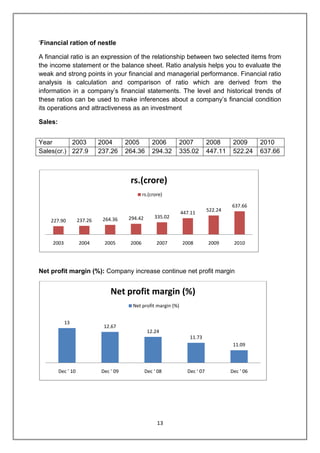

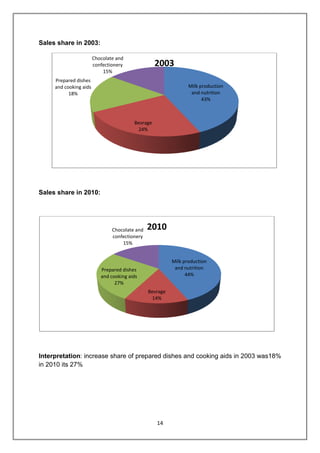

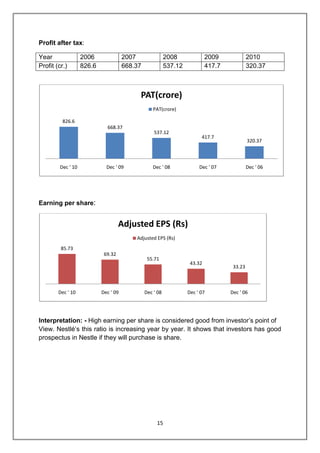

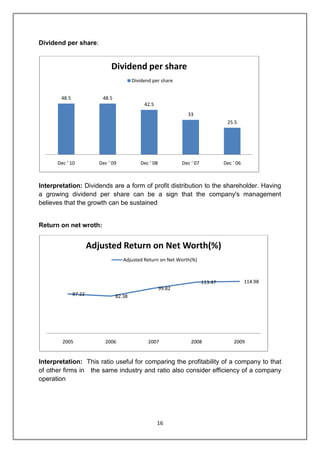

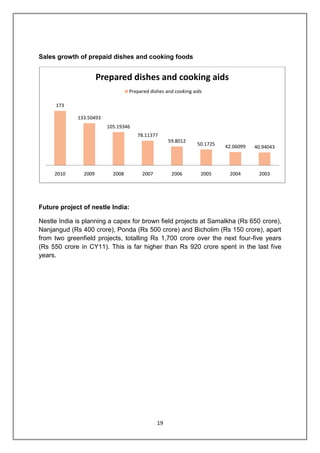

The document provides an extensive overview of fundamental analysis, primarily used for long-term investments, highlighting the importance of analyzing economic, industry, and company-specific factors. It emphasizes understanding macroeconomic conditions, industry dynamics, and assessing a company's financial health through various ratios. The report also specifically analyzes Nestlé India, detailing its commitment to quality products and its role in the Indian economy.