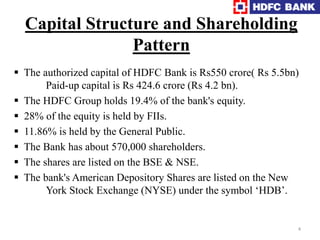

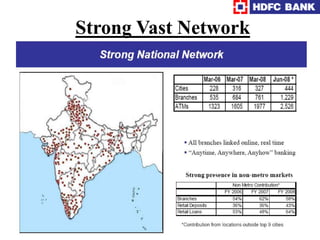

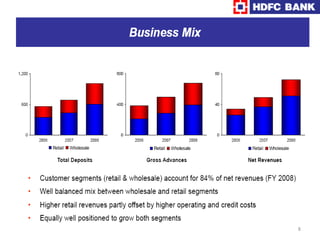

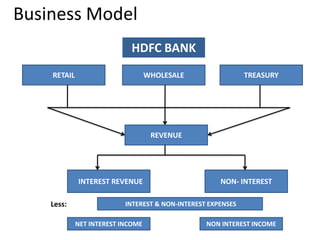

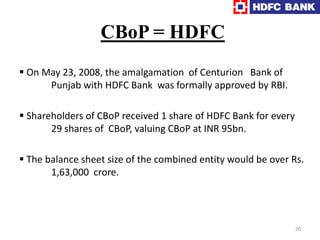

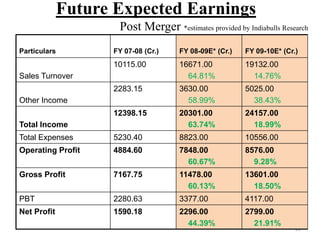

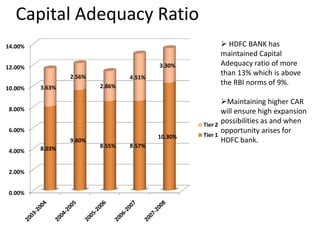

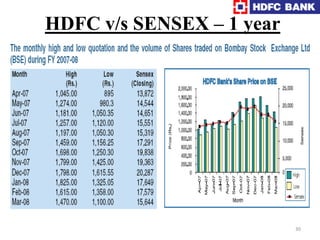

HDFC Bank was the first bank to receive approval from the Reserve Bank of India to operate as a private sector bank. It began operations in 1995 and has grown to become one of the largest banks in India. The bank focuses on retail, wholesale, and treasury banking. It has a widespread network across India and offers a variety of loan and deposit products to its customers. HDFC Bank aims to maintain high ethical standards and customer focus. It has a strong capital base and earns most of its revenue from interest income. In 2008, HDFC Bank acquired Centurion Bank of Punjab, significantly increasing its size and market share.