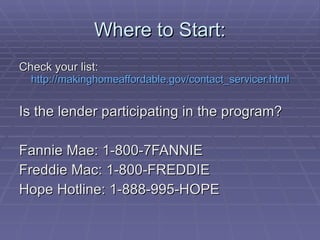

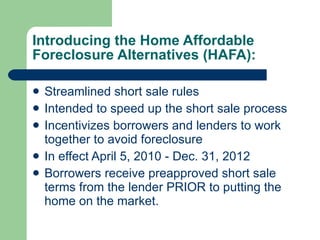

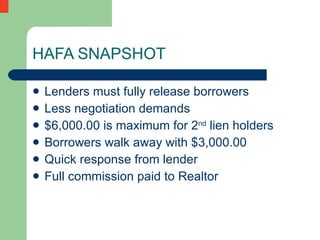

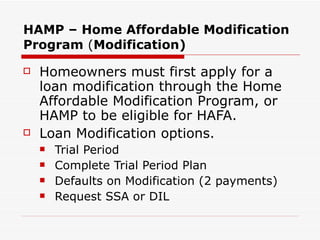

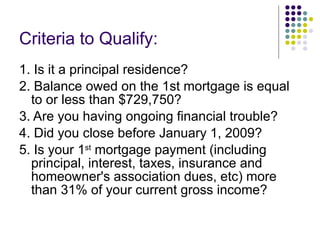

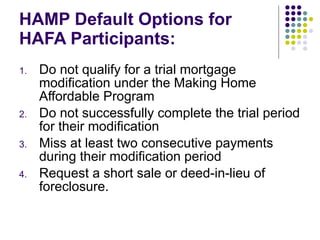

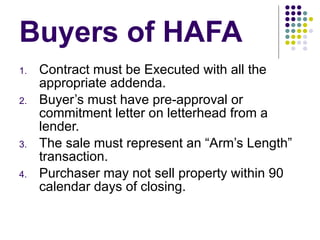

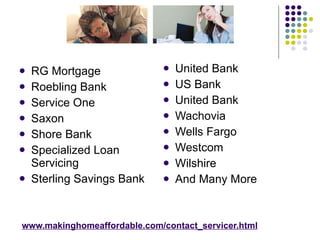

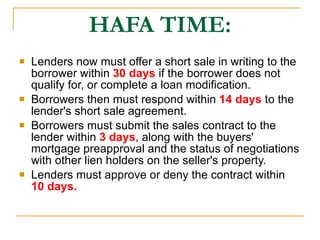

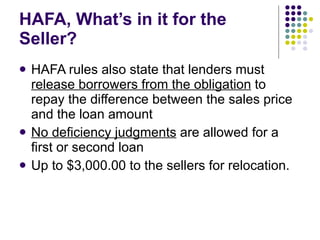

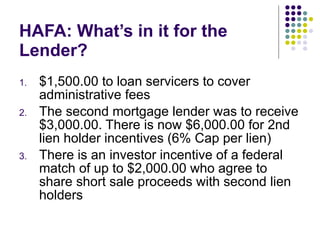

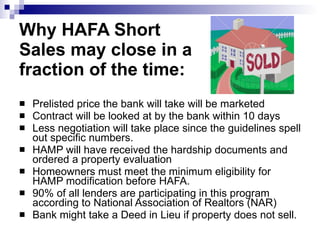

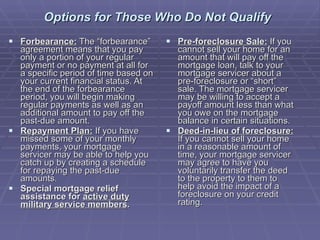

The document outlines the Home Affordable Modification Program (HAMP) and Home Affordable Foreclosure Alternatives (HAFA) aimed at assisting homeowners facing financial difficulties. It details eligibility criteria and procedures for short sales, including lender responsibilities and borrower benefits, such as debt forgiveness and relocation assistance. Additionally, it explains the incentives for lenders and real estate agents involved in the process, promoting quicker resolutions to avoid foreclosure.