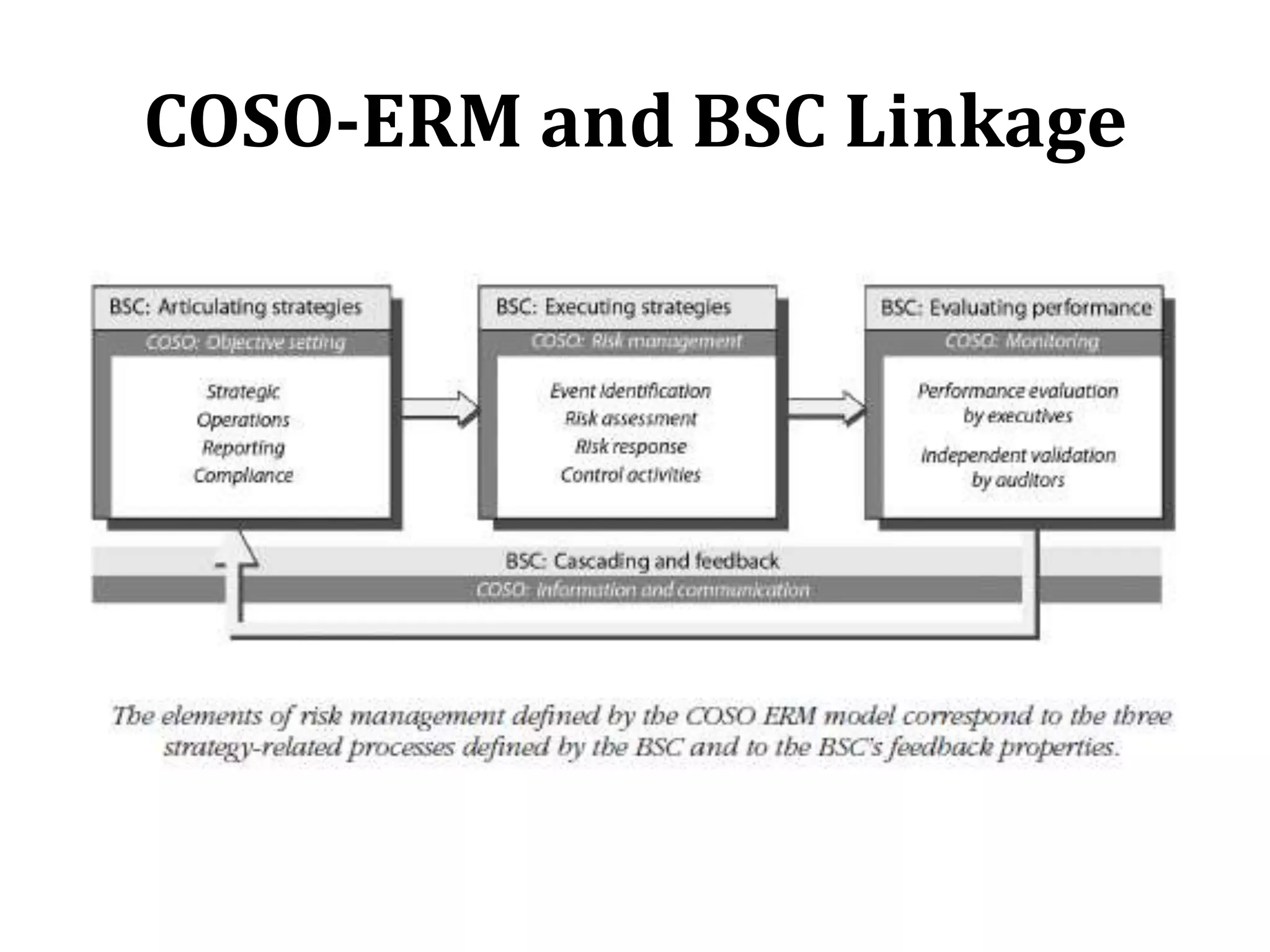

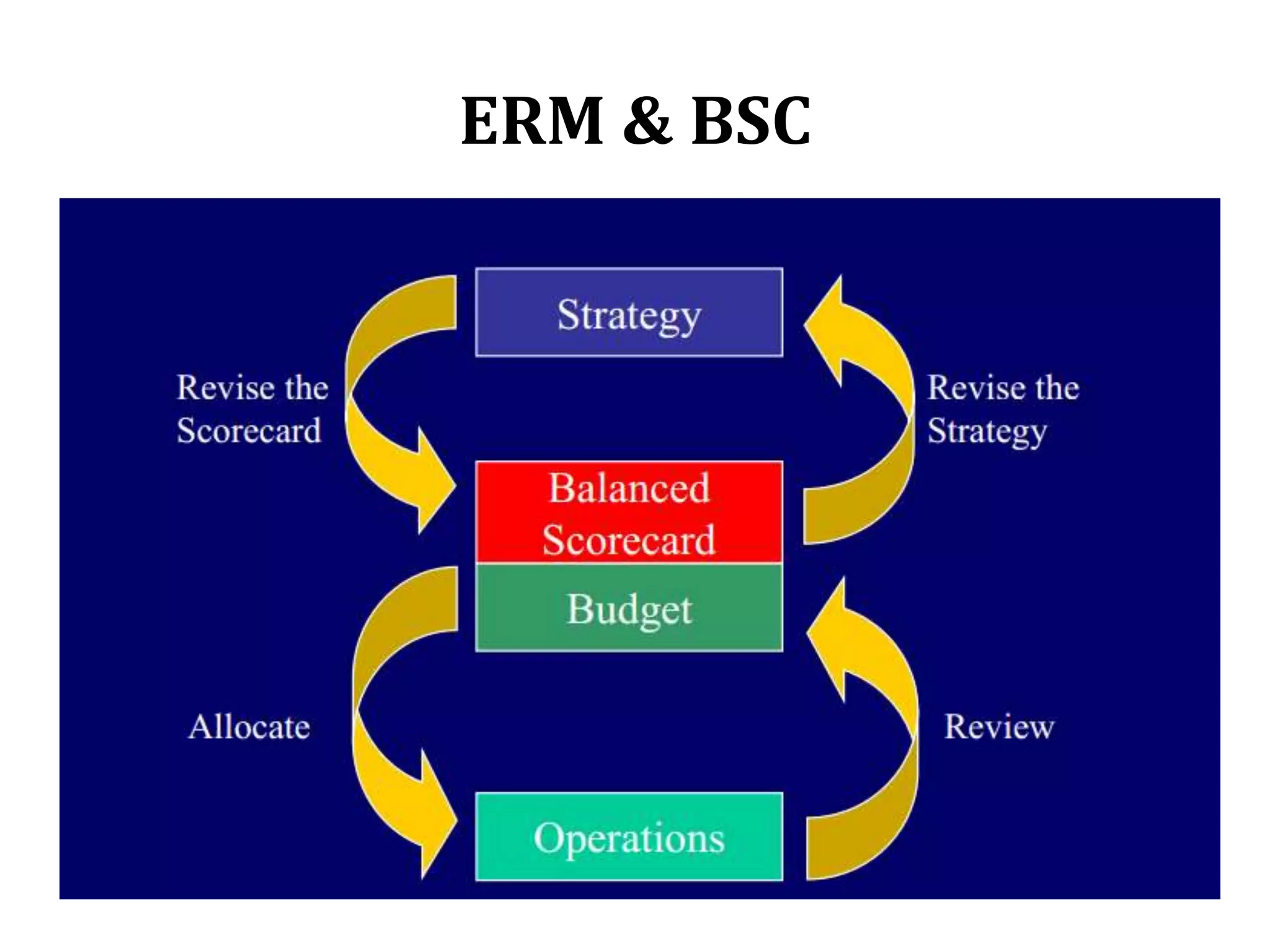

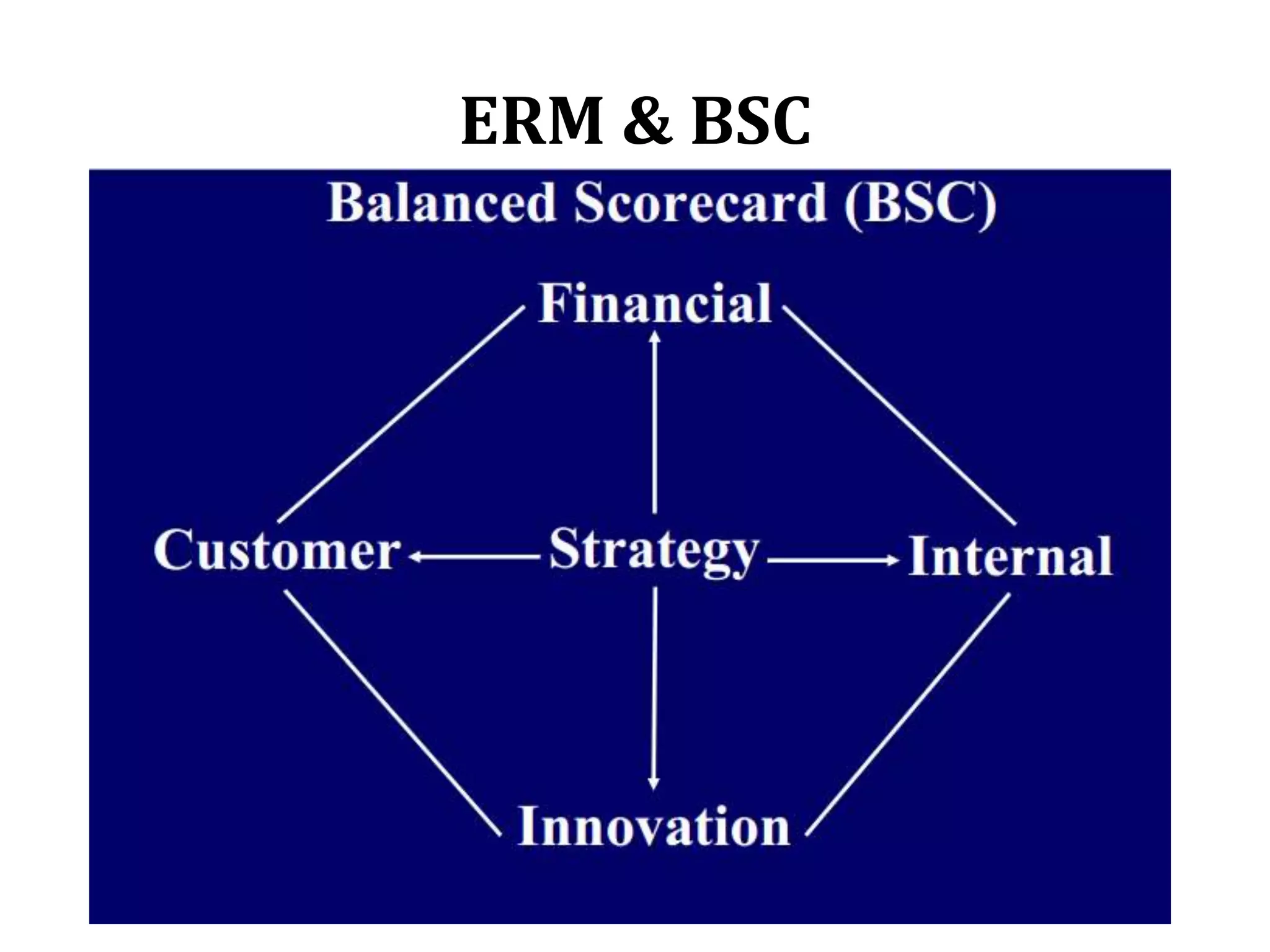

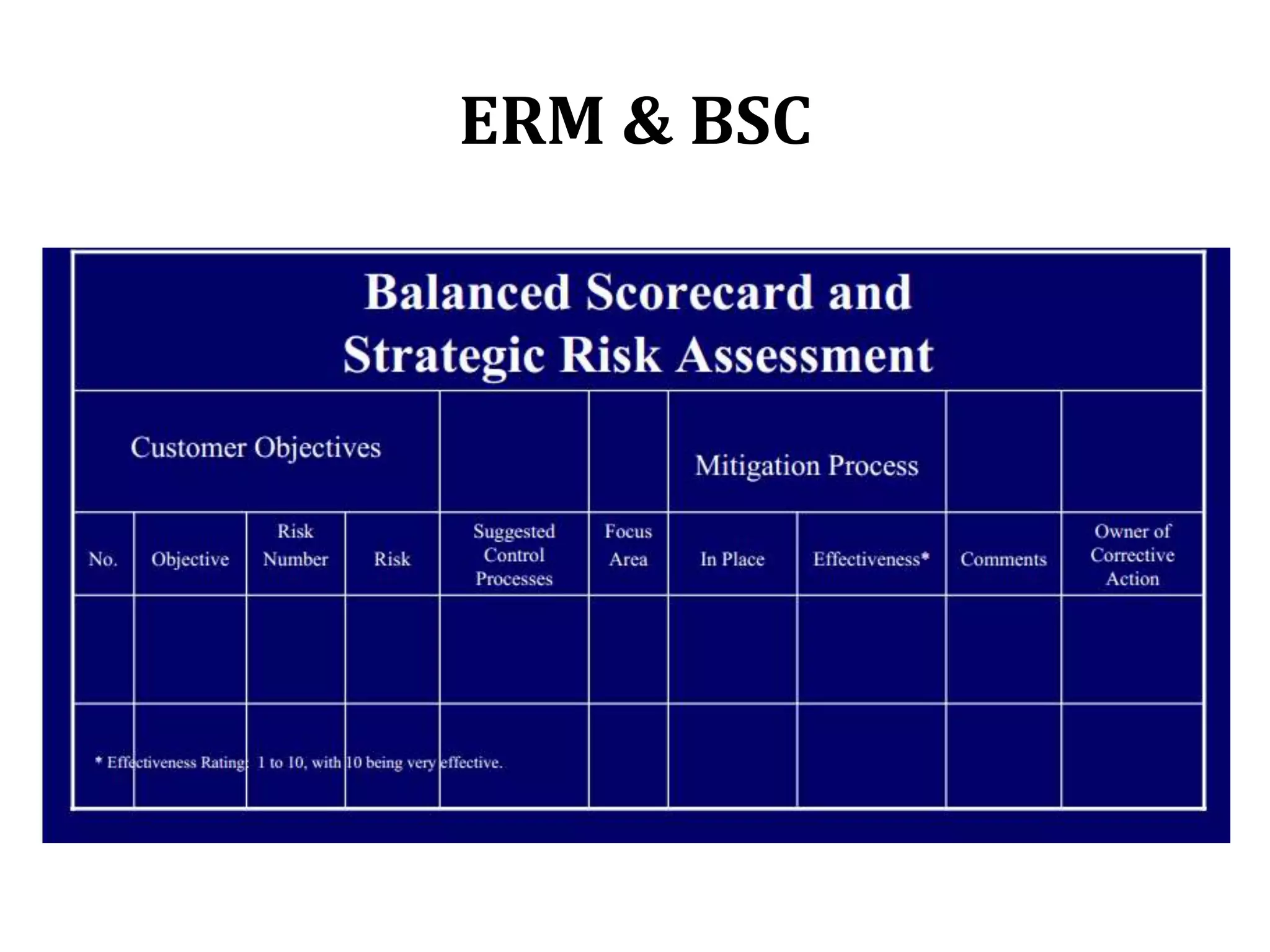

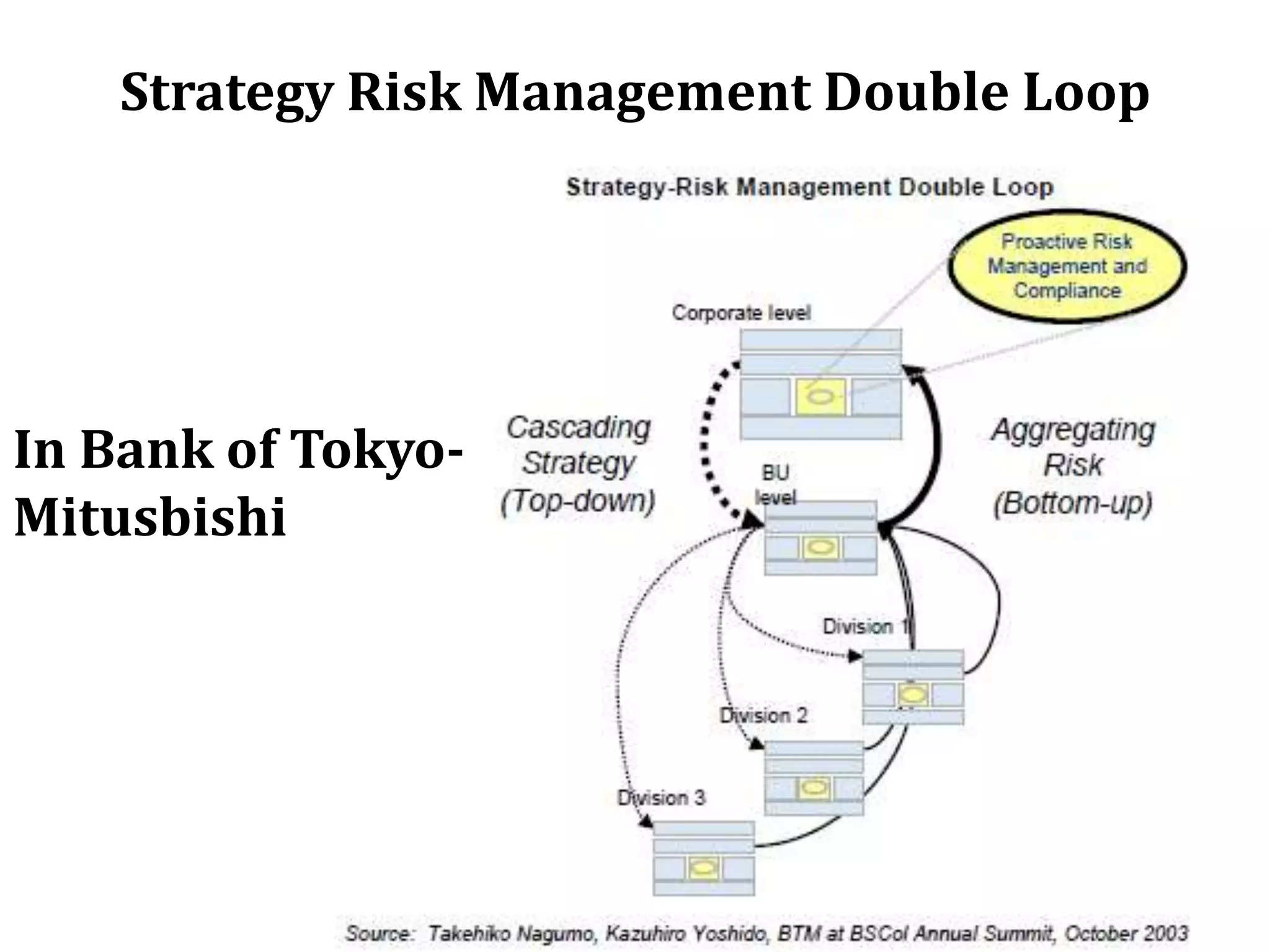

The document discusses how the Bank of Tokyo-Mitsubishi aligns enterprise risk management with strategy using the balanced scorecard approach. It notes that less than 10% of strategies are effectively executed, in part because risks are not properly managed and aligned to the strategy. The bank's CFO, T. Nagumo, believes risk management must be closely tied to strategic objectives. The document then explains how the balanced scorecard can help incorporate ERM into performance management by translating strategy into metrics in four perspectives: customer, internal process, learning/growth, and financial. This allows risks that affect all business units to be managed in a way that is aligned to and drives the corporate strategy.