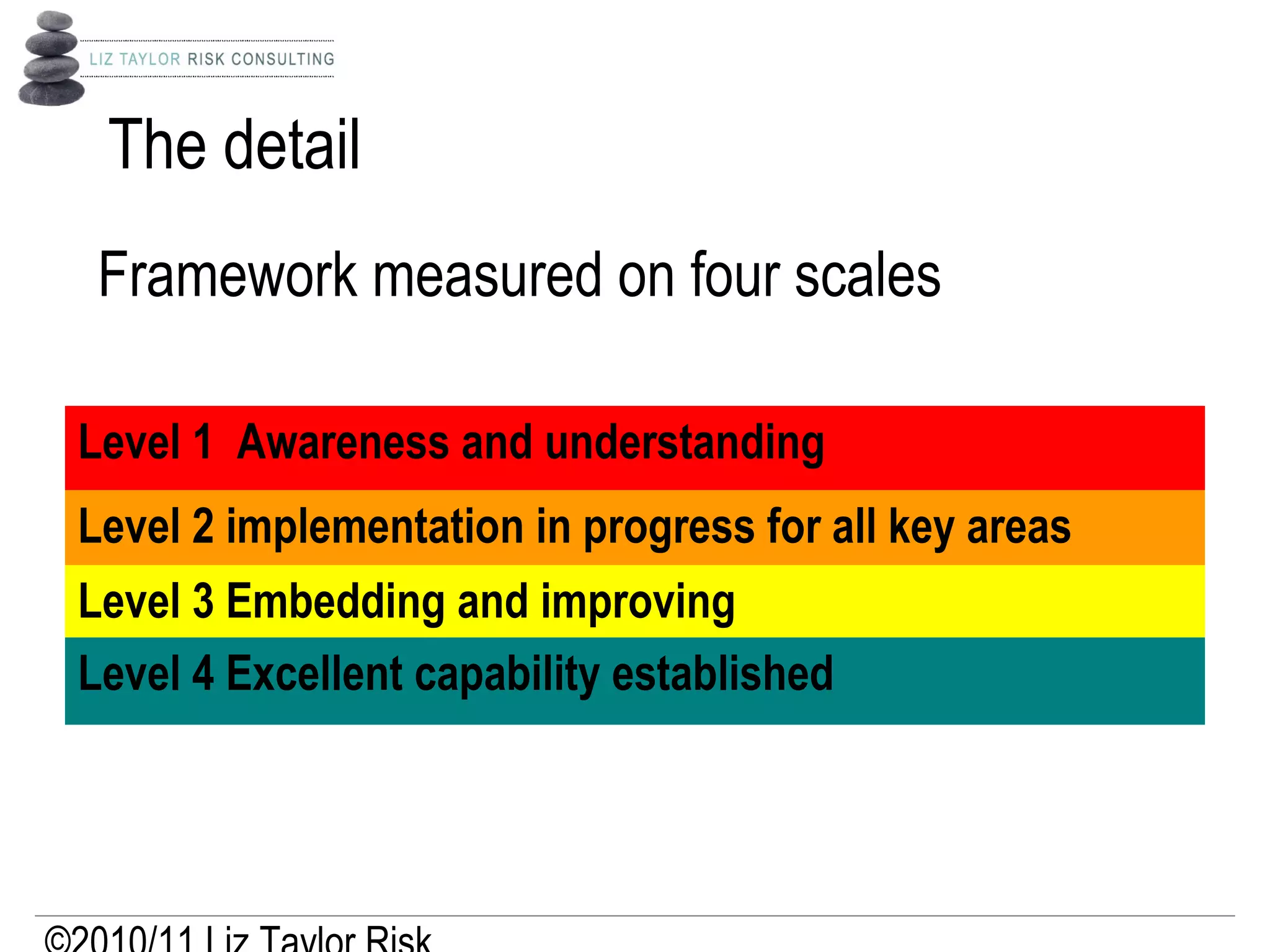

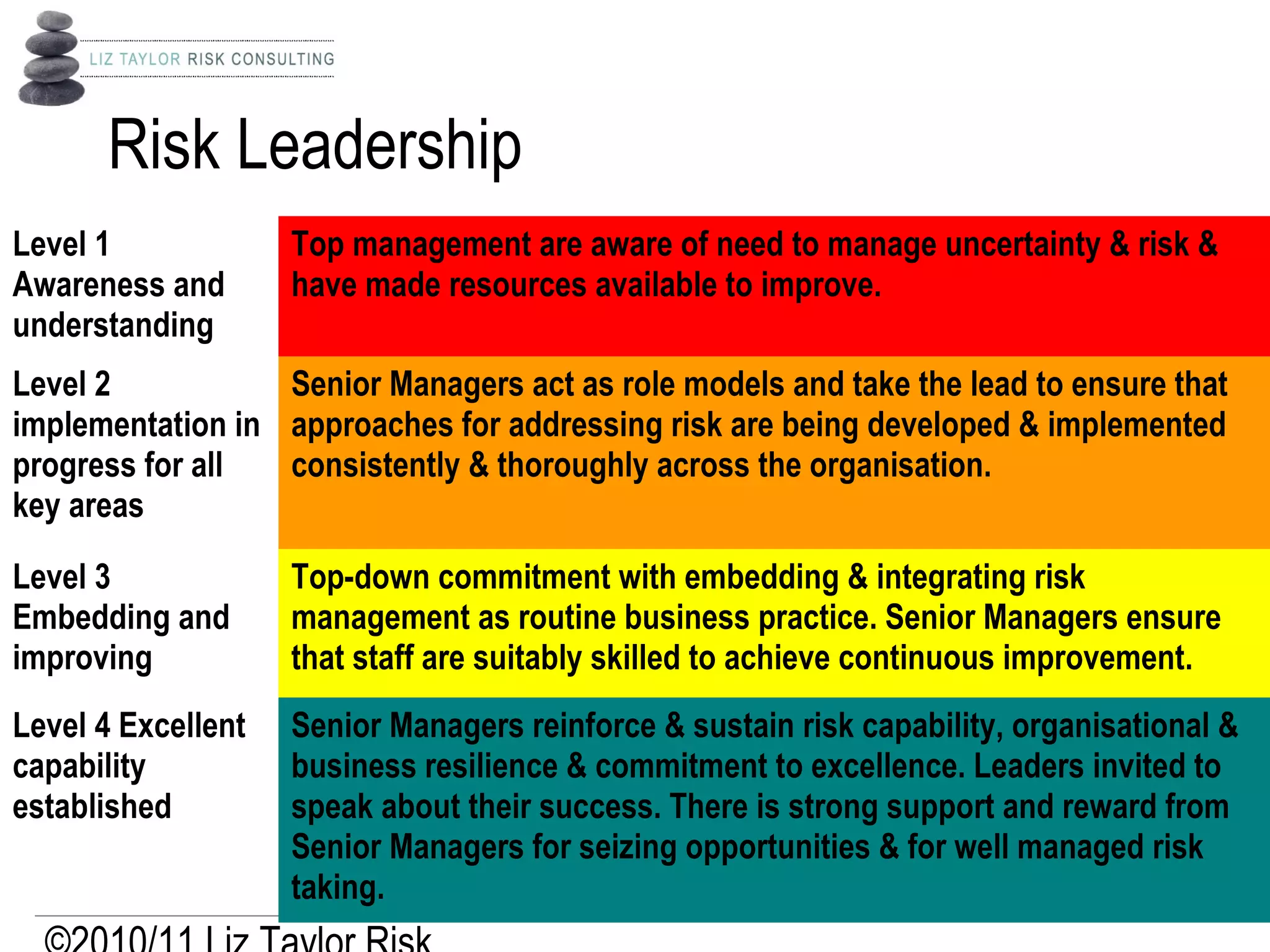

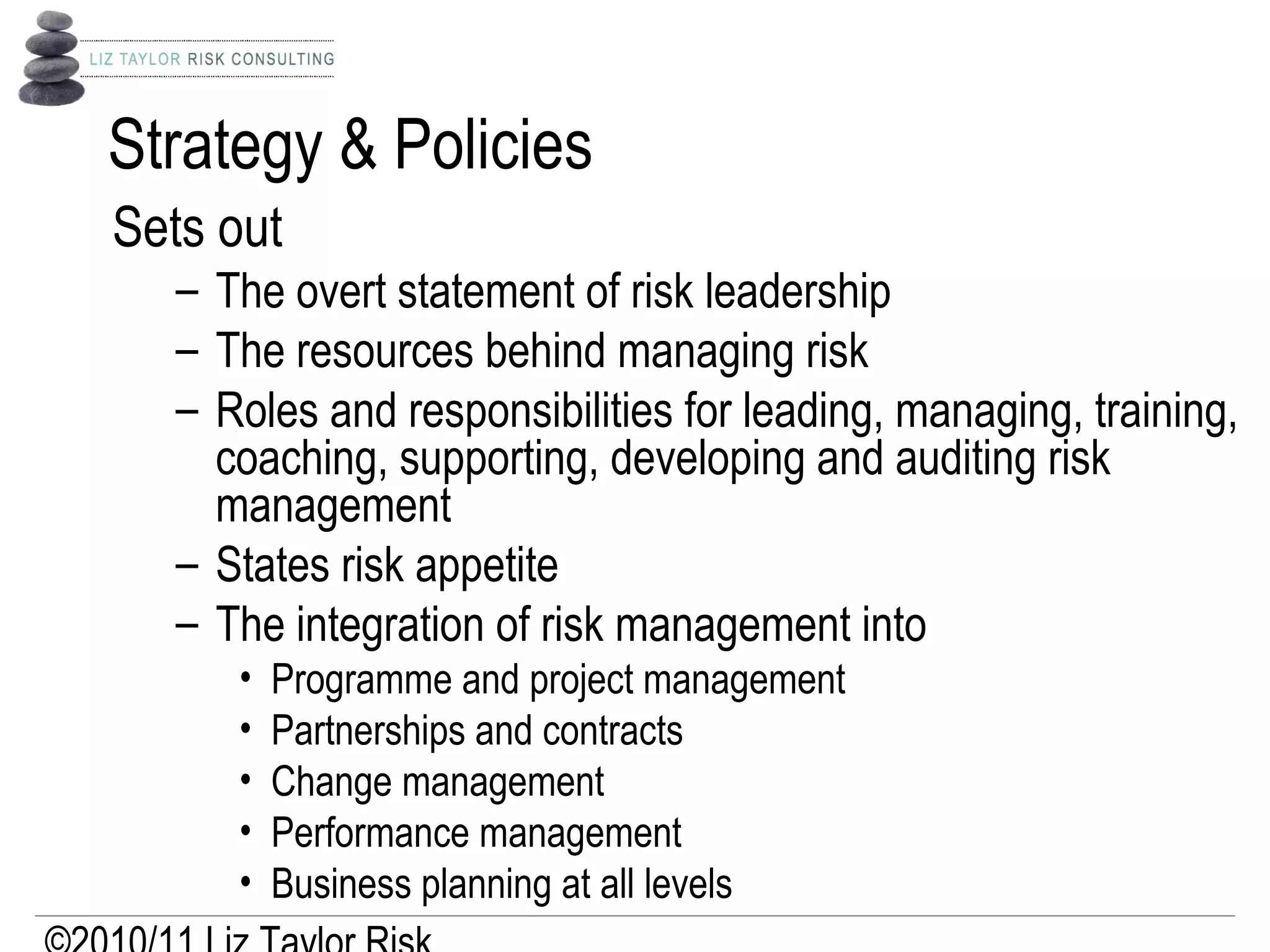

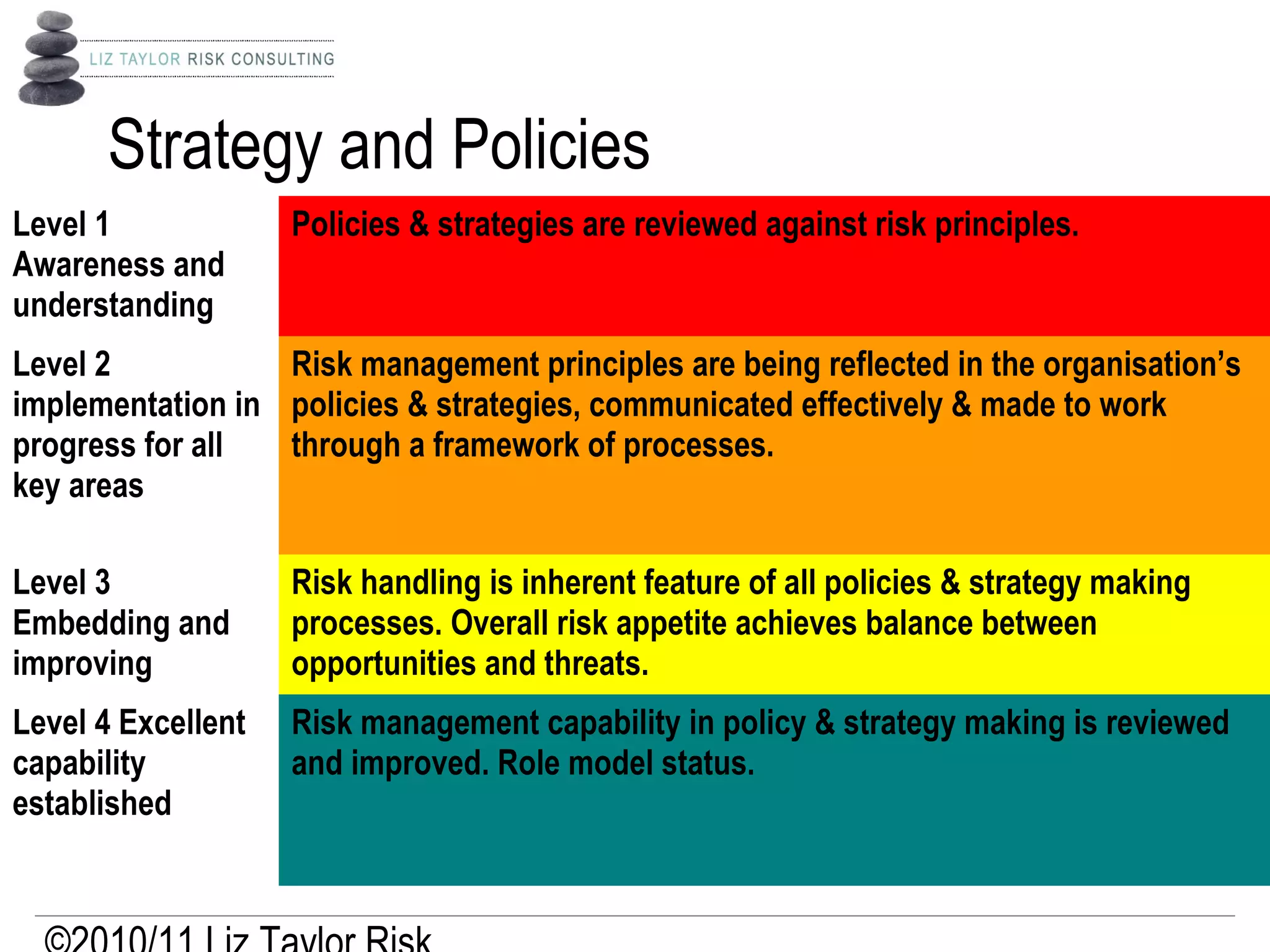

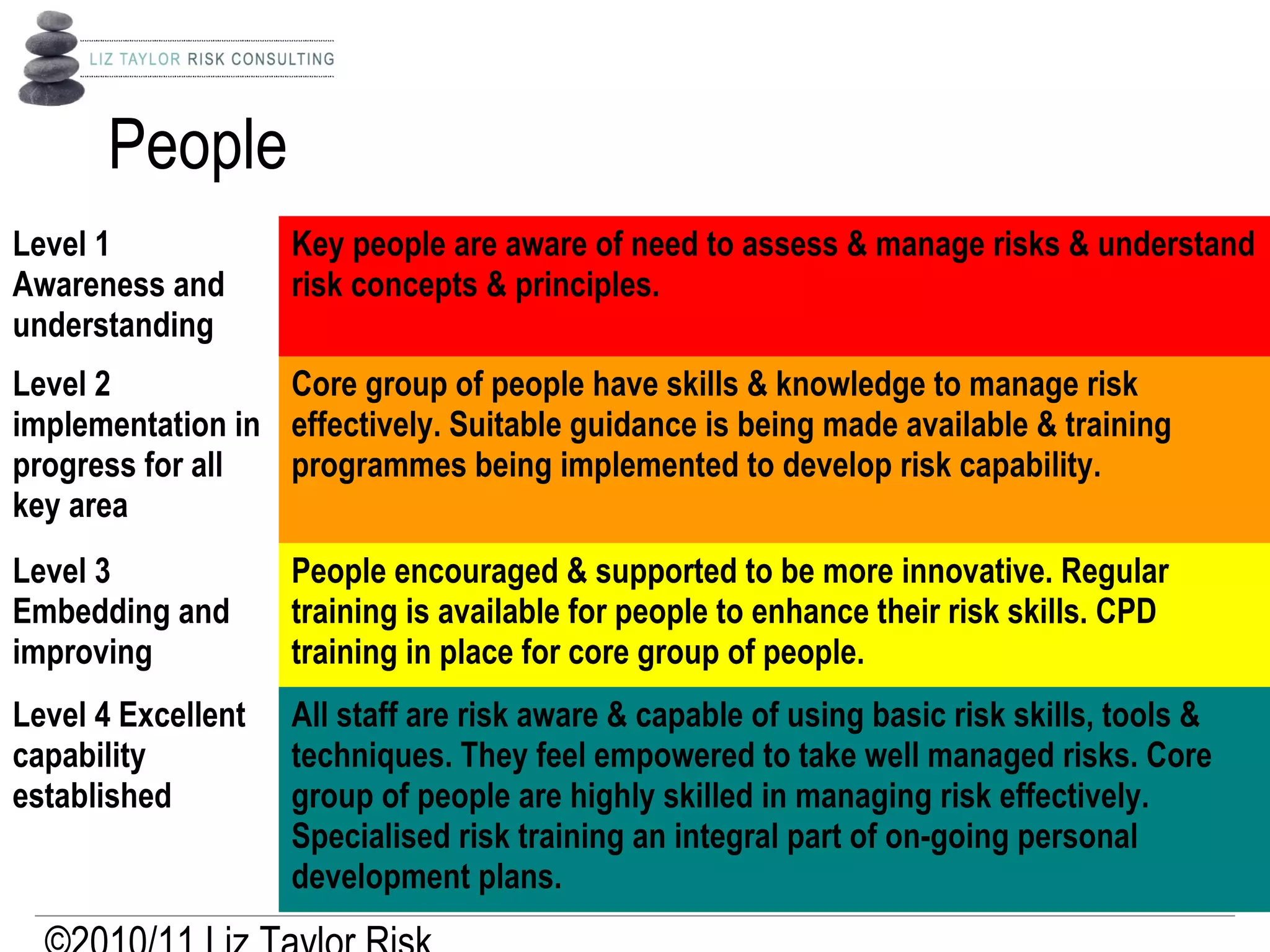

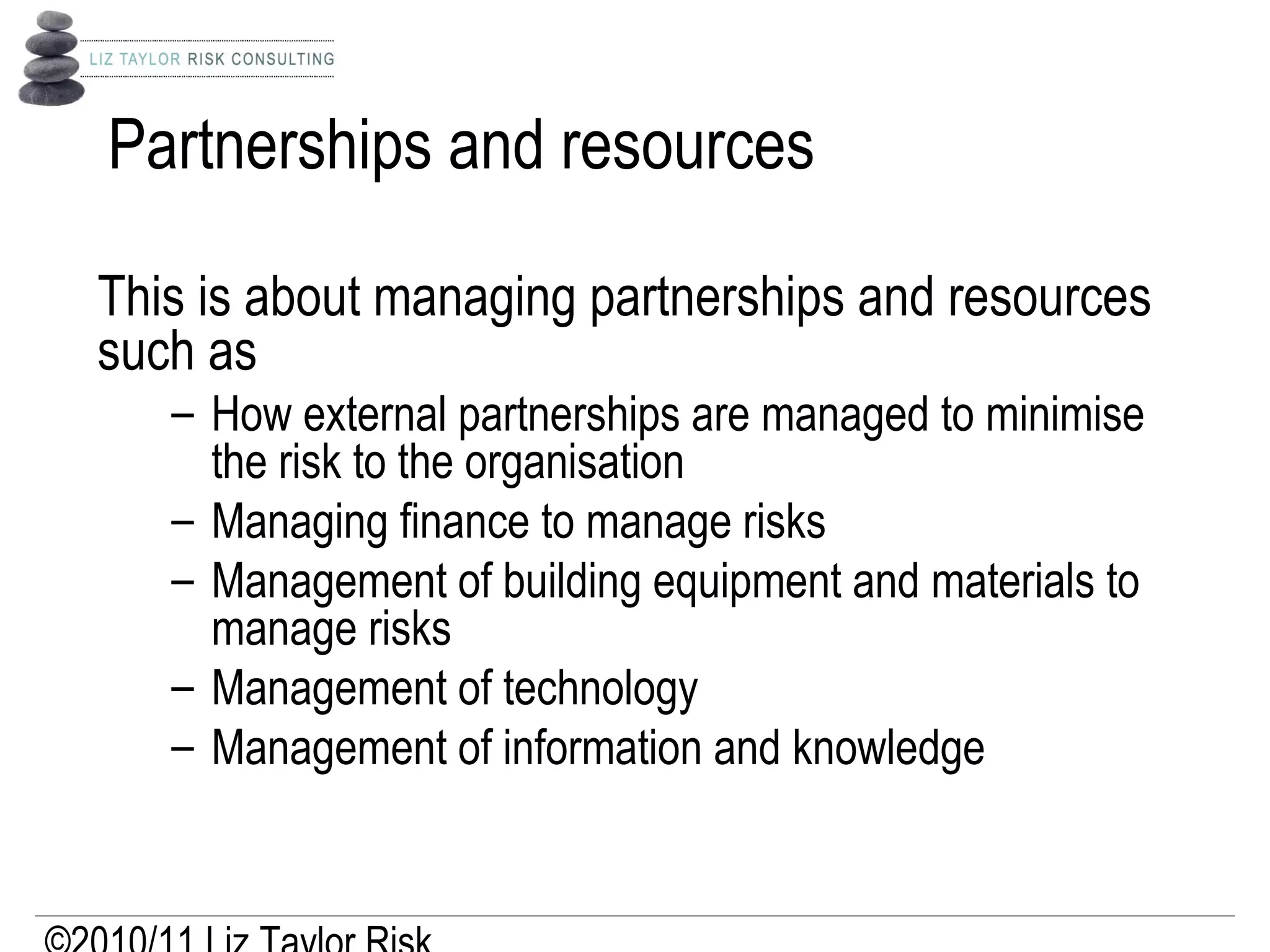

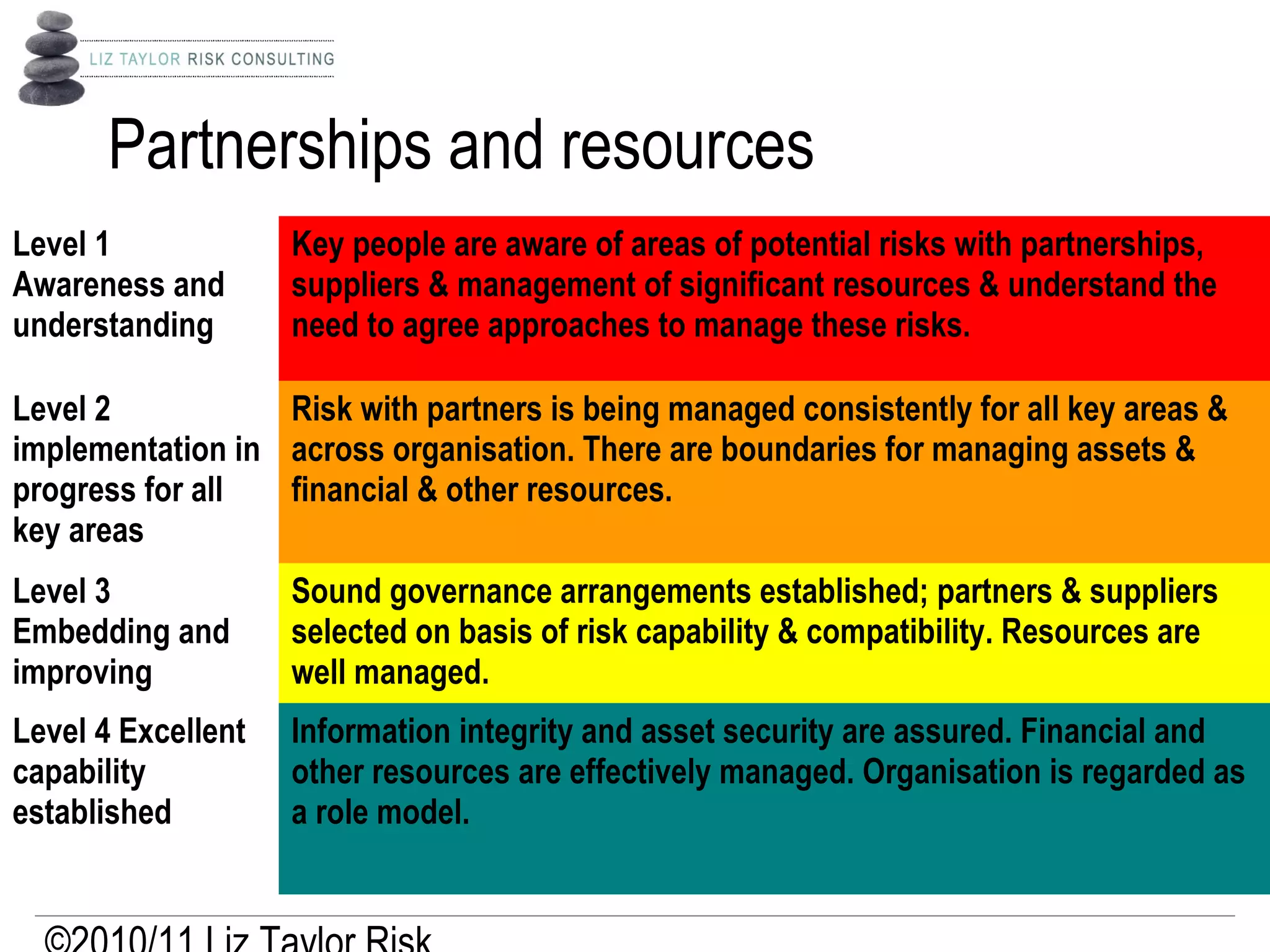

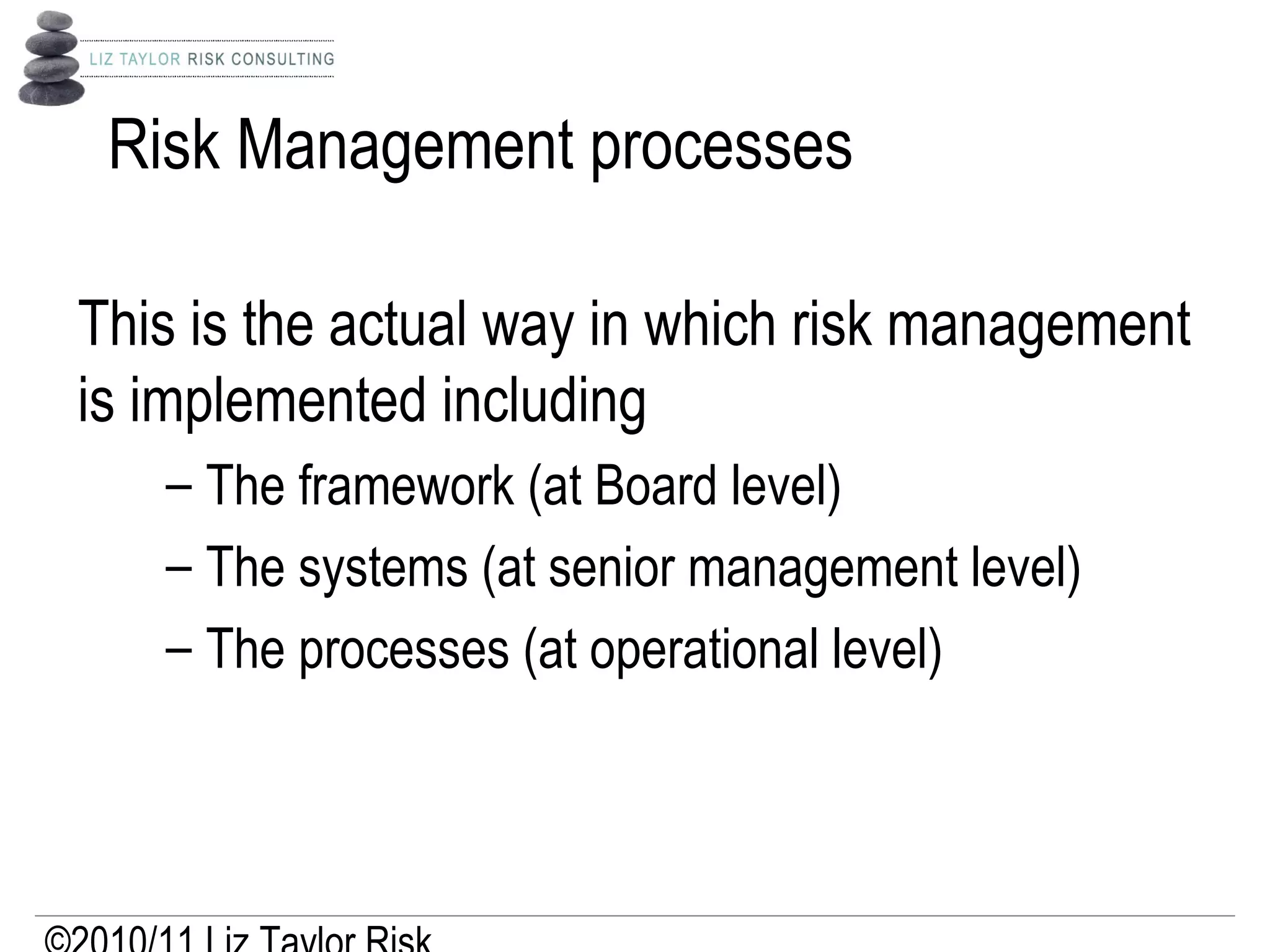

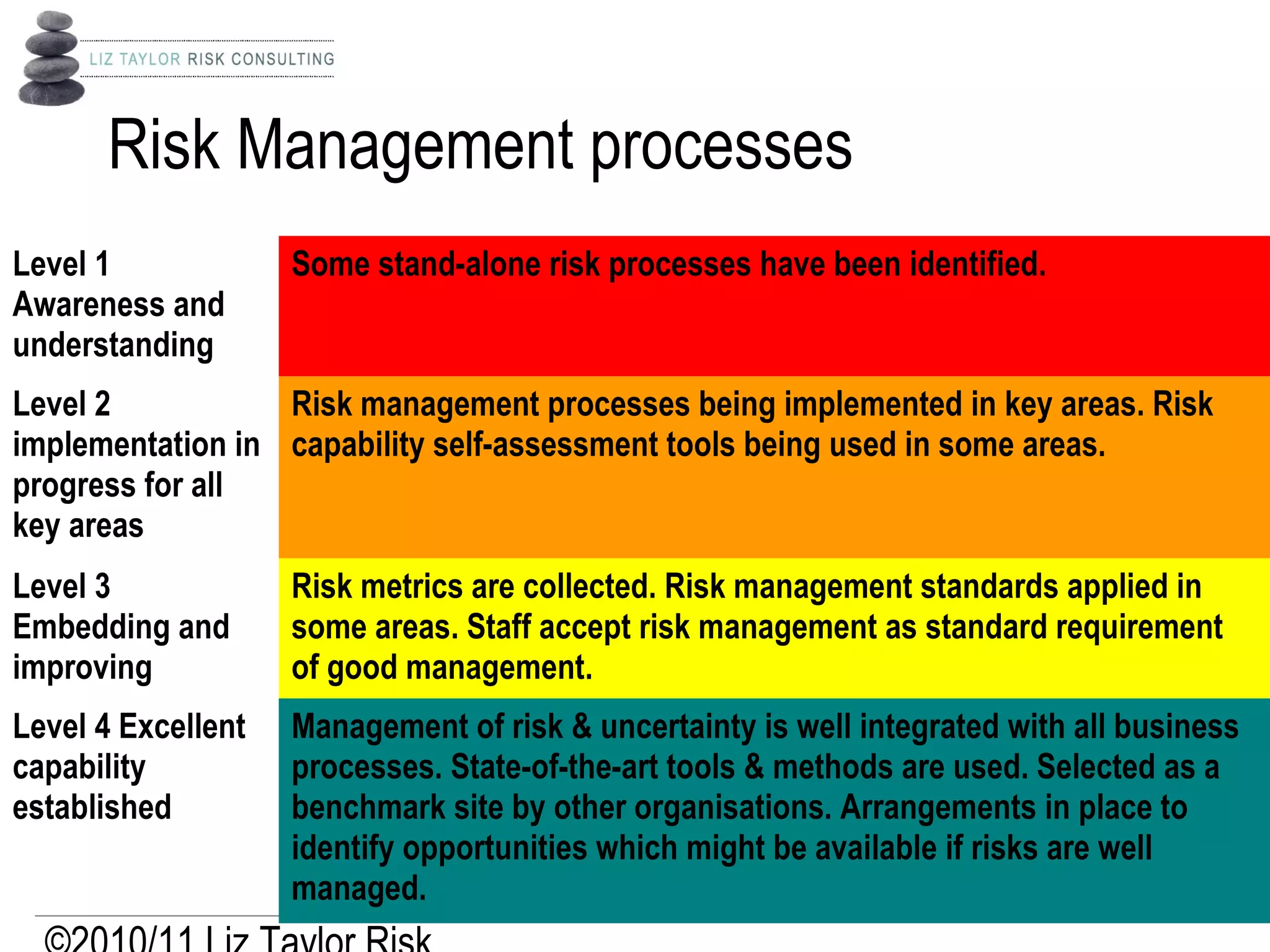

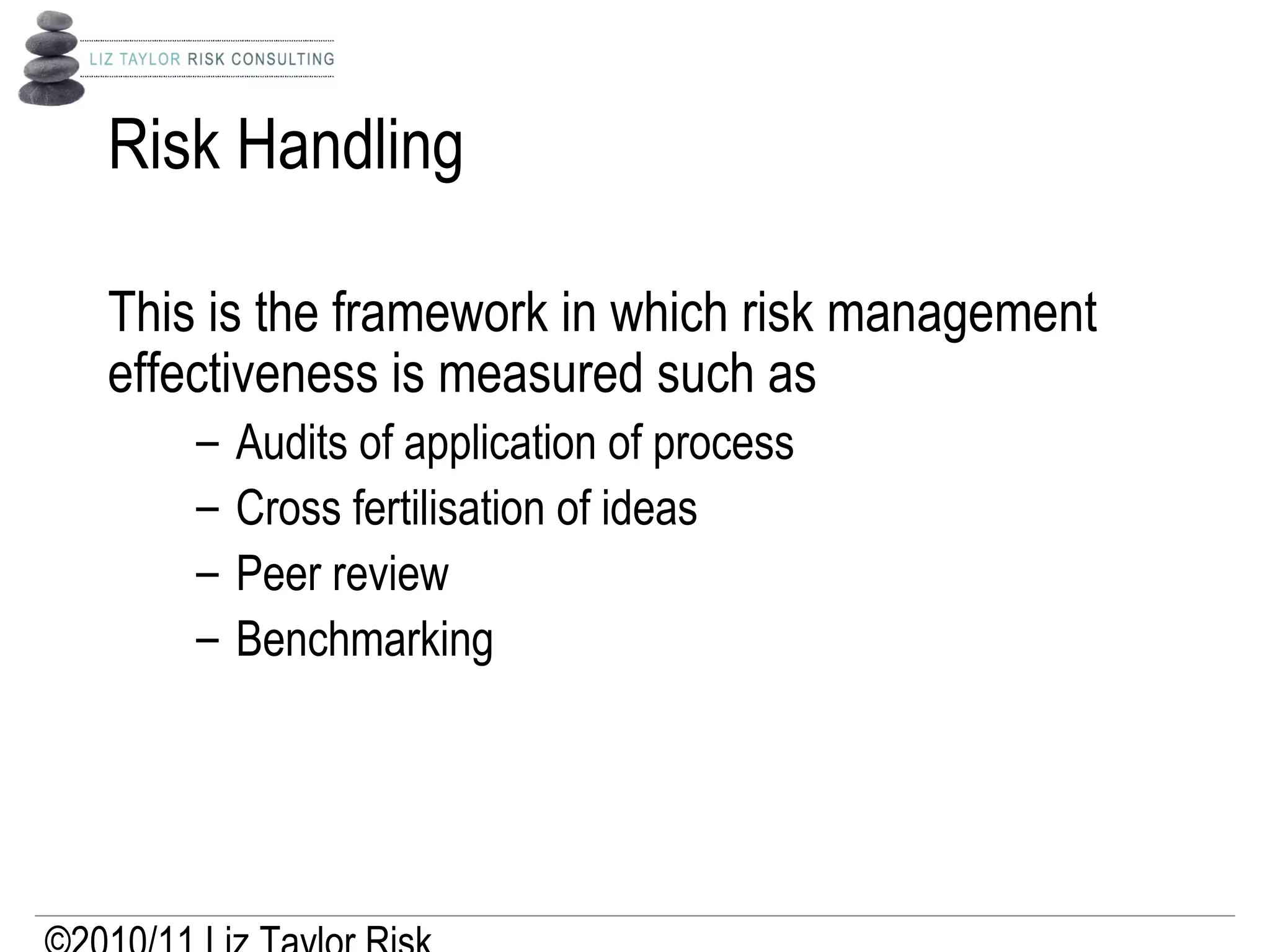

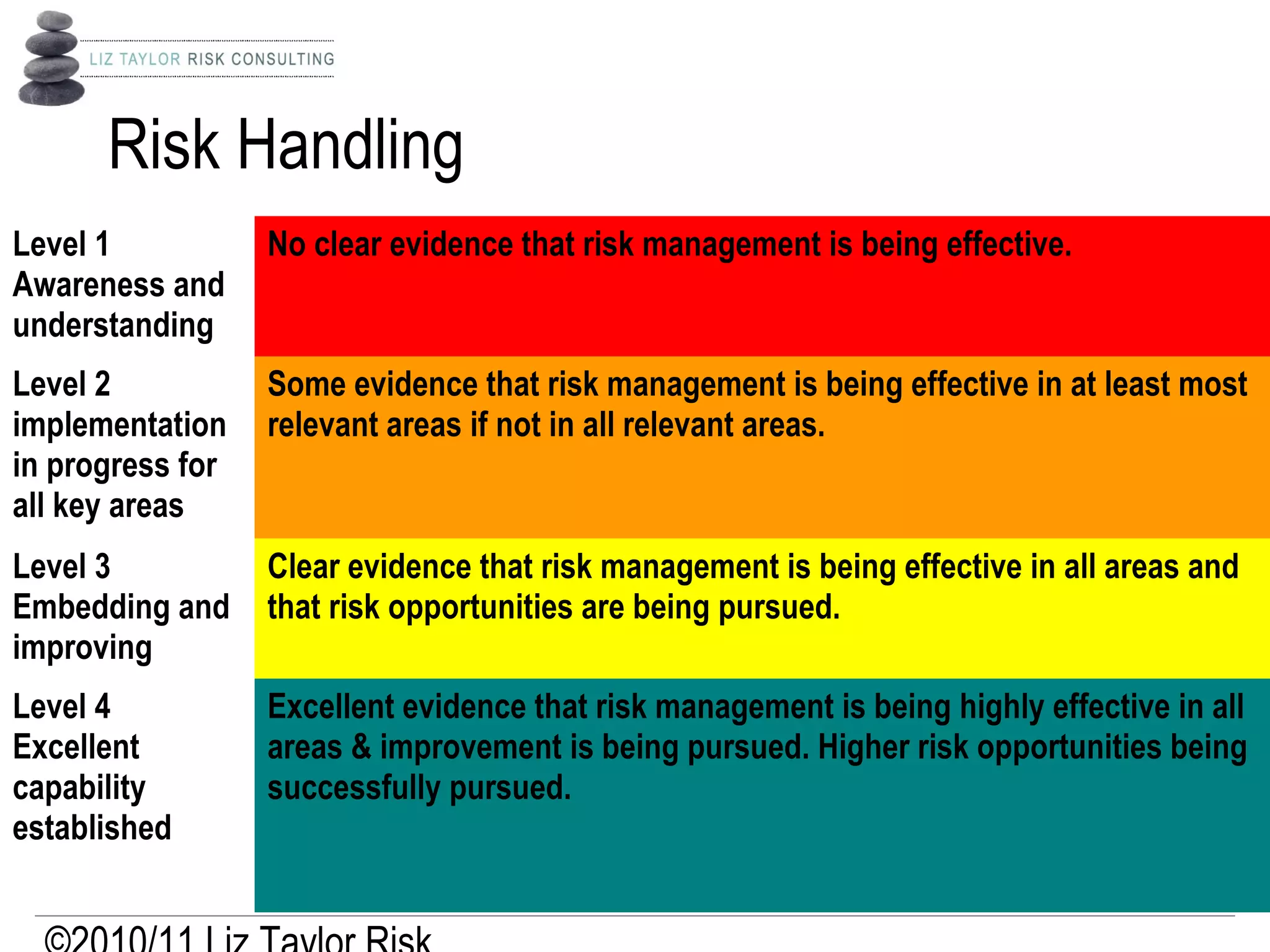

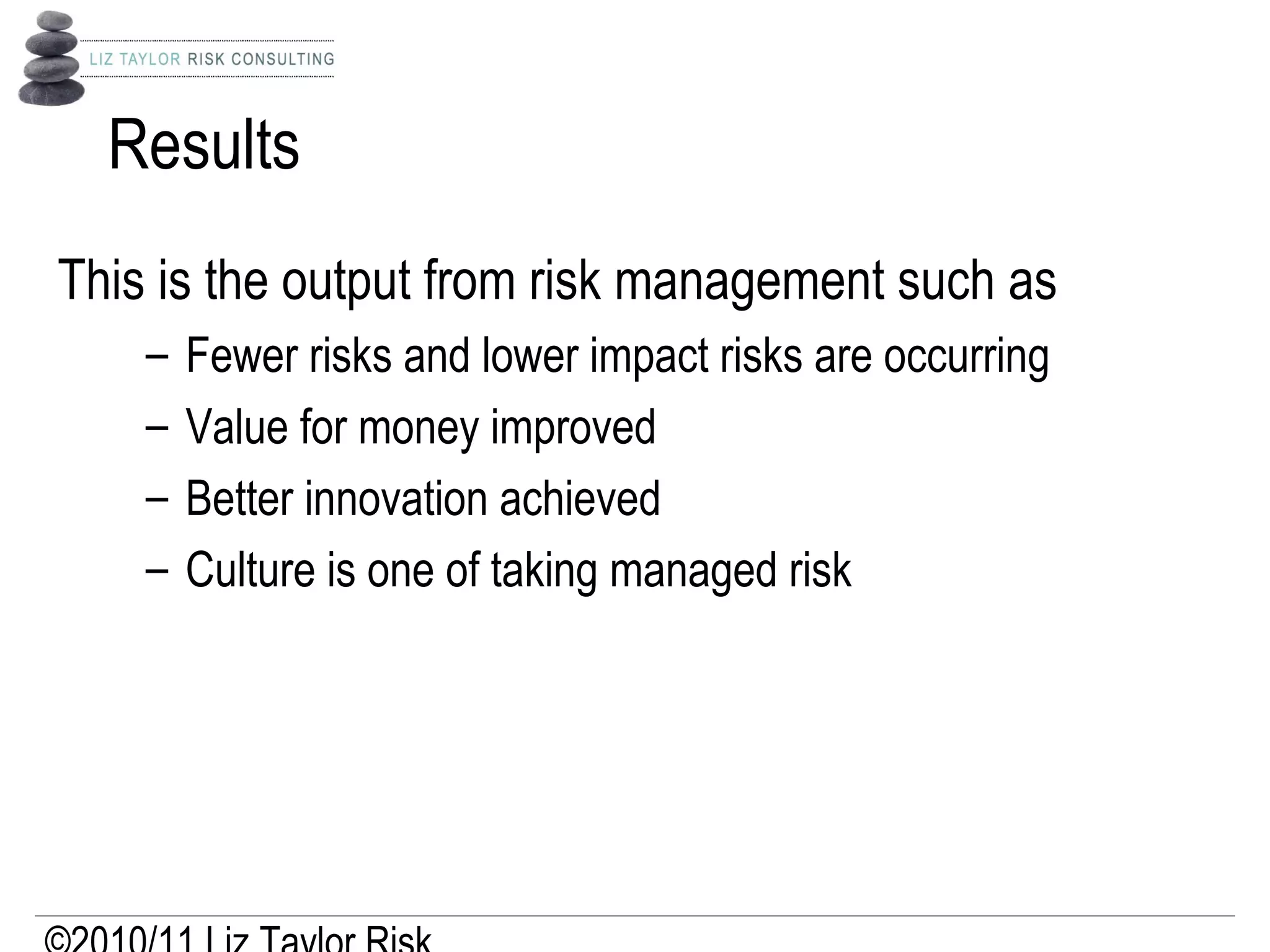

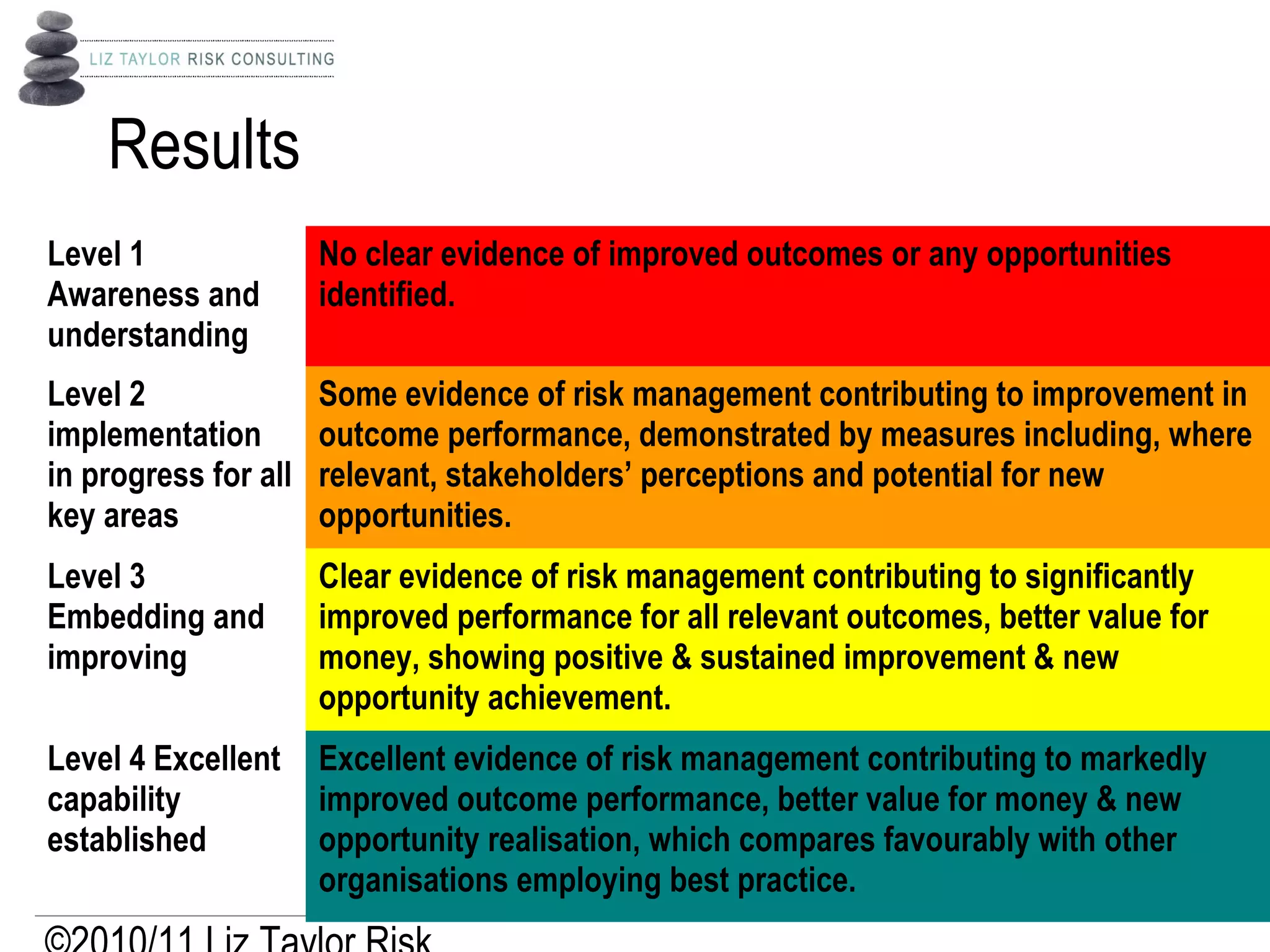

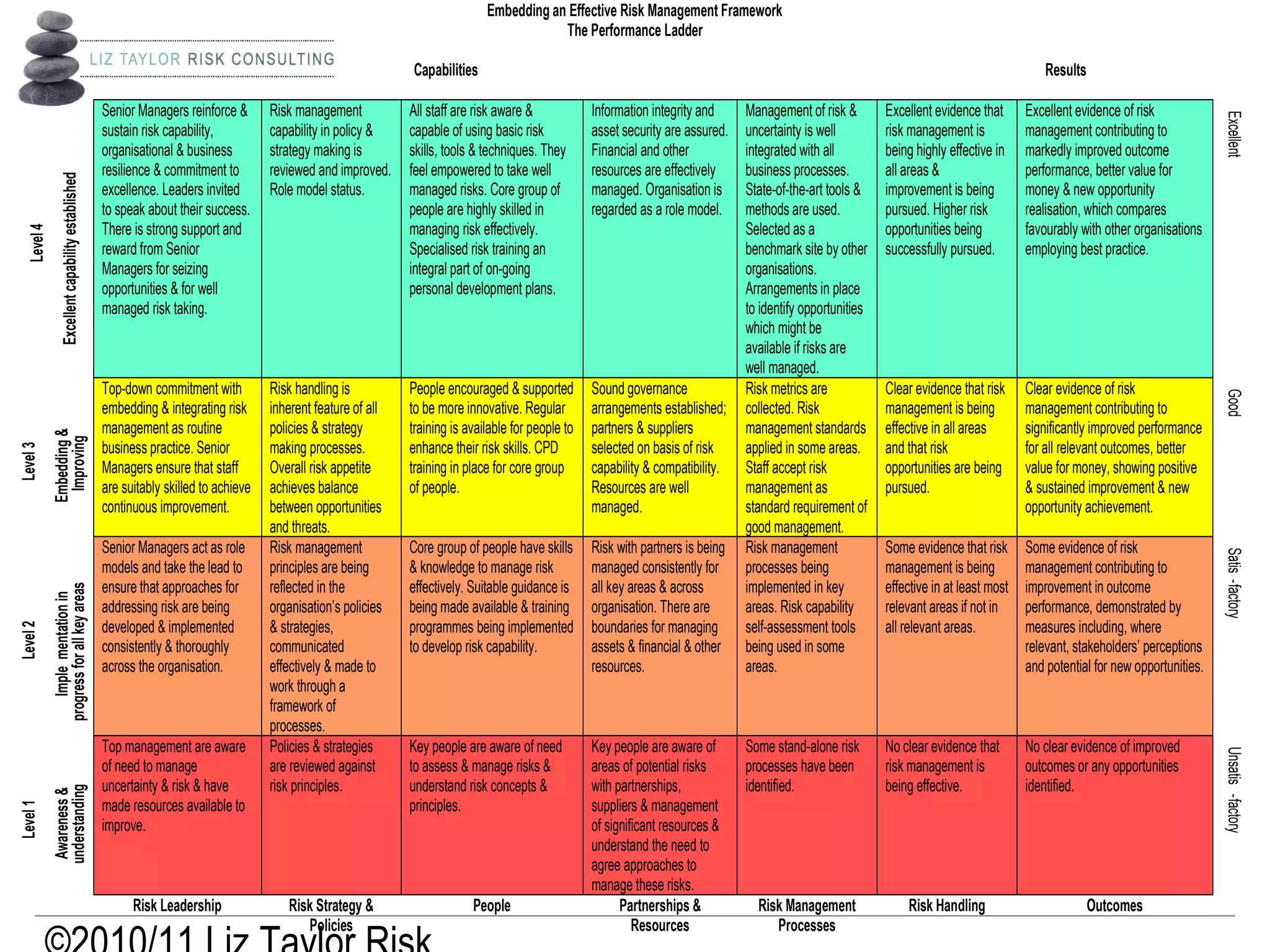

The document outlines the LTRC Risk Management Performance Ladder, which utilizes the EFQM model as a framework for effective risk management in organizations. It describes various capability levels from awareness to excellent capability, detailing aspects such as leadership, strategy, policy, and outcome measurement within risk management. The framework emphasizes the importance of embedding risk management into organizational practices to enhance resilience, innovation, and overall performance.