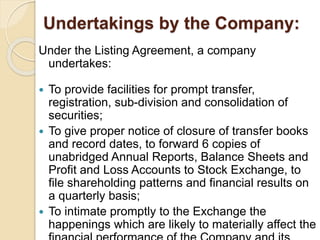

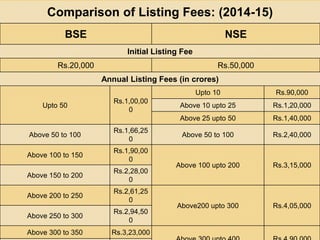

The document outlines the concept of listing agreements in the context of securities on stock exchanges, detailing its definition, objectives, and the obligations companies must fulfill. It compares the listing requirements and fees of BSE and NSE, discussing criteria such as minimum capital, market capitalization, profit-making records, and track records of dividend payments. Additionally, it emphasizes the legal frameworks and guidelines governing listings, ensuring investor protection and market liquidity.