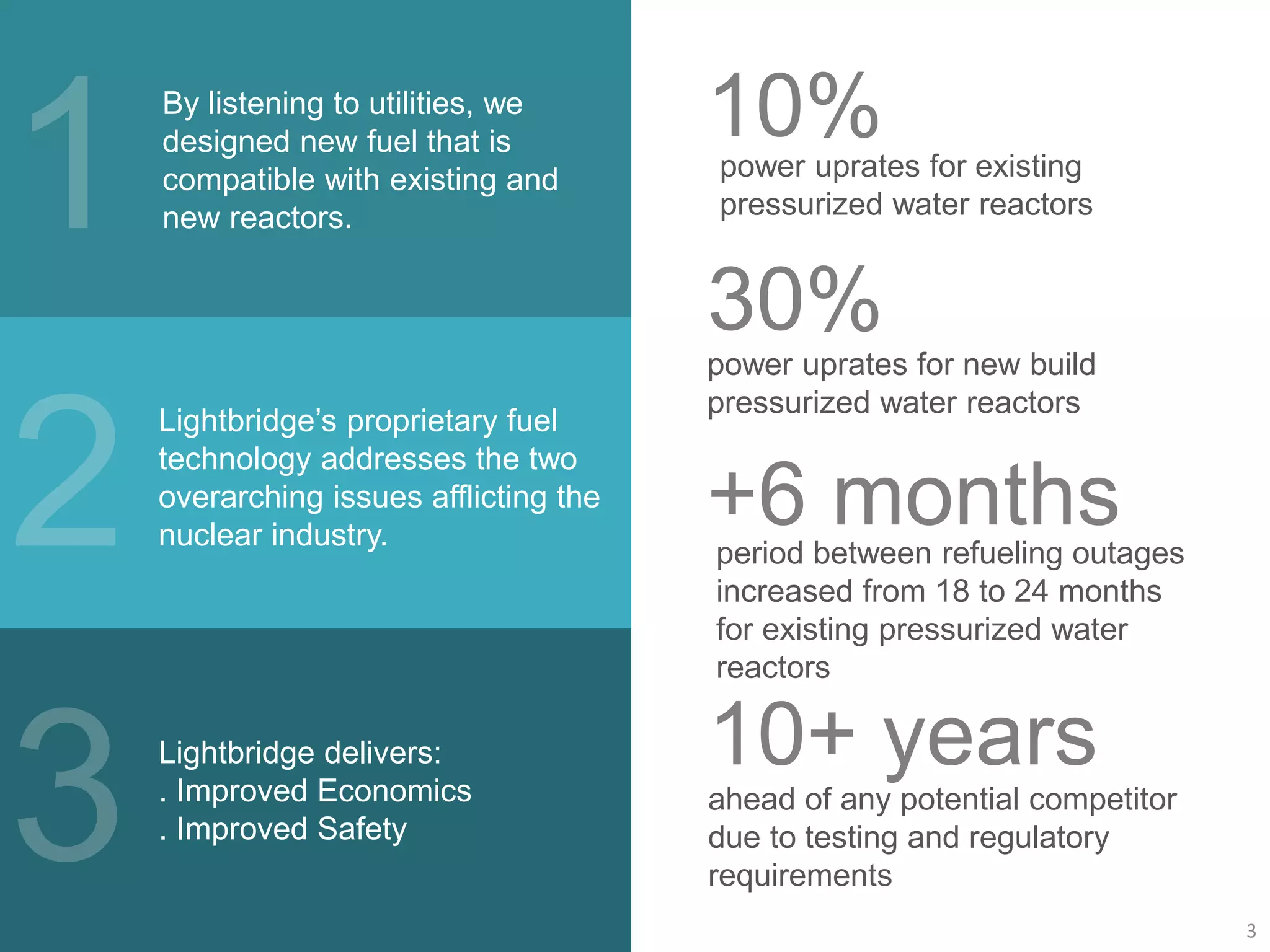

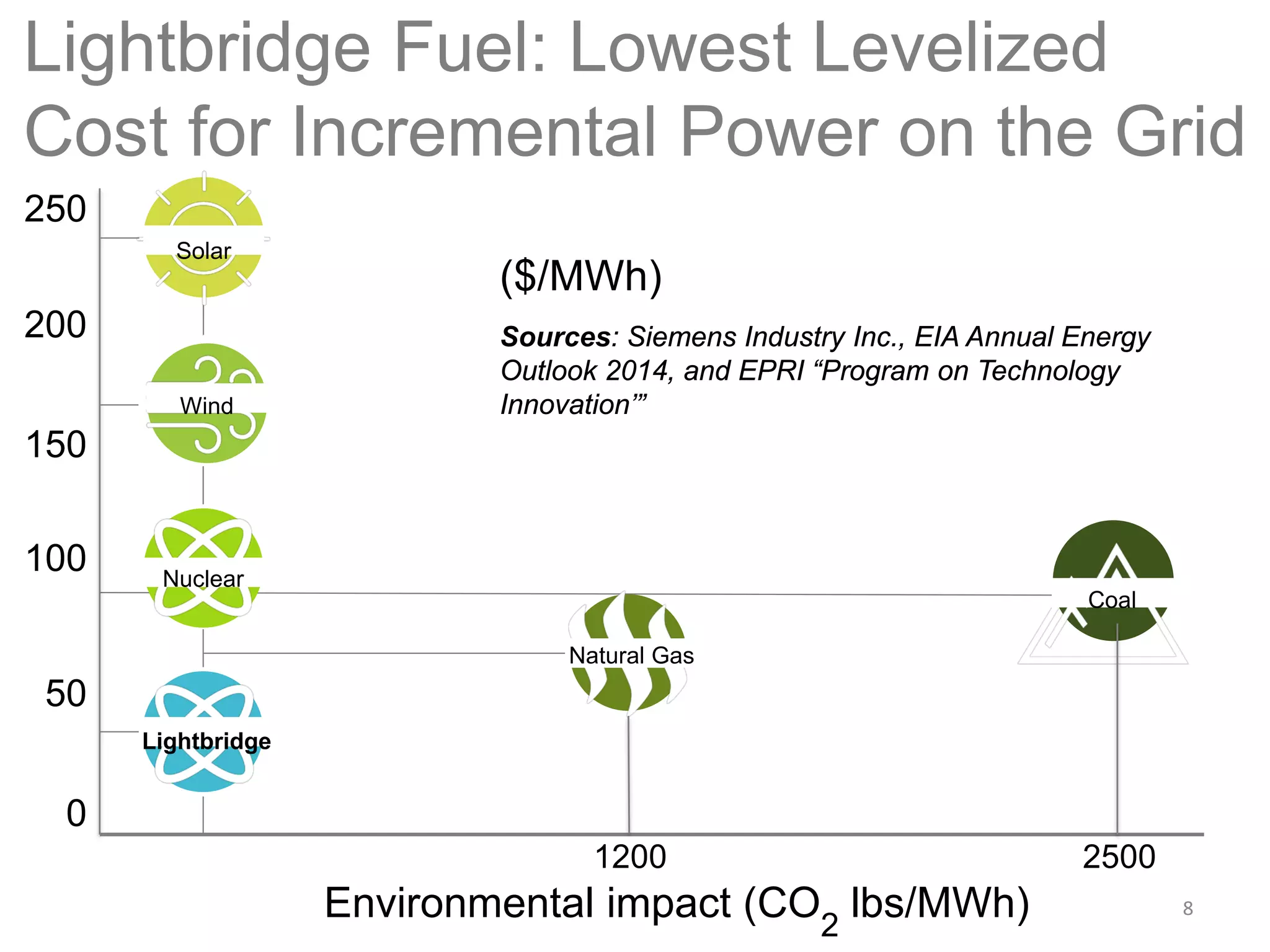

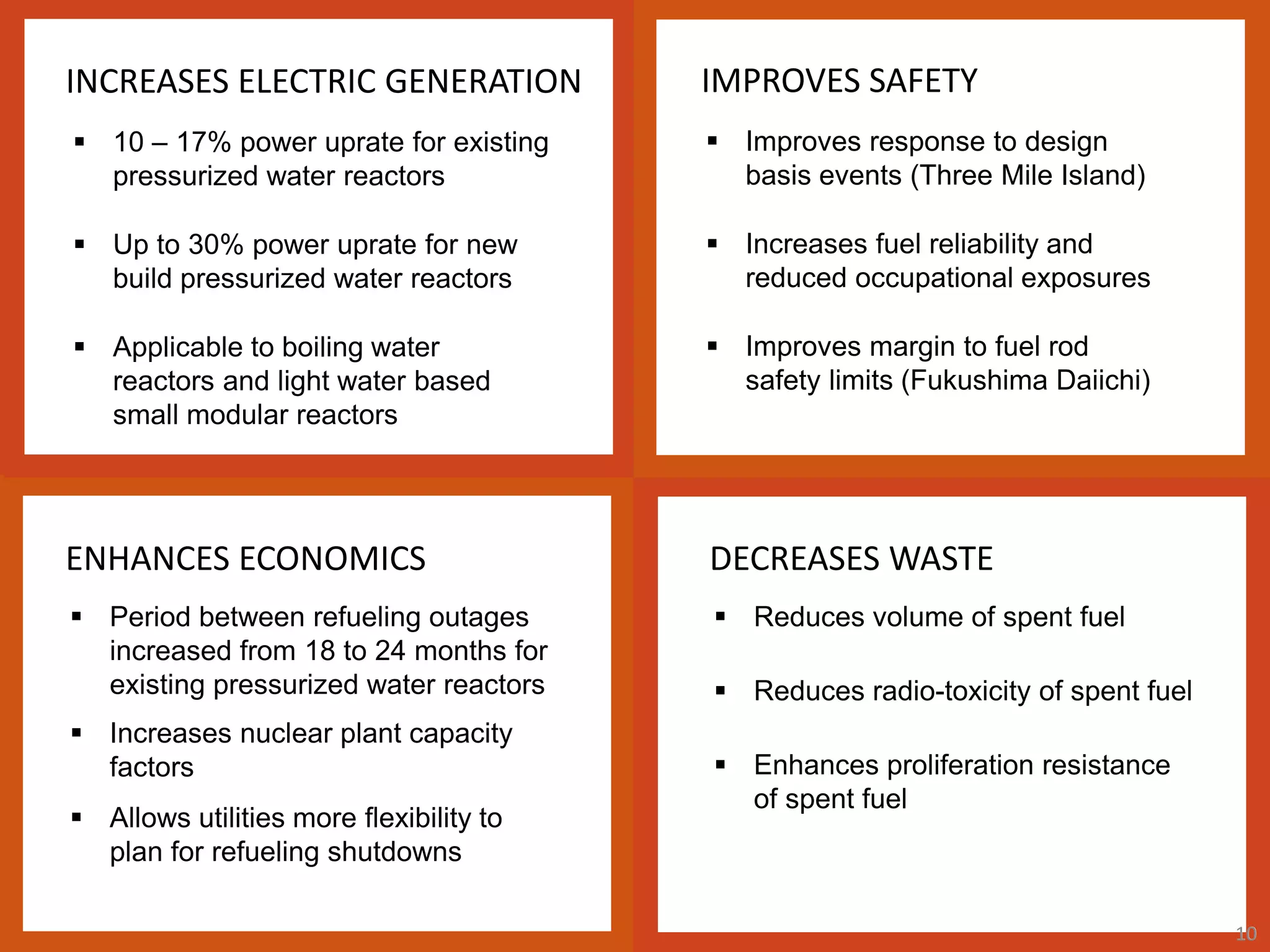

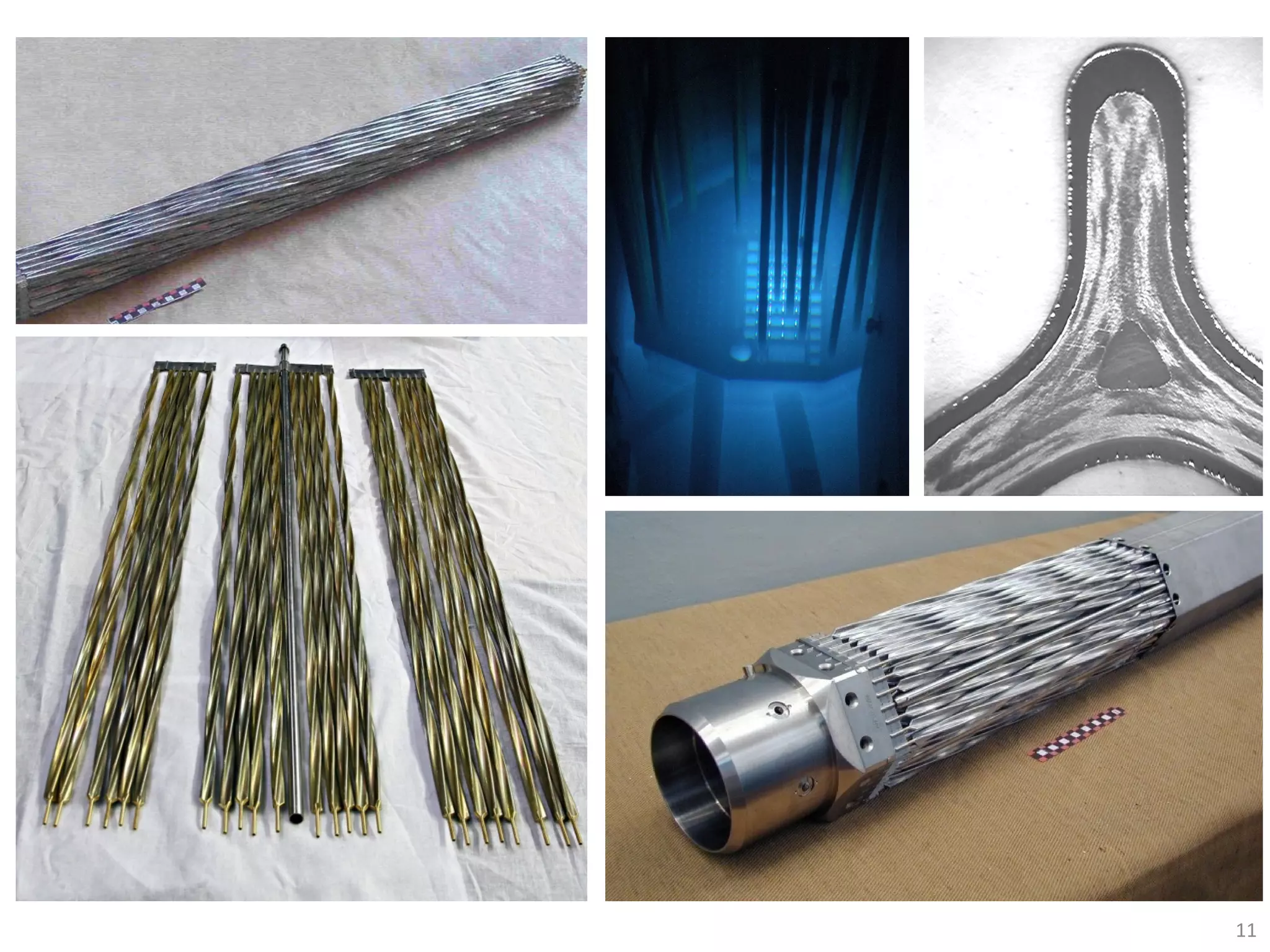

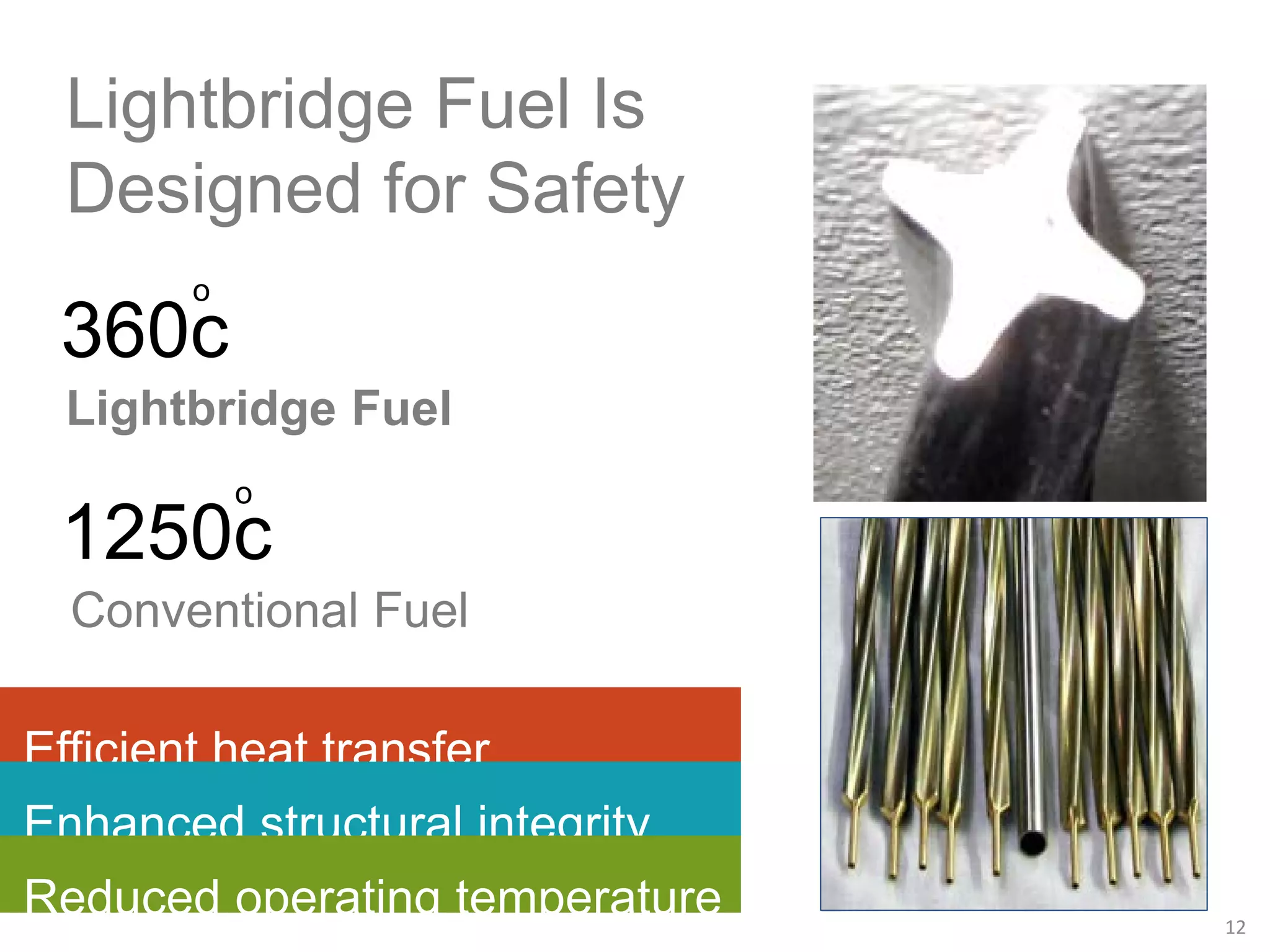

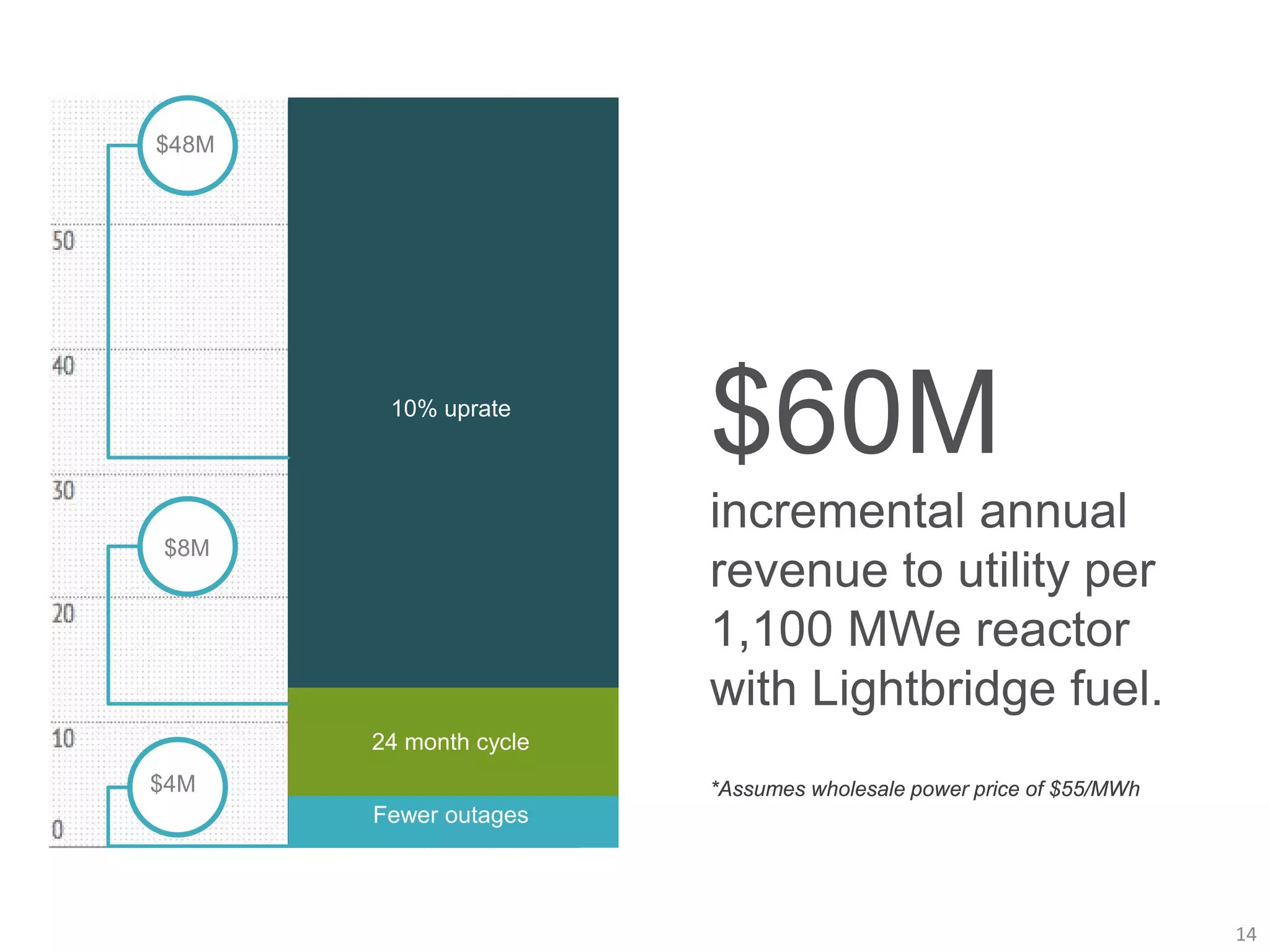

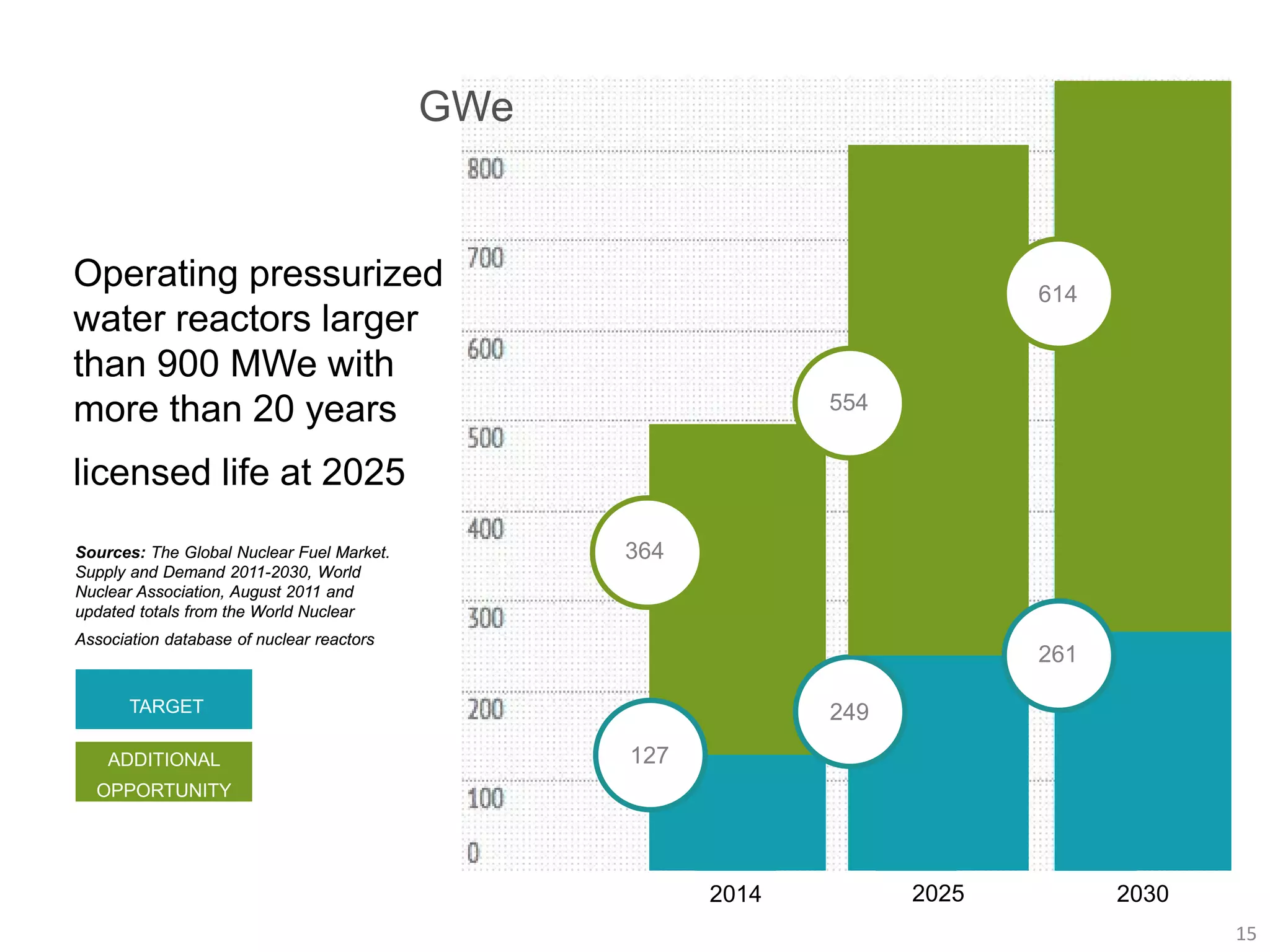

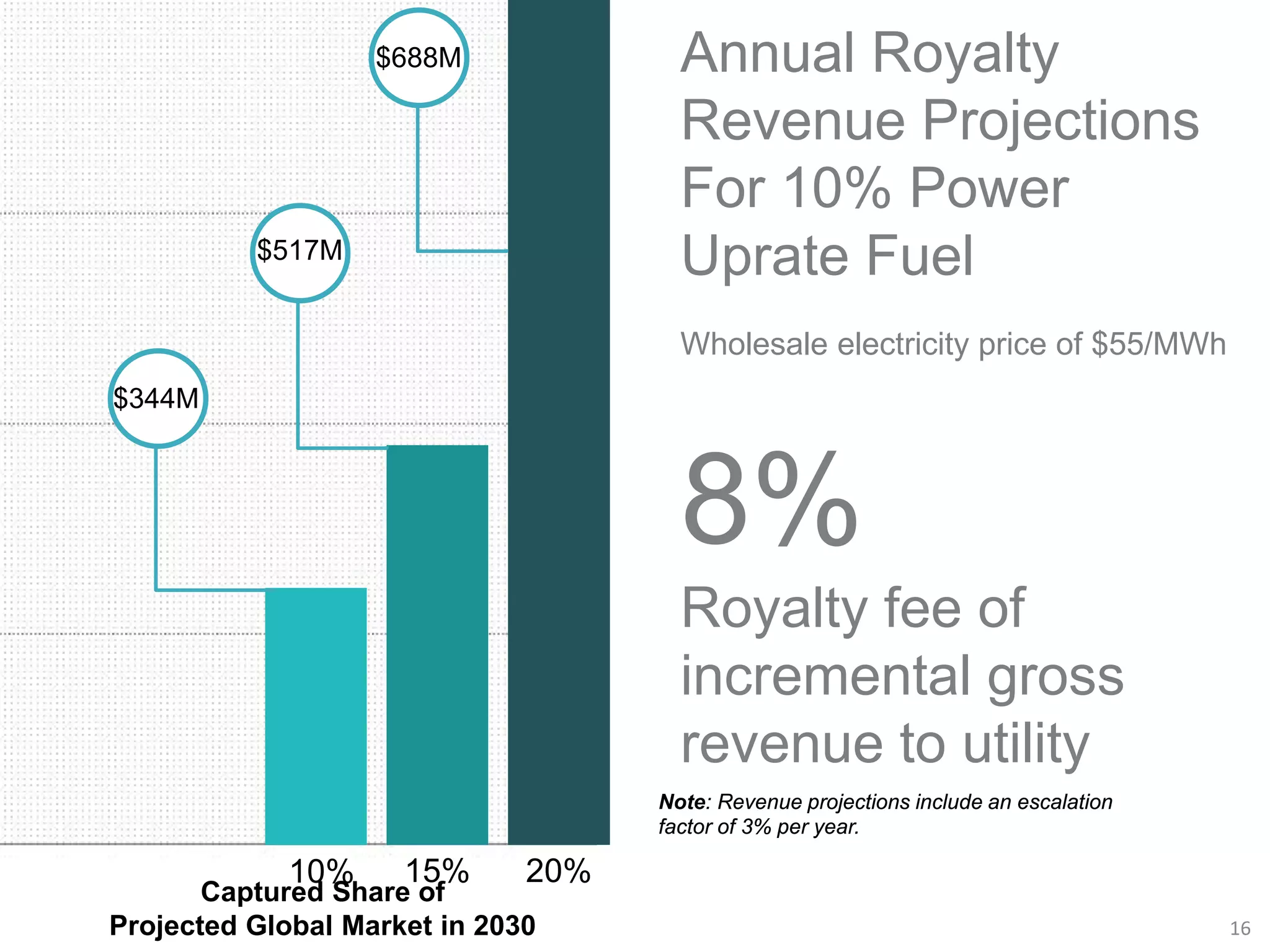

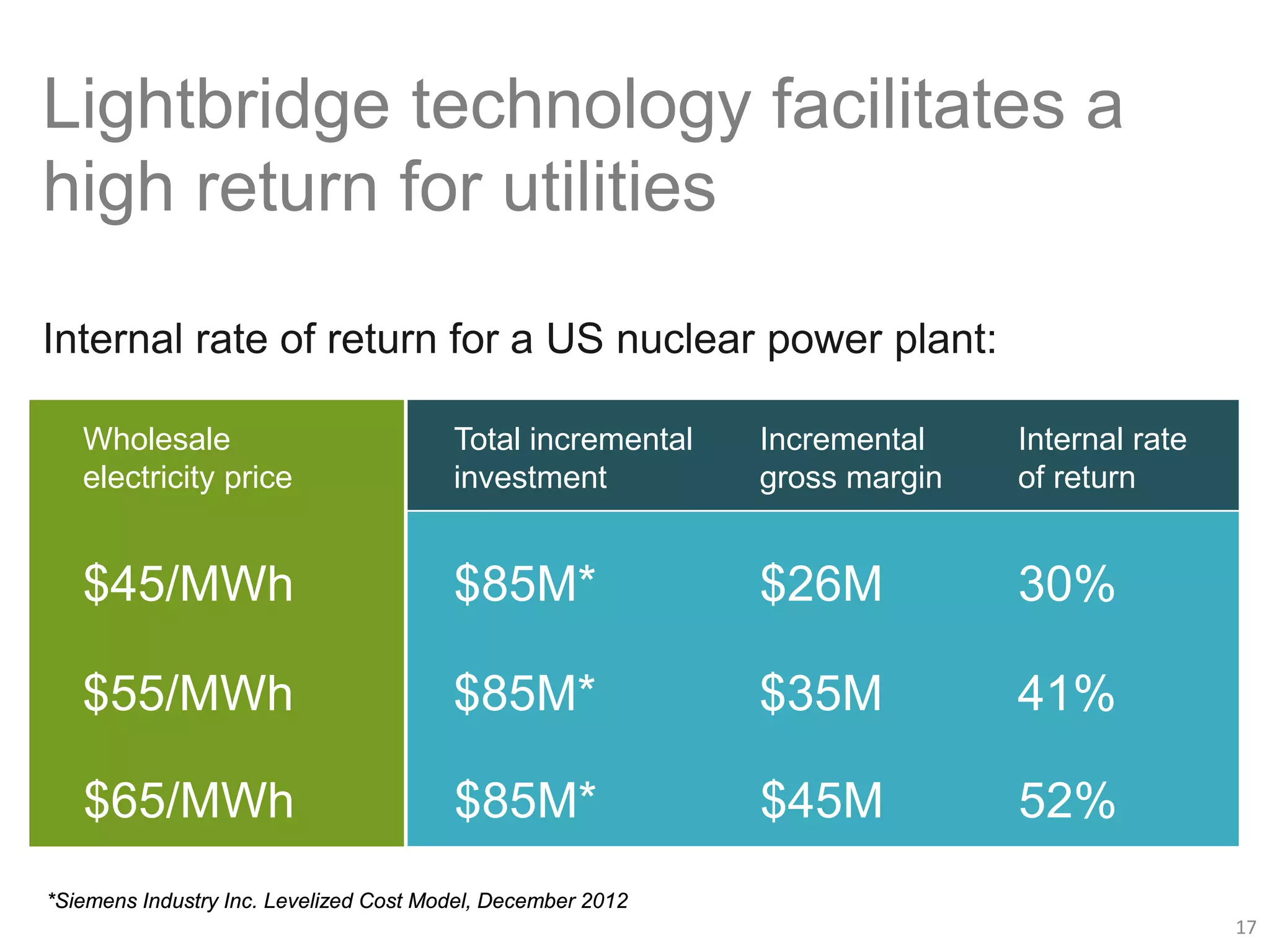

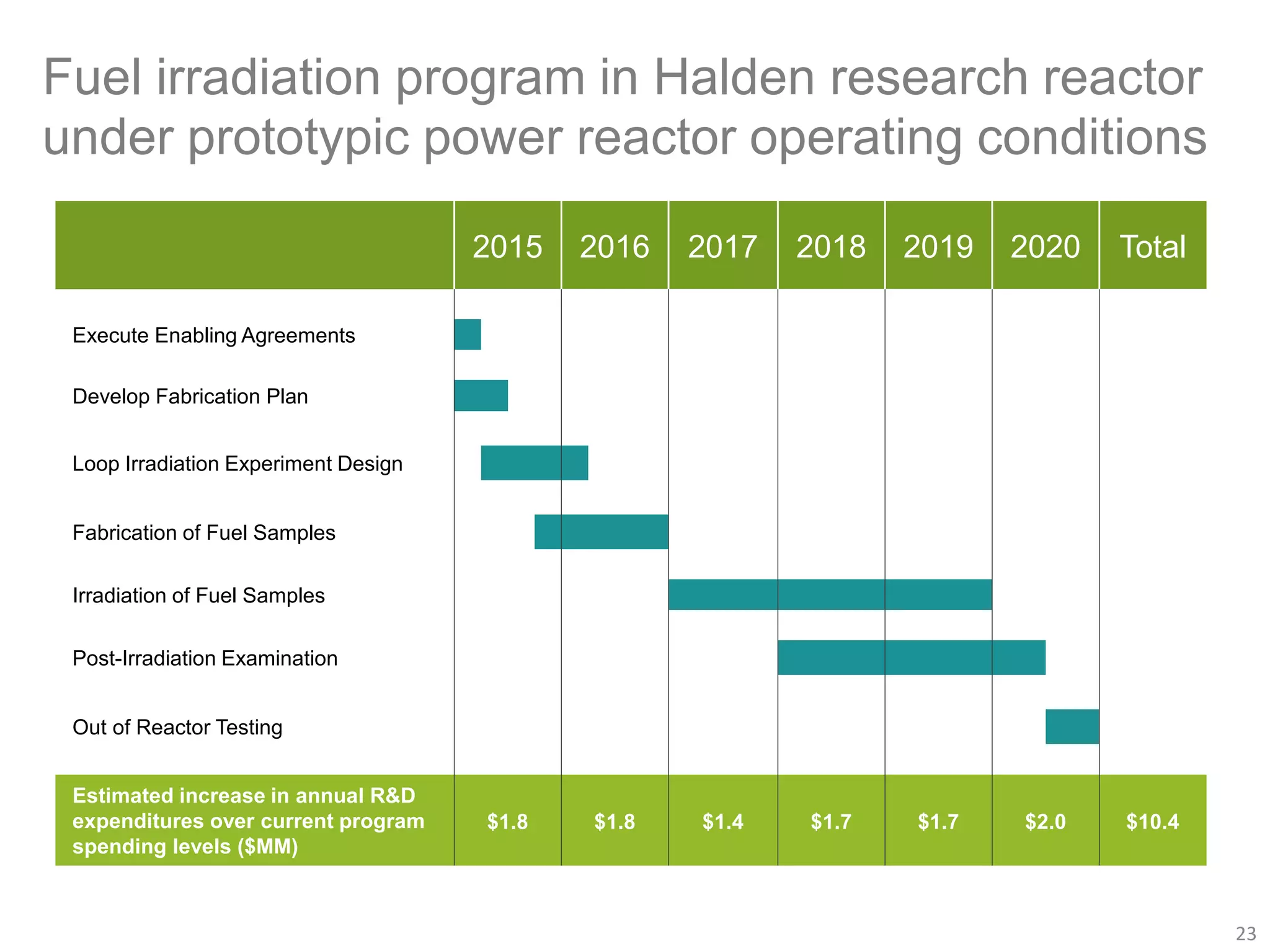

Lightbridge Corporation is developing nuclear fuel technology that can provide utilities with improved economics through increased power output and enhanced safety. Their metallic fuel design allows existing reactors to increase output by 10-17% and new builds by up to 30%. It also extends the period between refueling outages. Lightbridge expects to generate significant revenue through technology licensing fees and royalties as their fuel is used commercially in the growing $25 billion global nuclear fuel market. They are currently collaborating with Canadian Nuclear Laboratories to fabricate fuel samples for testing in research reactors with the goal of commercial deployment in the 2020s.