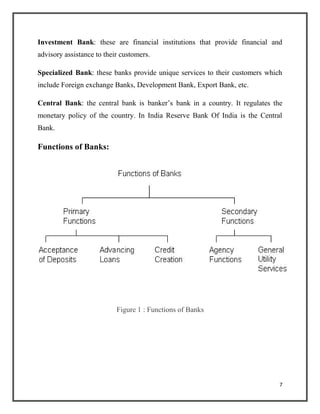

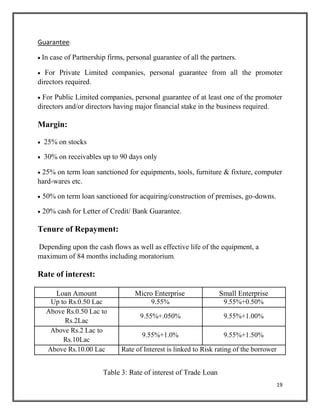

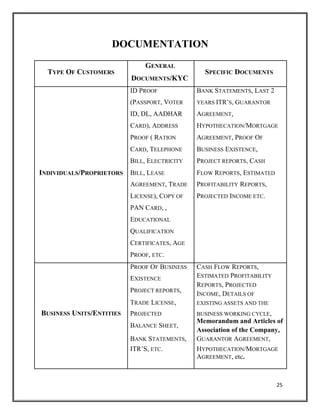

The document provides details about a study report submitted to Tezpur University on the procedure for disbursing commercial loans by Allahabad Bank, including its related aspects and case study of the Tezpur branch. It includes an introduction to banking and loan types. It then discusses Allahabad Bank's profile and details three main types of commercial loans offered: commercial vehicle finance scheme, trade loan, and property loan. For each loan type, it outlines the eligibility criteria, terms, rates of interest, and documentation required. The report aims to understand the end-to-end loan disbursement process and related policies.