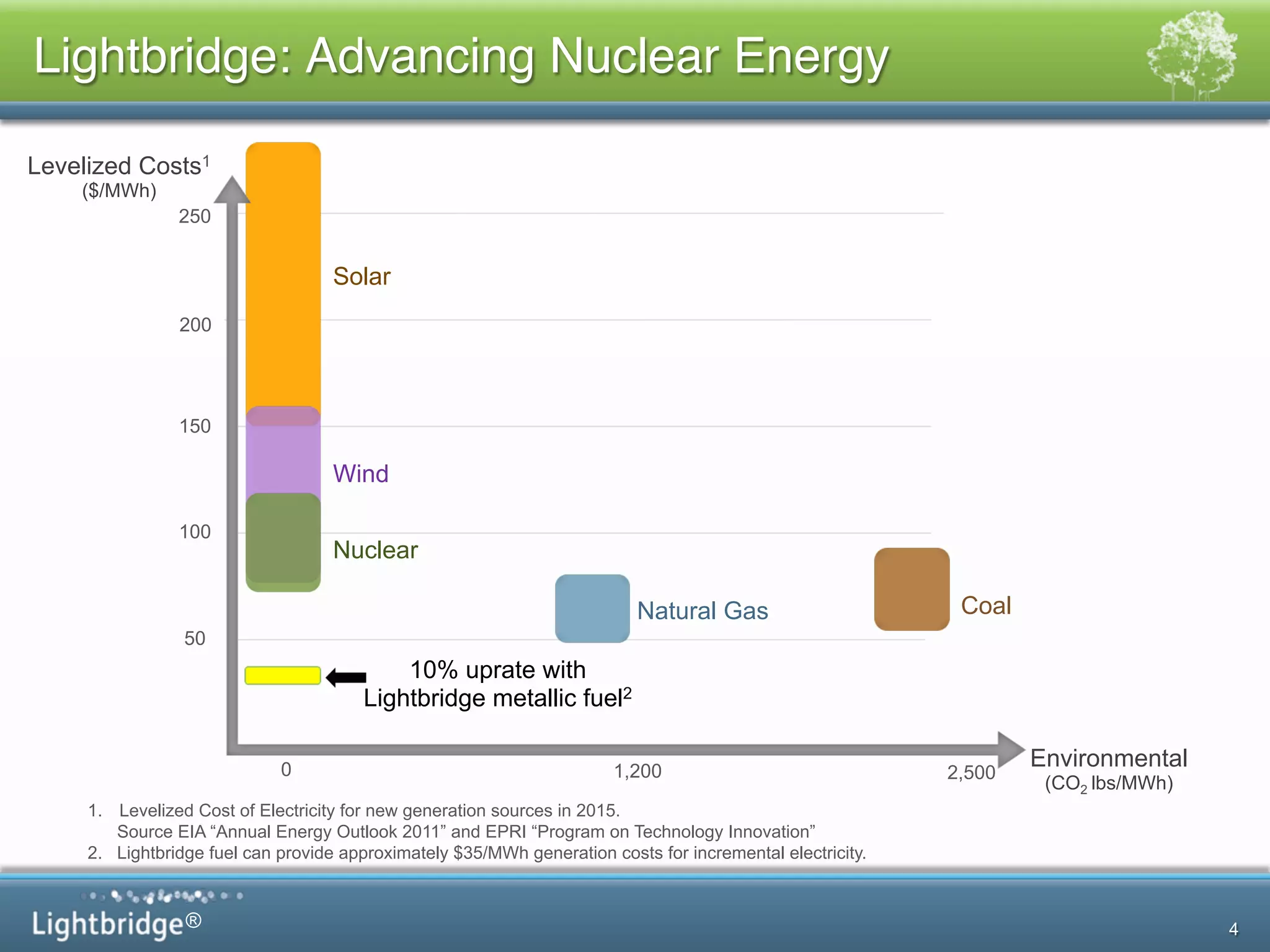

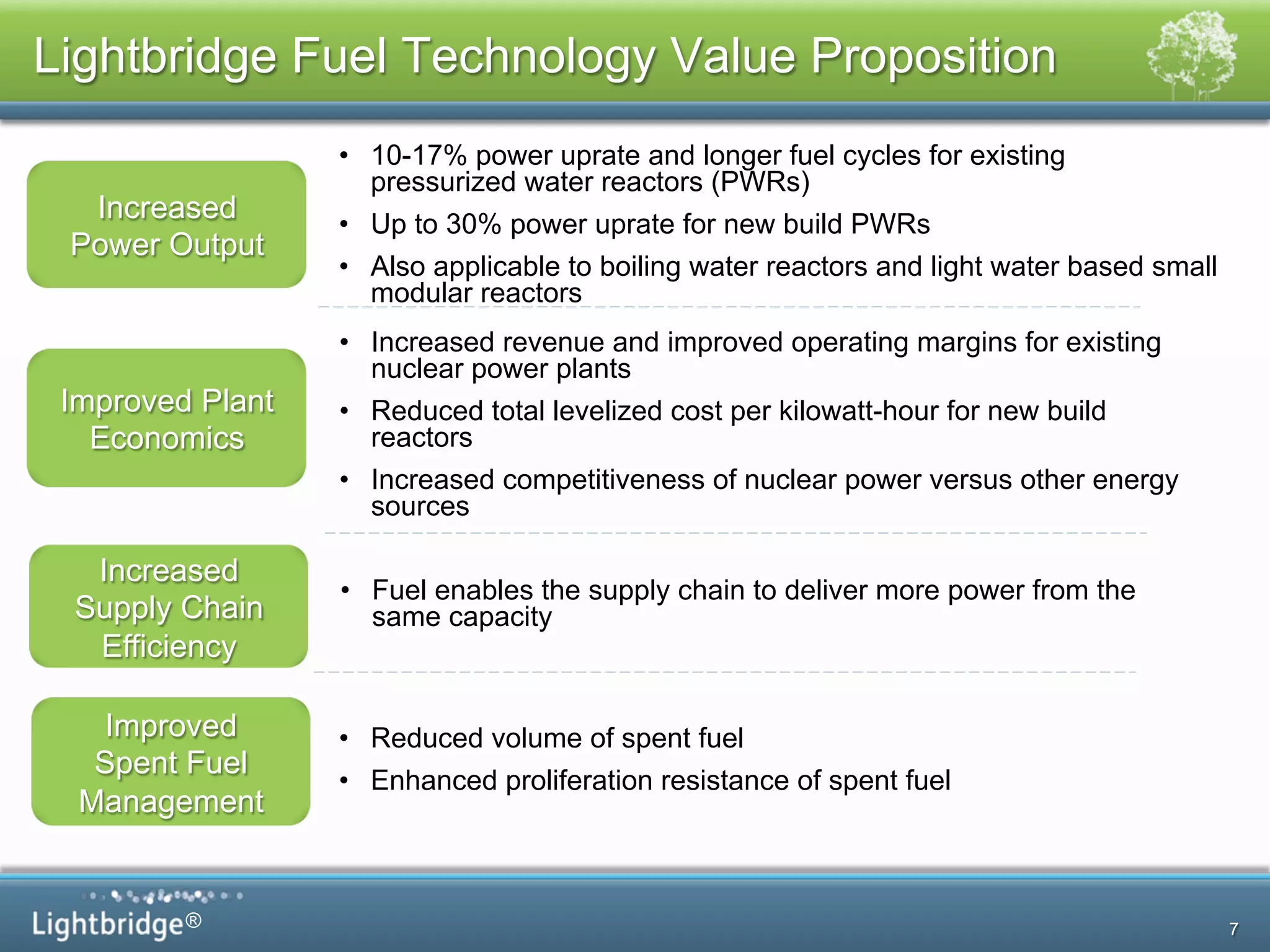

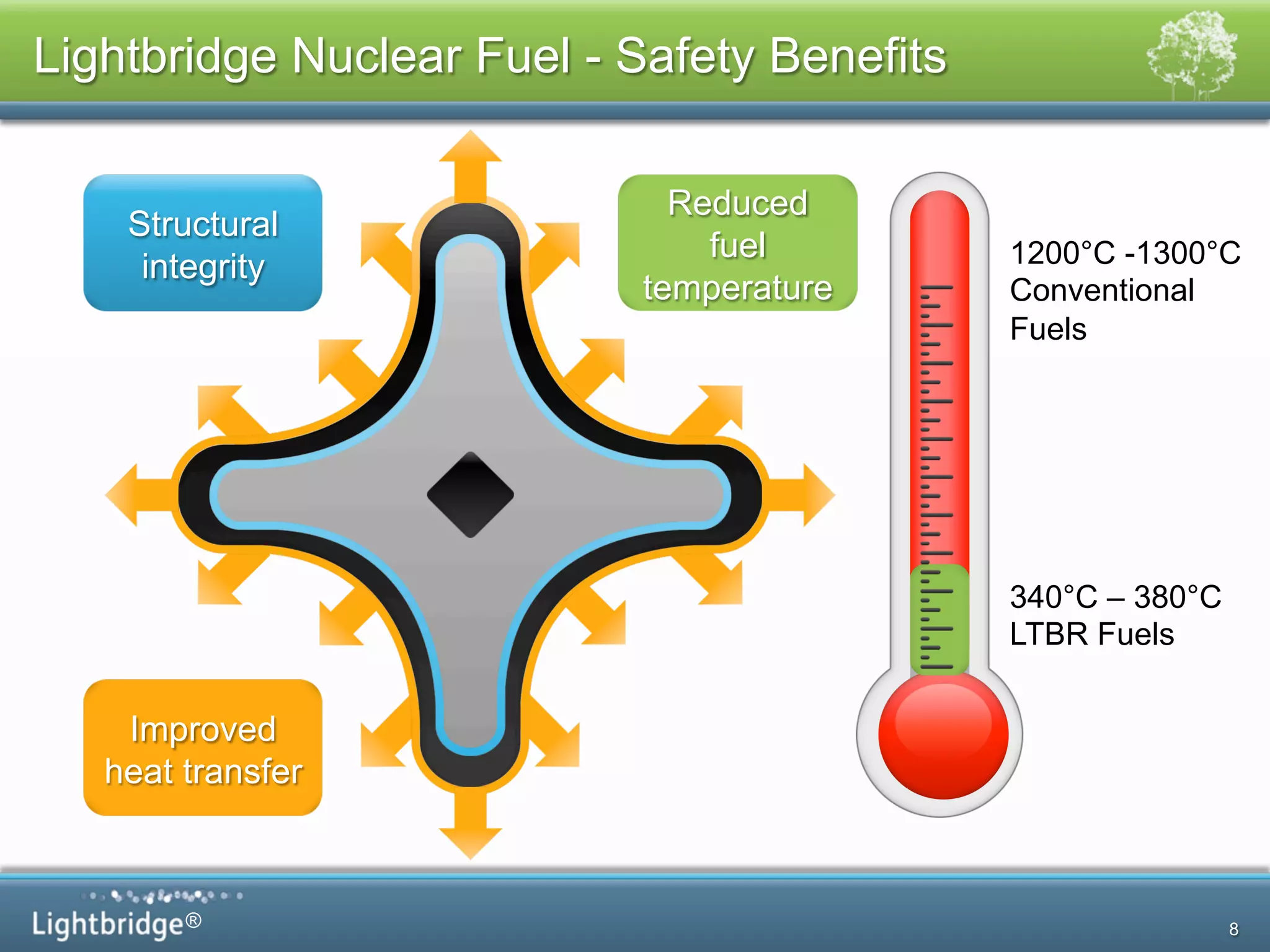

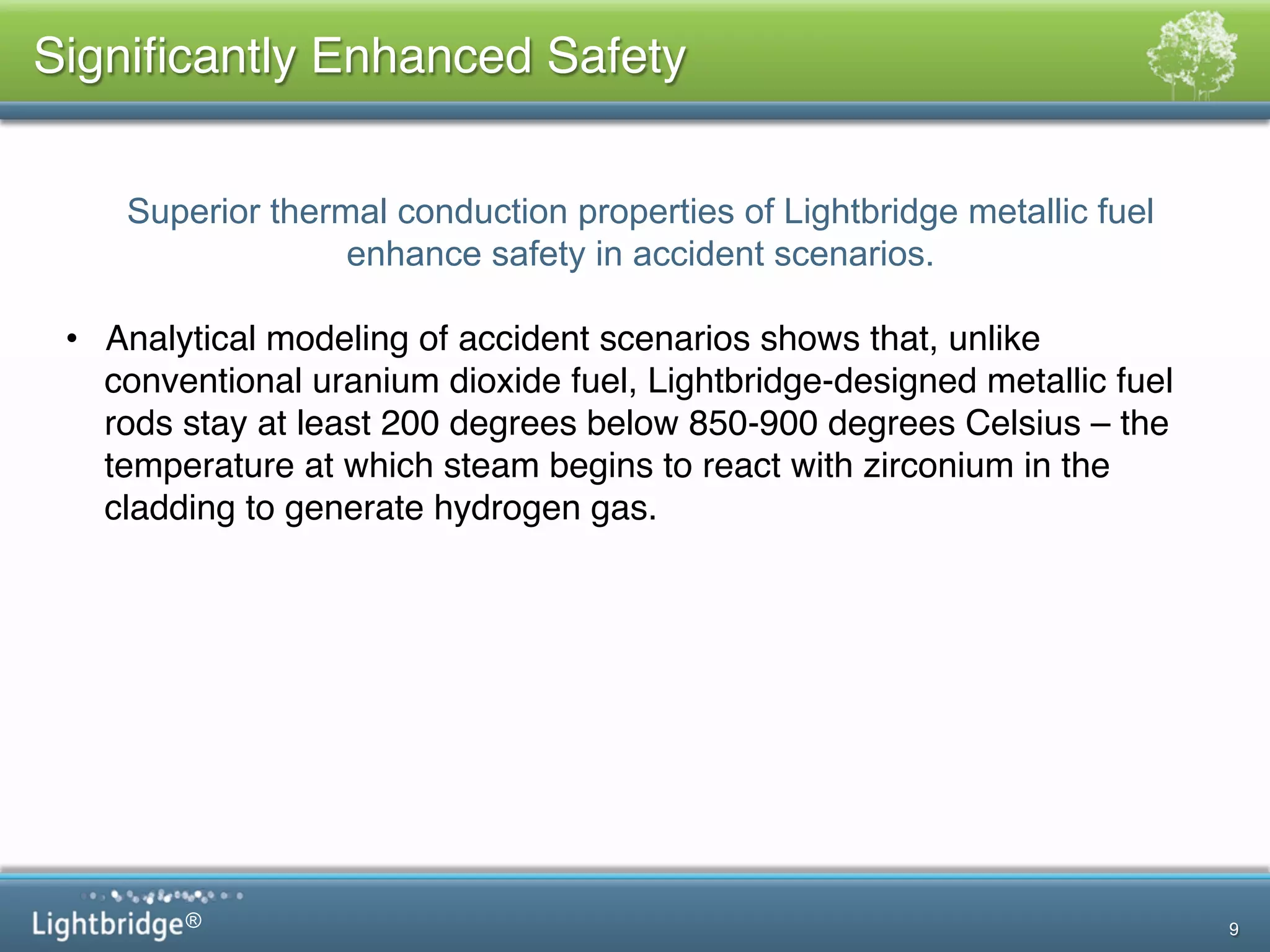

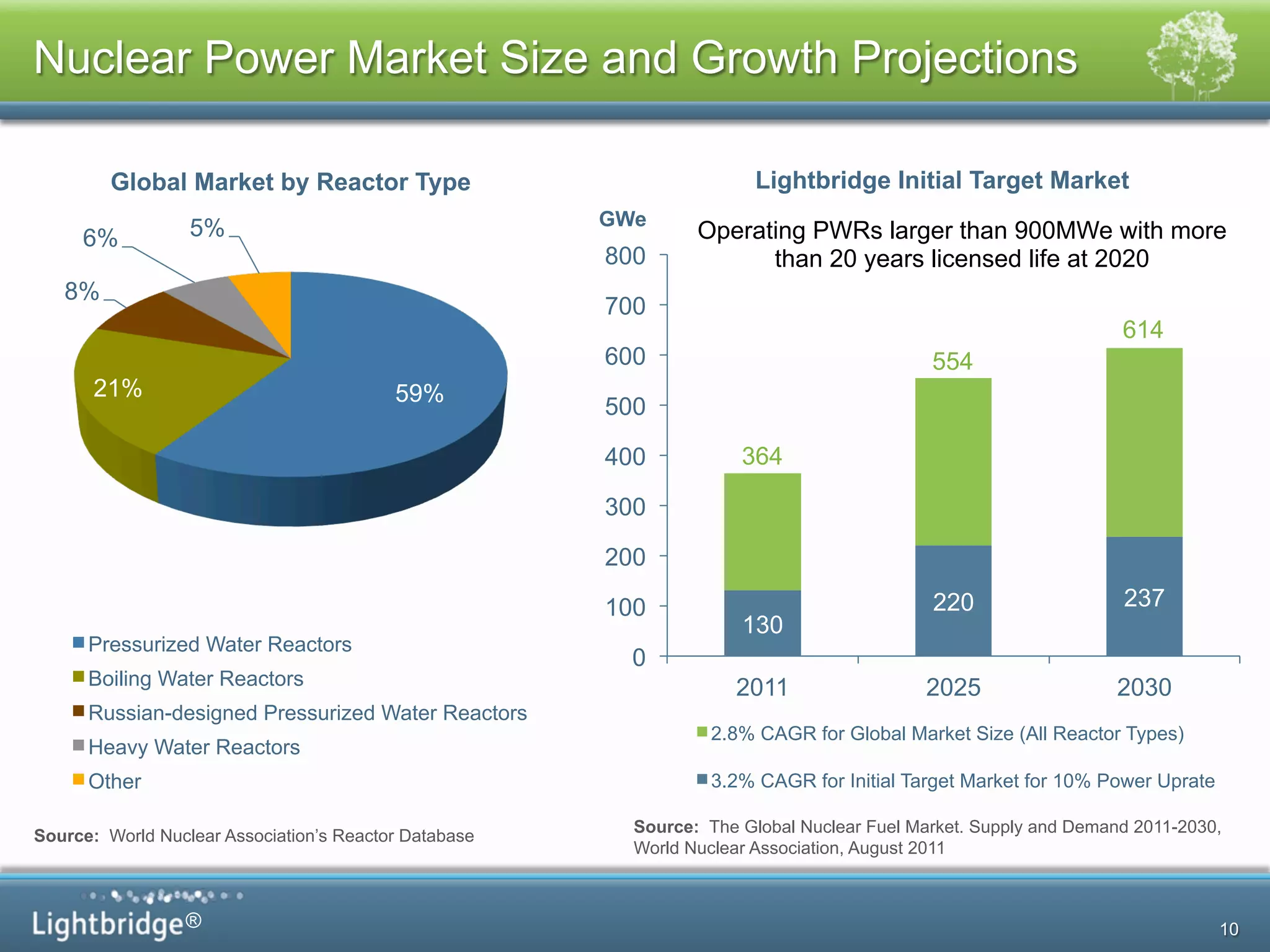

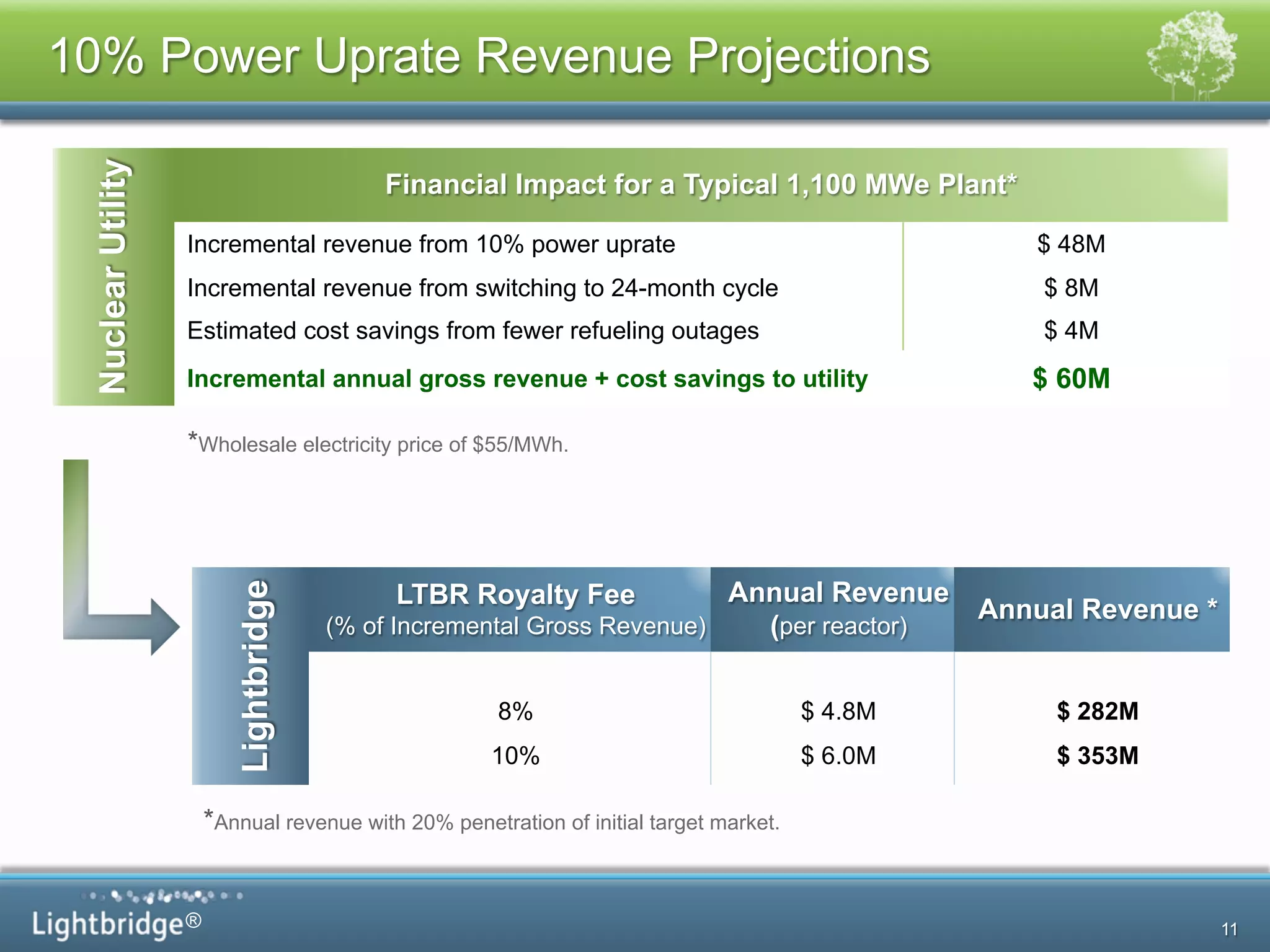

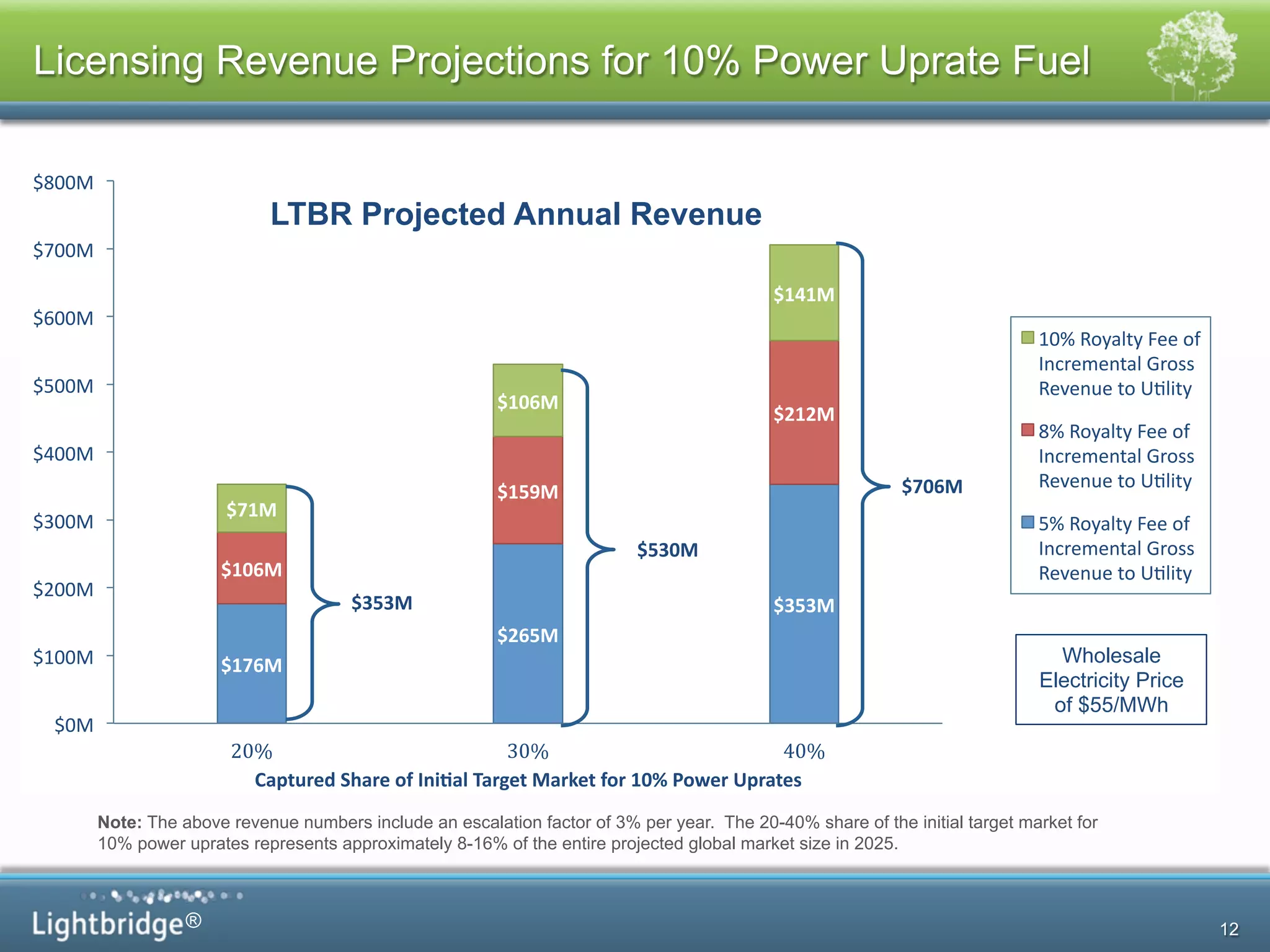

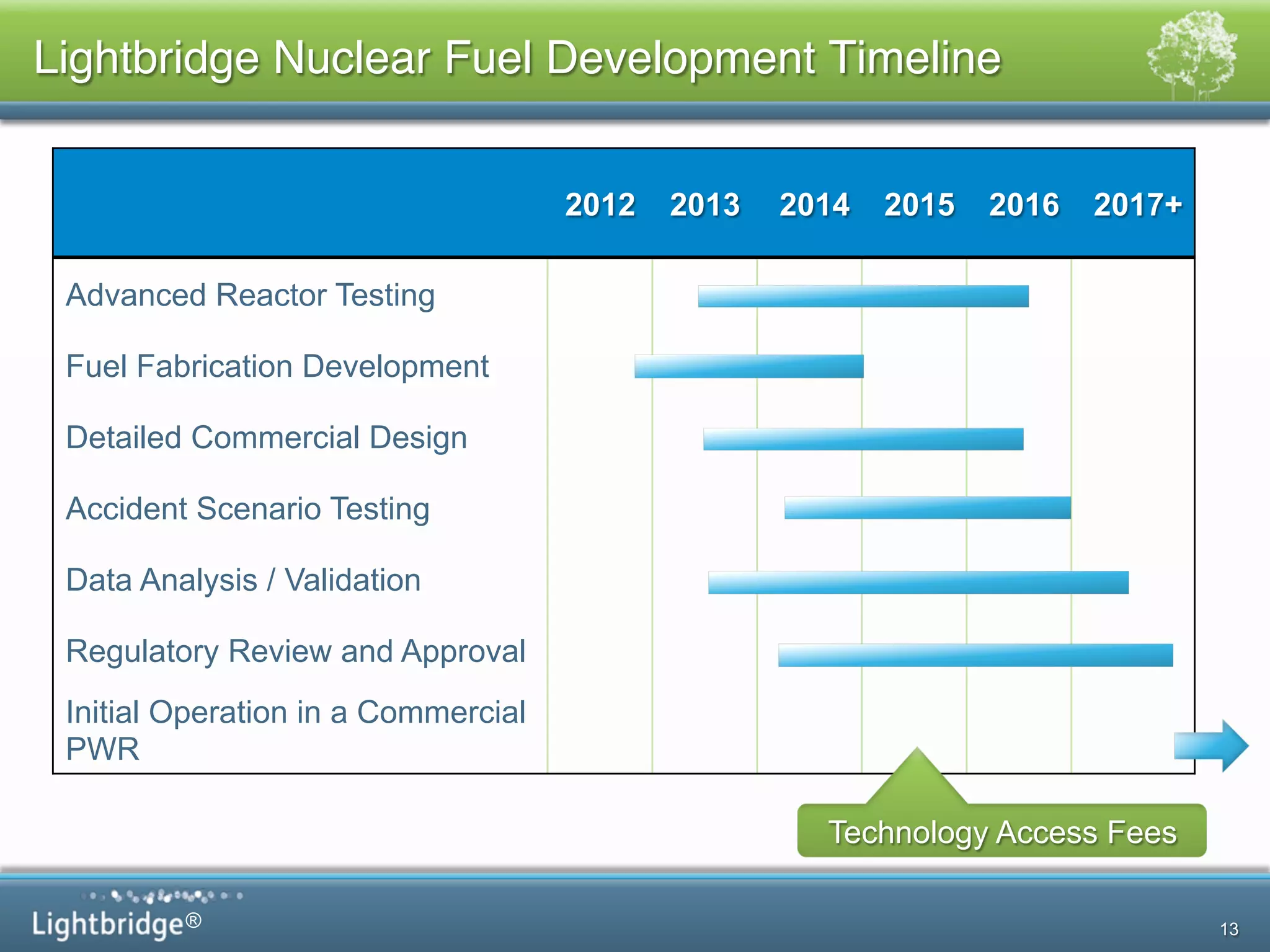

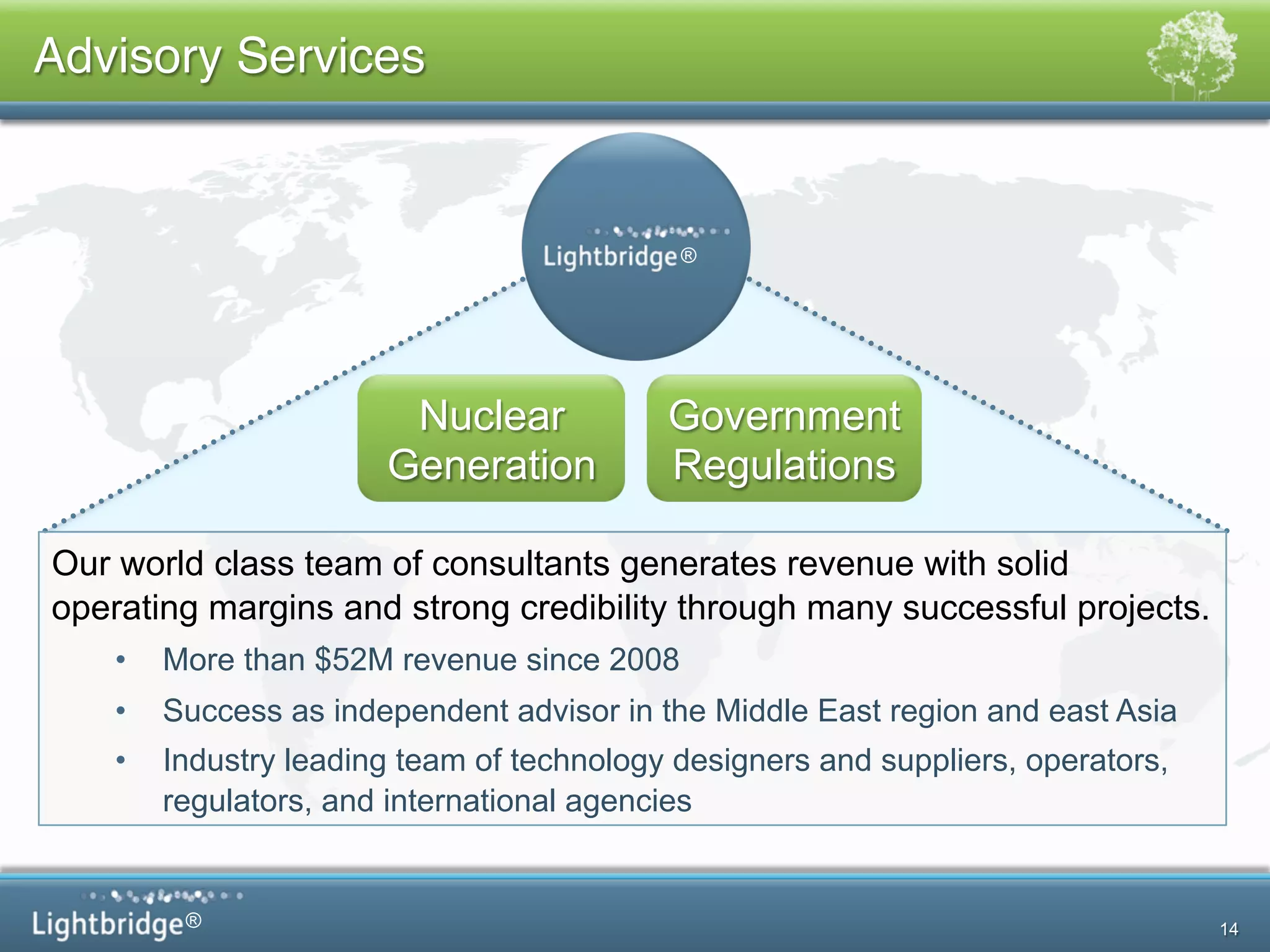

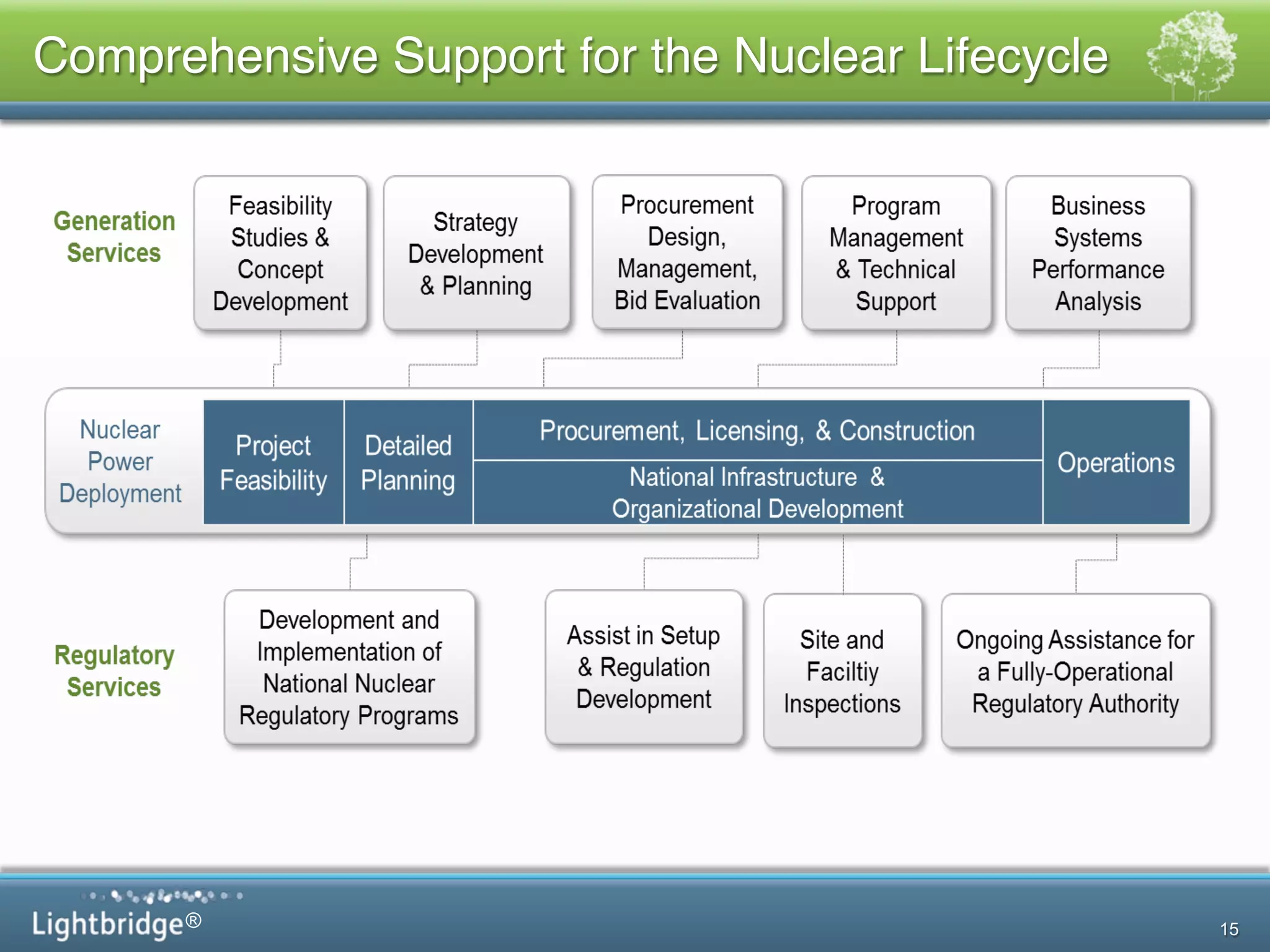

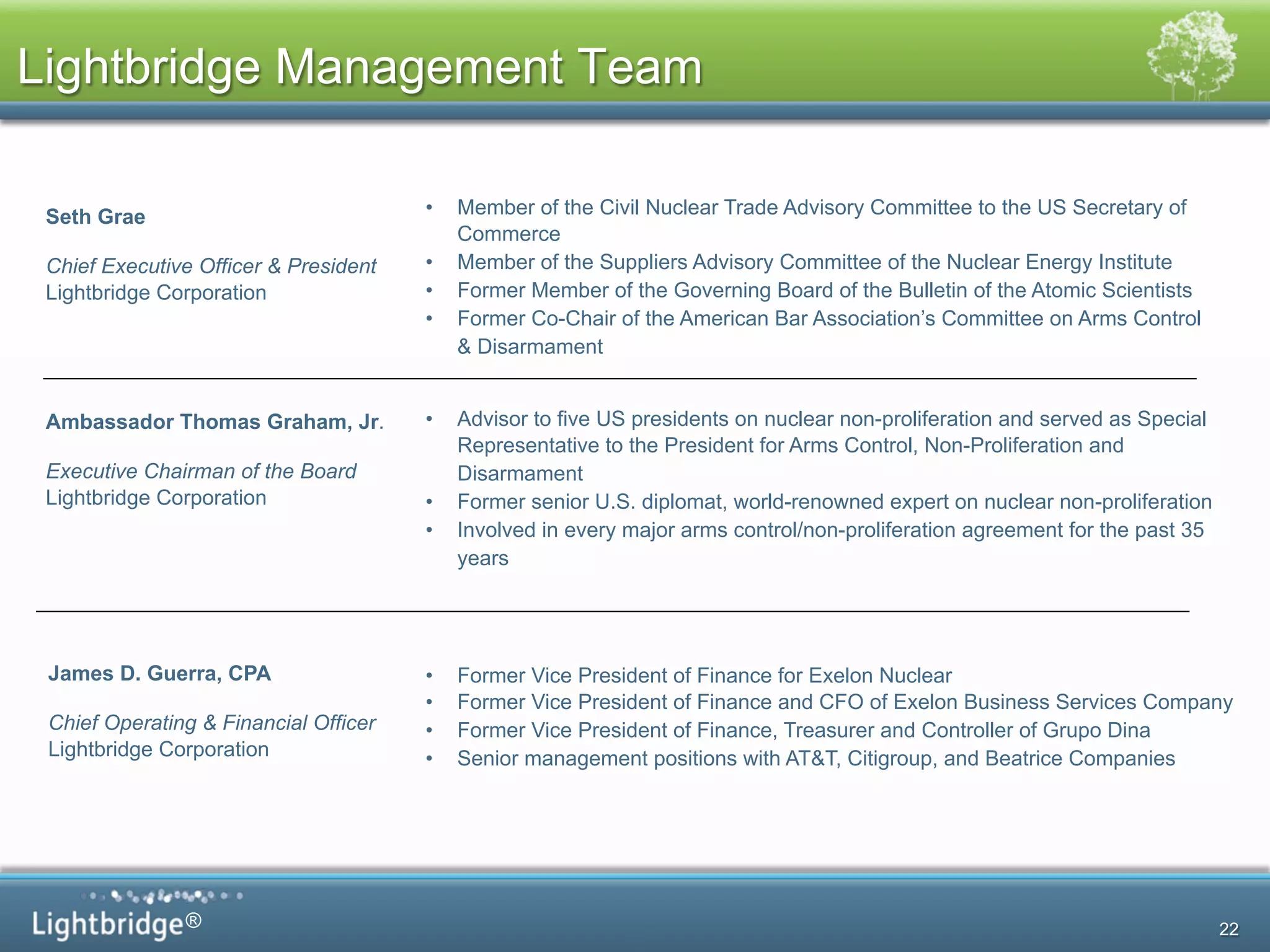

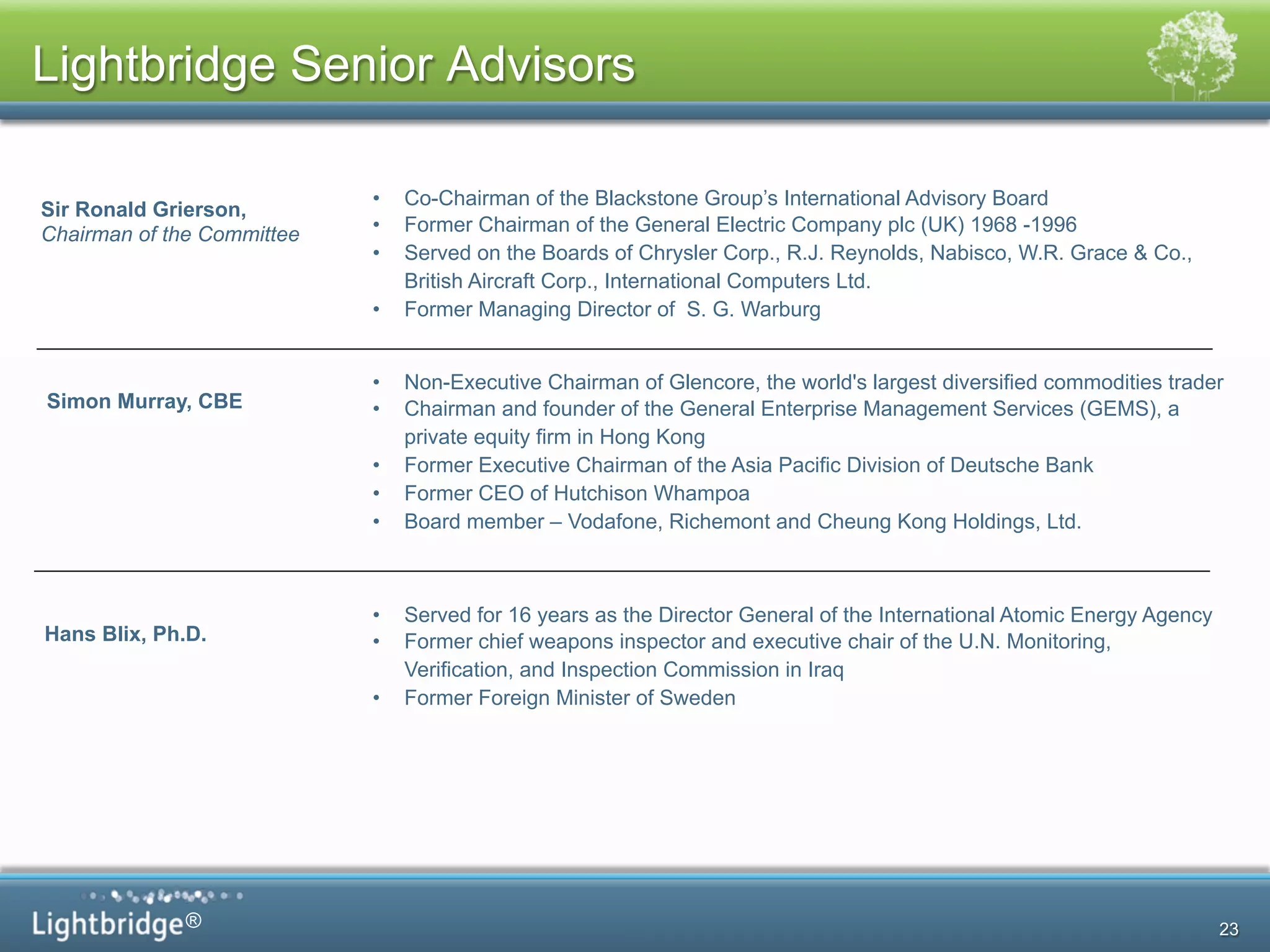

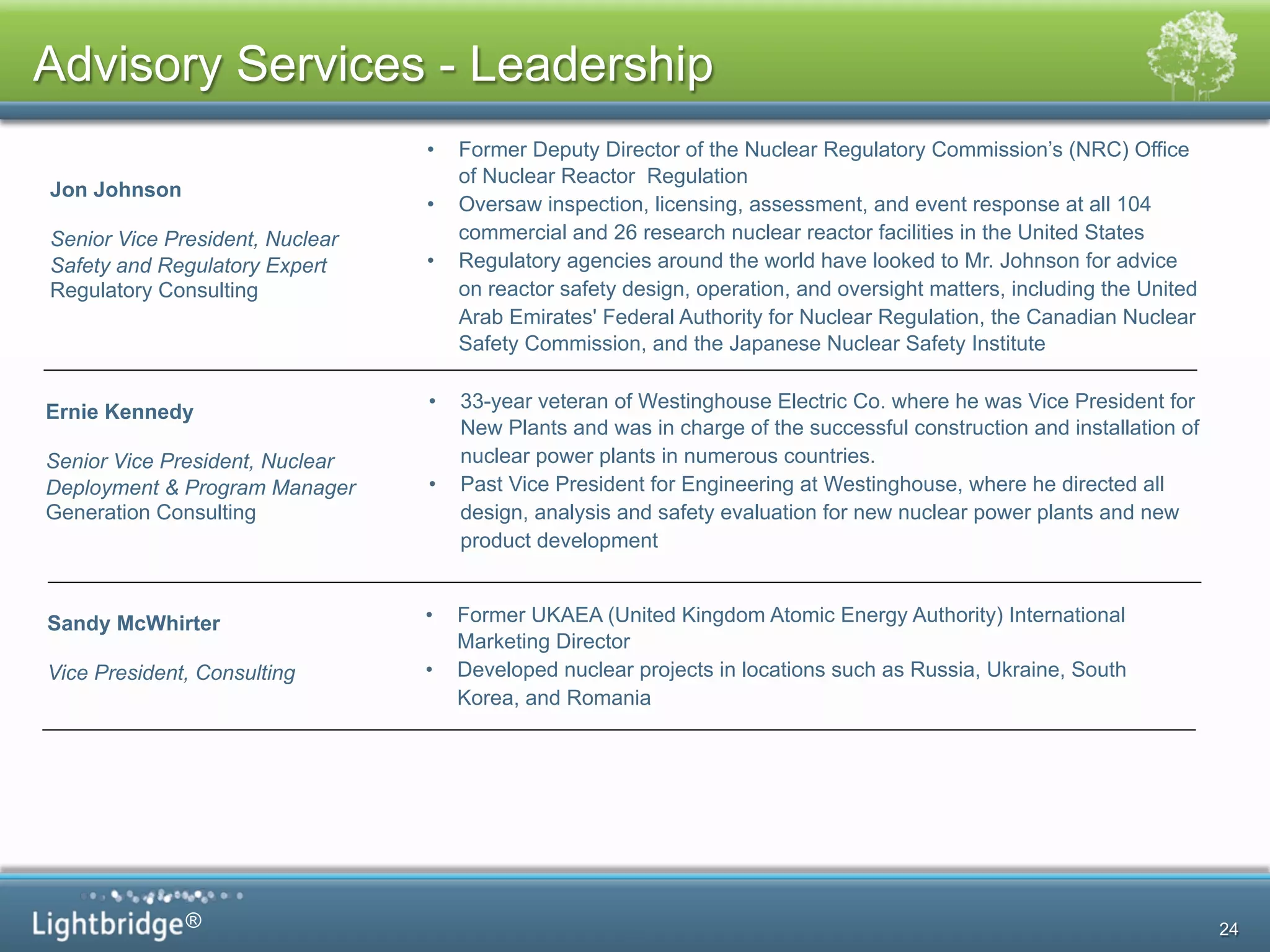

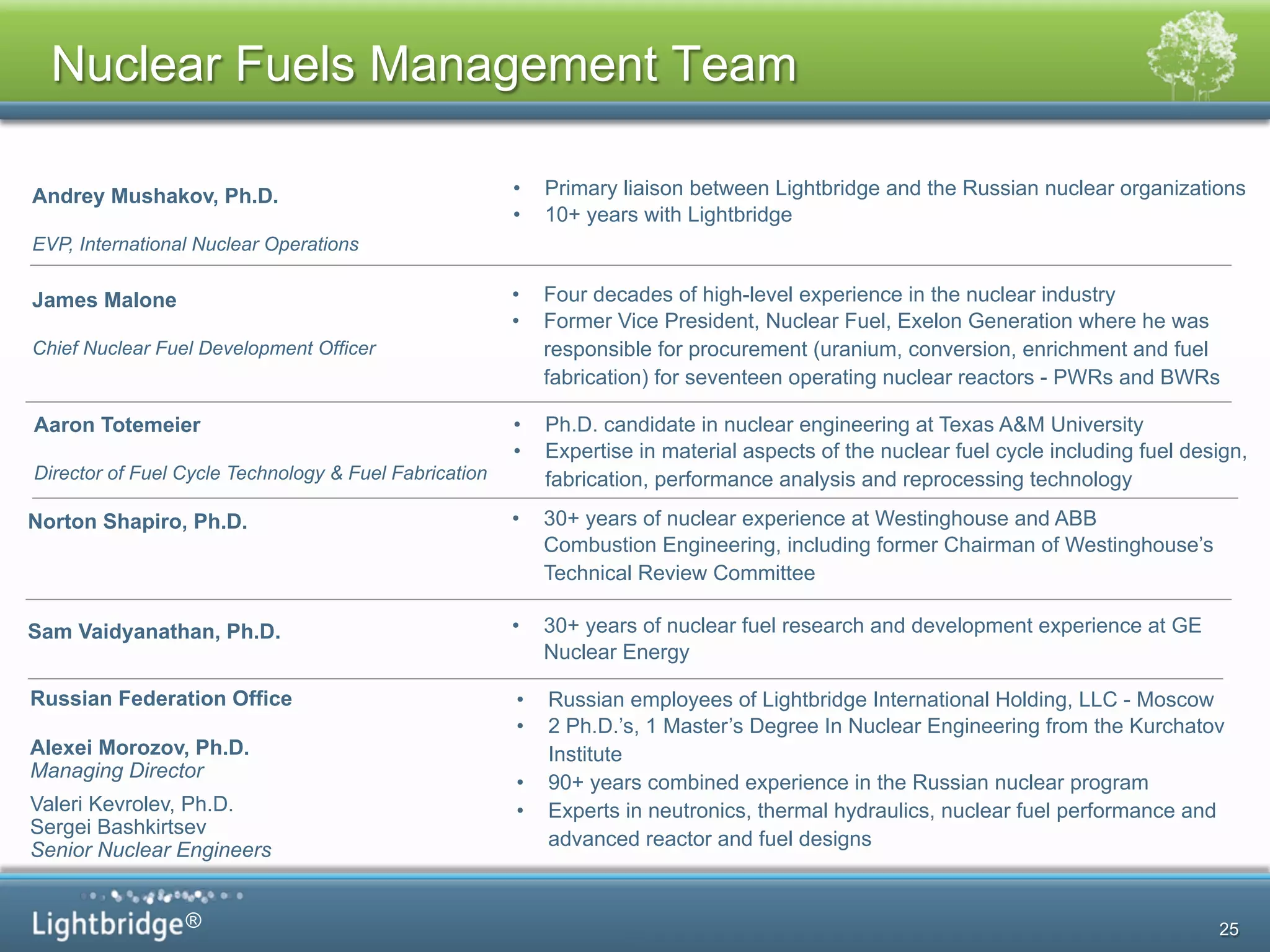

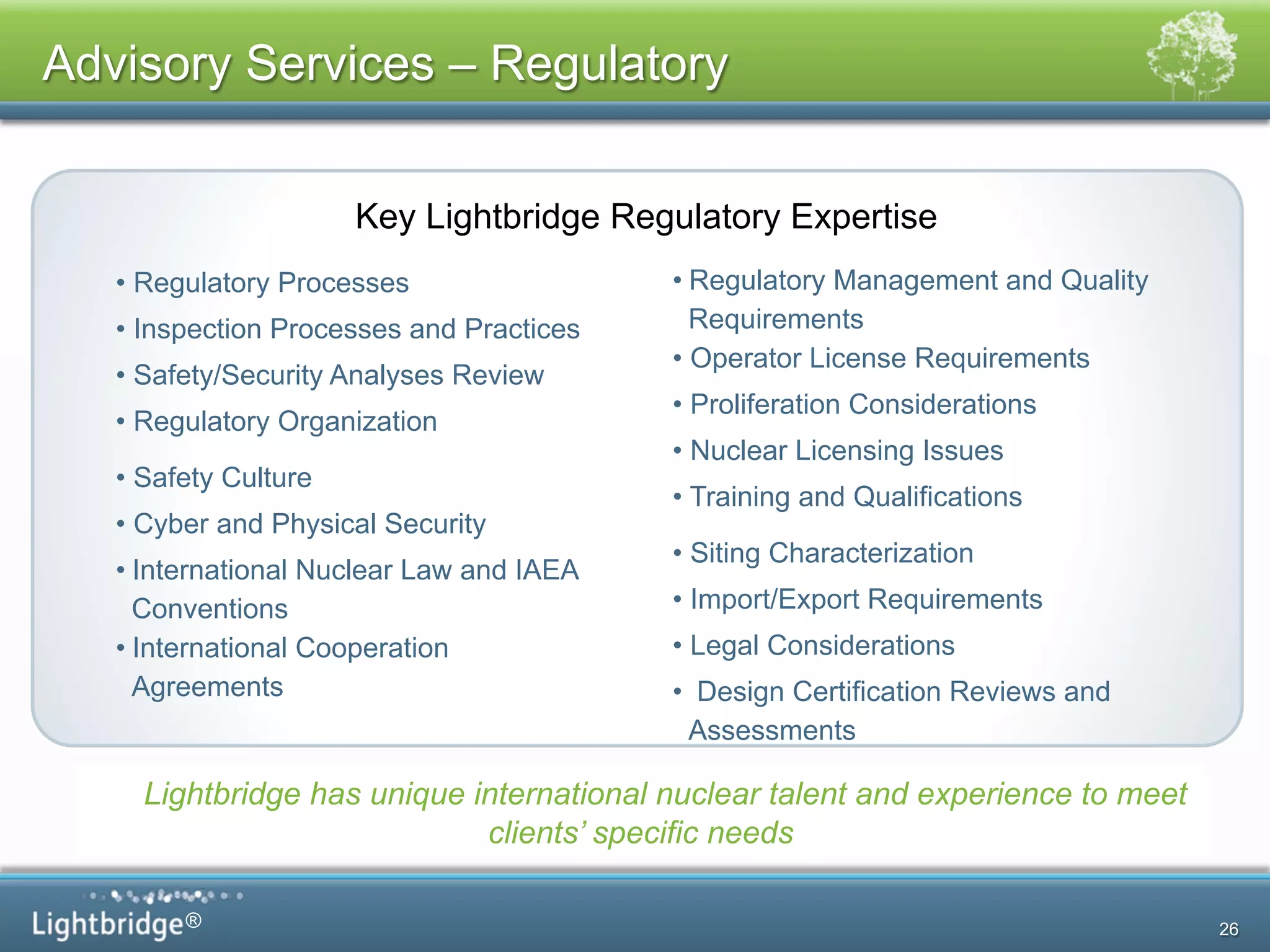

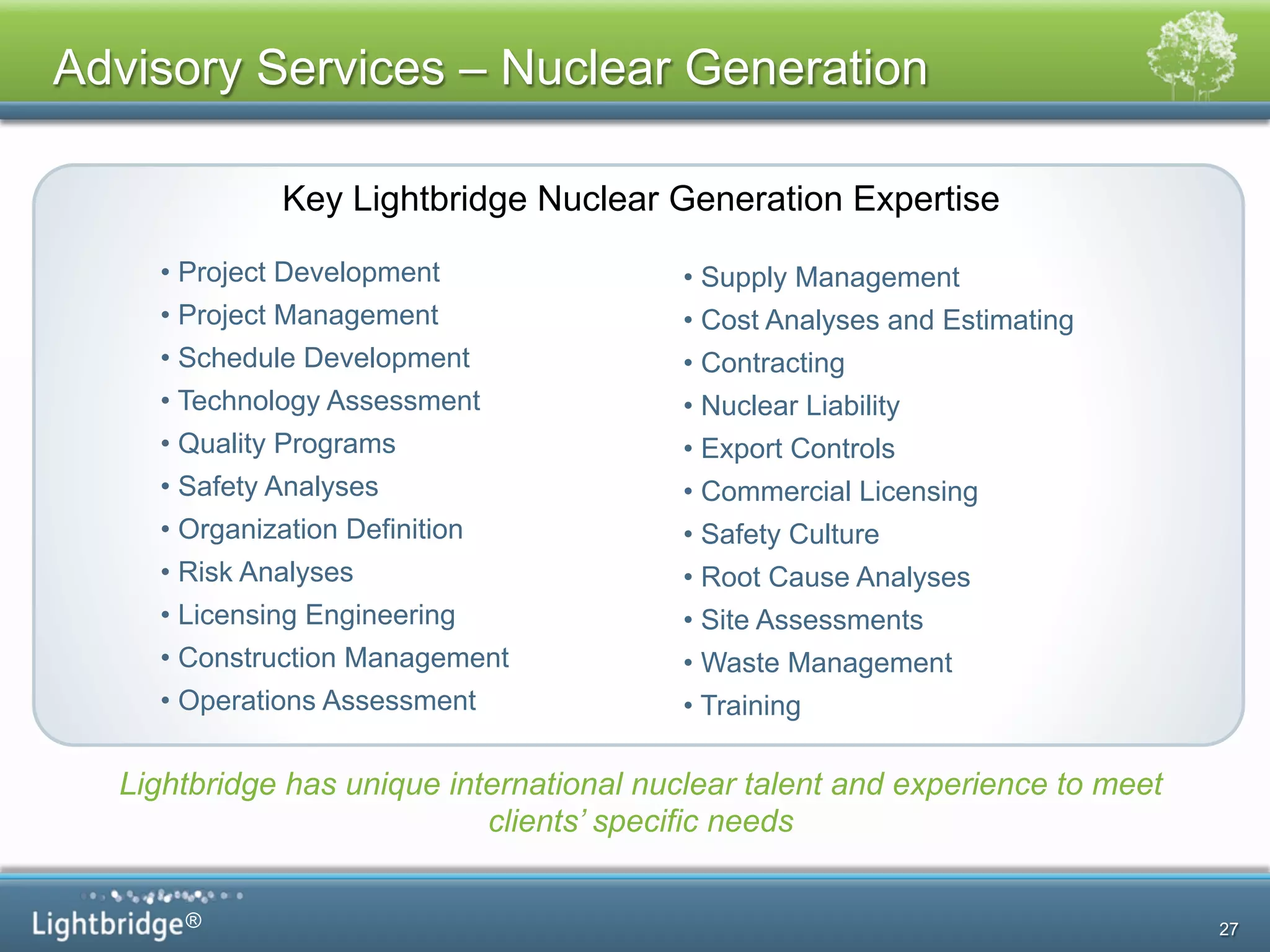

Lightbridge Corporation is an innovative nuclear fuel technology company that has developed a new metallic nuclear fuel design. The new fuel design provides several benefits including increased power output from existing reactors, improved safety, and reduced costs. Lightbridge has validated the technology and economics through third-party analyses and has an MOU with Babcock & Wilcox to develop a pilot fuel fabrication plant. The company also has a successful nuclear advisory services business and plans to license the new fuel technology globally. Lightbridge has an experienced management team and board of advisors with extensive experience in the nuclear industry.