The document discusses methods for measuring store visits through mobile advertising and location data, emphasizing the importance of defining target audiences and analyzing campaign data to correlate marketing spend with customer visits. It details methodologies such as GPS tracking and surveys to assess campaign effectiveness, as well as the 'halo effect' of advertising that continues to influence store visits post-campaign. Key findings include significant ROI from targeted campaigns and the rising importance of location-aware apps in driving consumer behavior.

![YPProprietary Information:©2016 YPLLC. All rights reserved. YP, theYP logo and all other YPmarkscontained herein are trademarks of YPLLC and/or YP affiliatedcompanies. All other markscontained herein are the property of their respective owners. *YP follows industry-standard

privacy practices in its use of targeted advertising and YP consumers are able to opt out of mobile location data collection at the device level and manage the use of their collected information by opting-out of retargeted advertising from third parties.]

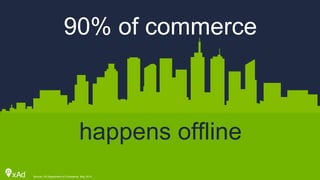

Data Rich Mobile Marketing

Always-on smartphone engagement generates large amounts of data

Big Box Shopper

Music Fan

Words With Friends

Travels ~20m daily

Leisure Traveler

Likes Jamba Juice

Casual Diner

Big Box Shopper

Search: Contractor

Lowes

CVS

Wendy’s

Yahtzee

TextNow

Locationdatapowersprofilesfortargetingbyaudiencesegments+location/proximity.

Runningacampaignwillalsogenerateatremendousamountofusefuldata.](https://image.slidesharecdn.com/lsa16wedattributionrevolution-160315152622/85/LSA16-Attribution-Revolution-The-New-Location-Analytics-3-320.jpg)

![Mobile Campaign Data Flow

YP Proprietary Information: ©2016 YP LLC. All rights reserved. YP, the YP logo and all other YP marks contained herein are trademarks of YP LLC and/or YP affiliated companies. All other marks contained herein are the property of their

respective owners. *YP follows industry-standard privacy practices in its use of targeted advertising and YP consumers are able to opt out of mobile location data collection at the device level and manage the use

of their collected information by opting-out of retargeted advertising from third parties.]

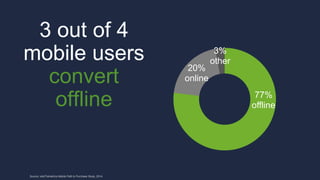

Location Based + 1st Party Profiles power mobile targeting:

Define

Audience

Target

Campaign

Wasmycampaign

successful?

Campaign Reporting

Ismobileadvertising

increasingmyrevenue?

Location Data to the Rescue!](https://image.slidesharecdn.com/lsa16wedattributionrevolution-160315152622/85/LSA16-Attribution-Revolution-The-New-Location-Analytics-4-320.jpg)

![Measuring Store Visits: How it’s done

YP Proprietary Information: ©2016 YP LLC. All rights reserved. YP, the YP logo and all other YP marks contained herein are trademarks of YP LLC and/or YP affiliated companies. All other marks contained herein are the property of their

respective owners. *YP follows industry-standard privacy practices in its use of targeted advertising and YP consumers are able to opt out of mobile location data collection at the device level and manage the use

of their collected information by opting-out of retargeted advertising from third parties.]

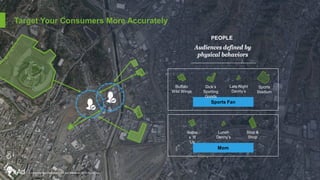

• Define the boundaries of the store

• Deploy Location Targeted Campaign

• Identify Store Visitors

• Methodology:

• Analyze GPS data from campaign

• Track sample of users (background)

• Surveys

• Check-ins (explicit or modeled)

SCALE](https://image.slidesharecdn.com/lsa16wedattributionrevolution-160315152622/85/LSA16-Attribution-Revolution-The-New-Location-Analytics-5-320.jpg)

![Measuring Store Visits: How it works

YP Proprietary Information: ©2016 YP LLC. All rights reserved. YP, the YP logo and all other YP marks contained herein are trademarks of YP LLC and/or YP affiliated companies. All other marks contained herein are the property of their

respective owners. *YP follows industry-standard privacy practices in its use of targeted advertising and YP consumers are able to opt out of mobile location data collection at the device level and manage the use

of their collected information by opting-out of retargeted advertising from third parties.]

Compare each visitor to our campaign data:

• Were they in our profile target?

• If so, did they receive an ad impression?

• And if so, did they click on the ad?

0.05%

0.15%

0.50%3x

10x

Control Impression Imp/Click](https://image.slidesharecdn.com/lsa16wedattributionrevolution-160315152622/85/LSA16-Attribution-Revolution-The-New-Location-Analytics-6-320.jpg)

![Measuring Store Visits: Results

YP Proprietary Information: ©2016 YP LLC. All rights reserved. YP, the YP logo and all other YP marks contained herein are trademarks of YP LLC and/or YP affiliated companies. All other marks contained herein are the property of their

respective owners. *YP follows industry-standard privacy practices in its use of targeted advertising and YP consumers are able to opt out of mobile location data collection at the device level and manage the use

of their collected information by opting-out of retargeted advertising from third parties.]

• Store Visit Reports proves correlation between

marketing spend and ad interaction to a customer

visit to a retail location.

• as high as 12X lift, upscale dining; 15X lift in auto

maintenance

• ROI can be calculated using customer visit rate,

in-store conversion rate, average spend per customer.

• “Halo Effect” report measure the impact of advertising

on store visits after the campaign has ended.](https://image.slidesharecdn.com/lsa16wedattributionrevolution-160315152622/85/LSA16-Attribution-Revolution-The-New-Location-Analytics-7-320.jpg)

![Data Transparency: This is just the start

YP Proprietary Information: ©2016 YP LLC. All rights reserved. YP, the YP logo and all other YP marks contained herein are trademarks of YP LLC and/or YP affiliated companies. All other marks contained herein are the property of their

respective owners. *YP follows industry-standard privacy practices in its use of targeted advertising and YP consumers are able to opt out of mobile location data collection at the device level and manage the use

of their collected information by opting-out of retargeted advertising from third parties.]

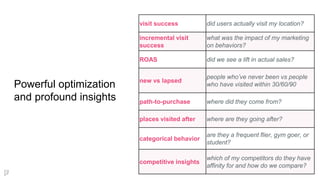

• Transparency: Mobile data heretofore

focused on building audiences and

targeting, but isolated from the advertiser,

is used to power meaningful business

insights.

• Campaign-as-Data Source: The once

incidental output of data is a source of rich

business analytics.

• Close ALL The Loops: With better

attribution comes the opportunity to

improve targeting and prediction.](https://image.slidesharecdn.com/lsa16wedattributionrevolution-160315152622/85/LSA16-Attribution-Revolution-The-New-Location-Analytics-8-320.jpg)