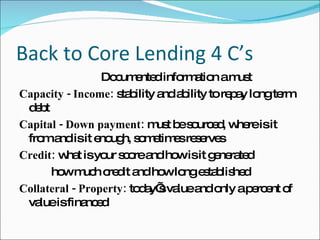

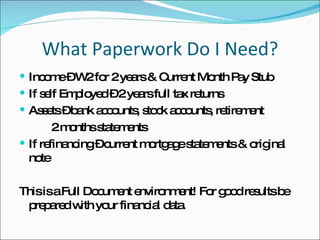

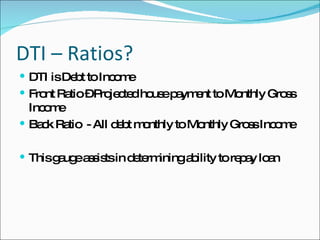

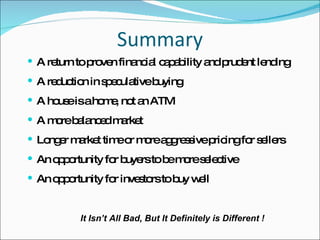

The document summarizes a presentation given at a home ownership fair about mortgages and refinancing. It discusses the speakers and organization hosting the event, provides an overview of current mortgage options and challenges, and offers tips for home buyers and those seeking to refinance. Key points covered include understanding conventional, FHA, VA, and USDA loan programs, the role of mortgage-backed securities, factors affecting credit approval like income, assets, credit history, and debt-to-income ratios, and why current market conditions make it a good time to buy a home.