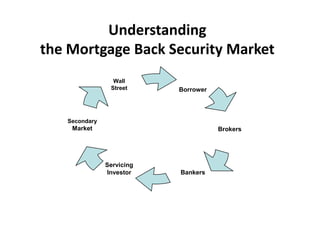

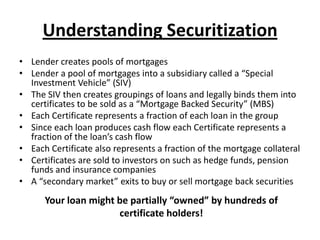

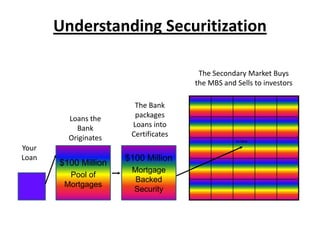

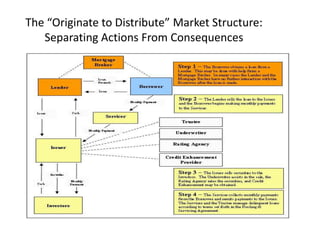

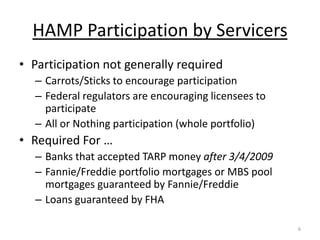

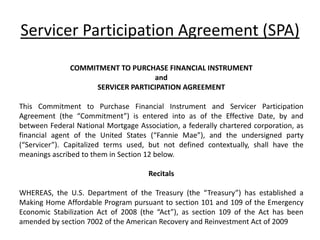

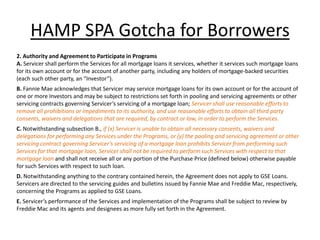

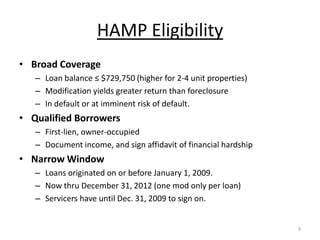

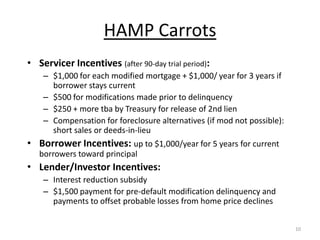

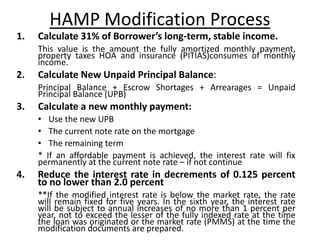

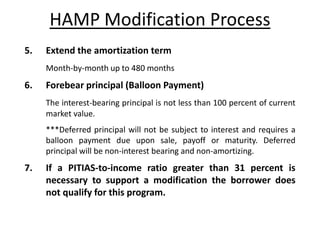

The document discusses the relationship between mortgage-backed securities (MBS) and the Home Affordable Modification Program (HAMP), explaining the securitization process and the roles of various entities involved. It outlines the eligibility criteria for borrowers to qualify for HAMP, detailing the servicer participation requirements, potential incentives, and the modification process. Additionally, it emphasizes the importance of engaging a CPA to navigate the complexities of loan modifications effectively.